As 2023 draws to a close, the Anchor Investment Team once again shares a selection of individual global share ideas that we are particularly excited about. However, it is important to start by reflecting briefly on the year that was and how Anchor’s global stock picks for 2023 turned out. At an overall market level, at least, 2023 has turned out a lot more favourably for investors than the cautious outlook most investment strategists predicted. A widely anticipated recession failed to materialise, as the US consumer proved far more resilient than expected, thus supporting economic activity. The emergence of artificial intelligence (AI) was also an unanticipated theme that turned out to be a major driver of investment performance for a select group of large US technology companies, which have become widely referred to as the Magnificent Seven (Apple, Amazon, Alphabet, Nvidia, Meta, Microsoft and Tesla). The significant outperformance of this select group of market heavyweights has done much to paper over what was a far tougher year for returns from the balance of the market than may be appreciated. With this context in mind, despite unfortunately not having included any of the Magnificent Seven among our stock picks for 2023, an equal investment into each of them over the period would have returned 37% at the time of writing – a very pleasing outcome.

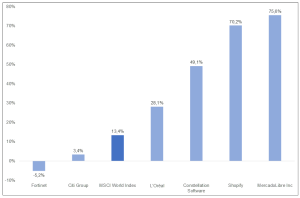

Figure 1: Anchor’s 2023 global stock picks – US$ total return

Source: Anchor, Bloomberg

Turning our attention to 2024, while most forecasters predict the era of rising interest rates (and hence their depressive effect on asset valuations) is behind us, particularly after the strong rally in equity markets through November, predictions for market returns in 2024 are once again relatively uninspiring. Reasonably demanding valuations at a market level and the expectation that economic activity will slow in 2024 because of the lagging impact of past rate hikes (opinion remains divided on whether this slowdown will be severe enough to push major economies into recession) sums up much of the basis for this cautious view. With the majority having got 2023 wrong from an outlook perspective, it is a fresh reminder of the healthy dose of humility with which one must approach future predictions. As things stand, though, it appears again that 2024 will be a year in which selecting the right stocks will be critical rather than hoping for a rising tide of the broader market.

With this in mind, what follows is a summary of the investment thesis for five shares (in alphabetical order) that we see as being particularly attractive at the moment. It is important to note that, while for this exercise, we will see how things turn out this time next year, these are shares we would expect to hold for many years. Thus, while Fortinet, for example, was disappointing in 2023, our excitement about it as a quality exposure to the secular growth potential that still exists in cybersecurity remains undiminished.

Citi Inc.: The upside is worth waiting for

We continue to see Citi as a compelling “self-help” story, and the share is trading at a significant discount to other players in the market with potential material upside to the share price (although we note that there is still some execution risk). This “self-help” story was laid out by current CEO Jane Fraser and her executive team at Citi’s Capital Markets Day in March 2022. By the end of 2023, Citi still appears to be on track with these plans despite several disruptive macro events since early March 2022. Briefly looking at the history of Citi over time, at the end of 1999, Citi had one of the largest market values of all the US banks. However, the onset of the 2007/2008 global financial crisis (GFC) significantly impacted the bank. Since then, banks such as JP Morgan Chase, Bank of America, Wells Fargo, and Morgan Stanley have overtaken Citi (US$90bn in early December 2023) in terms of market value. Citi’s share price performance has also been unexciting over the past five years.

Although Citi was previously a leader in the banking sector, the bank has now largely fallen away from the spotlight. Fraser has been working on simplifying the business and focusing on Citi’s five key strategic areas. The transformation at Citi will benefit the bank and its share price over the next few years. Citi continues to make significant progress with its restructuring and strategic shifts, which include:

- Largely reaching the end stages of selling out of/exiting various markets worldwide (expected to be completed in 2025 with the IPO of Citi’s Mexican retail bank).

- A bid to simplify the business structure and reduce the number of layers within the business has seen Citi reorganise its business into five main divisions.

- With this reorganisation, Citi is retrenching a significant number of employees so that the five main divisions will be fit for purpose.

