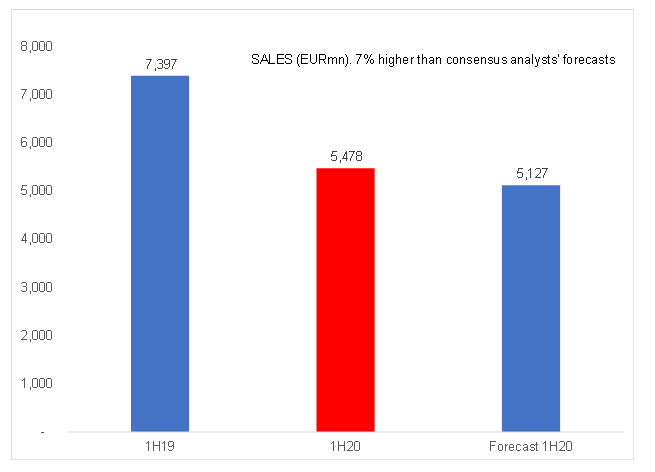

The COVID-19 pandemic wreaked havoc on the global luxury goods industry, with international flights being grounded and economies under lockdown, and Compagnie Financière Richemont SA (Richemont), which owns jewellery brands such as Cartier and Van Cleef & Arpels, had reported a 47% YoY revenue decline in its 1Q21 (the quarter ended 30 June 2020). However, the company’s 1H21 results (for Richemont’s 1Q21 and 2Q21 periods), released in early November, showed a pretty substantial beat vs expectations, both on the top line and down through the income statement. Revenue declined 25% YoY to EUR5.5bn (Figure 1), but Richemont also saw some positive trends coming through in 2Q20 after the sharp 1Q20 sales drop. Half-year profit fell 82% YoY to EUR159mn, while operating profit dropped 61% YoY to EUR452mn. Richemont’s margin (at c. 15.7% a year ago) stood at only 8.3%.

Figure 1: Richemont sales, EURmn

Source: Company data, Anchor

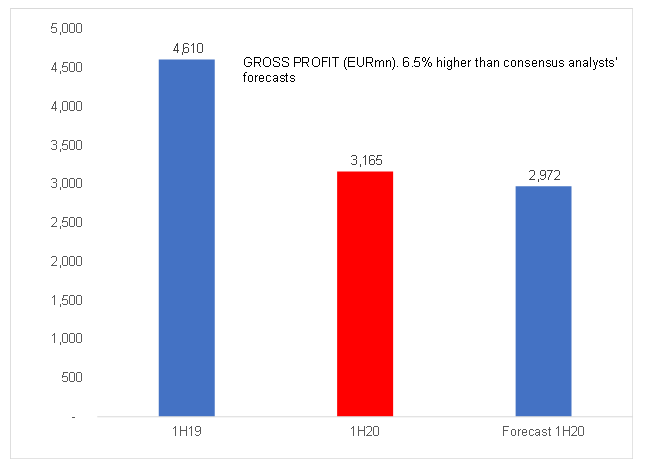

Figure 2: Richemont gross profit, EURmn

Source: Company data, Anchor

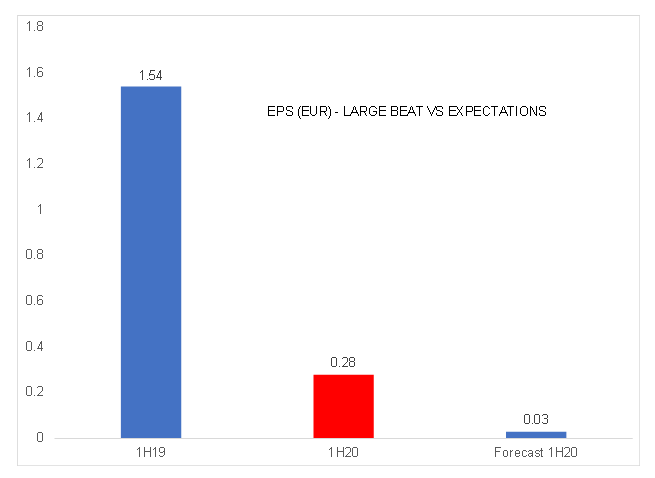

Earnings per share (EPS) was a large beat vs company and consensus analyst expectations, coming in at EUR0.28 – down 82% YoY (see Figure 3).

Figure 3: Richemont EPS, EUR

Source: Company data, Anchor

Europe and the Americas were the most severely impacted regions, with relative resilience in Asia Pacific and the Middle East and Africa. Asia Pacific, in particular, registered a V-shaped recovery in 2Q20 (+22% YoY). China, the epicentre of the pandemic in the first few months of this year, saw revenue jump 78% for the six-month period due to purchase activity reshoring in the absence of travel, and triple-digit growth in online sales. This strong growth in China contained the decline in Richemont’s Asia Pacific region and helped offset the sales drop in Richemont’s other regions.

