This year started with a slight wobble for global markets as the US Federal Reserve (Fed) expressed a more cautious stance on the pace of economic recovery and the US experienced arguably its most acrimonious transition of political power. Fortunately, sentiment improved quickly and, as of mid-February, most major stock markets were up strongly YTD.

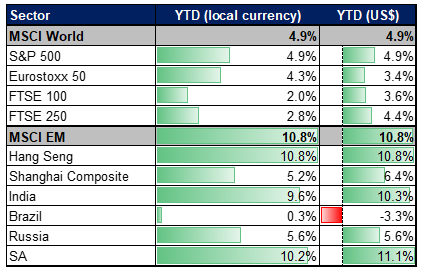

Figure 1: Global equity market returns YTD, to 12 February 2021

Source: Anchor, Bloomberg

Anchor started the year with undemanding expectations from global equity markets, with the surprisingly strong 2020 equity market returns having already seemingly baked some high expectations into asset prices (particularly in developed markets [DMs]). Considering the strong start to this year, we now have to ask the question as to whether there is a reasonable possibility of seeing markets flatline (or worse) for the remainder of 2021.

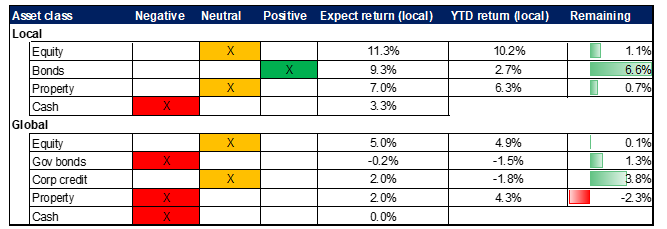

Figure 2: Anchor asset class views and expectations for 2021*

Source: Anchor, Bloomberg

*as published in The Navigator Strategy and Asset Allocation report 1Q21, dated 14 January 2021

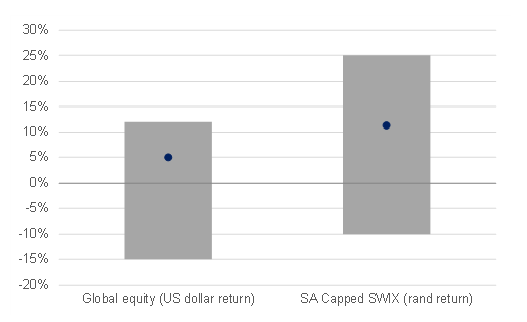

First, we need to ask ourselves whether what we are seeing in equity markets, in terms of their YTD performance, is within the realm of reasonable expectations. Even though the year is off to a slightly more robust start than we had expected, this outcome is still very much within the range of what we had reasonably forecast for 2021.

Figure 3: Anchor range of equity market return expectations for 2021*

Source: Anchor

* as published in The Navigator Strategy and Asset Allocation report 1Q21, dated 14 January 2021

Next, we have to ask whether the risks to sentiment or economic growth have changed meaningfully enough to change the outlook for asset class returns going forward? In our view, it would seem that the biggest factors potentially impacting sentiment and economic growth globally are:

- Fiscal support:

Democrats gained control of the US Senate, with victories in both the Georgia Senate seats run-off elections in early January, thus giving the party control of the Presidency, the Senate, and the House of Representatives. While Democratic control is by the thinnest of margins, it should be enough to ensure the passing of a fiscal stimulus package towards the high-end of expectations, with US President Joe Biden looking to deliver $1.9trn of fiscal stimulus (in addition to the $3.4trn of stimulus delivered in 2020).

- Monetary support:

Major DM central banks are expected to keep interest rates at close to zero for the next few years and are currently injecting about $500bn per month of liquidity into markets via quantitative easing (QE) programmes. Employment is likely to take a considerable time to return to pre-pandemic levels and, as such, we believe that the biggest risk to a slowing of this monetary support is likely to come from concerns about higher inflation. Our view is that inflation in most major DMs seems many years away, with the US economy seemingly the most likely to experience inflationary pressure. Our view is that the US will see an increase in inflation as economic activity normalises, but much of that will be transitory and, as such, will not pose a risk to ongoing monetary stimulus (for a more detailed analysis please click on the link for our report entitled Will inflation end the bull market?, dated 25 January 2021). We are watching US 10-year rates and inflation expectations closely for any signs that investors could start to see a sooner-than-expected change in the trajectory of monetary stimulus, though this remains an unlikely scenario to us for the foreseeable future.

- Vaccine rollout:

At the time of writing, c. 170mn COVID-19 vaccinations have been administered globally, with about 6mn vaccinations now happening daily around the globe. While this seems immaterial in the context of the global population (c. 2% of 7.7bn people globally), it represents a meaningful portion of the DM population (c. 1.7bn), which account for the bulk of economic output. The US and Europe (accounting for c. 45% of global economic output) are expected to have vaccinated their way to herd immunity during the course of this year, while China and Japan (accounting for c. 22% of global economic output) have been effective at controlling the spread of the virus even without significant vaccination rollouts. It is also expected that, even in those countries which are slow to roll out vaccination programmes, governments are becoming more adept at maintaining high levels of economic activity, while containing new waves of infections. Here we are watching for signs of a meaningful spread of vaccine-resistant mutations in major economies to derail progress, though we believe that this is a low-probability outcome.

