World markets sentiment remained upbeat in March (MSCI World +3.3% MoM) and in 1Q24 (+9.0%) as a US soft landing narrative, ongoing tailwinds from artificial intelligence (AI) shares, and optimism that central banks will start cutting rates in 2H24 helped power global markets higher. Escalating tensions between major global powers, the wars in Gaza and Ukraine, as well as Germany and the UK slipping into technical recessions seemed to be placed on the back burner as markets barrelled ahead. As widely expected, the Bank of Japan (BOJ) said last month that it was moving away from its 17-year, sub-zero interest rate monetary policy framework. The BOJ’s move away from yield curve control and details on the reduction in domestic asset purchases pressured the yen, providing a supportive underpin for the US dollar.

Market moves were further compounded by the release of the US Federal Reserve’s (Fed) latest Federal Open Market Committee (FOMC) minutes and the FOMC’s more dovish updated projections for the US economy, where it reiterated its guidance for a total of 75 bps in rate cuts this year. This guidance came despite upward revisions to GDP growth and core personal consumption expenditure ([PCE], the Fed’s preferred inflation gauge) projections. Amidst this market respite and optimism over the Fed’s economic outlook, the Swiss National Bank (SNB) surprised market participants by being the first among the big, developed economies to cut interest rates (by 25 bps, SNB’s first cut in nine years), prompted by a significantly lower inflation forecast. This saw the Swiss franc weaken against the US dollar and drove spot gold prices to record levels surpassing US$2,220/oz.

In US economic data, February headline inflation, as measured by the Consumer Price Index (CPI), disappointed, coming in at 3.2% YoY – up from January’s 3.1% YoY print. February core CPI, excluding the erratic food and energy components, rose 3.8% YoY vs January’s 3.9% YoY reading. MoM, headline and core inflation both advanced 0.4%. February US retail sales printed below expectations despite improving on January’s data, rising 0.6% MoM vs January’s downwardly revised 1.1% MoM decline. YoY, retail sales rose 1.5% in February vs January’s 0.6% rise. In line with expectations, February’s core PCE, excluding food and energy, rose 2.8% YoY. This was the same as January’s YoY print and remained above the Fed’s goal (which targets a 2% annual inflation rate) but in line with market expectations. MoM, February core PCE rose 0.3% vs 0.4% in January. Meanwhile, US 4Q23 GDP data were revised higher, to 3.4% YoY (above the previous estimate of 3.2%).

All three major US benchmark indices ended March and 1Q24 higher, recording a fifth consecutive month of gains. The Dow rose 2.1% MoM (+5.6% 1Q24/YTD), ending March at 39,807.37 – close to the 40,000 level. The tech-heavy Nasdaq Composite advanced by 1.8% MoM (+9.1% 1Q24/YTD), and the blue-chip S&P 500 Index popped 3.1% MoM (+10.2% for 1Q24/YTD and its best 1Q performance since 2019).

Major European markets also rose in March, with Germany’s DAX gaining 4.6% MoM (+10.4% 1Q24/YTD), while France’s CAC closed 3.5% higher (+8.8% 1Q24/YTD). In economic data, February euro area inflation slowed to 2.6% from 2.8% YoY in January, while EU annual inflation came in at 2.8% in February, down from 3.1% in January, according to Eurostat. Germany’s February inflation rate eased to a two-year low of 2.5% YoY vs January’s 2.9% YoY print. Energy prices played a big part in the decline, dropping 2.4% YoY, on average. France’s February inflation slowed to 3.0% YoY vs January’s 3.1% print – the lowest reading since January 2022. The country’s core inflation (excluding food and energy prices) declined again, reaching 2.6% in February vs January’s 3.0% YoY print.

In March and 1Q24/YTD, the UK’s blue-chip FTSE-100 rose 4.2% and 2.8%, respectively. February UK inflation fell to 3.4% YoY vs January’s 4.0% YoY print – the slowest rate since September 2021. Last week’s official data confirmed that the UK economy entered a “shallow” recession in 2023, as GDP growth shrank 0.1% in 3Q23 and 0.3% in 4Q23. These data were unchanged from preliminary estimates.

