ECONOMICS

As we enter 2Q21, there are increasing signs of divergence between global economies. Strict containment measures and increasing infection rates will hold back growth in some countries (such as India, Brazil, parts of the European Union [EU], and Africa), while other countries will benefit from effective health policies, faster vaccine deployment, and strong policy support. Nevertheless, the broad direction of travel is still one of optimism over world growth in 2021, as markets eye a gradual loosening of restrictions. Global GDP growth forecasts currently range around 5.5%-6%, with global output set to rise above pre-pandemic levels by mid-2021. However, despite the improved global economic outlook, output and incomes in many countries at the end of 2021 will remain below the levels expected prior to the pandemic.

A common theme in global markets since the start of this year has been the rise in inflation expectations. A combination of large fiscal stimulus, ultra-loose monetary policy, and renewed economic optimism has led market commentators to debate the potential for a rise in future inflation. Whilst cost pressures have begun to emerge in commodity markets due to the resurgence of demand and temporary supply disruptions, underlying inflation remains mild, held back by spare capacity around the world. In the most recent forecast round, the European Central Bank (ECB) and the US Federal Reserve (Fed) have made large upward revisions to their inflation outlooks for 2021, with the Bank of England (BoE) making a more modest upgrade. In comparison, the inflation outlook beyond 2021 was left relatively unchanged, with only minor upward revisions made across the three central banks. This reinforces the narrative reiterated by both the Fed and the ECB that any increase in inflation this year will be a purely transitory rise, which is somewhat at odds with market expectations.

Regardless, against rising short-term interest rates and inflation expectations, government bond yields have risen sharply. March saw US President Joe Biden sign his $1.9trn American Rescue Plan into law, adding to the Trump administration’s $900bn COVID-19 relief package from December 2020. Taken together, this represents an unprecedented fiscal boost worth 13% of GDP. In addition, further stimulus measures were announced in March, with Biden unveiling a US$2trn American Jobs Plan, which will focus on increasing spending on major infrastructure categories as well as confronting climate change and attempting to curb wealth inequality over an 8-year period. The plan is expected to generate “millions of new jobs” and, to help pay for it, the Democrats aim to part-fund it with tax hikes. However, the tight party balance in the Senate casts doubt on the feasibility of sanctioning any tax rises, which would maximise the total fiscal stimulus.

Across the seas towards Europe and Asia, attention remains firmly focused on the race between the spread of the newer and more contagious strains of COVID-19 on the one side and vaccinations on the other. In Europe, the pace of inoculations has been too slow to contain a resurgence in infections. As a result, social restrictions have had to be extended in several countries. This will hold back the economic recovery in 2Q21 and explains the ECB’s insistence on countering any tightening in financial conditions for the time being – including its decision in March to front-load quantitative easing (QE) or bond purchases. But, if vaccinations take the planned step up during 2Q21, then activity should rebound strongly within the medium term.

Locally, SA’s public finances continue to present a big problem with no easy solutions. National Treasury’s (NT’s) 2021/2022 Budget, tabled in February, was arguably the most important and difficult budget since the dawn of democracy in 1994. SA’s fiscal situation remains precarious and the country’s debt service burden is unsustainable, so striking the right balance between providing relief and improving the fiscal prognosis of the country was imperative. Overall, the budget struck a confident note, and was viewed in a positive light by financial markets. However, government remains in a tight race to repair its finances and, whilst there has been credible progress, execution risk continues to remain high.

Overall, we believe that NT has done as much as it can at this stage to beat back any further ratings downgrades within the short- to medium-term, although ultimately this will depend on the execution of this fiscal strategy and the implementation of growth reforms. The Budget Review reports encouraging, albeit gradual, progress with the turnaround at the SA Revenue Service (SARS). However, general state-owned enterprises (SOE) reforms (outside of progress with energy reforms), remain frustratingly slow. Only time will tell if progress with proposed growth reforms augment with the necessary fiscal consolidation to ensure SA’s debt stabilisation. Until the health risks associated with COVID-19 are sufficiently under control, a more durable recovery in confidence and economic activity will be difficult. On balance though, we expect that SA will continue to rebound from the lockdowns of last year and we expect above trend economic growth this year and next.

SA EQUITY

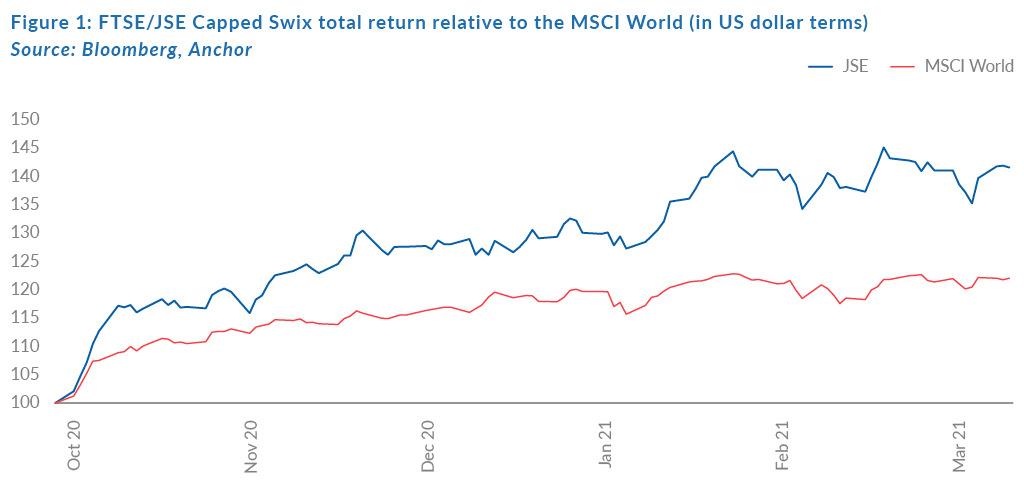

The FTSE/JSE Capped Swix delivered a commendable 12.6% rand-denominated total return in 1Q21 and was a noticeable outperformer relative to most global equity markets, which delivered a return of 5.04% in US dollar terms (the comparable US dollar return for the JSE was 11.9%). The JSE’s outperformance represented a continuation of a trend that started at the beginning of November 2020, when vaccine efficacy was first published, and which also happened to coincide with a change of guard in the US presidency.

