In this note, the Anchor investment team highlights a selection of global equities worth watching in the year ahead (the chosen shares are discussed alphabetically). Please remember that these individual stock ideas may not necessarily be reflected in all client portfolios (as our portfolios have different mandates and risk-return profiles). However, we tried to find stocks that indicate how we pick our shares, which mirror our philosophy in this regard.

As 2024 draws to a close, it looks at the time of writing like it will go down as a very fruitful one for investors in global equities. Despite the many potential curveballs that dominated the news headlines (a multitude of national elections globally, spreading conflict in the Middle East, and China’s continued economic weakness, to name just a few), the cold assessment of all of this by Mr. Market, was that moderating inflation, falling interest rates and healthy US economic momentum is what really mattered. Looking under the bonnet, it was clear that navigating 2024 profitably was more tricky than the headline index returns imply.

Another year of US exceptionalism means that US equities now account for 75% of the MSCI World Index, the benchmark commonly referenced for developed market (DM) equity performance. Within US equities, while performances did broaden out somewhat in the latter part of the year, an unusually large proportion of the heavy lifting was done by a narrow group of mega-cap stocks driven mainly by the AI theme (Nvidia’s 142% rally has been particularly consequential in this context).

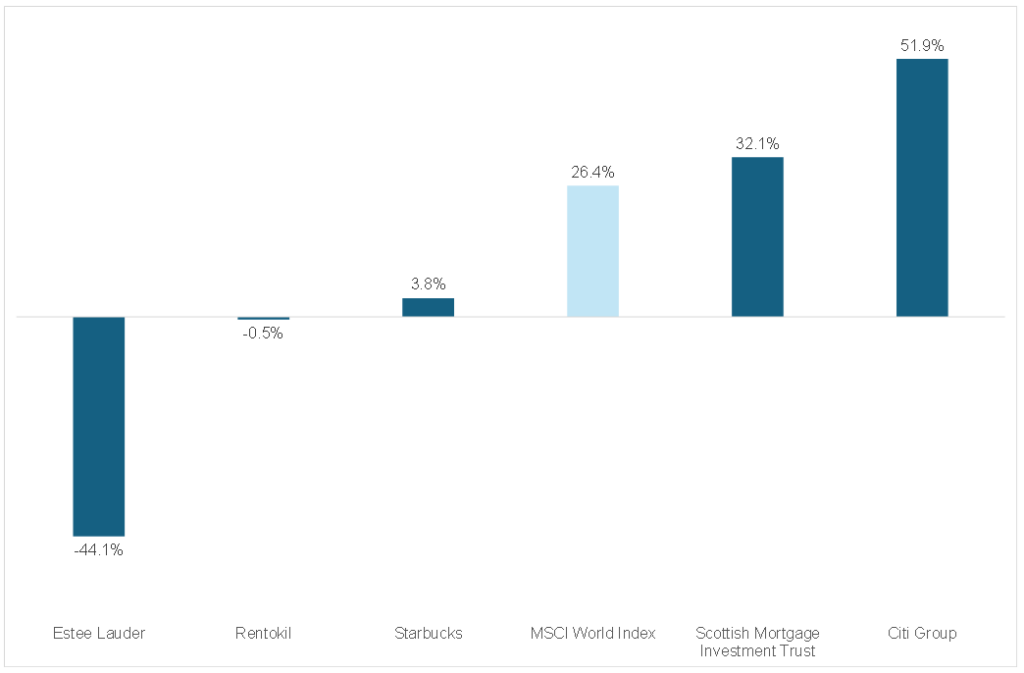

Looking at our scorecard for 2024, a 9% return from an equal-weighted basket will not have anyone reaching for the bubbly this Festive Season. With the possible exception of Scottish Mortgage Investment Trust, all our picks were fallen stars with a strong self-help theme attached to them. The lesson from this is that righting the ship, even for quality companies with a long history, is a complex task. For investors, these opportunities require patience and, at times, a thick skin.

Figure 1: Anchor’s 2024 global stock picks – US$ total return

Source: Anchor, Bloomberg

Taking on board lessons learned, we turn our attention to the year ahead. Sifting through the various outlooks that dominate one’s inbox at this time of year, there is a decidedly ‘TINA’ (there is no alternative) tone to them – a lousy and politically fractured Europe, China facing the sharp end of President-elect Donald Trump’s tariffs and consistently disappointing investors with measures announced to counter its economic ills leaves most of them anticipating another year of US exceptionalism. This, despite demanding valuations and much that is unpredictable about the market impact of Trump 2.0. For now, that likely calls for one to assume the market-friendly aspects promised on the campaign trail will stick (shredding of regulation, tax cuts, keeping energy costs down) while the problematic ones are nothing more than bluster. It is undoubtedly going to be an eventful year ahead!

Among our stock picks for 2024 (see our note entitled Anchor’s global stock picks for 2024, dated 11 December 2023) that did not work, it must be said that we have retained Rentokil in our portfolios. We are keeping the faith that this typically quality defensive company will work its way through the current period of indigestion with its sizeable Terminix acquisition. This serves as a reminder that we aim to identify quality compounders that we would be happy to own for many years – something often missed when considering some individual stock ideas with just a one-year time horizon in mind. Our 2025 ideas, the investment cases for which we set out below, stick firmly to our quality compounder philosophy, swimming somewhat against the TINA-US theme in that we include several non-US ideas but provide a good spread across geographies and industries. Learning from our fallen stars of 2024, the importance of strong operational momentum is exactly what our 2025 lineup seeks to deliver.

Admiral: An attractive long-term investment

By David Gibb, Fund Management

Admiral (ADM) is a short-term, primarily vehicle, insurance company, although it offers other types of insurance (e.g., travel and home insurance) and services (e.g., personal loans and legal services). It is based in Cardiff, UK, and has operations in Europe and the US. After a period of over-earning for the short-term insurance industry in 2020 and 2021 due to the impact of COVID-19 on driving behaviour (people were working from home, and accident rates dropped significantly), 2022 proved to be one of the most challenging years in its history. Inflation on car repairs escalated sharply while insurance premiums could not keep up. For those insurers who were poorly capitalised, 2022 was a near-death experience. 2023 was the year of catch-up as premiums continued to rise and claims inflation was more predictable. In 2024, the premium cycle appears to have turned over, with insurance premiums drifting down after the sharp rises in 2022 and 2023. Claims inflation remains elevated but predictable.

