Pulp and packaging company Sappi reported results for the year ended 30 September 2022 on Thursday (10 November). FY22 was an amazing year for Sappi – its best year ever in terms of absolute profit levels. It also reduced its net debt by 41% (US$800mn) and reinstated the dividend for the first time since 2018.

FY22 sales rose more than one-third to US$7.3bn, while the cost of sales increased to US$5.93bn. In metric tonnes, the most sales came from graphic paper (43.4%), followed by packaging and speciality paper (one-fifth) and forestry (18.51%). By geography, Europe led the way with 40% of sales, followed by SA (37.85%) and the US (but US sales generated more money than SA). Higher sales prices offset headwinds from Russia’s war on Ukraine to extreme weather.

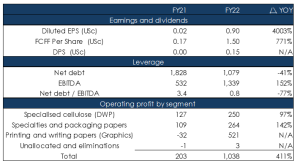

Figure 1: Sappi overview and forecasts, in US$mn unless otherwise indicated

Source: Sappi, Bloomberg, Anchor

The graphic paper business had its best year in FY22 in terms of margins and profitability.

Figure 2: Sappi paper business operating margin

Source: Sappi, Bloomberg, Anchor

The demand for graphic paper over the past year has been unprecedented and has resulted in overordering and over-stocking. On the earnings front, Sappi Europe CEO Marco Eikenlenboom said that ” … The situation we are currently in graphics was partly to be expected. It’s in a destocking situation that is not abnormal. What was exceptional and unprecedented was the demand that we saw in the last 12 months. Basically, a result of capacity being taken out and post-COVID additional activity.” This resulted in overordering and overstocking, which is what is happening now on the graphic side. Eikenlenboom noted that it is not something to get overly worried about but that it has an effect on the current order intake and, therefore, on the seemingly softening of the market – it is two-fold destocking and a slightly softer market than 12 months ago.

Graphic paper demand is expected to resume its annual market decline of 5%-6% in FY23. Sappi CEO Steve Binnie said on the earnings call that in North America, markets remain tight. He added that while the North American markets may not be as strong as they were six or three months ago, that was from an extremely high point. He noted that the industry’s operating rates are still very high, adding, “we are still pretty confident in North America.”

In Europe, the market has been softening, but Sappi is seeing high inventory levels across the value chain and lower order activity in recent weeks. Looking ahead to 2023, Sappi continues to believe that demand will decline by 5% or 6% p.a. Binnie noted that, at present, order activity is lower than those levels. However, Sappi is confident that it relates to an inventory adjustment, and it may have an impact on 2Q23. Still, ultimately for the full-year (FY23), it is likely to be better than what the Group is experiencing currently (where order activity is low).

Dissolving wood pulp (DWP)

Binnie also touched on the weaker outlook for the DWP business. DWP’s primary use is in the clothing sector, and there is currently weaker sentiment in the textile value chain (with high retail inventories in the sector, which has had a knock-on effect across the value chain). This will put some pressure on demand for dissolving pulp and viscose and alternative fibres (which has been happening over the past few weeks), which is one of the reasons that pulp prices and dissolving pulp prices have dropped. However, there is a strong destocking currently underway to reverse that trend. Still, we will have the headwind of destocking for the next few months. What this means for Sappi is that a high proportion of its volumes will contract.

Figure 3: Sappi earnings outlook

Source: Sappi, Bloomberg, Anchor

We previously thought that the June 2022 quarter (3Q22) would be the peak for Sappi’s earnings this cycle. However, that proved wrong, and 4Q22 (to end September 2022) turned out to be even better (in fact, the best in the company’s history). The share is up 20% YTD and c. 25% this quarter. We believe we have started the downturn in earnings, given the commentary from management on the earnings call (on which we elaborated above). How severe the downturn gets remains to be seen, but we are happy to stay on the sidelines. The share is trading at 5x 2023 earnings with a 4% dividend yield and the expectation for earnings to decline by 24% (see Figure 3). We would not be buyers of the counter at current levels.

At Anchor, our clients come first. Our dedicated Anchor team of investment professionals are experts in devising investment strategies and generating financial wealth for our clients by offering a broad range of local and global investment solutions and structures to build your financial portfolio. These investment solutions also include asset management, access to hedge funds, personal share portfolios, unit trusts, and pension fund products. In addition, our skillset provides our clients with access to various local and global investment solutions. Please provide your contact details here, and one of our trusted financial advisors will contact you.