The Journey of an Investor

Many people, early on in their investing journeys, believe they have an innate ability to see the future. The reality is that we become far better investors when we make peace with the fact that we cannot know the future. Once we start investing because we cannot see where the world will be tomorrow, let alone in five years, we tend to make far better investment decisions. We are then inclined to allocate different priorities to the stocks we invest in.

The Definition of innate: An innate quality or ability is one you were born with, not one you have learned.

Source: dictionary.cambridge.org

In an unpredictable world, we emphasise factors such as economic moats, balance sheet strength and management quality. An uncertain view of the world makes us build in a margin of safety around the value we are willing to pay for a business. In addition, viewing the future as unpredictable likely makes us allow for a longer-term time horizon when investing. Simply put, believing we can see the future makes us overconfident as investors. Incorporating the abovementioned factors into our investment process acknowledges our inability as investors to see the future.

What has happened recently in the markets

Since early 2022, there has been heightened volatility and uncertainty in global stock markets. The S&P 500 Index is materially down from its highs, with many individual stocks falling by 50% to 70% or even more. As a result, business and finance news shows have been dominated by individual experts and panel discussions searching for the elusive “market bottom”. Many investors might feel they need to hold off on buying new stocks or adding to existing positions until the market bottom is in.

Debates are raging around whether this is a “market bottom” or a “bear-market rally”? The market rallies we have seen in recent months are often dismissed as being merely driven by short covering. However, the reality is that all bear markets end with a sharp short-covering rally, so this point adds little value to the current debate.

Global strategists publish a range of year-end targets for the S&P 500 Index, and we all wait with bated breath to see who ends up being the most accurate. Given that markets typically go up over time, strategists usually predict a rising market for the coming year. The exception is after a difficult year like 2022, where a much bigger focus is on trying to call the market bottom.

There is nothing wrong with having an overall market view. We are all humans with opinions. Any strategist worth their salt will try and establish a view of where the market is headed and at what level the broad index might bottom out. However, this should not cloud our judgement when it comes to stock picking.

In more uneventful times, when markets steadily trend higher, investors do not worry too much about the broader market view. However, in a protracted sell-off (such as the current one since early 2022), investors often treat individual stocks as untouchable until there is some magical all-clear that the S&P 500 Index has bottomed. One of the issues with this is that we only know where the market bottom is well after the event. Once we can identify the market bottom with hindsight, the market has typically rallied significantly off its lows. Unfortunately, the bottom all-clear is sometimes only given months or even years after the market has bottomed.

It could be true that the current overall S&P 500 Index in 2023 might have further to fall. That certainly seems to be the consensus view amongst global sell-side strategists. Some also believe the market will first collapse in 1H23, followed by a strong rally in 2H23. However, that view could just as easily be wrong. Essentially this is another form of market timing. Also, there are always individual stocks that bottom well before the broad market index does.

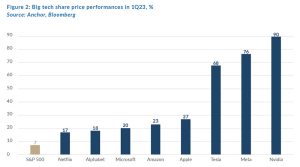

A recent example, using a broad definition for “Big Tech”, shows that there has been a decent comeback for the sector in 2023. In some ways, these big stocks are relatively safe havens in the current banking sector turmoil. Durable business models, strong balance sheets, decent margins (for most), and having underperformed in 2022 have set them up well for 2023. However, going with the consensus negative view about the near-term outlook for the overall market would have prevented an investor from taking advantage of some of these individual stock opportunities that had presented themselves during 2H22.

Our best advice

My advice is to avoid mingling market timing with stock picking. Too often, consensus top-down views on markets end up being wrong. I am in the camp that believes market timing is a skill that very few investors consistently get right over time. We might get it right once or twice. However, once market timing becomes part of our mindset, one is tempted to start knee-jerking and selling some shares whenever we think the overall market looks a bit toppish. Then it becomes a case of calling “11 of the past 3” market corrections.

When one makes a call on the overall S&P 500 Index, the investor is making an aggregate call on 500 companies spread out over many different industries. The composition of the S&P 500 Index has also changed over the years. So, the history around aggregate multiples and margins is not a perfect science. In many ways, it is much easier to have a high conviction on an individual stock than an overall market index. This is especially true if you thoroughly analyse the business you want to invest in. Of course, some diversification is always prudent.

The question could be asked whether a top-down view that tech shares were extremely overvalued in 2021 could have saved the investor a lot of pain in the 2022 sell-off. The answer is that we would have gotten our pointer about where the overall tech market might be heading when each individual stock we were looking at was trading at extremely elevated multiples. A robust bottom-up, stock-by-stock analysis should lead us to the correct top-down decision rather than the other way around. That same negative top-down view of the tech sector would have been a disaster over the past decade.

If we are looking for signs that the overall market might be approaching a floor, often the best pointer is when individual stocks we know well start trading at compelling valuations that have not been seen in a long time. So here is the bottom line; If you come across a quality business trading at a decent valuation, take a longer-term view and buy some shares. Try not to let your top-down market view dissuade or influence you in any way.

At Anchor, our clients come first. Our dedicated Anchor team of investment professionals are experts in devising investment strategies and generating financial wealth for our clients by offering a broad range of local and global investment solutions and structures to build your financial portfolio. These investment solutions also include asset management, access to hedge funds, personal share portfolios, unit trusts, and pension fund products. In addition, our skillset provides our clients with access to various local and global investment solutions. Please provide your contact details here, and one of our trusted financial advisors will contact you.