In our previous Navigator (The Navigator – Anchor’s Strategy and Asset Allocation, 1Q21, dated 14 January 2021), we highlighted several factors unique to the construction of the JSE that make it well placed to benefit from the ongoing rotation in equity positioning – away from the defensive attributes of growth names and into those sectors more reliant on a cyclical uptick in global growth and inflation (value/cyclical type businesses on lower multiples). The current macroeconomic backdrop, with the expectation of rising global growth, higher inflation, and supportive conditions for many commodities seems to continue to suit the JSE which, at an index level, now comprises of more than 50% of listed counters being in the financials and basic material sectors (both of which are net beneficiaries of rising inflation and commodity prices).

While the recent strong quarter (1Q21) for the Capped Swix should intuitively decrease the total return expectation for the market over the course of the next 12 months, we remain encouraged by the pace at which the return of the market has been matched by rising earnings expectations, particularly in those cyclical sectors and as a result our total return expectation has remained in the region of 12%.

As investors with a strong bias towards growth and quality, the continued market leadership by cyclicals/value counters leave us with a relatively uneasy feeling as experience had led us to approach these types of value-driven equity market rallies with additional caution, forcing us to continuously reassess the sustainability of each move higher.

Navigating the notoriously cyclical basic material sector between now and the end of the year is arguably the mostly challenging portfolio construction decision JSE managers face, with optically cheap multiples (further amplified when applying spot commodity prices), which could potentially lure investors into a false sense of security in the assumption that low multiples really mean cheaper stocks. Barring one or two exceptions, investors cannot fault companies’ management teams’ handling of the most recent cycle. Capital allocation discipline (very little new supply) combined with, for the most part, “in line” production numbers, have resulted in management teams having navigated a particularly disruptive 2020 without fault and with the top lines having experienced a welcome boost from higher commodity prices as the levels of free cashflow generated by the sector has hit a record high. For investors to remain invested from these levels, where an investment thesis cannot rely on any form of the “self-help” element that it did a few years back when balance sheets were stretched, investors need to be comfortable with the sustainability of demand for various metals being produced.

For us, the most interesting development in the sector is the relatively high intensity of commodity usage in the transition away from carbon-intensive energy production towards a cleaner, more sustainable, energy future. As managers we are reluctant forecasters of future commodity prices, but one aspect of the future that we are comfortable to take a firm view on is that the movement towards greener energy production is real, and that some key commodities (copper, aluminium, and the battery commodities) will be in structural demand for the foreseeable future, most likely at the expense of oil, coal, and iron ore. For now, the risks of lower commodity prices in base metals seem to largely reflect in the prices of the equities and, as a result, our total return expectation over the next 12 months remains in the double-digits.

Turning to the more domestically focussed sectors of the market, we entered the year incrementally more bullish on domestic stocks for the first time in a while, with the net result being an upweighting of retailers and industrials in our core equity mandates. The decision to upweight was not driven by top-down factors, with SA’s economic outlook still facing severe structural challenges but more driven by some company specific opportunities.

We have been particularly encouraged by the way certain management teams have navigated the past year, with some of our investee companies emerging from the crisis with highly cash-generative businesses, clearly articulated strategies on capital allocation, and growth ambitions. Companies such as Mr Price, Transaction Capital, Woolworths, and Shoprite come to mind. Even a business like MTN, continuously plagued by the uncertainties of doing business in frontier markets, has done a good job in comforting us that it is on the right track in terms of selling non-core assets, reducing debt, and simplifying its business, while also delivering encouraging operational metrics.

As a result, earnings revisions keep moving in the right direction and with the base set relatively low, after many years of operating in a lacklustre growth environment, we see significant upside optionality should some top-line growth emerge.

In terms of the large cap, rand-hedge industrials, we continue to view a business such as Bidcorp as one of the best placed, locally listed companies to benefit from the unlocking of the global economy. We remain of the view that investors are underestimating the upcoming wave of consumer euphoria as lockdown restrictions are lifted in the UK and Europe, two of Bidcorp’s key food service markets. There are no businesses listed in SA as geared to a “return-to-normal” in Europe as Bidcorp and we feel that local investors are placing too low a probability on Bidcorp surpassing its FY19 profit numbers by FY22.

It is also encouraging that our process seems to be uncovering a wider breadth of opportunities across the local market than we have seen in a while. From Aspen’s J&J JV on vaccine production, to Wilson Bayly Holmes Ovcon (WBHO) being a beneficiary of increased local mining capex or Raubex’s strong market positioning for increased spending on infrastructure, opportunities certainly seem to be emerging more frequently than we have been accustomed to in recent years. As always, the goal is to remain focused on quality, capital allocation and trustworthy and competent management teams. There is no shortage of these in SA, let us just hope that the political environment presents the right backdrop to leverage off.

SA BONDS

SA bonds began 2021 with a period of strength through to early February. However, thereafter the US 10-year yield began to increase, dragging EM bond yields higher. As a result, SA bond yields are higher over the past quarter (for 1Q21 the R2030 benchmark went from 8.725% to 9.465%). The local yield curve remains steep, and we believe that this once again presents investors with a strong yield-to-term relationship. Longer-duration debt remains more attractive as long as the short-end of the curve is pegged down by the repo rate (currently still at 3.5%).

The most recent SA Reserve Bank (SARB) Monetary Policy Committee (MPC) meeting unanimously resolved for a hold on interest rates. This was in sharp contrast to past meetings, where the split was between holding and cutting (with holding being the view of the majority in the MPC). This, in turn, has fed some expectations of future rate hikes into the market.

At present, the forward rate agreements’ (FRA) Strip prices factor in a 50-bpt rate hike to the end of 2021, with a further 125-bpt increase priced in by the end of 2022. We are of the view that the market is being over exuberant on its rate hike expectations for SA, and we expect a sluggish economy and slow inflation to keep rate hikes in check. Thus, the repo rate is expected to slowly drift upwards over the next 2 years.

Nevertheless, the current yield on offer from the R186 of 7.46% (with a maturity date of end-2026), makes it a very attractive bond to hold in the near term. Given the low recent inflation prints (and expectations for near-term inflation to print in the 3%-4% region), SA 10-year debt currently offers a real return north of 6%.