Admiral, the UK’s leading car insurer and a challenger in many European markets, has managed these turbulent times with consummate skill. To build customer loyalty during COVID-19, it provided premium holidays as customers were housebound. To protect profitability in 2022, it was the first to hike premiums as claims inflation began to take off. And now, with premiums drifting down, it is well-placed to compete in a more normalised environment.

However, with the share price having risen only 1% over the past twelve months and offering a P/E multiple of 14x and a dividend yield of 6.3% to December 2025, Admiral’s market capitalisation does not reflect the superior quality of the business. For those concerned about share prices across the Atlantic, Admiral has the potential added benefit of being part of the much-unloved UK stock market.

The Group’s 1H24 results were excellent, surprising on the upside and leading to an increase in the share price on the day the results were released. Turnover jumped by 43% YoY – significantly ahead of expectations. This can be attributed to Admiral’s continued effective response to the insurance cycle. Globally, vehicle insurance premiums have increased over the past 12 to 18 months to counteract claims inflation and maintain healthy margins. Admiral increased its prices in late 2022 and early 2023 but began to decrease insurance premiums ahead of its competitors at the start of 2024. This allowed it to gain market share as many of its competitors continued to increase premiums – making Admiral’s premiums comparatively more attractive.

Admiral has gained c. 2% market share in the UK Motor market, holding a substantial 21% share in 1H24. The company has achieved significant growth in its customer base, with a 12% YoY increase in aggregate customers and a 15% YoY rise in its UK Motor business customers. EPS rose by a healthy 35% YoY for 1H24. We note that the market often struggles to forecast the company’s profits due to reserve adjustments. Nonetheless, consensus estimates for Admiral’s FY24 earnings have been meaningfully adjusted upwards. Premiums have started to decline again as profitability within the industry has largely been restored. Some industry players have been relatively aggressive in lowering premiums to gain customers. With profitability relatively stable within the industry, the focus has been on retaining customers. Claims inflation remains high but seems to be moderating slowly, dropping slightly from 10% in 2023 to the high single digits this year. Claims inflation will have to decline further to allow for more meaningful premium decreases. Accident rates remain below pre-pandemic levels, which we believe is likely partly due to improved vehicle technology.

The company continues to have a good, long-term outlook, but we are past the recent “sweet spot.” Admiral is now focused on retaining its market share as claims inflation gradually reduces. It remains in a strong claims reserve and solvency position. The market is becoming more competitive, indicating that premiums have increased sufficiently. Admiral has been working on diversifying its insurance book in terms of geography and insurance type. Geographically, the company has a presence in Europe and the US, though the US business has not yet been successful. Admiral has been working on diversifying away from vehicle insurance by moving into pet and home insurance.

Regarding valuation, our discounted cash flow (DCF) model shows an attractive upside of c. 44% from the current share price (as at 6 December 2024). The dividend yield (2024) is just above 5%, and the P/E ratio is 14.3x to the end of 2025, with good EPS growth expected. The share price is up c. 1% in British pounds over the past 12 months. We believe that Admiral is an attractive long-term investment, offering a high return on equity and a decent dividend yield.

Alphabet: Searching for a Brighter Future

By Nick Dennis, Fund Management

In 2017 a team of Google scientists published the research paper “Attention is All You Need”, which became foundational for generative AI. Ironically, some now perceive Google as lagging in AI, with its core Search business seen as vulnerable to disruption by AI-first companies like OpenAI and Perplexity. Coupled with heightened regulatory scrutiny from the US Department of Justice (DOJ), this perception has led Alphabet, Google’s parent company, to trade at a forward P/E of 18.5x – 12% below its five-year average of 21x. By contrast, the S&P 500 trades at a P/E of 22.5x, a 13% premium to its five-year average. This valuation gap presents a compelling investment opportunity in Alphabet shares, both on an absolute and relative basis.

A Proven Track Record in Innovation

By the late 1990s, dozens of search engines crowded a nascent market (remember AltaVista and Ask Jeeves?) with many boasting a multi-year head start over Google. Yet Google’s revolutionary PageRank algorithm propelled it to a 90% market share in search, highlighting its ability to disrupt established players.

While newer competitors like ChatGPT have gained attention in generative AI, Google’s unique strengths suggest it remains well-positioned for long-term success. These include:

- A proven history of AI innovation, including advancements in machine learning.

- Access to vast datasets, including text, audio, and video.

- Globally scaled data centre infrastructure, powered in part by its custom-built Tensor Processing Units (TPU) chips.

- An unmatched distribution network, with eight products boasting over one billion users each.

The Power of the Search Ecosystem

Google owns the most valuable piece of real estate on the internet: the Google search bar. While tech-savvy users may experiment with AI applications like ChatGPT, the overwhelming majority still rely on Google for information retrieval. The company’s introduction of AI-enhanced search features, such as ‘AI overviews,’ is already promoting increased user engagement. Google’s mission, “To organize the world’s information and make it universally accessible and useful,” aligns naturally with AI’s potential to enhance its core offerings, paving the way for greater monetisation.

Regulatory Wildcards and Opportunities

Regulatory risks remain an overhang, with the possibility—albeit unlikely—of a court-mandated breakup. The DOJ’s proposed remedies appear severe and potentially overreaching, but a shift in political priorities under the new US administration could lead to a more favourable regulatory environment. Easing regulatory pressures in 2025 could function as a positive catalyst for Alphabet shares. However, the more critical narrative will revolve around Alphabet’s ability to demonstrate its capabilities in AI, reassuring investors and driving its share price higher.

Fortinet: Founder-run business with a strong focus on prudent capital allocation

By James Bennett, Global Equity Market Analyst

When ranked by revenue, Fortinet stands out as the second-largest independent, pure-play cybersecurity company. Founded in 2000 by brothers Ken and Michael Xie, who continue to lead the company, Fortinet is based in California (US) and was listed in 2009. With a current market capitalisation of US$73bn, it holds a unique position in the cybersecurity industry.

