British American Tobacco (BTI), the manufacturer of cigarettes and vaping products, released a pre-close trading statement on Thursday (8 December) ahead of the release of its FY22 results (due to be announced on 9 February 2023). The Group was confident it would meet its FY22 guidance with the New Category segment continuing to drive strong volume, revenue, and market share growth for the business. The key points for us from the trading statement include the following:

- BTI’s constant currency foreign exchange (FX) revenue growth was expected to be between 2% and 4% YoY (unchanged from previous guidance).

- Net finance costs are estimated to be above GBP1.6bn (previously, this number was closer to GBP1.6bn, i.e., revised higher).

- BTI forecast mid-single-digit EPS growth in constant currency terms (unchanged).

- Operating free cash flow (FCF) is expected to be above 90% (unchanged).

- Net debt/EBITDA is at the upper end of the 2x-3x corridor.

- An FX tailwind of c. 7% (previously at 6%) is expected.

- Global tobacco volumes are forecast to be down 2% YoY in FY22 (this is better than the previously anticipated 3% YoY decline).

- BTI has added a further 3.2mn consumers within its non-combustible franchise in 9M22, reaching 21.5mn in total. This was on the back of new product launches and other innovations.

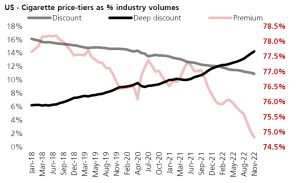

BTI ramped up marketing spend in the US to slow market share losses it is seeing from downtrading (both of which are likely to be a short-term earnings headwind for the Group).

Figure 1: The US consumer continues to downtrade

Source: UBS analysis, NielsenIQ

Valuation

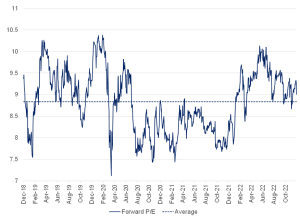

BTI is trading on a forward P/E of 9.1x – marginally above the average over the last few years. The share is currently on a forward dividend yield of c. 7% (for FY23), and share buybacks should add c. 3.3% to shareholder returns in 2023.

Figure 2: BTI Forward P/E ratio

Source: Bloomberg, Anchor

Conclusion

BTI reported some slight negatives from higher debt costs and signs of downtrading in the Group’s key US market, but this was offset by a stronger-than-anticipated FX tailwind. There was also solid progress on BTI’s next-generation products (while still loss-making, it remains on track for profitability in 2025). On balance, however, this was slightly negative. Nevertheless, we believe that the share offers a decent refuge for investors, with mid-single-digit earnings growth, dividends and share buybacks delivering a total return in the low- to mid-teens (in hard currency), albeit with bouts of volatility associated with regulatory pressure, particularly in the US menthol market which still accounts for c. 30% of total profit.

At Anchor, our clients come first. Our dedicated Anchor team of investment professionals are experts in devising investment strategies and generating financial wealth for our clients by offering a broad range of local and global investment solutions and structures to build your financial portfolio. These investment solutions also include asset management, access to hedge funds, personal share portfolios, unit trusts, and pension fund products. In addition, our skillset provides our clients with access to various local and global investment solutions. Please provide your contact details here, and one of our trusted financial advisors will contact you.