In our view, all three of the abovementioned factors, supporting global economic activity and market sentiment, remain intact for now and do nothing to materially change our outlook for those major asset classes on which we focus.

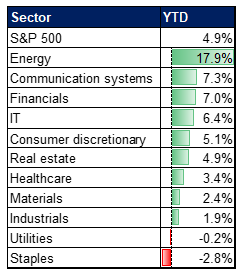

Monetary and fiscal stimulus measures should be broadly supportive of equity markets, while we expect progress on vaccinations will most likely help with a re-rating of cyclical sectors, which have been the hardest hit by movement restrictions. We have already seen a cyclical re-rating start to play out to a limited extent in the energy and financial sectors (and, to a lesser extent, in the real estate sector, which also has some structural headwinds).

Figure 4: Some cyclical sectors have started to re-rate based on the expectation for a vaccine-induced economic normalisation

Source: Anchor, Bloomberg

What about valuations?

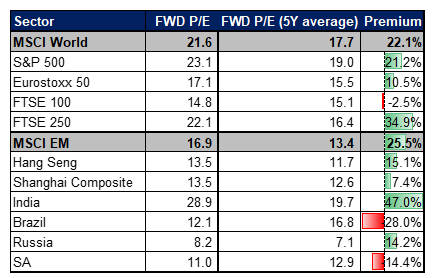

We are also not oblivious to concerns about above-average valuations for equity markets, with many markets trading significantly above their long-run averages:

Figure 5: The liquidity environment is supportive of elevated valuations

Source: Anchor, Bloomberg

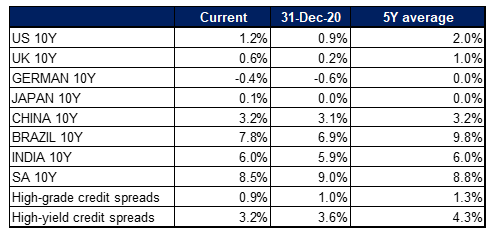

While elevated valuations may limit some of the upside potential for global equity markets, we think that the environment remains supportive of these valuations, particularly as record low interest rates in DMs render meaningful allocations to cash and bonds relatively unappealing.

Figure 6: Low DM yields are driving investors in search of better potential returns

Source: Anchor, Bloomberg

How does this impact the local equity market?

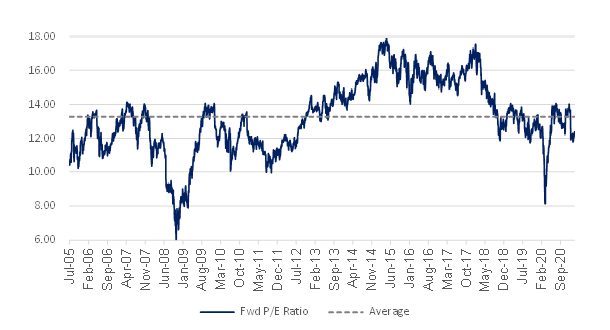

We have had many conversations with clients about the recent strong performance of the local equity market (FTSE/JSE Capped SWIX +10.2% YTD). The JSE’s performance seems out of sync with the dire state of the local economy or, indeed, its prospects, especially given the delays in the rollout of a vaccination programme, structural headwinds to growth, and an already heavily indebted fiscus.

We think there are two primary reasons that leave us less concerned about the disconnect:

- Valuations already reflect a fairly dim view of domestic economic prospects, leaving a low hurdle for positive surprises.

Figure 7: FTSE/JSE SWIX Index – below average valuations on undemanding earnings expectations leave room for positive surprises

Source: Anchor, Bloomberg

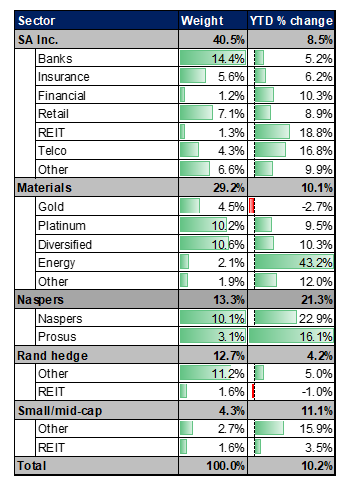

- The composition of the local bourse means that companies representing less than half of the market value of the FTSE/JSE Capped SWIX Index derive most of their earnings from domestic economic activity.

Figure 8: Most of the local bourse is sensitive to factors beyond SA’s borders

Source: Anchor, Bloomberg

Conclusion

Globally, we believe that the factors supporting economic and equity market growth remain firmly in place for the foreseeable future. Domestically, the stock market has the potential to achieve further gains as sentiment towards emerging markets improves, the local economy outperforms low expectations, and most of the local market is driven by factors beyond our borders.