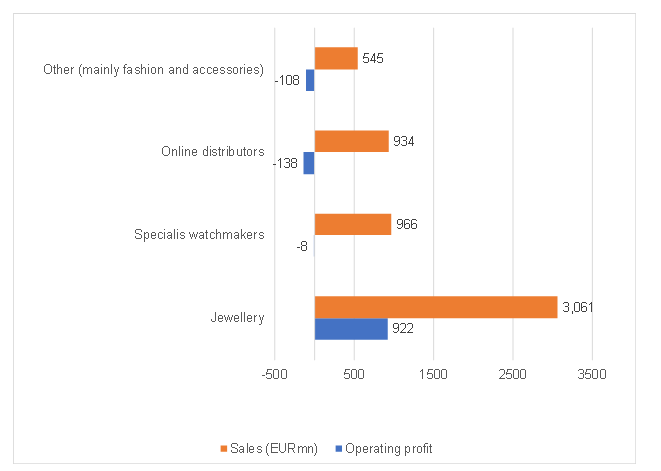

By segment, Jewellery remained the bedrock of the business and was the only profitable category in the half-year period.

Figure 4: Richemont results by operating segment

Source: Anchor

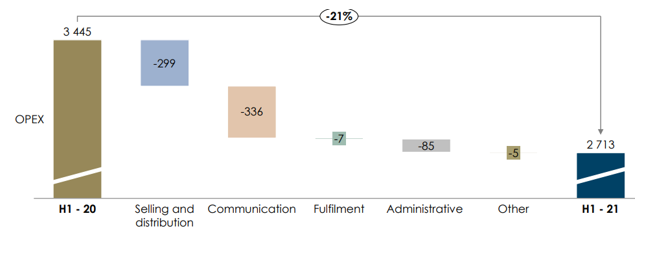

The gross margins fell from 62.3% to 57.8%, but this was not surprising given the difficulties of the period and managing inventory levels etc. The operating margin dropped from 15% to 8% , although cost containment was quite good, with operating expenses falling 21% YoY and meaningful cost cuts made in Selling and Distribution (accounting for 53% of operating expenditure) and Communication (mainly events, launches, etc. being cancelled or delayed).

Figure 5: Richemont results by operating segment

Source: Company data

The major headwinds in the COVID-19 environment were outlined in the financials as being:

- Lower manufacturing capacity utilisation;

- adverse currency movements;

- higher gold prices; and

- a highly competitive pricing environment in online fashion.

However, we note that none of these should come as major surprises and, in our view, earnings upgrades for Richemont will likely follow these results.

The market also seemed to react very positively to the announcement that Richemont was partnering with Alibaba and Farfetch to speed up the digitisation of the luxury goods industry and improve access to China by investing $550mn each into Farfetch China, described as a “funky deluxe online retailer”. Alibaba and Richemont will hold a combined 25% stake in the joint venture that includes Farfetch’s marketplace operations in China. Chinese consumers have taken to online luxury consumption with great purpose during the pandemic and, according to estimates by the Farfet CEO Jose Neves, there is $70bn of sales in luxury goods coming out of China which is not being met by brick-and-mortar retailers. A tie up with Alibaba, which has 750mn customers, therefore makes sense. However, our concern is that Richemont has yet to make the online luxury retailer which it acquired in 2018, YOOX Net-A-Porter Group (YNAP), and the rest of its current online thrust to date, profitable.

During the question and answer (Q&A) session, Richemont Chairman Johann Rupert was adamant that the company had to remain committed to the online journey, and the events of 2020 were a reset button, not a pause button. The venture with Alibaba would offer optionality to brand owners, Maisons, new partners and customers. Given Richemont’s healthy cash position (EUR2.1bn, after paying the FY20 final dividend), the investment also does not require any new debt or equity.

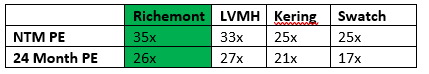

The Richemont share price has rallied by c. 15% since the results were announced (to 13 November’s closing price) and it is now trading at fairly racy valuations (see Figure 6 for Richemont’s one- and two-year forward price earnings).

Figure 6: Richemont valuation

Source: Company data, Anchor

We believe that Richemont will need a good second half (EPS of C. EUR1.30) and then keep up that run rate to FY22 to grow into its rating and be approximately equally valued vs LVMH, the juggernaut in the luxury sector. However, the share has broken out of its six-month R100 -R115 range and will, in our opinion, form a new range from R115–R130 over the next few months into 2021, when trading updates and results can prove the recovery and growth thesis to investors more confidently, particularly with regard to its online sales and strategy.