The expectation is that by late 2024, when the restructuring has been largely completed, the cost curve will begin to trend down, allowing returns to increase to more competitive levels. An improvement in the return on tangible common equity (ROTCE) is a key goal for Citi and will be the primary metric to monitor going forward. Divisional highlights from the Group’s 3Q23 results include:

- The Services business, comprised of Treasury and Trade Solutions (TTS) and Security Services, performed very well during this period. The Services business is arguably the jewel in Citi’s portfolio.

- The Markets segment had the best third quarter over the last decade in terms of rates and currency revenues.

- The Investment Banking division saw revenue increase by 34% YoY.

- The Personal Banking division experienced its fifth consecutive quarter of double-digit revenue growth YoY.

- The Wealth Management business increased revenue by 2% YoY and saw both client assets and Citigold clients grow 7% YoY. There is scope to grow this business significantly.

Citi’s tangible book value per share is currently c. US$86.9, and the current share price is around US$47. Citigroup is trading at about 0.55 of its tangible book value (TBV) – by far the cheapest of the large US banks. The ROTCE was 7.7% for 3Q23, and we expect this to increase to c. 11%/12% over the next two years, highlighting that this is the primary investment case for Citigroup. By comparison, JP Morgan Chase generated a vastly higher ROTCE of 22% in 3Q23 and is trading at 1.9x TBV.

Despite “a lot of fear in the share price”, we remain optimistic about Citi’s prospects. Our estimates suggest a potential upside of almost 200% from current levels if management can continue delivering on its existing plan.

We take comfort in the fact that the company has exceeded expectations over the last few quarters, is keeping in line with and executing its strategy and restructuring plan, and that there have been no material changes in guidance in the last set of results. Once the business passes through the current retrenchment period (by March 2024), company morale should recover, and the business will be able to operate on much healthier cost metrics. Citigroup is trading on a P/E of 7.8x to December 2023, and we have a price target of US$140, with an upside of 196%.

Estee Lauder: Long-term quality to win over short-term challenges

Estee Lauder sits in the camp of a historically great business that has fallen on harder times in the recent past. It has been in business for 77 years. In the 11 years leading up to the end of 2022, Estee Lauder averaged an excellent 27% return on capital employed (ROCE). It is arguably the only major cosmetics company to focus almost exclusively on the prestige end of the global beauty market.

Despite a strong rally from its recent lows, the Estee Lauder share price remains about 60% below its 2021 all-time highs. This contrasts with other cosmetics companies like L’Oréal, which achieved all-time highs in 2023.

After earnings had risen steadily over many years, its earnings started to fall sharply from 2Q22. Therefore, we are six quarters (18 months) into this earnings slump. Historically, it has experienced a short earnings dip every few years, which has typically created good entry points for buying the share. However, this current earnings decline is more significant in the percentage decline and the duration of the slump. This has proved more worrying to the market.

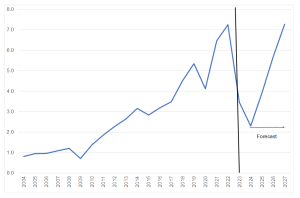

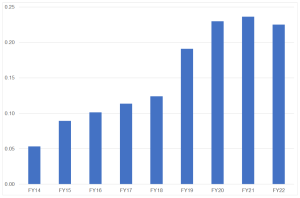

Figure 2: Estee Lauder EPS performance (including forecasts to FY27), US$

Source: Anchor, Company reports, Morgan Stanley. Chart based on June financial year-end.

The main issue negatively affecting the company has been its large exposure to China’s travel retail market. Global travel retail accounted for c. 27% of Estee Lauder’s sales in FY22 (significantly higher than its peers). Estee Lauder’s travel retail sales have been solid outside China and South Korea. With China, the last major country to exit COVID-19 lockdowns, prestige beauty, primarily via the travel retail channel, has been materially negatively affected in this market.

High retail and end-user inventories have triggered a bout of significant destocking. Over recent years, these inventories have been exacerbated by the emergence of a large reseller market in China. These resellers have fueled high inventories due to deep price discounting and the excessive sale of samples and close-to-expiry-date products. China regulations require a three-year expiration date for skincare products, which must be marked on the packaging. Consumers know these products are still good to use after expiration and are happy to buy them close to the three-year expiration, especially if the price is discounted.