Looking ahead, we foresee fair yields slightly below current levels, implying that there is capital appreciation, as well as interest income, to be generated by these SA Government Bonds (SAGBs). We are pencilling in a 12-month total return on the All Bond Index of 9.75%, which comprises interest income of 9.0% and capital gains of 0.75%.

SA RAND

Rising global yields have not put a dampener on the rand, which has continued to strengthen, supported by strong terms of trade keeping the trade balance positive. The higher domestic real yields and the stronger performance of the domestic equity market have also played a role in supporting the local currency. In the near term, we expect that these supportive factors will continue to support the rand, although their benefits will likely dissipate towards the end of this year.

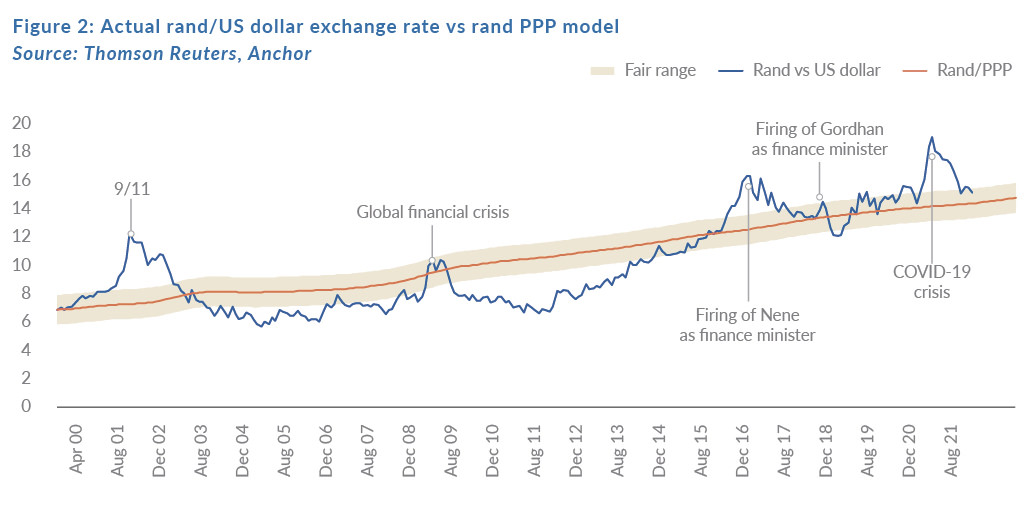

Projecting the rand’s value in a year’s time is a fool’s errand. The rand vs US dollar exchange rate is one of the world’s most volatile currency pairs and trades well away from any modelled fair value for long periods. We note, however, that the rand trades within a R2.50 range to the US dollar in most 12-month periods.

We retain our purchasing power parity (PPP) based model for estimating the fair value of the rand and we have extended this out by three months since the publication of The Navigator – Anchor’s Strategy and Asset Allocation, 1Q21 report on 14 January 2021. Our PPP-modelled value for the rand vs US dollar at the end of the next 12 months is R14.38/$1 (See Figure 2). We apply a R2.00 range around this to get to a fair value range of between R13.38/$1 and R15.38/$1.

We expect the rand to remain particularly volatile even though we do think that it might touch the mid-point of our fair band before weakening again. This would imply that we see scope for up to a 2.5% improvement from the rand’s current levels as global macro factors dominate.

GLOBAL EQUITY – THE BULL MARKET CONTINUES …

Global equity markets ended 1Q21 around 5% higher (MSCI World +4.9%, S&P +6.2%, FTSE up 11.3%, emerging markets [EMs] +2.3%). This was our projected return for 2021, with market levels now exceeding almost all of the 2021 year-end targets set by global investment banks at the end of 2020.

Our view at the beginning of 2021 was that we remained in a bull market and equity returns were likely to remain positive, with the risk of our projected return being exceeded over the short term. Our projection was for a 5%, 12-month US dollar forecast return for the MSCI World Equity Index.

We retain this positive view and our 12-month projection of a 5% US dollar return, with only high valuations preventing us from stretching our target to double-digits. During 1Q21, global GDP forecasts were upgraded and US earnings results for 4Q20 came in a full 17% higher than what was forecast three months earlier (5% earnings growth vs a consensus forecast of -12%). Businesses have recovered from the effects of the pandemic significantly faster than expected, driven by high commodity and energy prices and rapid growth from the big tech companies.

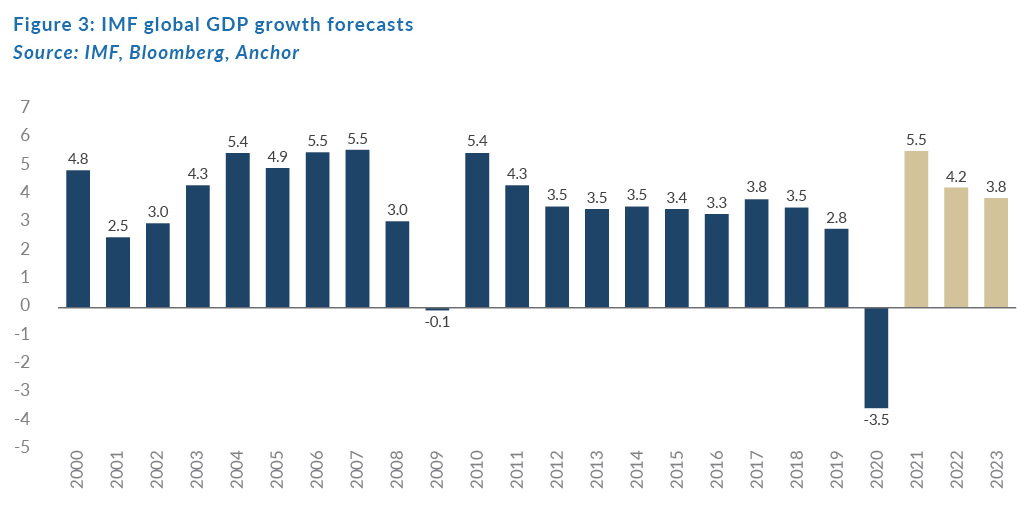

The International Monetary Fund’s (IMF) GDP forecasts show a sharp rebound in 2021, with an above-trend growth again for the next two years as the recovery completes.