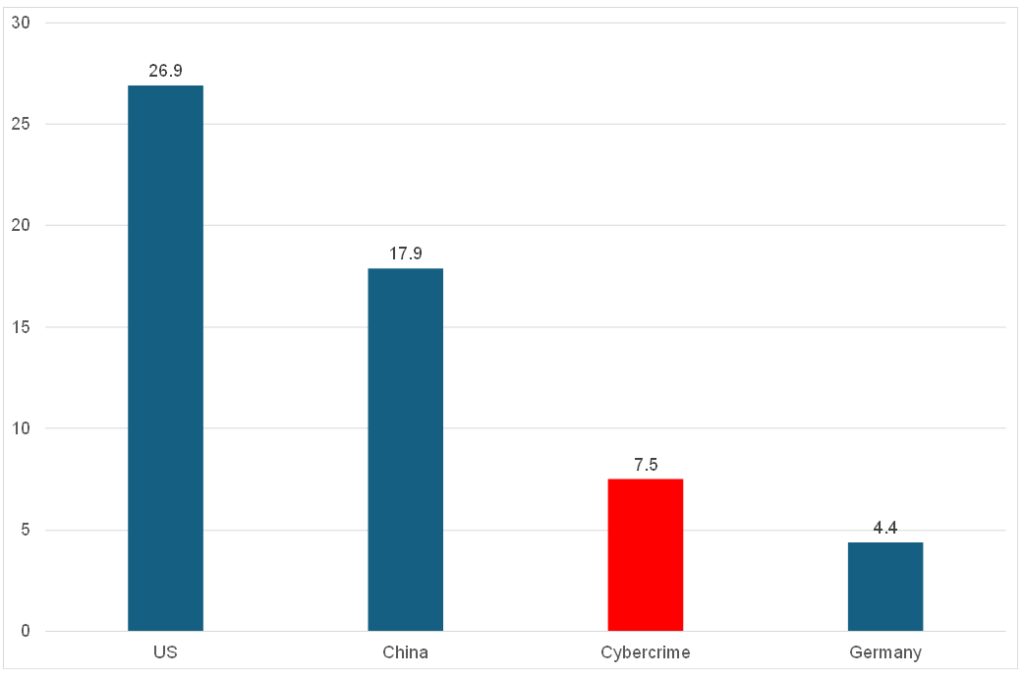

The estimates of cybercrime’s costs to the global economy vary widely, ranging between US$5trn and US$10trn p.a. Either way, the cost is enormous. This has led many observers to rank cybercrime as the third-largest “economy” in the world after the US and China.

Figure 1: The largest global economies in 2023, US$trn

Source: IMF, Anchor.

We have used the mid-point of the US$5trn-US$10trn range estimate for the cybercrime economy.

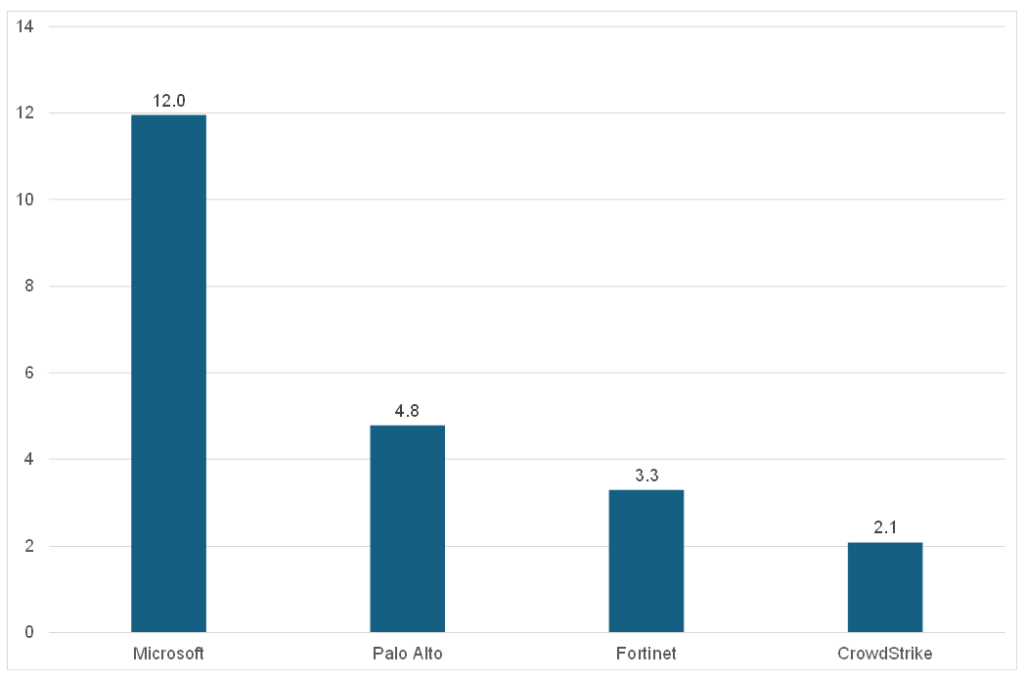

Microsoft is considered the biggest player in the cybersecurity industry. However, it bundles many cybersecurity products into broader software packages. As such, its estimates of c. US$20bn in cybersecurity revenue is often taken with a pinch of salt. It is unclear whether it could achieve this level of revenue if its cybersecurity products were all sold on a standalone basis.

Palo Alto is the largest independent cybersecurity company in the world, yet it has only a c. 5% global market share. Fortinet is likely the second-largest independent, with a c. 3% market share.

Figure 2: Cybersecurity market share by company, %

Source: Company reports, Statista Market Insights, Anchor

Microsoft’s market share is based on the company’s indication that it achieves c. US$20bn in annual cybersecurity revenue.

Cybersecurity is considered the most defensive part of the global tech sector, meaning it is the least likely to be cut in an economic downturn. Furthermore, it is arguably the second fastest-growing software sector behind artificial intelligence (AI). This means the sector can be owned on a through-the-cycle basis.

Given the dramatic increase in cyber hacks and ransomware attacks, corporate cybersecurity spending is not just an option but a necessity. While purchases of the latest cyber protection can be delayed, this is only a temporary solution. The shift to the cloud is another key secular theme in global tech. In many respects, this cloud theme overlaps with the cybersecurity theme. The move to the cloud has dramatically raised the attack surface, which must be protected, spawning a whole new wave of cloud-native cybersecurity solutions. Rising global geopolitical tensions have also heightened the risk of cyber warfare.

The vendor offerings in cybersecurity are diverse, with many large corporates using 40 to 60 vendors for their cybersecurity needs. This has made protection complex and costly, with a wide range of solutions that do not always talk properly to each other. One key theme that has been developing in cybersecurity is the consolidation of these solutions down to fewer, wide-platform vendors.