China’s equity market disappointed, although it did record modest advances, with Hong Kong’s Hang Seng Index up 0.2% MoM (-3.0% 1Q24/YTD) and the Shanghai Composite Index rising 0.9% MoM (+2.2% 1Q24/YTD). On a positive note, after shrinking for five consecutive months, China’s official March Manufacturing PMI printed at 50.8 vs February’s 49.1. The official non-manufacturing PMI, measuring business sentiment in the services and construction sectors, rose to 53.0 in March vs 51.4 in February. The 50-point mark separates expansion from contraction.

Japan’s benchmark Nikkei closed March 3.1% higher (+20.6% 1Q24/YTD), ending above the 40,000 mark and hitting an all-time high of 41,087.75 on 22 March. Japan’s February headline CPI accelerated to 2.8% YoY vs January’s 2.2% print. Core inflation, excluding fresh food prices, was at 2.8% compared with 2% in January. Japan’s economy narrowly avoided a technical recession as GDP growth data were revised up, showing that it grew by an annualised 0.4% in 4Q23 vs an earlier provisional projection of a 0.4% contraction.

Among commodities, the gold price was the star attraction, soaring 9.1% MoM to record highs (+8.1% 1Q24/YTD) and ending the month at US$2,229.87/oz, on the back of Fed rate cut expectations (the gold price tends to share an inverse relationship with rates) and its appeal as a safe-haven asset. The oil price recorded its third month of gains in March (+4.6% MoM/+13.6% 1Q24/YTD), as an improving macroeconomic outlook and oil markets’ hope that OPEC+ production cuts would remain in place throughout this year pushed the price closer to US$90/bbl level (oil ended the month at US$87.48/bbl). The platinum price rose by 3.5% MoM (-8.1% 1Q24/YTD), while palladium jumped by 7.4% (-7.6% 1Q24/YTD). Iron ore’s decline continued in March – down 17.6% MoM and 28.0% in 1Q24/YTD.

After significantly lagging global and emerging markets (EMs) in January and February, South Africa’s (SA) JSE finally woke from its slumber in March, with the FTSE JSE All Share Index gaining 2.5% MoM (it is still down 3.1% in 1Q24/YTD), while the FTSE JSE Capped SWIX rose by 2.9% MoM (-2.3% 1Q24/YTD). Resources counters, especially gold and platinum group metals (PGM) miners, were the best performers on the local bourse, with the Resi-10 jumping 13.9% last month (-0.5% 1Q24/YTD). After three months of gains, the SA Listed Property Index ended March 1.0% lower (+3.8% 1Q24/YTD), while the Fini-15 lost 4.1% MoM (-7.7% 1Q24/YTD). Conversely, the Indi-25 gained 2.4% (+0.2% 1Q24/YTD), buoyed by its largest constituents, Prosus and Naspers (up 6.1% and 6.4% MoM, respectively), which were, in turn, pulled higher by the performance of their biggest holding, China’s Tencent which rallied 10% MoM. Highlighting the March performances of the biggest shares on the JSE by market cap, the largest company on the exchange, BHP Group, rose by 1.6% MoM. In comparison, the second- and third-biggest shares – Anheuser-Busch InBev and Richemont fell by 1.6% and 5.9% MoM, respectively. Other large-cap counters, such as Glencore, soared by 14.2%, while British American Tobacco (BAT) rose by 0.5%, MoM. The rand strengthened against the US dollar, up 1.4% MoM. However, for 1Q24/YTD the rand is down 3.1% vs the greenback.

In local economic data, in line with expectations, SA’s 4Q23 GDP increased by only 0.1% QoQ, narrowly avoiding a technical recession after loadshedding improved in 4Q23. Six industries recorded positive growth QoQ, with transport, storage, communication, mining and quarrying, and the electricity sectors posting the strongest gains. GDP grew by 0.6% in 2023, primarily due to higher economic activities in finance, real estate, and business services; transport, storage, and communication; personal services; and manufacturing. While 2023 GDP was higher than pre-pandemic growth of 0.3% in 2019, excluding the pandemic years, it was the worst print since 2009. February headline CPI came in at a four-month high, printing at 5.6% vs 5.3% YoY in January. MoM, CPI rose 1.0% in February. Core inflation (excluding food, fuel, and electricity) advanced to 5.0% YoY vs January’s 4.6% print as increasing health insurance costs filtered into the data. The latest print means that inflation has moved further away from the 4.5% midpoint of the SA Reserve Bank’s (SARB’s) target band, where it prefers to anchor expectations although it remains within the bank’s 3%-6% range. Reflecting the depressed SA consumer environment, retail trade sales volumes contracted 2.1% YoY in January, down from December’s festive season-boosted growth of 3.2% YoY.