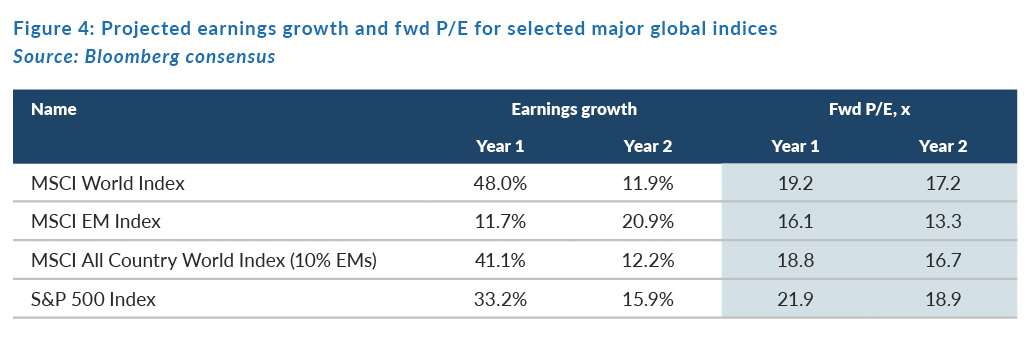

The growth in Figure 3 above will translate into strong company earnings growth, as shown in Figure 4 below. The table shows the projected earnings growth and forward P/E multiples of the world’s most meaningful indices.

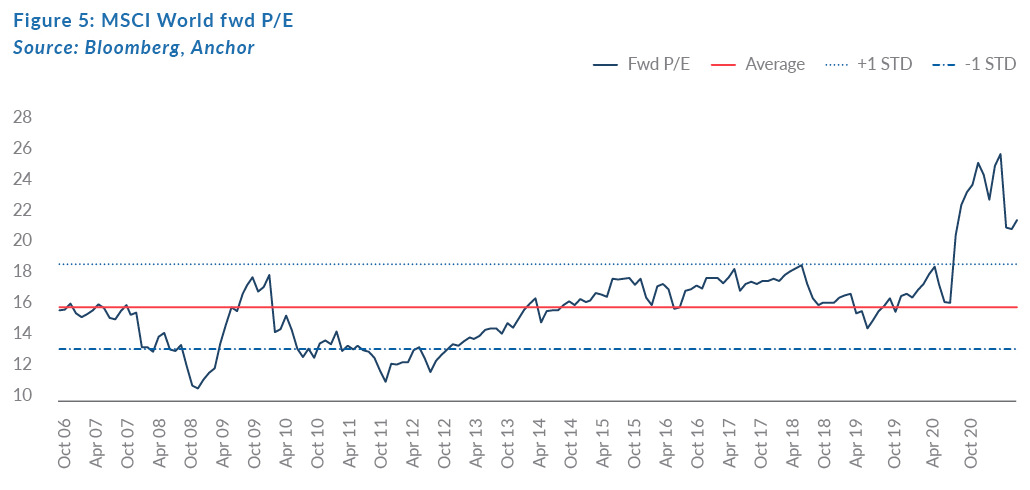

A recovery-driven 2021 48% increase in global earnings (many companies made losses in 2020), however is at least partially priced in, with the MSCI World forward P/E of 19.2x – well above the long-term average shown in Figure 5 below.

So, the market is priced for strong growth and investors should balance caution with optimism in projecting future returns. There are many factors that can change sentiment and, at these valuation levels, the impact could be material. Conditions are great for businesses looking forward, but 1Q21 saw the first sign of concern from markets that the recovery was too rapid. Worries about stimulus-induced growth resulting in inflation rising too fast saw US 10-year bond yields more than double. This resulted in a sharp drop in 2020’s growth shares and a matching rise in the more cyclical and “recovery” plays.

Depending on an investor’s positioning so far in 2021, the investment experience has been markedly different. We think this could continue to be the case and below we outline the prospects for what we consider to be the different categories of global equity markets:

GLOBAL TECHNOLOGY SHARES

Depending on what you include in this category, technology companies now make up close to 40% of global stock markets. This is where the long-term growth is and should form the core of any investment portfolio. But quality growth does not come cheap, and this sector of the market delivered remarkable returns in 2020, and in many instances became fully valued. They have so far underperformed in 2021, as the recovery, and certainty, of the earnings of more cyclical and COVID-19-impacted businesses has been a better short-term bet. One should also differentiate between the larger-cap tech companies (Alphabet, Facebook, Alibaba etc.), which we think are now offering significant value, and the smaller tech companies, which have come off 20%-40% from their highs and are starting to, once again, offer pockets of good value.

CYCLICAL MATERIAL SHARES

We have been in a structural commodity boom market and prices of many commodities are now around all-time highs. Share prices are mostly pricing-in a sharp drop over the next 12 months in commodity prices and, if these are sustained for a reasonable time, there could be continued strong performances from these shares. Infrastructure spend will be strong globally for some time and the path of Biden’s new infrastructure plan will be followed closely.

FINANCIAL SERVICES

Conditions in 2021 are likely to be great for US banks. Higher bond yields make it easier to make money and higher interest rates (which will happen eventually), mean higher returns for bank balance sheets. Overly conservative provisions made in 2020 will be partly reversed and we believe that consumer demand will grow meaningfully for the next 12-24 months. Quality banks have rebounded strongly already, and these banks are no longer in the value category, but momentum should continue. We believe there is more upside.

GLOBAL INDUSTRIAL BUSINESSES

This segment covers a broad range of businesses, but the general recovery should mirror the economic recovery. The better-quality businesses have already bounced back, but there is a segment of recovery plays (airlines, hotels, cruise liners, etc.), where confirmation of an end to the pandemic could still see material rises in share prices. We see great value in global pharma companies, which offer investment profiles that we consider attractive – 10% earnings growth at 10x P/E multiples, with an example of this being a company like GlaxoSmithKline (GSK).