Fortinet has one of the most comprehensive cybersecurity solutions platforms in the world. This makes Fortinet a one-stop shop for corporates. Fortinet is considered best-in-class in several areas of cybersecurity, such as firewalls, SD-WAN and OT security. This is all brought together by its proprietary single operating system called FortiOS. The issue with a comprehensive platform is that if a vendor is best-in-class in several areas, it does not have to be the absolute best in its other offerings. These just have to be good enough. Small, point solution vendors have no choice but to be the absolute best in what they do.

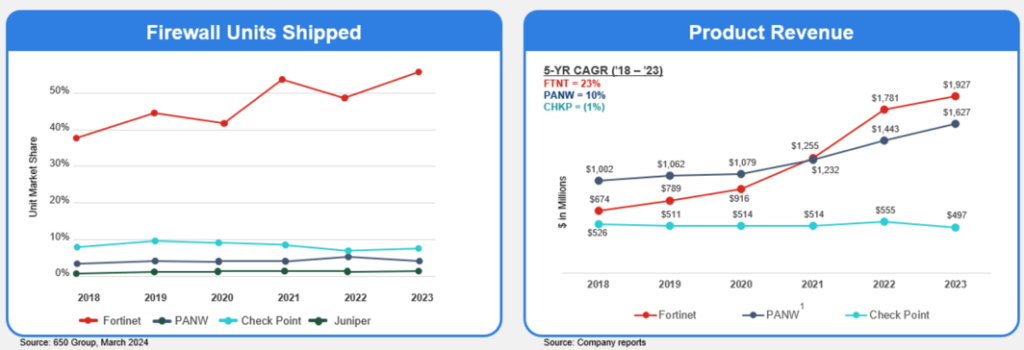

Figure 3: Fortinet material gainer in firewall market share

Source: Fortinet

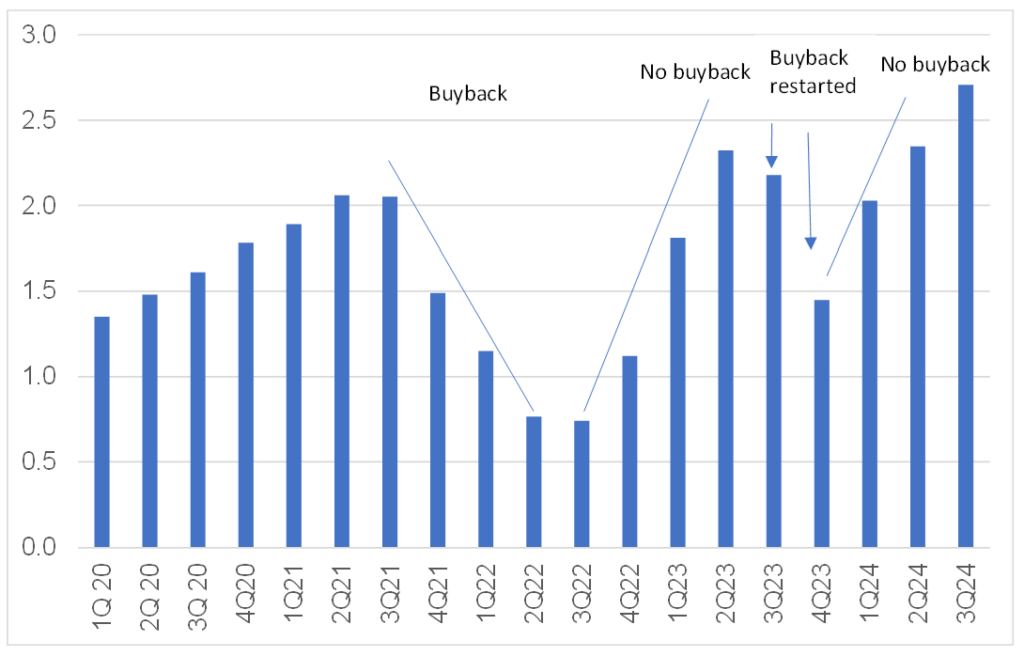

Fortinet is an exceptionally well-run company with a significant focus on shareholder returns. It has lower equity dilution from stock-based compensation than most other tech companies. It is in a net cash position and uses most of its free cash flow to buy back its shares (typically only after the share price has fallen). As such, it has reduced its shares in issue by about 10% over the past five years. Also, Fortinet has a proud record of internal innovation rather than conducting multiple smaller bolt-on acquisitions to gain leadership in cybersecurity. Fortinet’s free cash flow margins of c. 40% are incredibly high and put it within the top 10% of all the companies listed in the S&P 500 Index on this measure.

Figure 4: Fortinet’s strong balance sheet – net cash, US$bn

Source: Fortinet, Anchor

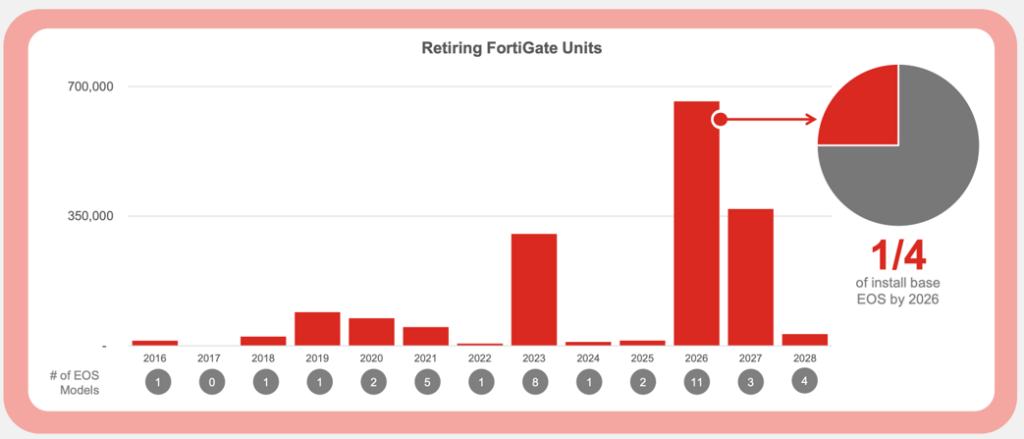

About 30% of Fortinet’s revenue comes from selling its physical firewalls. A firewall typically gets replaced every 4-5 years, so Fortinet’s hardware sales are driven by the refresh cycle. The company recently reported that a record number of its devices in the market are reaching end-of-service (EOS) in 2026, followed by another material number in 2027. Given the typical order lead times, Fortinet’s firewall orders will likely pick up sharply by 2H25 at the latest.