With risks to the inflation outlook skewing increasingly to the upside, the SARB’s Monetary Policy Committee (MPC) meeting on 27 March saw the MPC keeping rates on hold (as widely expected) with the repo rate at 8.25% and prime at 11.75%.

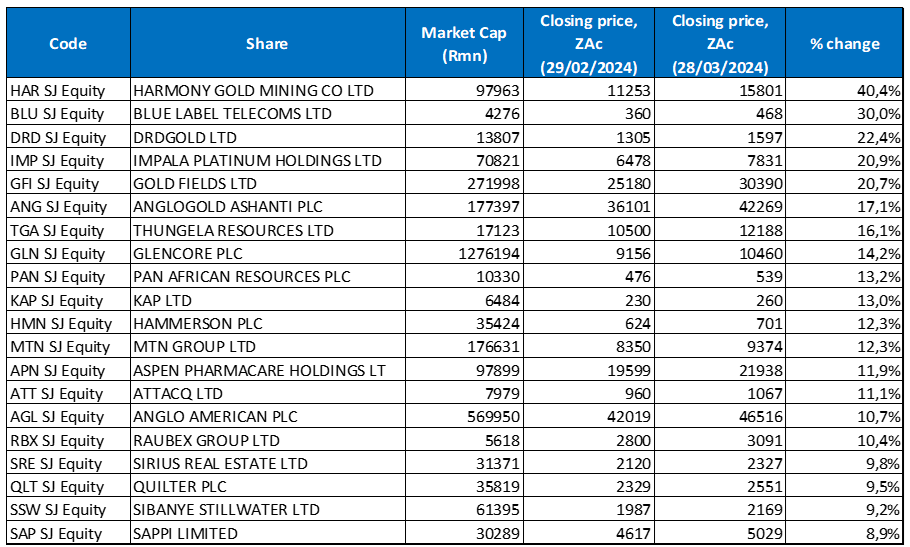

Figure 1: March 2024 20 best-performing shares, MoM % change

Source: Bloomberg, Anchor

Property shares were the outperformers for three consecutive months since December (albeit that this performance has been somewhat skewed, driven mainly by UK- and Europe-focused stocks [rand-hedges] and local property companies with growing footprints in offshore markets). However, in March, commodity counters took the lead. As the gold price soared to record highs and PGM prices jumped, mining counters were the big winners, with eleven of the top 20 shares in March coming from the resources sector. Harmony Gold was March’s top performer, with its share price soaring by 40.4% MoM. In February, the gold miner declared a record interim dividend as it benefitted from a stronger gold price and increased output. Harmony was followed by Blue Label Telecoms (+30.0% MoM) in second spot, and another gold counter, DRDGold, was third, with a share price gain of 22.4% in March.

In its 1H24 results, Impala Platinum (Implats; +20.9% MoM), last month’s fourth-best-performing share, reported a revenue decline to R43.4bn from R57.8bn in 1H23, while its headline EPS stood at ZAc365 vs ZAc1,654, recorded in the same period of 2023. However, a jump in the prices of palladium (+7.4% MoM) and platinum (+3.5% MoM) saw a bounce in local PGM counters such as Implats and Sibyane Stillwater (+9.2% MoM), with both posting good share price gains in March.

Implats was followed by Gold Fields and AngloGold Ashanti plc, with MoM share price gains of 20.7% and 17.1%, respectively. In March, AngloGold said that it expects to meet its gold output target of up to 2.79mn ounces this year despite its Tropicana mine in Australia being flooded. The gold miner’s FY23 results showed a net loss of US$235mn vs net income of US$233mn in FY22. It also recorded an FY23 basic loss per share from continuing operations of US$0.56 compared to FY22 basic EPS from continuing operations of US$0.55. The loss was mainly due to lower gold sales, corporate restructuring costs, higher environmental provisions, and the cost of job cuts, as well as care and maintenance at Córrego do Sítio in Brazil, which was idled in August.