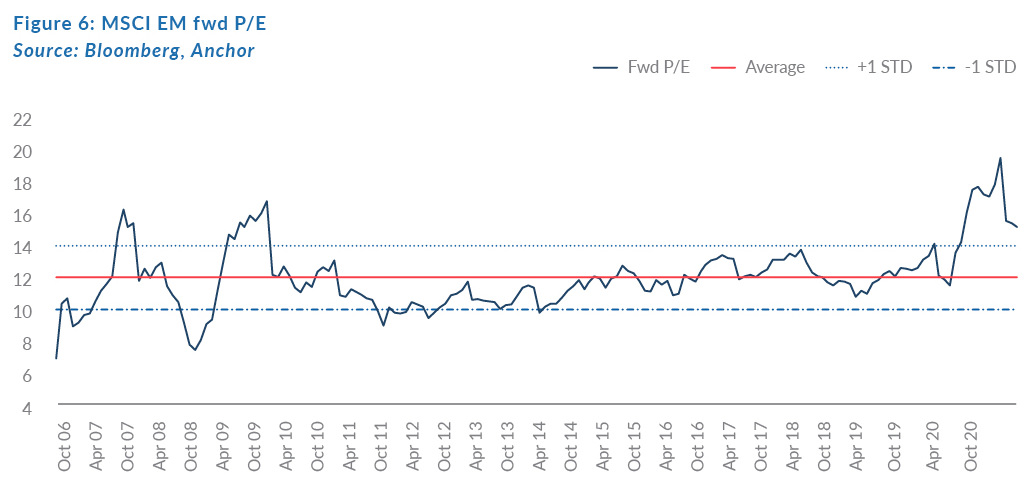

EMs

EMs obviously cover all of the categories above but tend to move in unison. If markets continue upwards and the world maintains its “risk-on” stance, Figure 6 below shows that valuations are a lot more attractive and offer potentially bigger upside.

Markets are far from homogenous and stock picking becomes increasingly important when valuations are high. Our base case is for the market to move upwards, and we can still compile a share portfolio with appealing prospective returns, but we also note that our caution increases as the market rises.

GLOBAL PROPERTY

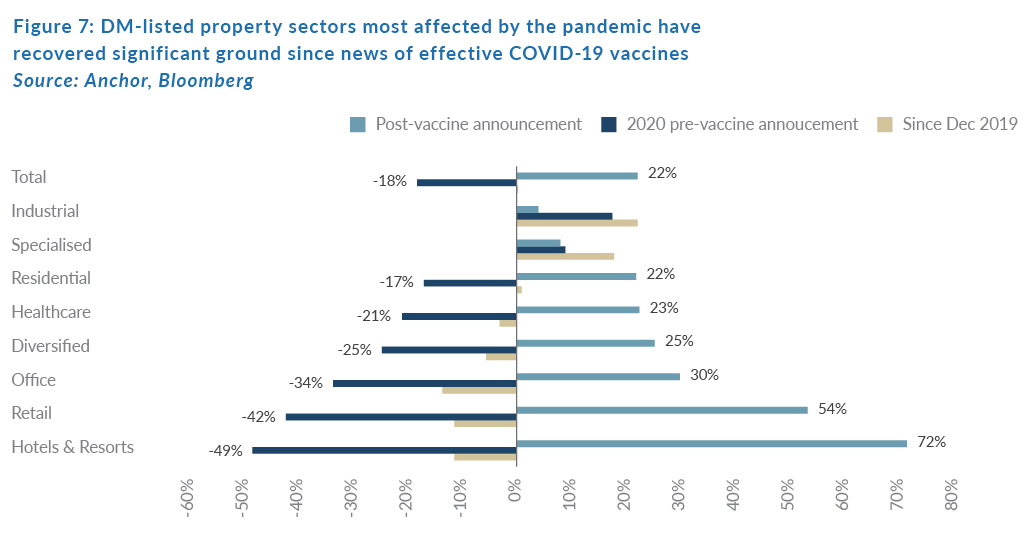

The rotation that started in early November 2020, with announcements confirming the launch of effective COVID-19 vaccines, gathered momentum into 2021 and, while most of the pandemic-affected, global listed property sectors are below their pre-COVID 19 levels, they have recovered significant ground.

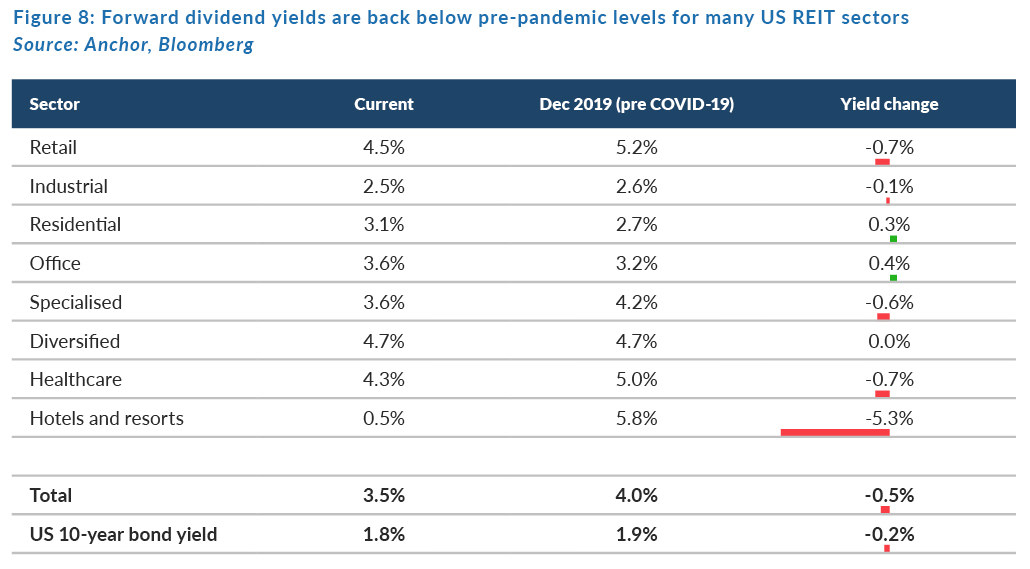

The recovery has driven forward dividend yields for US real estate investment trusts (REITs; 3.5%) to below their pre-pandemic levels (4%), and, while some of this can be explained by the slightly lower interest rate environment (US 10-year government bond yields are also about 0.2% lower than their pre-pandemic levels), it is fair to say that the recent rally has already discounted a fairly rosy outcome.