It is always challenging to talk about P/E multiples for a business where the EPS has collapsed. The stock will likely appear optically expensive based on this collapsed EPS base. As such, Estee Lauder trades on a high trailing FY23 P/E of c. 40x based on collapsed earnings. Assuming a steady earnings recovery, its forward P/E could be below 20x about three years out. Remember that Estee Lauder historically trades more as a luxury goods type company than a lower P/E consumer staple. These luxury goods companies typically trade on very high multiples. The destocking situation in China for the prestige beauty industry cannot last indefinitely. An end to the destocking should see a material pickup in Estee Lauder’s China sales, even without meaningful growth in end-use demand.

Ultimately, all global cosmetics companies are compelled to operate in China as it will likely be one of the industry’s high-growth markets over the next decade. It is difficult to pick the exact quarter when things might turn up for Estee Lauder’s China business. However, when it comes, the recovery is likely to be reasonably rapid. Estee Lauder is essentially a turnaround call, and the danger with these types of calls is that they simply fail to turn around. However, we are leaning into Estee Lauder’s long-term track record for this call. Furthermore, we rely on the fact that destocking events seldom last forever.

Rentokil Initial: Market Leader in a fragmented industry

Pest control and hygiene have been a societal problem for all of history. In modern times, with accelerated urbanisation, this has led to an increased demand for Rentokil Initial’s services. Within pest control, Rentokil is the world leader and within hygiene, it is the market leader in two-thirds of its markets. Rentokil is committed to an ethos of protecting people and enhancing lives by providing pest control solutions across commercial and residential sectors through connected, digitally enabled, energy-efficient and sustainable pest control services.

The pest control industry is inherently resilient to tough economic conditions. Commercial customers rely on pest control to protect their customers, and these services are often required by law. Residential customers have a low tolerance for pests in their homes and want problems resolved quickly and professionally. The company has also been highly resilient to inflation over the past year as it managed to pass on fuel and wage costs to customers.

Although Rentokil has market dominance, the pest control industry is highly fragmented. This leads to synergistic M&A opportunities as companies acquire their rivals to acquire key contracts and then streamline their operations with scale, modern logistics and technology. There are approximately 75,000 pest control companies globally, of which c. 18,000 operate in the US, where Rentokil Terminix is the largest provider. On average, the company makes a small acquisition each week. However, in 2022, Rentokil made a substantially sized acquisition of Terminix, a leading US pest control operator. The combined entity took its North American exposure to over 60% of the business. The company operates in 87 countries and recently started operations in Pakistan and Argentina as it expands into emerging markets, which are even more fragmented, allowing for greater opportunity to dominate and scale up operations quickly and efficiently.

One of its best ways of unlocking value in a new acquisition is improving the route density of the existing fleet. Regarding its acquisition of Terminix, Rentokil believes it can reduce the number of individual routes by 33% and, in doing so, close less productive branches, hugely improving operational efficiency and leading to margin expansion over the next several years.

What is particularly attractive about Rentokil Initial is that, being a services company, it typically has a low capex demand, leading to a high return on capital employed (ROCE) and high free cash flow generation. Its revenue generation is consistent and often locked in with contracts, thus supporting a recurring earnings stream over the long run. These high-quality earnings, in turn, support additional acquisitions, a progressive dividend policy and timely debt paybacks.

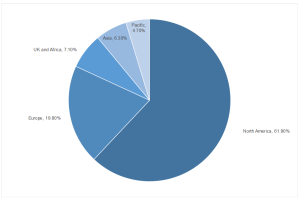

Figure 3: Rentokil revenue percentage by geographic exposure, 1H23:

Source: Anchor, Rentokil Initial Financials

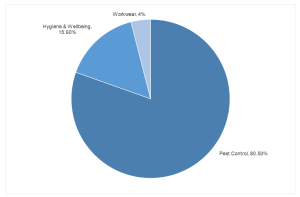

Although the company is domiciled in the UK, it is a globally diversified business. Following the Terminix deal, revenue generated from North America is now 62% of its geographic exposure, followed by Europe at 20%. Pest control is 80% of revenue, followed by 15% in Hygiene and 4% in Workwear.