SA’s poor rail performance and falling coal prices (from the record levels seen in 2022 and early 2023) have weighed heavily on Thungela Resources’ (+16.1% MoM) financial and share price performance in 2023 (the share was down 46.4% YoY). It also impacted its FY23 results, released on 18 March, which showed that earnings were down c. 73% YoY due to a decrease in export volumes and a drop in the coal price (coal plummeted c. 55% from an average of US$270/tonne in 2022 to US$121/tonne in 2023). The decline in coal prices resulted in Thungela’s headline EPS falling by 73% YoY to R35/share, while net profit was down c. 72% YoY to R5bn (R18.2bn in 2022). However, Thungela did declare a final dividend of R10/share, which was much stronger than expected, equating to 82% of 2H23 diluted HEPS. The company also announced an R500mn buyback programme, equal to c. R3.50/share in buybacks.

Diversified miner Glencore, mid-tier gold producer Pan African Resources, and diversified industrial, chemical and logistics Group KAP Ltd rounded out the top-ten performers for March with MoM share price gains of 14.2%, 13.2%, and 13.0%, respectively. Glencore’s group chair said in its latest annual report that the company believes the best approach for growth in its industrial business is “…to consider promising acquisition opportunities while progressing potential organic growth opportunities in our existing transition metals portfolio …”. Glencore said it is increasingly confident of its strategy as energy transition commodities such as copper, nickel, cobalt, zinc, vanadium, and aluminium have been touted to become substantially more important given their roles in the technologies and infrastructure that underpin low- or no-carbon energy sources. Pan African Resources reported 1H24 results (to end December 2023) in mid-February, showing that its revenue increased to US$193.95mn from US$156.49mn posted in 1H23, while headline EPS advanced by 46.0% YoY. A rise in production (c. 7% YoY) and a rally in the gold price (+14% in the period under review) helped lift its 1H24 profit by c. 47% YoY. The Group has a dual listing on the JSE and the UK’s Alternative Investment Market (AIM).

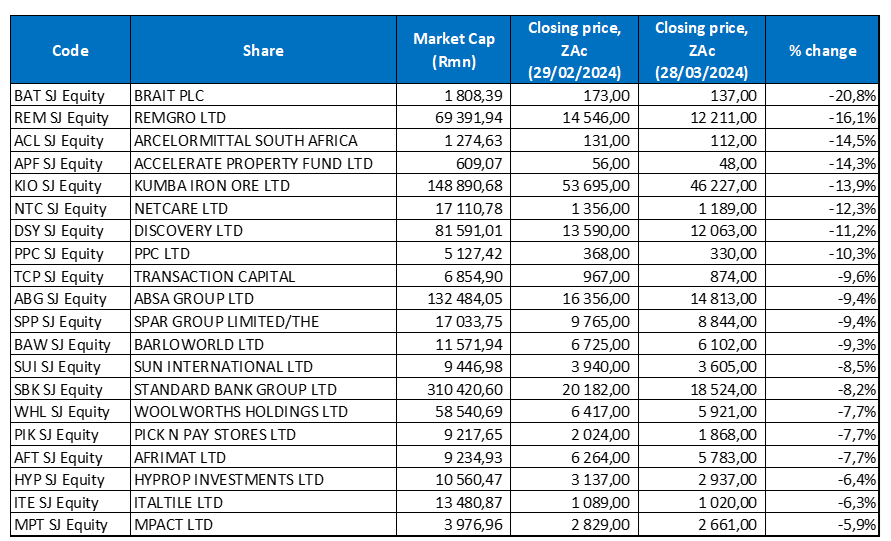

Figure 2: March 2024 20 worst-performing shares, MoM % change

Source: Bloomberg, Anchor

Investment holding company Brait Plc was March’s worst-performing share, down 20.8% MoM. Brait said in a voluntary pre-close trading statement that the business has continued to perform strongly despite adverse trading conditions and the impact of high inflation on consumer spending. Revenue in its MillBake business continued to see inflationary price increases delivered during the period under review, while the Groceries and International business showed positive momentum during 2H as its Confectionary business benefitted from operational improvements and synergies from the Mister Sweet acquisition. It noted that the operational and financial turnaround of Virgin Active SA, which Brait has said it might list, continued during the period under review. Virgin Active SA’s active membership base increased from 606k members on 30 September 2023 to 625k on 29 February 2024. The overall performance resulted in an increase in active members from 972k in September 2023 to 1.0mn members as of 29 February.

Brait was followed by investment holding company Remgro, which recorded an MoM decline of 16.1%. In its 1H24 results, Remgro indicated that its revenue rose to R25.4bn from R24.2bn in 1H23, while it reported a diluted loss per share of ZAc432, compared with EPS of ZAc701 recorded in the same period of 2023.