In this regard, the sector that sticks out like a sore thumb is the hotels and resorts sector, which is a fairly immaterial corner of the global REIT market and is dominated by a few US hotel operators. These REITs experienced significant operating losses in 2020 and analysts are not particularly optimistic about the prospects of them paying dividends in 2021.

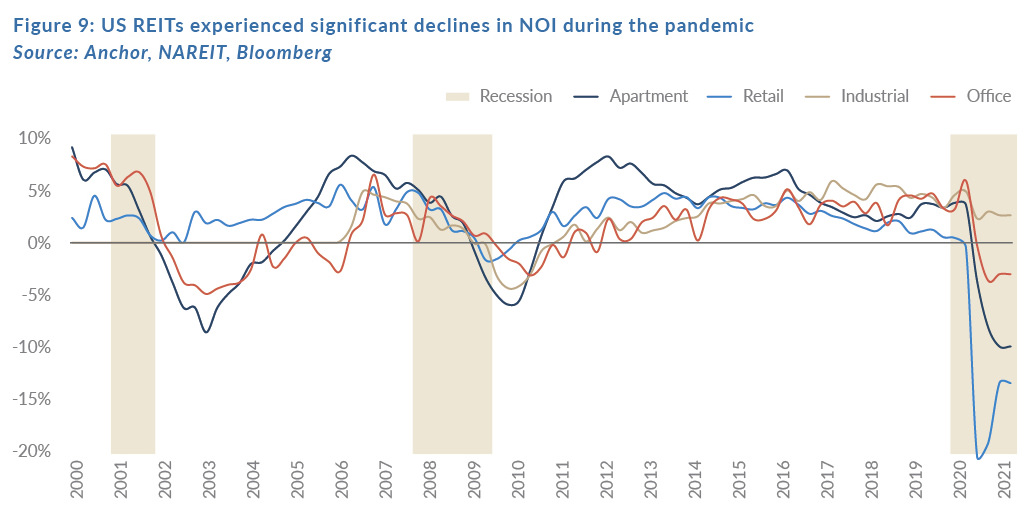

The North American REIT Association (NAREIT) estimates that the average net operating income (NOI) for US REITs fell significantly during the pandemic.

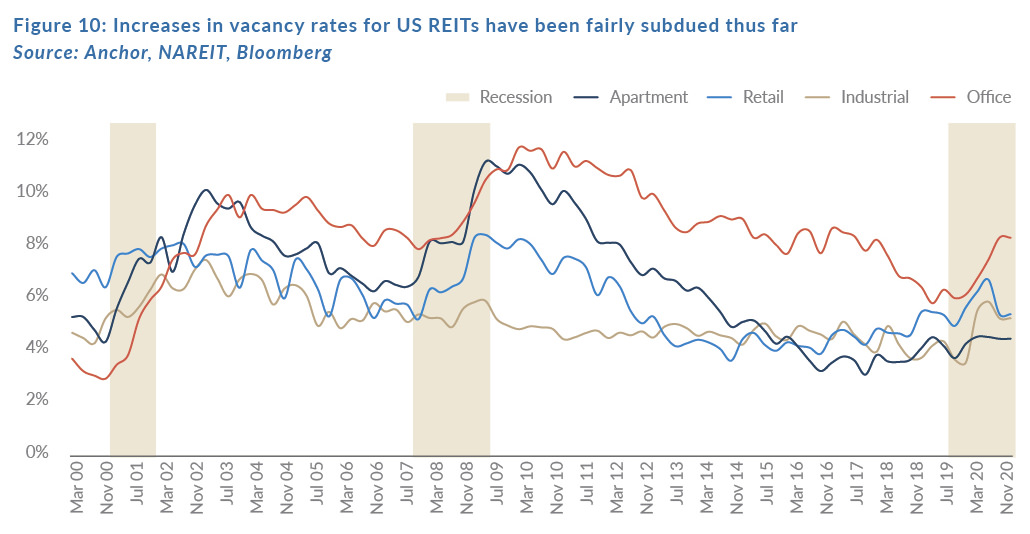

Despite the largest NOI declines in 20 years for many sectors, the bulk of this came without material increases in the average vacancy rates, with the office sector the only major REIT sector to see a material rise in vacancy rates.

Historically, vacancy rates have taken a couple of years to peak, as long leases have resulted in a prolonged adjustment in most commercial property sectors. Given the external nature of this economic crisis, it is tempting to factor in a V-shaped recovery to rentals and no need for a prolonged rise in vacancy rates. The challenge with the current COVID crisis, like with most others, is deciding whether the behavioural changes it catalysed will be of a cyclical or structural nature. The office sector is one that has lots of question marks around the impact of a shift to more people spending more time working from home (WFH), while the retail sector, which was already struggling to adjust to a shift towards online retail activity pre-pandemic, saw the pandemic accelerate that trend.

On the flipside, those sectors that have benefitted most from the pandemic e.g., data centres and warehouses supporting online retail, are seeing supply accelerate on expectations that these pandemic-induced trends will persist. We think that 1Q21 US corporate earnings, due out shortly, will show a continuation of the trends seen last year, with a cautious tone about the trajectory from management, that is likely to follow for the next set of results (2Q21) before green shoots of an improvement appear for subsequent quarters.

The cautious tone over the next couple of quarters should help keep a lid on valuations before a stabilisation in 4Q21 and 1Q22 changes the prospects. With a decent amount of good news already baked into current valuations and a reasonable amount of disappointing earnings still to be digested, we expect that investors in global REITs are likely to experience a mild capital loss, which should be more than offset by income, to deliver a 3% total return in US dollar terms over the course of the next twelve months.