Figure 4: Rentokil revenue percentage by sub-industry exposure, 1H23

Source: Anchor, Rentokil Initial Financials

Free cash flow

Service companies like Rentokil Initial tend to be highly cash-generative businesses that can reinvest in their business or make strategic acquisitions. These high-quality earnings translate into an efficient use of capital captured by a high return on capital employed (ROCE) of over 20%, far greater than the average industrial company’s estimated cost of capital.

Figure 5: Rentokil free cash flow* per share, US$

Source: Anchor, Rentokil Initial Financials

*Free cash flow generation has increased YoY, except in 2022 when it acquired Terminix.

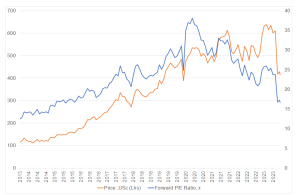

Figure 6: Rentokil share price vs P/E ratio*

Source: Anchor, Rentokil Initial Financials

*The blue line is the expected P/E ratio based on the next twelve months of earnings. The orange line is the market price.

Rentokil Initial is trading on a forward P/E ratio of 17x (the current share price divided by next year’s earnings) – its lowest valuation since 2016. The company is expected to grow EPS, on average, by 13% over the next two years, putting the business on a PEG ratio (P/E divided by growth) of 1.3x, which is extremely attractive considering the fundamentals and quality of the business. The recent share price drop resulted from poorer economic expectations for 2024. Still, management has stressed that due to the defensive nature of the business and the improving synergies from past acquisitions, 2024 should still produce strong organic growth. The company will pay you a 1.9% dividend to be patient, thus adding to a likely excellent total return over the next several years.

Scottish Mortgage Investment Trust: An unloved play on future innovation

Scottish Mortgage Investment Trust (SMT) has nothing to do with mortgages at all, and its only connection with Scotland that we can see is that its fund managers are from Baillie Gifford, headquartered in Edinburgh. Originally formed in 1909, today it is the largest closed-end investment trust (meaning that it has raised a fixed amount of permanent capital, which, unlike a unit trust, its investors cannot withdraw at their discretion) in the UK.

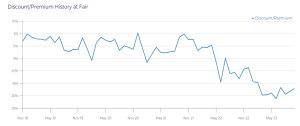

SMT is unashamedly a growth stock investor and was a poster child for the era of growth investing with a 16x return for those investors lucky enough to have owned it from the beginning of 2010 until the end of 2021. At this point, rapidly rising interest rates collided with what, in retrospect, had become a bubble in valuations for growth equities. Not only did SMT’s portfolio of investments suffer a dramatic decline in value in 2022, in common with all long-duration equities (equities, mostly currently loss-making, whose valuations were dependent on expectations of sizeable profits well into the future), it also experienced several company-specific events which rubbed salt into the wounds: (1) its star fund manager, James Anderson, whose vision was widely credited with delivering SMT’s exceptional investment performance stepped down, leading to natural apprehension whether his successors would be able to sustain the performance; and (2) SMT was embroiled in a rather public board-level scrap involving a disagreement among board members about aspects of the investment strategy, further unsettling shareholders. An out-of-favour investment style combined with these company-specific issues has seen SMT, which routinely traded at a premium to its net asset value (NAV) in better times, sink to a large discount.

Figure 7: SMT discount/premium to NAV vs history

Source: Company data

While investing in innovative growth companies might be out of fashion, it does not mean innovation has stopped. If anything, the appearance of ChatGPT and interest in all things AI that it spawned in 2023 perhaps reveals that innovation is alive and well behind the scenes. Its investment team makes the point that there is no reward for owning the median stock – a portfolio’s performance is heavily influenced by the outsized impact of a small number (as little as 4%) of exceptional companies. In pursuit of those outsized opportunities, it describes its investment philosophy as aiming “to identify companies that have sufficient opportunity to deliver such outlying returns and to own them for long enough without interference so that the return accrues to our shareholders”.