Steel Group ArcelorMittal SA (AMSA) was March’s third worst-performer, with a share price drop of 14.5% MoM. AMSA has recently outlined the impact that the mooted wind-down of its long steel (products such as rebar, wire rods, merchant bars, rails and sections) business will have on local economies, particularly that of Newcastle, which accounts for over R10.0bn of the Group’s annual procurement. In its latest annual report, released last week, AMSA says the wind-down of the business, which also impacts its Vanderbijlpark plant, will lead to a significant loss of the Group’s intellectual property. AMSA relies heavily on state rail monopoly Transnet to transport 91% of its iron ore and 100% of the coking coal consumed at its Newcastle and Vanderbijlpark plants. The company has blamed issues at Transnet for the planned closure of its unit and, in February, deferred the wind-down for six months following consultations with the government and organised labour. However, the Group says it had become clear it would be an uphill task to make the long steel business competitive due to several factors, including a 20% drop in steel consumption and low activity in key steel-consuming sectors.

AMSA was followed by Accelerate Property Fund (-14.3% MoM), Kumba Iron Ore (Kumba; -13.9% MoM), and Netcare (-12.3% MoM). Despite Kumba reporting a 16% YoY rise in revenue, the company announced that it would still cut c. five hundred jobs due to “railway challenges.” Meanwhile, in a voluntary operational update for the five months ended 29 February 2024, Netcare revealed that total paid patient days (PPD) rose 0.3% YoY in its hospitals and emergency services segment. Moreover, total average occupancy levels stood at 62.1%, primarily in line with the prior period. Total revenue per PPD for the segment increased by 6.2%, and total Group revenue rose by 5.0% in 1Q24.

Discovery Ltd (-11.2% MoM) reported 1H24 results last month, which showed that its net income increased 7% YoY to R15,674mn from R14,604mn posted in 1H23. Basic headline EPS declined by 1.0% YoY to ZAc493.8 from Zac498.4, while normalised headline earnings were up 11.0% YoY at R3,320mn. The company said it is on track to exceed its target of 1mn banking clients in 2026 as its Discovery Bank business had reached its monthly operational break-even ahead of the target date.

In an operational update for the ten-month period that ended on 31 January 2024, cement producer PPC (-10.3% MoM) revealed that Group revenue rose by 27.6% YoY, driven mainly by continued strong growth in its Zimbabwe operations. However, cement sales volumes decreased by 4.0% YoY, and Group EBITDA margins improved to 13.6% in the current period from 9.9% in the comparable period of last year. This is lower than the half-year EBITDA margin, excluding Cimerwa, of 15.3%. It said the margin decrease compared to the half-year is due to lower SA cement margins, the weak performance in the materials business, one-off costs at a Group level, and marginally lower EBITDA margins in its Zimbabwean operations.

While Transaction Capital’s share price jumped by 17.8% in February after it announced its intention to raise between R900.0mn and R1.25bn by selling some shares in WeBuyCars ahead of a planned unbundling and separate listing, the share price retreated again in March (-9.6% MoM). The share was hammered by dwindling fortunes in the company’s SA Taxi division, which posted an R3.7bn loss from continuing operations last year. Taxi owners owe SA Taxi more than R17bn.

Finally, Absa Group rounded out the ten worst-performing shares with a 9.4% MoM share price decline. In March, Absa reported FY23 results, which showed that it increased its headline EPS by just 1% YoY. Bad debts rose sharply, and retail profits dropped. This was a disappointing result compared to Absa’s peers in the SA banking sector, which have performed well.

