Food insecurity in a global context

The latest data from the United Nations Food and Agriculture Organization (FAO) point to 29.3% of the global population facing moderate or severe food insecurity, with 40% experiencing severe food insecurity. Thus, food security (or rather the lack thereof) remains a very real, current problem across the globe due to multiple factors that limit access to sufficient and nutritious food. For example, poverty and unemployment can prevent people from being able to afford enough food to meet their nutritional needs. At the same time, natural disasters and conflict can disrupt agriculture and food supply chains.

The COVID-19 pandemic has also contributed significantly to the global problem of food security, with millions losing their jobs and struggling to access food, especially in the most vulnerable communities. Additionally, the effects of climate change, such as extreme weather events and soil degradation, threaten food production – compound this with recent supply-chain disruptions, and the issue is exacerbated even further. The consequences of food insecurity are far-reaching, with malnutrition and other health problems, as well as decreased productivity and economic growth. Addressing food security is crucial for improving health, reducing poverty, and promoting sustainable economic development globally.

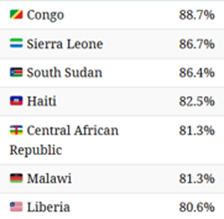

By definition, food insecurity occurs when an individual does not have access to the adequate quantity or quality of food they require to meet their biological needs. Unfortunately (and unsurprisingly), the African continent bears most of the burden when it comes to global food insecurity, with 14 out of the top 15 food-insecure countries being in this region. The data also paints a relatively grim picture for Middle Eastern and South American countries, while North America and Western Europe have moderate or severe food insecurity marked below 10%.

Figure 1: The prevalence of moderate or severe food insecurity by country, three-year average, 2019-2022

Source: Visual Capitalist

Nonetheless, it is difficult to blame the reason for African food insecurity on just one particular cause. Climate change, conflict in Africa, government debt, and Russia’s war on Ukraine have all contributed in different ways to worsening food security conditions on the continent. The Russia-Ukraine conflict, for example, led to European aid for African countries dropping substantially. At the same time, grain exports from Ukraine and Russia fell as ports in the Black Sea experienced disruptions. The war has also disrupted fertiliser supplies, with Russia being the world’s top exporter of fertiliser, and a substantial rise in farming input costs as energy prices soared in 2022.

The Global Food Inflationary Environment

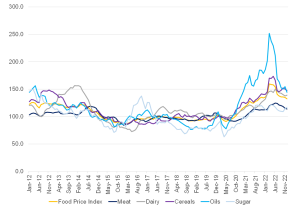

Overall, food prices have risen substantially in the last year due to surging energy prices and supply chain disruptions. As a result, the FAO Food Price Index (which measures the change in the international prices of a basket of food commodities) recorded a 14.3% increase between 2021 and 2022. Positively, however, the index printed 1.0% YoY lower in December 2022, declining for the ninth successive month, following a 1.9% decrease from November 2022.

Figure 2: FAO’s Global Food Price Index performance

Source: FAO, Anchor Capital

How do energy prices trickle down to food prices?

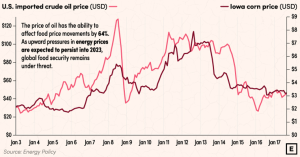

Energy costs trickle down to food prices in a variety of ways. As illustrated below, the simple correlation between historic oil and corn prices can paint a telling picture. Essentially, the oil price can affect food prices by up to 64%.

Figure 3: The historical correlation between oil and corn prices

Source: Visual Capitalist

Interestingly, the International Monetary Fund (IMF) predicts that the effects of the 2022 energy cost crisis may have yet to materialise fully. According to its research, a 1% increase in fertiliser prices can increase food commodity prices by 0.45% within four quarters. With natural gas, a major input for nitrogen-based fertiliser, being 150% more expensive in 2022 than in 2021, this may be a cause for concern in the coming months. In addition, a rise in fertiliser costs is also connected to harvest levels in forthcoming seasons. Reduced use of fertiliser as a result of high costs can lead to diminished crop yields, and the IMF predicts that a 1% drop in global harvests bumps food commodity prices by 8.5%, potentially indicating that the worst of it for food prices (and thus potentially global food security) is still to come.