Figure 5: Fortinet at the start of a meaningful hardware refresh cycle

Source: Fortinet

Companies like Fortinet seldom go on sale from a valuation perspective. We can hardly make a case for Fortinet being a value stock. However, it has an excellent track record of delivery and several best-in-class products in the cybersecurity industry. This is an industry with strong secular tailwinds.

Fortinet is trading on an EV/12-month forward sales multiple of 10.5x. This is significantly lower than the 20x-80x multiples the US high-growth tech companies traded on during the 2020-2021 valuation bubble. Fortinet is currently trading at a one-year forward P/E of 36x. While this might appear high, it is not uncommon for US growth tech stocks to sustain these multiples. This multiple is also towards the lower end of Fortinet’s valuation range over time.

Novo Nordisk and Eli Lilly: Rivals in the battle to treat obesity

By Ross McConnochie, CFA, Offshore Analyst/Portfolio Management

Every few years, the pharmaceutical industry unveils a revolutionary product that changes the lives of millions of humans. In the 1980s, it was Prozac and Xanax. In the 1990s, it was Viagra. In the 2000s, it was Nexium and Humira, and now, in the 2020s, it is the weight-loss drugs Wegovy (Ozempic) by Novo Nordisk and Zepbound (Mounjaro) by Eli Lilly.

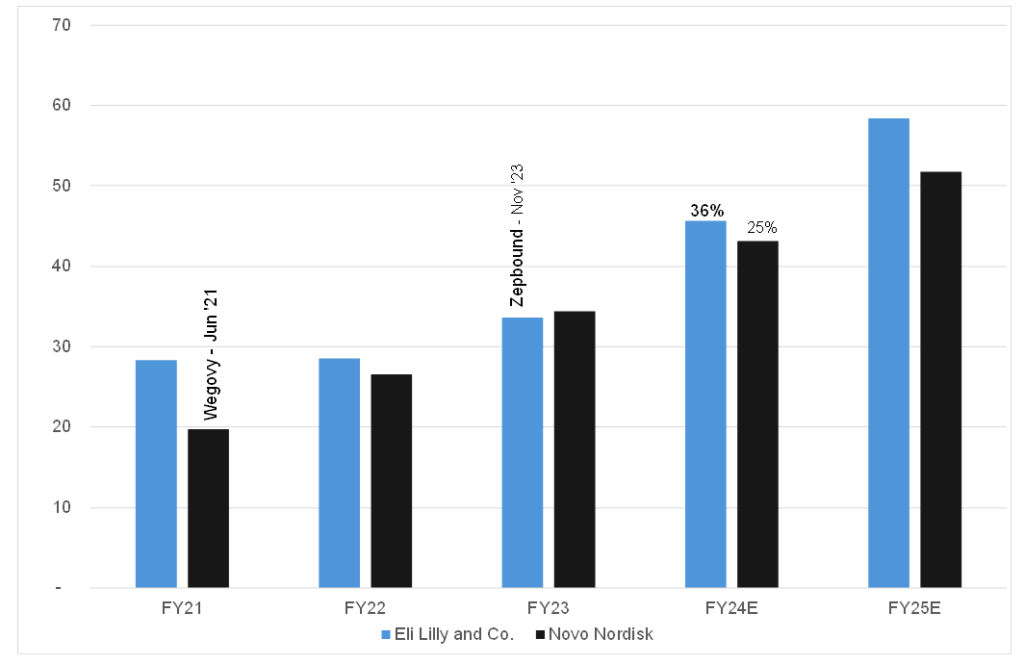

These latest blockbusters are collectively called glucagon-like peptide -1 receptor agonists (GLP-1s) and are a class of medications initially used to manage blood sugar levels in people with type 2 diabetes. However, one of the “side effects” of these medicines was the suppression of hunger. Novo Nordisk was the first to rebrand and receive US Food and Drug Administration (FDA) approval for Wegovy as a weight loss drug in June 2021. Eli Lilly followed with Zepbound in November 2023. As appetite suppressants, these drugs gained significant attention from the public, in particular because of their use by celebrities, so much so that there are still occasional shortages due to the high demand.

According to the World Health Organisation (WHO), obesity has nearly tripled since 1975, and there are now more than one billion people globally who are clinically obese. Of the 1bn, 890mn are adults and 160mn are adolescents. Total GLP-1 sales at Novo Nordisk and Eli Lilly are likely to be US$45bn in 2024, and analysts believe the total obesity drug market could be greater than US$130bn by 2030.

In 2024, Eli Lilly’s GLP-1 sales account for approximately 40% of total revenue, which is expected to rise to two-thirds of total revenue in 2026. For Novo Nordisk, GLP-1s were already 63% of 2024 revenue, rising to 70% in 2026. Obesity drugs are quickly becoming the primary driver for these companies.

Figure 1: Eli Lilly and Novo Nordisk revenue comparison, US$bn

Source: Company financials, Bloomberg, Anchor.

The chart above shows the revenue comparison (in US dollar terms) between Eli Lilly and Novo Nordisk with the release dates of their GLP-1 drugs approved for use in obesity. Eli Lilly and Novo Nordisk are expected to grow revenue by 36% and 25% YoY in 2024, respectively.

GLP-1s are relatively convenient to take as a once-a-week injection to the stomach or thigh. Still, both companies are scrambling to produce an oral tablet to market, for which Eli is expected to release trial results in 2025. Patients tend to cycle on and off the medication over more extended periods. Sadly, patients are gaining weight when not taking the drug as they return to their old habits. This consequently creates a long-term reliance on the drug and a recurring revenue stream for Novo and Eli. GLP-1s do have some side effects (primarily gastrointestinal) and thus are more appropriate for clinically obese patients who are in desperate need of assistance and where the benefits may outweigh the risks. However, the market expects these companies to reduce these side effects over time, allowing for the expansion of the total addressable market to people with lower body mass indices (BMIs).

Doctors are currently seeing better efficacy and tolerability from Zepbound over Wegovy, with some patients losing 21% of their body fat compared to Wegovy’s 15%. This partly explains why Eli Lilly has been the better-performing share this year. Still, in December 2024, Novo is expected to release trial results of its updated variant of Wegovy called CagriSema, which Novo Nordisk claims will reduce body weight by 25% without increased side effects.