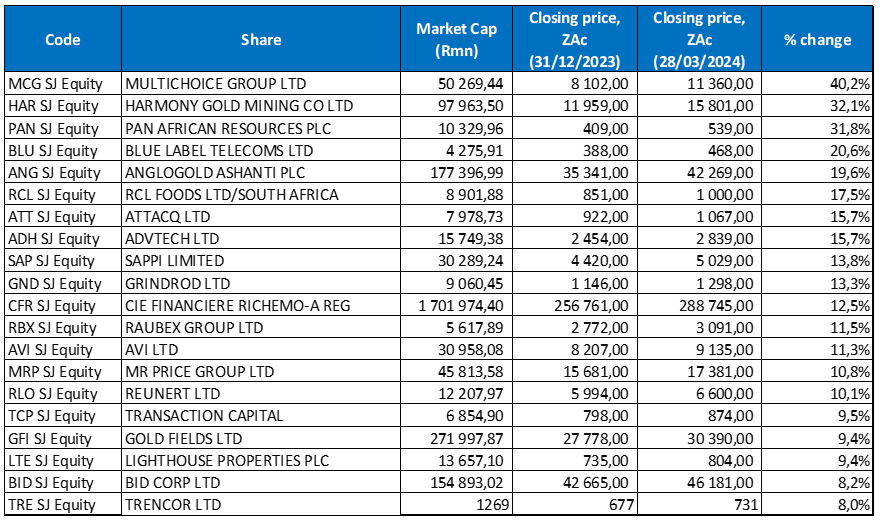

Figure 3: Top-20 best-performing shares, 1Q24/YTD

Source: Bloomberg, Anchor

The 1Q24/YTD best-performing shares featured thirteen of the year-to-end February’s best performers. Seven shares entered the best performers club YTD: Harmony, Blue Label Telecoms, AngloGold Ashanti, Attacq, Sappi, Raubex, and Gold Fields. Most of these new entrants are from the resources sector (three are gold miners) and are companies that performed well in March, buoyed by the strong gold price.

For 1Q24/YTD, Multichoice again took the top spot with a 40.2% gain after its share price rose by 8.8% in March. In February, French broadcaster Canal+, which currently owns a 35.01% stake in Multichoice, submitted a letter to MultiChoice’s board of directors containing a non-binding indicative offer (a cash consideration of R105/share) to acquire all MultiChoice’s issued ordinary shares that it does not already own (subject to obtaining the necessary regulatory approvals). However, MultiChoice rebuffed the offer as undervaluing the business before asking Canal+ to sweeten the deal. Canal+ then raised its offer to R125/share on 5 March, valuing the deal at c. R37bn. The current offer on the table is mandatory for MultiChoice investors to take up all the shares it does not already own by 8 April.

Multichoice was followed by Harmony and Pan African Resources (both discussed earlier), which were in second and third place, respectively, with 1Q24/YTD gains of 32.1% and 31.8%. Blue Label Telecoms was in fourth place, advancing by 20.6%, and AngloGold Ashanti was in fifth place, up 19.6% for 1Q24/YTD.

On a 1Q24/YTD basis, RCL Foods dropped to sixth place with a share price gain of 17.5%. Attacq followed RCL with an advance of 15.7%. RCL reported 1H24 results in early March, which showed that its revenue rose to R20.1bn from R18.6bn posted in 1H23, while diluted EPS stood at ZAc119.6, compared with ZAc57.2 recorded in the same period of 2023. The food Group also announced that its board has approved the spin-off and separate listing on the JSE of its Rainbow Chicken business. Meanwhile, Attacq’s share price was up 11.2% in March. The real estate investment trust (REIT), in its 1H24 results, indicated that its gross revenue rose to R1.4bn from R1.1bn posted in 1H23, while its diluted EPS increased 31.9% YoY to ZAc36.4.

Rounding out the remainder of the ten best-performing shares for 1Q24/YTD were private education provider ADvTECH (+15.7%), Sappi (+13.8%) and ports and logistics services Group Grindrod (+13.3%). Grindrod reported FY23 results in early March, which showed that its revenue fell to R4.9bn from R5.9bn recorded in FY22, while headline EPS for total Group operations (continuing and discontinued operations) came in at ZAc151.7, compared to ZAc128.9 in FY22. Grindrod also increased its total dividend to ordinary shareholders by 84% YoY, with its cumulative dividend coming in at ZAc72.4/share.