SA’s food inflation environment

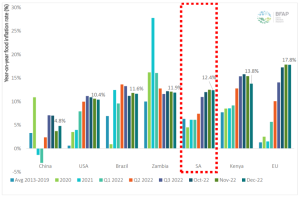

Globally, South Africa’s (SA’s) food inflation trajectory over the past two years or so has been relatively moderate compared to other key global markets, despite its recent upward trend. In December 2022, SA food inflation was lower than in the EU and Kenya but higher than in Zambia, Brazil, the US and China. Compared to November 2022, decreasing food inflation rates have been observed for the US, Brazil, Zambia, SA, Kenya and the EU.

Figure 4: Food inflation rates by country, YoY % change

Source: BFAP

Whilst SA’s overall inflation rate has decreased over the past six months (albeit rather modestly), local food inflation remains sticky. This is due to several supply shocks in various global agricultural commodity and livestock markets. These shocks have, in turn, also filtered through to the local market. The Collins Dictionary’s word of the year in 2022 was “permacrisis”, which refers to a state of permanent shocks in which the world economy has found itself over the past two years. In agricultural commodity markets, these crises ranged from hot and dry conditions in key production areas to geopolitical unrest and supply chain disruptions. The latest factor driving global maise and oilseed prices, for example, is a severe drought in Argentina, although rain during the third week of January did cause prices to ease somewhat.

High grain and oilseed prices have, in turn, also affected production costs in livestock markets. This, combined with disease issues, limited the supply of products such as poultry which provided upward movement in global and local poultry meat and egg prices. Locally, higher prices in international markets and a weak exchange rate during 4Q22 were the real drivers of food inflation. Although global monetary policy dynamics have primarily driven exchange rate movements, the increase in the frequency and intensity of loadshedding has also contributed to a weaker rand.

What will 2023 bring in terms of food security for SA?

While SA is technically food secure, on average, at a national level, most households need adequate nutrition to meet their dietary needs for an active and healthy lifestyle. According to Statistics South Africa, the number of hungry and food-insecure South Africans is about 11% of the population (or 6.5mn people). Moreover, for most South Africans, the rising cost of living is a harsh reality – according to the latest Household Affordability Index (which tracks food price data from 44 supermarkets and 30 butcheries in Johannesburg, Durban, Cape Town, Pietermaritzburg and Springbok), a monthly household food basket cost R4,917.42 in January 2023 – an increase of 11.7% YoY.

As we move further into 2023, both global and local market dynamics will be essential factors influencing local food prices. The second Brazilian maise crop will be a critical global determinant of staple food price trajectories over 1H23. Locally, maise and soya futures markets are trading at export parity levels, reflecting the market sentiments that SA is still on track to produce surpluses of maise and soya beans under current cropping conditions. This is, however, different with sunflower prices, which have increased sharply of late, as the market factors in fewer hectares planted to sunflowers. This implies that local availability could become a cause for concern in the following months, which will naturally influence sunflower oil retail prices.

The relative strength of the rand and the extent of continued loadshedding will also play a role. The impact of loadshedding on the economy and the food system is severe, to say the least. Loadshedding increases cost directly and indirectly through higher rates of wastage and spoilage within food chains. Financial results from several food companies indicate that fuel expenses to run generators during blackouts are skyrocketing. These costs cannot be absorbed in the chain and are, to a large extent, passed on to consumers. As such, SA’s unique energy crunch will likely be the key reason why the economy may not follow global trends of decreasing food price inflation during 2023 – thus further exacerbating food insecurity within the country.

At Anchor, our clients come first. Our dedicated Anchor team of investment professionals are experts in devising investment strategies and generating financial wealth for our clients by offering a broad range of local and global investment solutions and structures to build your financial portfolio. These investment solutions also include asset management, access to hedge funds, personal share portfolios, unit trusts, and pension fund products. In addition, our skillset provides our clients with access to various local and global investment solutions. Please provide your contact details here, and one of our trusted financial advisors will contact you.