Although competition in the space is intense, it is quite clear that these two companies are the market leaders in obesity treatment. However, picking a winner is incredibly difficult as they each gain a short-term advantage over the other when updated products are approved. We thus believe a split investment between the two companies is better on a risk-adjusted basis. This will allow for better diversification of possible FDA rejections, litigious risks, manufacturing issues, and patent cliffs that pharmaceutical companies typically experience.

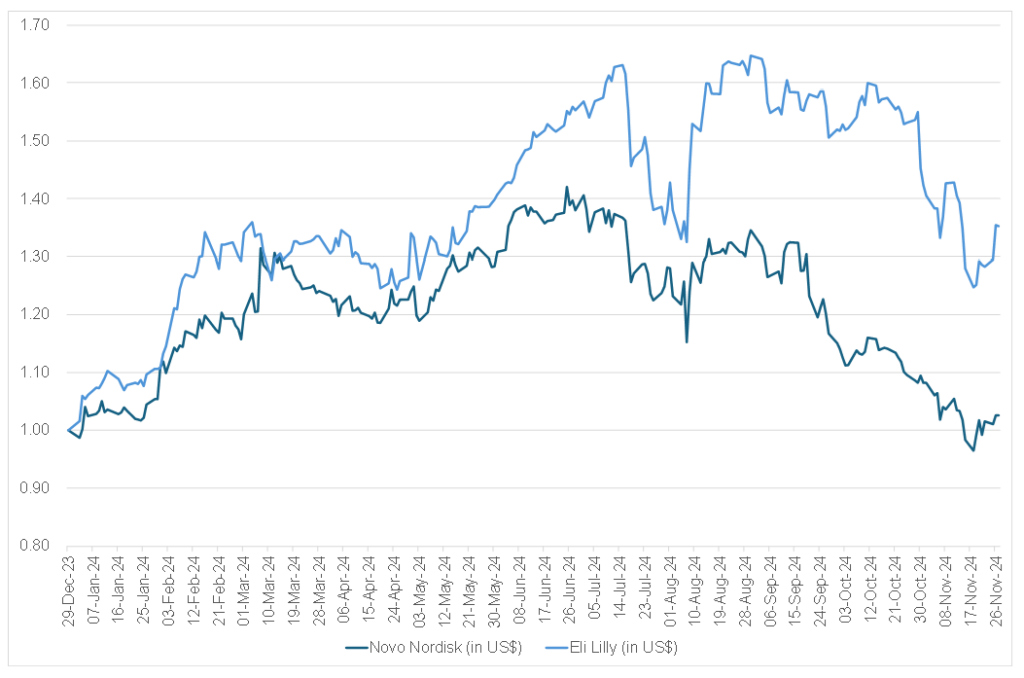

Figure 2: Eli Lilly and Novo Nordisk share price performance since 31 December 2024, rebased to 1

Source: Bloomberg, Anchor.

Both shares were stratospheric performers in 2023 but have taken a breather in 2024. The most recent sell-off in pharmaceuticals was due to Trump’s election victory and the anticipated impact of Robert F Kennedy Jr. being appointed as his administration’s health secretary.

So far, these drugs have proven to be a massive success in the fight against obesity. The long-term societal improvements are expected to be immense, with cost savings over 10-15 years from improved cardiovascular outcomes, fewer cancer and liver disease cases, and higher employee satisfaction/fewer missed work days. It is looking more and more likely that these drugs might become societal norms for a larger group of people needing assistance with food cravings, and Eli Lilly and Novo Nordisk are well-positioned to continue to take advantage of this long-term recurring revenue.

Rheinmetall AG: Prospering in a changing world order

By Mike Gresty, CA(SA), CFA, Fund Management

In retrospect, Russia’s invasion of Ukraine in February 2022 marked the end of the 30-year “peace dividend” the world had enjoyed since the fall of the Berlin Wall, which roughly coincided with the end of the Cold War. The growing realisation among investors that the subsequent changing world order is an enduring theme has led to considerable interest in what had for decades been a largely ignored corner of the market – defence. Unfortunately, translating the theme into viable investment options has proved trickier than one might think. Many companies exposed to this theme are poor quality (delivering mediocre returns on capital), have extensive civilian exposure alongside their defence activities or have not seen much change in their prospects because of country-specific budget issues or their particular defence focus not being relevant.

Rheinmetall (RHM), a recent addition to the Anchor Global High Street Equity model portfolio, addresses many of the above shortcomings and appears particularly well-placed to benefit from Europe’s urgent need to upgrade and modernise its defence capability after decades of falling short of the NATO target of 2% of GDP (cumulatively c. EUR1.3trn of underspending to date). Founded in 1889 to produce ammunition for the German Empire, Rheinmetall was forced to switch entirely to manufacturing civilian production post World War 2. It resumed armaments and ammunition production in 1956 and, from the 1970s onwards, began to expand internationally through a series of acquisitions. In the past decade, Rheinmetall has made a strategic pivot towards defence, exiting several of its civilian automotive businesses in the process. In FY23, defence accounted for c. 87% of Group operating profit and this proportion is set to rise going forward.

Undoubtedly, a possible near-term risk for the Rheinmetall investment case would be an end to the hostilities in Ukraine – something that US President-elect Donald Trump has promised to bring about in short order post his inauguration. Whether this happens or not, we expect the potential opportunity extending to the end of the decade to be considerable. Some points in this regard are as follows:

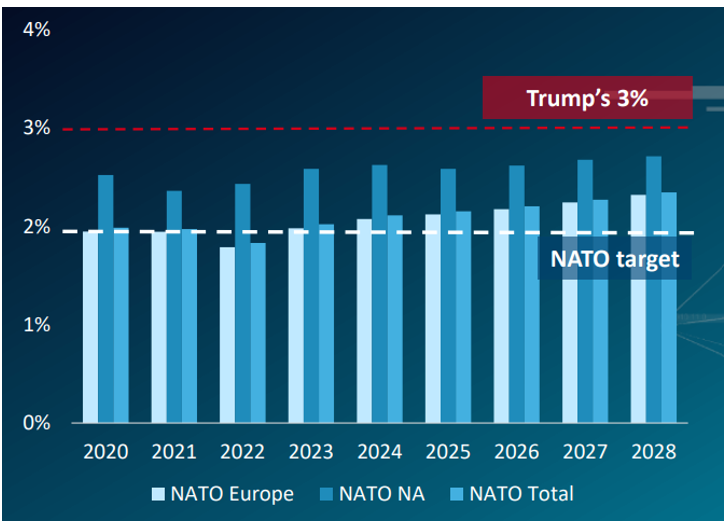

- On the campaign trail, Trump pledged to push NATO allies to raise their target for defence spending to 3%. Whether this happens or not, the reprioritisation of defence for Europe in the face of aggression from Russia is evident from the projections shown in the chart below (drawn from the latest Rheinmetall Capital Markets Day). Note too that, within this spending, at least 20% is to be spent on defence equipment and research.