GLOBAL BONDS

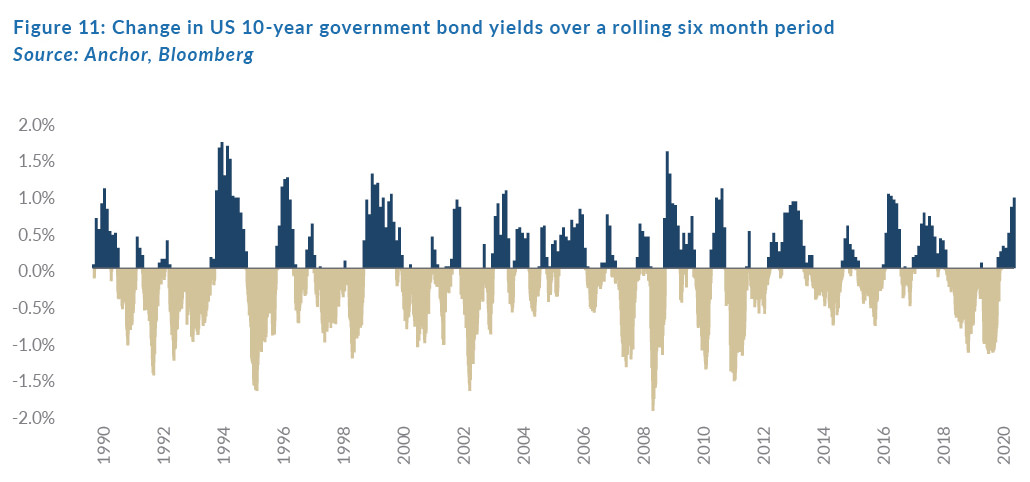

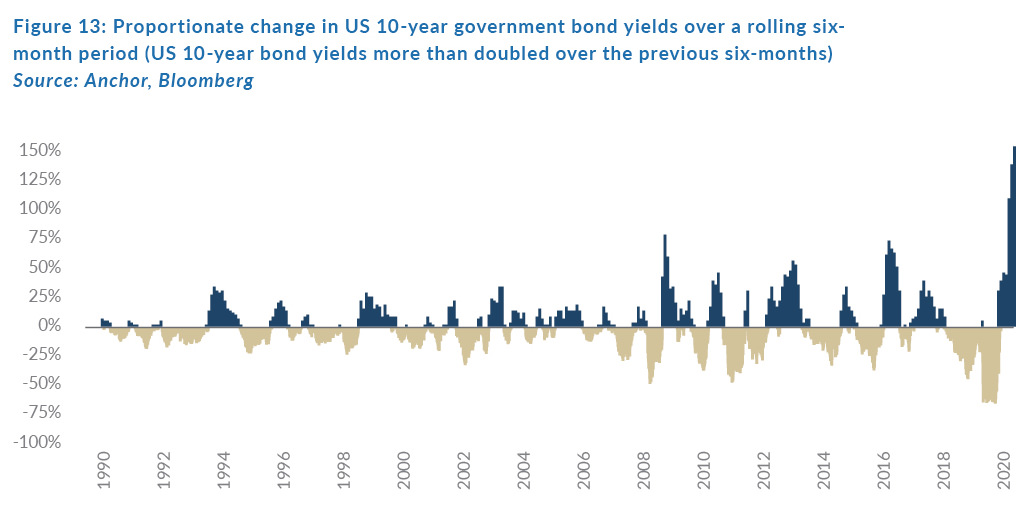

US 10-year bond yields, usually a topic that could send insomniacs to sleep, had an eventful 1Q21, even finding itself the subject of a few memes on the Reddit forum used by a new generation of tech-savvy young retail investors, WallStreetBets. The US government bond market is one of the largest and most important sectors of global financial markets (currently valued at more than $20trn), since rates on US government bonds form the cornerstone of financial market valuations. So, it is difficult to underestimate the role of US government bond yields in financial markets but, as the proxy for “risk-free” investing, it is expected to exhibit fairly low volatility. The recent pace of moves in US 10-year bond yields (yields climbed > 1% in the past 6 months) is certainly large within historical context. In fact, this is only the third time in the past decade that we have seen a move of that quantum.

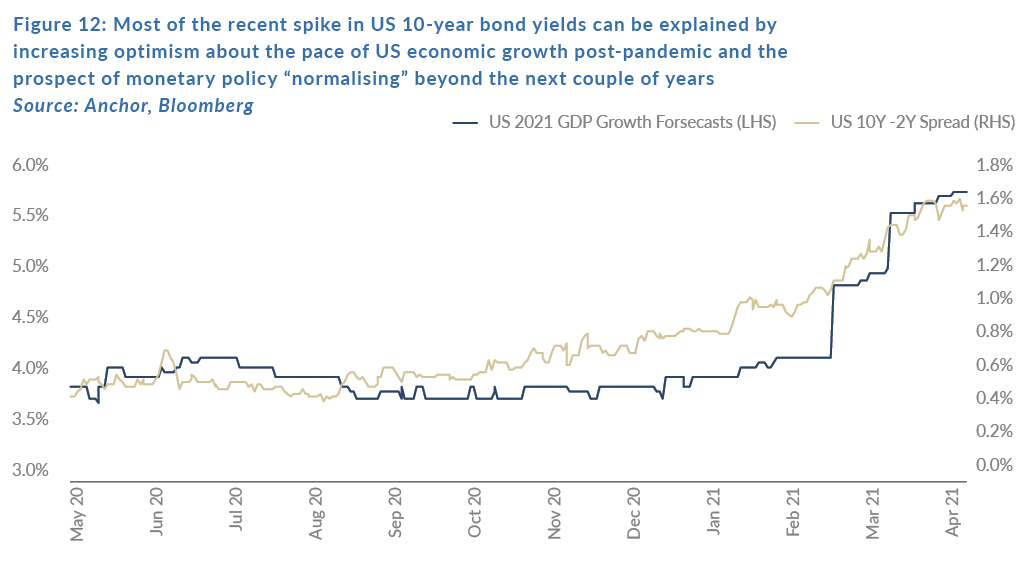

We were certainly amongst those caught off guard by the pace of the moves as we believed that ongoing central bank support would be enough to keep a lid on US 10-year bond yields. What has become clear is that, while investors are happy to follow Fed guidance that it will keep short-term rates anchored at around 0% for the next few years to ensure that it is not responsible for derailing the economic recovery, the market seems to be looking through that to a time when monetary policy will normalise and that has been reflected in the “steepening of the yield curve” (i.e. market implied rates for tenors beyond the next couple of years reflect the removal of central bank support). Recent speeches by US Fed chair, Jerome Powell, have made it clear that the Fed is very comfortable with the market’s assessment that the economic recovery is on track and monetary policy will eventually normalise.