A few other important points to note about SMT’s structure, which are not easy to replicate in other structures, are as follows:

- It can use debt, limited to 30% of equity.

- It can use share buybacks if it chooses to address the discount.

- In recent years, it has introduced exposure to private markets (limited to 30% of the fund). It points out that what it sees as the reduced capital intensity of growth today means that companies are staying private for longer. This means that less of the upside from growth accrues to investors in the listed space.

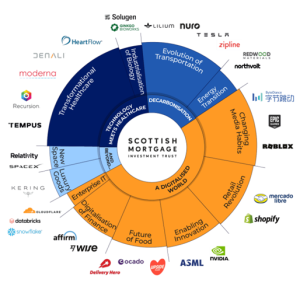

SMT holds c. 90 investments at any given time, although the top 30 comprise 75%-80% of total exposure. A flavour of the sort of investments that rank among its largest holdings is shown in the diagram below. Among them are the unlisted holdings in SpaceX, Northvolt and Bytedance, which investors would unlikely be able to gain exposure to themselves.

Figure 8: Investments held by SMT

Source: SMT

Although SMT’s share price has recovered to some extent since its nadir in early 2023, the discount it trades to its NAV reveals the extent to which it remains out of favour. We think the exposure it provides to an exciting portfolio of growth assets, whose valuation should respond strongly to declining interest rates in 2024, sets SMT up very nicely at this point. For the patient investor, could this be a potential multi-bagger again in the years ahead?

Starbucks: A latte opportunity brewing

The market seldom provides investors with the chance to buy a high-quality franchise at a discount. Typically, the best businesses are only on sale during bear markets or when the company is experiencing a rough operational patch. Rarer still are the occasions when neither of these conditions are met. Starbucks is a timely example, having sold off sharply, along with other high-quality US blue-chip stocks, in 2Q23 and 3Q23. There were two proximate causes for the decline. First, the rapid rise in the yield on the US 10-year government bond (ostensibly due to aggressive upcoming issuance from the Treasury) put pressure on most long-duration assets. Second, Starbucks may have been collateral damage in the selloff of the Food, Beverage, and Restaurant sectors, triggered by fears surrounding the potential impact of a new breed of appetite-suppressing weight loss drugs. As a result, Starbucks’ P/E ratio de-rated to more than one standard deviation cheap vs its five-year history.

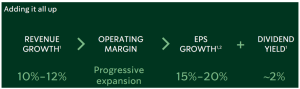

Early evidence suggests little to no impact from weight-loss drugs on coffee consumption, with de minimis effects on the rest of Starbucks’ basket. In the meantime, the company’s algorithm of double-digit revenue growth and 15% to 20% YoY growth in earnings per share (EPS) appears largely intact.

Figure 9: Starbucks should deliver a robust blend of revenue and earnings growth

Source: Starbucks 2022 Investor Day

Starbucks’ business model naturally generates high returns on invested capital. Management aims to strike a balance between reinvesting in the business to drive growth and returning cash to shareholders through buybacks and dividends.

Figure 10: Starbucks achieves a balance between reinvesting in the business and returning cash to shareholders

Source: Starbucks 2022 Investor Day

A key question is whether recently appointed chief executive officer Laxman Narasimhan, who previously served in the same role at Reckitt Benckiser, can fill the enormous shoes of Starbucks founder and former CEO Howard Schultz. Narasimhan has made a strong start, but the jury is still out, and we will watch his progress with interest.

With lingering concerns of a potential US recession on the horizon, we take comfort from the fact that coffee is an arguably addictive, relatively low-ticket expense. Consumers may hold off on a new car or home purchase but should continue to console themselves with the small luxury of their daily cup of java. Starbucks’ positioning as the ‘third place’ after the home and office reinforces this almost emotional connection, creating a sense of familiarity and comfort.

Longer term, recession or not, we believe that Starbucks has plenty of room for expansion, particularly in emerging markets. Given the habitual nature of the product, Starbucks’ high return on invested capital and extensive growth runway, we feel confident in Starbucks’ prospects over the medium to long term.