Figure 1: Projected defence spending, % of GDP

Source: Rheinmetall CMD

- Among the lessons learned in Ukraine has been the return to high-intensity conventional warfare, resulting in enormous demand for munitions. For Europe to meet the NATO requirement of a 30-day inventory of ammunition, the re-stocking required equates to six years of production (some estimates point to a much higher requirement than this). Rheinmetall’s Weapon and Ammunition division (the Group’s highest margin and largest profit contributor [40% of operating profit]) has invested heavily in capacity. Its largest acquisition to date of Spanish company EXPAL in 2023 and the construction of several new facilities across Europe will increase Rheinmetall’s 155mm artillery capacity from 350k rounds p.a. in 2023 to 1.1mn by 2026.

- According to Janes Defence Budgets Annual Review, the US alone accounts for c. 37% of global defence spending – c. 3x more than the next biggest spender (China). Currently, the US accounts for just 8% of Rheinmetall’s revenue. Importantly, given Trump’s tariff threats, all of this is manufactured locally in the US. Rheinmetall’s acquisition of US-based LoC Performance Products in 2024 strengthens the Group’s position to pursue a number of tenders for military vehicles for the US Army. This reflects an ambition to expand its exposure to the significant US defence market from what is currently a very low base.

Rheinmetall again upgraded its guidance to the market at its recent Capital Markets Day in November 2024. It envisages doubling its revenue between 2024 and 2027. Furthermore, with the strongest growth set to come from its higher-margin Weapon and Ammunition and Vehicle Systems (tanks, military trucks, infantry fighting vehicles, and artillery systems) divisions, it expects operating margins to expand from c. 14% in FY24 to 18% by FY27. This translates into compound earnings growth above 30% on a CAGR basis over the next three years.

Currently, Rheinmetall trades at 21x 12-month projected earnings. We see this as undemanding in the context of the strong growth prospects ahead. Given the factors that underpin this growth, Rheinmetall is relatively insulated from typical macroeconomic uncertainty that may derail other companies. Thus, it provides an interesting option for investors seeking diversification from such risks. However, given the nature of its activities, it may be a company that some shareholders will not wish to hold.

Tencent: An attractive proposition

By Seleho Tsatsi, CFA, Investment Analyst

In our view, Tencent’s combination of strong moats, above-market growth rates, and an undemanding valuation multiple makes it an attractive investment proposition.

Tencent leads the market in social networks in China with 1.4bn monthly active users (MAUs) for WeChat. That makes it the largest social network in China by some distance. WeChat includes several platform-esque features. For example, Mini Programs lets users enjoy thousands of “light” apps on WeChat. Official Accounts allows creators to post their content at scale on WeChat. These features make the app indispensable for enterprises and creators. Similarly, the ability to book tickets, play video games, send money, or connect with friends makes the super-app indispensable to individuals. China’s internet users spend an estimated one-fifth of their online time on WeChat.[1]

Tencent remains the biggest video game developer in the world. Its industry-defining titles include Honor of Kings, PUBG, League of Legends, and Fortnite (through its 40% stake in Epic Games). Together, social networks and online games contribute about half of the business’s sales. We believe that while growth may not return to the heady days of 25%-35% p.a., it will recover to more attractive long-term levels, offering potential for future growth.