Our task now is to forecast the direction of rates from here and, from that perspective, we consider the following factors:

- How will inflation evolve?

- At what level do higher yields become unsustainable?

HOW WILL INFLATION EVOLVE?

We think that we will see some transitory inflation because of pandemic-induced supply chain issues and low base effects. However, the Fed will look through these and underlying structural trends and the composition of the US inflation basket will keep the Fed’s preferred measure of core inflation comfortably below 2% for most of the foreseeable future. (For more detail on this read our recent article entitled Will inflation end the bull market?, dated 25 January 2021).

AT WHAT LEVELS DO HIGHER YIELDS BECOME UNSUSTAINABLE?

Earlier in this article, we discussed the recent change in US 10-year bond yields in absolute terms, but perhaps more pertinent to the debt sustainability discussions is the size of the move relative to its level. Over the past six months, yields have more than doubled off a low base (US 10-year bond yields were c. 0.7% six months ago). This is comfortably the biggest proportionate six-month move in US 10-year bond yields we have seen – more than double the proportionate move of any previous spike in yields.

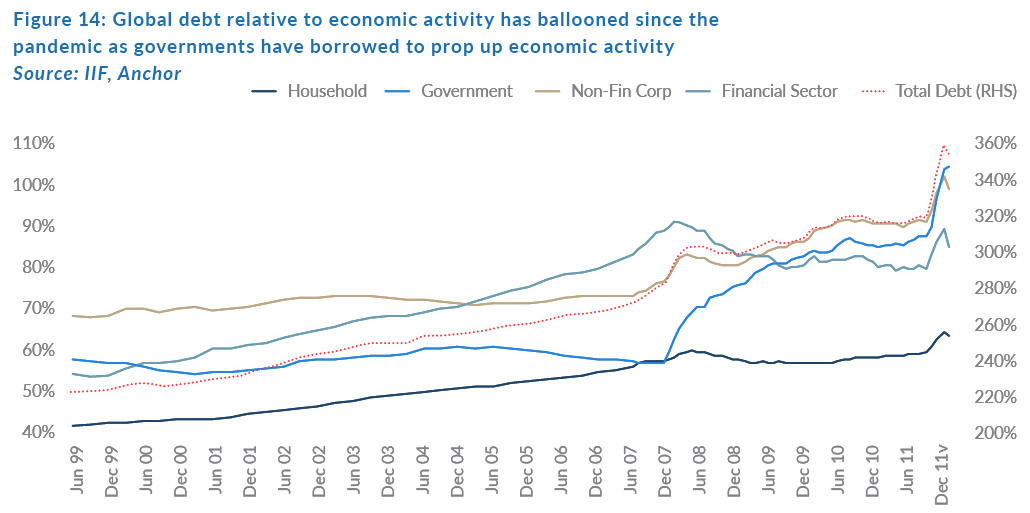

The proportionate move is relevant given the affordability of the world’s current debt load as a function of historically low interest rates. Government debt, in particular, has ballooned over the past decade even as banks and households have worked to keep their indebtedness under control in the wake of the global financial crisis (GFC). While improving economic activity should help consolidate the level of relative debt, the sustainability of the debt requires interest rates to remain near historic lows, particularly given that governments (particularly the major DM ones – the US, Europe, and Japan which owe the bulk of the debt) are significantly less able to reset their debt load via default like other major borrowers (households, corporates, and the financial sector). The alternative to default, which comes in the form of transferring the debt back to households and corporations via higher taxes, we think is largely politically unpalatable and much less likely to happen.

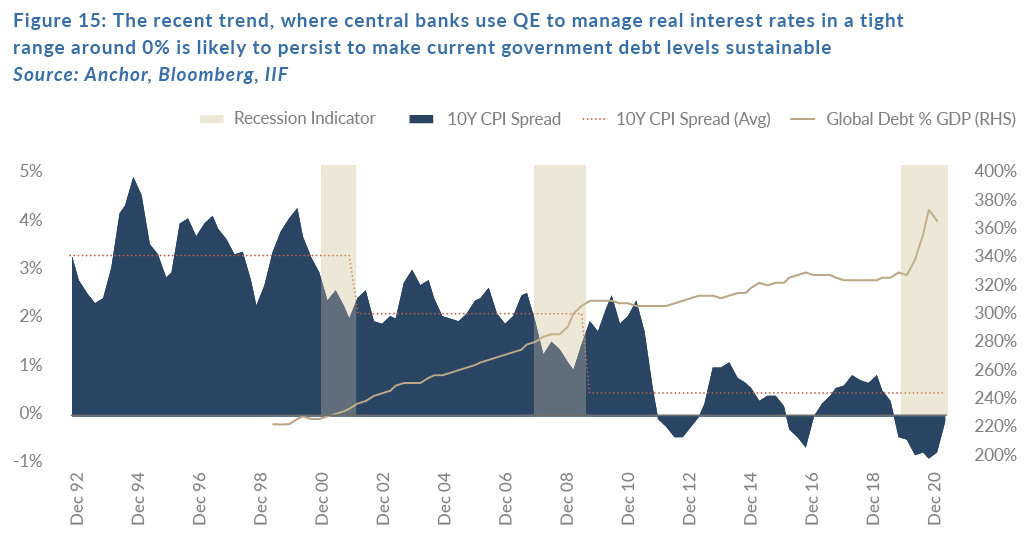

With that context, we think it is likely that we will see major central banks working to maintain real interest rates in a fairly tight range of around 0% as we have seen over the course of the past decade, using QE as the tool with which to achieve that outcome.

So, with the current term premium on US government debt already factoring in a fairly rosy outcome, any spikes in inflation are likely to be transitory in nature and central banks are likely to use QE to manage the real interest burden on governments’ heavy debt levels. We think US 10-year bond yields are likely to top out at around 1.85% over the course of the next year, leaving investors in US 10-year government bonds with a 0.4% total return. Even though US investment-grade corporate credit spreads are at their post-GFC lows, we think the strong economic trajectory likely supports them around these levels, leaving investors in the asset class with a total return over the next year of 1%.