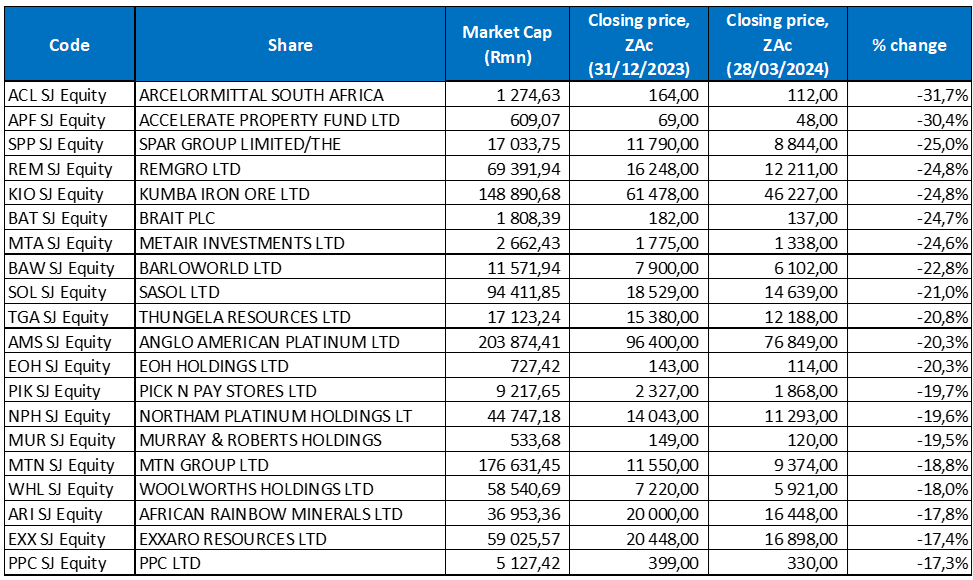

Figure 4: Bottom-20 worst-performing shares, 1Q24/YTD

Source: Anchor, Bloomberg

There was also an overlap between the year-to-end February worst-performing shares and the 1Q24/YTD worst-performers to the end of March. AMSA (discussed earlier) was the worst performer, declining by 31.7% for 1Q24/YTD. It was followed by Accelerate Property Fund (-30.4%) in second place and The Spar Group (-25.0%) coming in third. Last month, Accelerate announced the sale of its Cherry Lane Shopping Centre for R60mn. It intends to apply the full proceeds of the sale to the reduction of debt and capital reinvestment into its core property portfolio as part of ongoing efforts to review its assets and ensure that they align with its current business strategy and growth plans. In a trading update for the 24 weeks ended 15 March 2024, supermarket Group Spar revealed that its turnover increased by 8.8% YoY, and total wholesale sales rose 5.7% YoY, impacted by a weaker-than-expected grocery business performance. Spar’s combined core grocery and liquor turnover increased by 6.0% YoY. The Spar grocery wholesale business saw sales rise 5.0% YoY. In comparison, its pharmaceutical business delivered impressive turnover growth of 17.7% YoY, driven by increased loyalty from Pharmacy at Spar retailers and growth in Scriptwise revenue. The company will release its 1H24 results on or about 12 June 2024.

Spar was followed by Remgro (-24.8% 1Q24/YTD), Kumba (-24.8% 1Q24/YTD), Brait PLC (-24.7% YTD) and industrial products company Metair Investments (-24.6% 1Q24/YTD). In March, Metair reported solid FY23 results, which showed the company returning to the black, as it focused on the recovery of its wiring business at its managed associate Hesto Harnesses and stabilising Mutlu Akü in Turkey. Metair recorded a revenue increase of 14% YoY to R15.9bn from R13.9bn posted in FY22, while its headline EPS stood at ZAc135.0, compared with a loss per share of ZAc17.0 in the previous year. Despite the positive results buoying the share price to a MoM gain of 7.5%, the counter is still down in 1Q24/YTD. It has been stuck in the doldrums for a while and recorded a share price drop of 35.5% in 2023. Still, its new CEO (the third in one year), Paul O’Flaherty, who started in January, said that “… his immediate focus is to restore leadership capacity, stabilise Hesto, reach a decision on the way forward with Mutlu Akü and address the potential EU antitrust issue at Rombat, ….”

Industrial brand management company Barloworld Ltd, Sasol, and Thungela Resources rounded out the ten worst-performing shares in 1Q24/YTD, with share price declines of 22.8%, 21.0%, and 20.8%, respectively. In a voluntary trading and operational update for the five months ended 29 February 2024, released last month, Barloworld (-9.3% MoM) revealed that Group revenue declined by 5.5% YoY to R15.6bn, while Equipment Southern Africa revenue fell 4.9% YoY to R9.70bn and its Equipment Eurasia’s revenue decreased by 11.1% YoY to US$159.0mn. Its Ingrain segment’s (one of Africa’s largest producers of unmodified and modified starch, glucose, and other related products) revenue dropped 5.2% YoY to R2.6bn. The company attributed the performance to a mix of global and local headwinds, including a commodity downturn, electricity shortages, port bottlenecks and high interest rates, which have negatively impacted its operations. Barloworld is expected to release its interim results on or about 27 May.