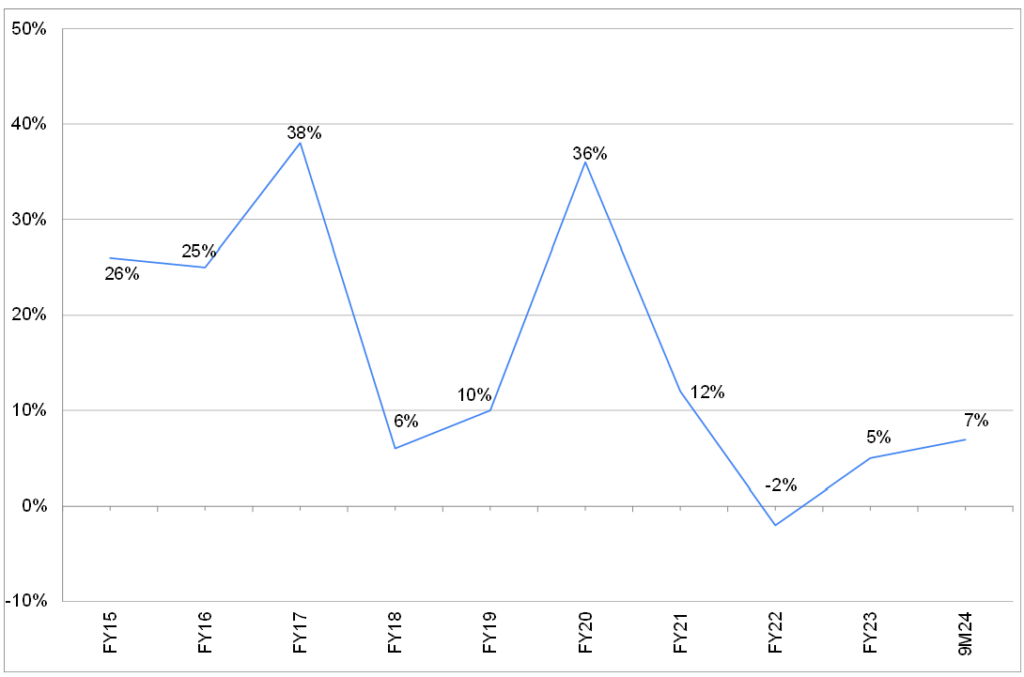

Figure 1: Tencent video game revenue growth, YoY % change

Source: Anchor, Bloomberg

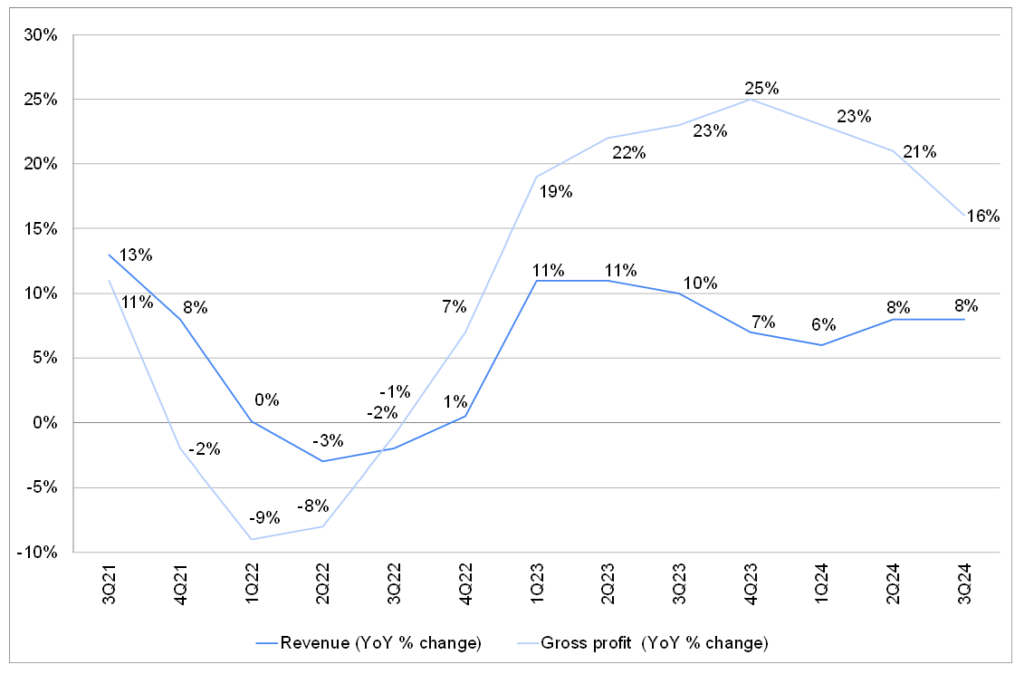

Since the slowdown in 2022, Tencent’s growth has been driven by margin expansion. Revenue has grown at 6%-11% p.a., but gross profit has grown at 16%-25% p.a.

Figure 2: Tencent margin leverage driving growth

Source: Anchor, Bloomberg

As Tencent management discusses below, one of the drivers for this margin leverage has been a shift towards higher-margin revenue streams. The runway for this continues and is expected to be long.

| “Gross profit has grown two times as fast as our revenue, and that’s been for two reasons. The primary reason has been the mix shift toward these higher-margin revenue streams that you talked about. And then the secondary reason has been efficiency initiatives, cost management initiatives. And together, those have resulted in the multiplier from revenue growth to 2.6 times further gross profit growth. Looking forward, then we do assume at some point, some of the efficiency initiatives will have yielded the efficiencies that we sought to capture. And therefore, that driver of gross profit growth exceeding multiplying revenue growth will decelerate. On the other hand, we believe that the mix shift to higher-margin revenue streams is a phenomenon that has many years to run. And therefore, we think that our gross profit will continue to increase faster than our revenue but potentially at a 1x multiplier rather than at a 2x multiplier looking forward.” – James Mitchell, Chief Strategy Officer (2Q24 results call) |

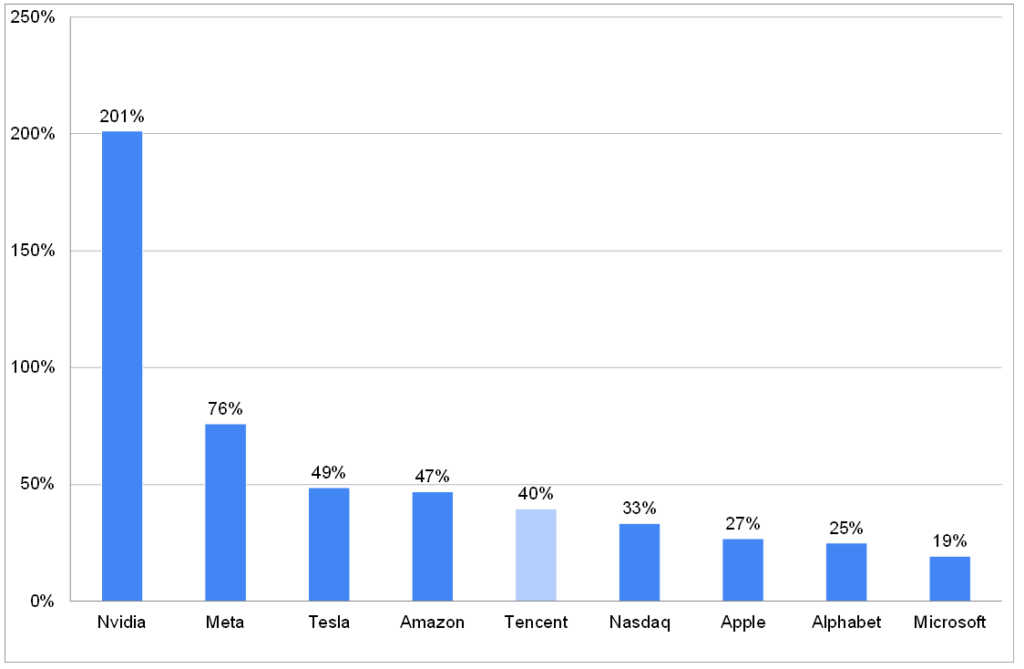

Investment sentiment around China remains downbeat. Economic growth is muted, and geopolitical risks seem to be mounting. However, it is important to note that the Tencent share price has performed reasonably well this year, a testament to the company’s resilience. Although it may not feel like it, the share has performed respectably compared to large-cap US technology stocks in 2024.

Figure 3: Tencent US dollar return, YTD

Source: Anchor, Bloomberg

Revenue growth of 8% to 12%, gross profits growing ahead of revenue, and decent operating expense management can lead to low-to-mid-double-digit earnings growth over time. Investors can participate in this story at a 15x forward earnings multiple. That multiple does not include a US$130bn investment portfolio, representing 25% of Tencent’s US$512bn market cap. We believe this is an attractive proposition.

[1] Chen, L. (2022) The Story of Tencent & China’s Tech Ambition. Hodder & Stoughton.