Boris. Brexit. Trade wars. Trump. Orange is the new black. Unorthodox is the new orthodox.

It certainly feels like uncertainty is on the rise – for the man on the street and the professional investor alike. In times of constant flux, it’s helpful to remind ourselves of the things that don’t change. The constants. We need wisdom that is timeless and enduring.

For guidance, I like to ask the rhetorical question, “What would Peter do?”

Notwithstanding his many (many!) years in the market and ample wisdom, I am not referring to Anchor’s CEO, Peter Armitage (sorry Pete!). Rather, I’m referring to Peter Lynch, who ran the Fidelity Magellan fund for 13 years in the 1980s and 1990s, compounding capital at an astounding 29% p.a. Lynch also authored two investing classics, One up on Wall Street and Beating the Street. Both are aimed at retail investors and are written with infectious enthusiasm and without complicated jargon. As Lynch describes the challenges the markets were grappling with at the time, it seems that the only certainty in the market (and arguably, life) is uncertainty. Reflecting on the worries of the day, Lynch noted:

“You can find good reasons to scuttle your equities in every morning paper and on every broadcast of the nightly news.”

Investors try to assess the impact of the latest ‘unknowables’ on the economy and then, in turn, on the market itself (two additional unknowables) causing asset prices to move. Of course, a feedback loop exists between asset prices and the economy. For example, as bearish investors pour money into bonds, interest rates fall, lowering the cost of financing for consumers and businesses in the real economy. This is bullish for the economy and, theoretically, for stocks. The logic quickly becomes circular and infinitely complex. Unknowable to the power of unknowable. It’s no wonder that Lynch concluded:

“Predicting the economy is futile. Predicting the short-term direction of the stock market is futile.”

Lynch’s alternative solution is for investors to focus instead on something they can wrap their heads around:

“Invest in companies, not the stock market.”

Lynch’s success was driven in large part by a small group of companies whose stocks became “baggers”. A double bagger is a stock that doubles, a ten bagger is a stock that rises tenfold, and so on.

“All you need for a lifetime of successful investing is a few big winners, and the pluses from those will overwhelm the minuses from the stocks that don’t work out.”

This observation also applies to the broader market. Professor Hendrik Bessembinder found that, in the US between 1926 and 2016, just 4% of shares accounted for 100% of the market’s excess return over 1-month Treasury bills. The other 96%, in aggregate, merely matched the returns of short-term fixed income.

If baggers are so essential to wealth creation, then it is surely a worthwhile endeavour to explicitly seek out those stocks with “multibagger” potential. Unfortunately, there are no hard and fast rules for finding and profiting from these companies. Lynch does, however, provide the foundational principle:

“This in a nutshell is the key to the big- baggers and why stocks of 20-percent growers produce huge gains in the market, especially over a number of years. It’s no accident that the Wal-Marts and The Limiteds can go up so much in a decade. It’s all based on the arithmetic of compounded earnings.”

Another fund manager and author, Chris Mayer, took the bagger idea to an extreme in his book 100 Baggers – Stocks that return 100 to 1 and how to find them. Mayer researched 100 baggers and attempted to find common attributes among them. Needless to say, there is no magic formula or three easy steps to riches. However, Mayer distils the essence of the book into a handful of key ideas, which include:

- You have to look for them.

- Growth, growth and more growth.

- Lower multiples preferred.

- Economic moats are a necessity.

- Owner-operators preferred.

- You need time.

- Luck helps.

- You should be a reluctant seller.

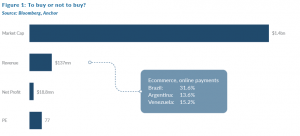

Armed with Lynch and Mayer’s wisdom, let’s look at a company and consider whether it has bagger potential. The company is headquartered in Argentina and operates an ecommerce marketplace with an integrated online payments solution. By country, significant contributors to revenue include Brazil (32% share), Argentina (14%) and Venezuela (15%). Revenue grew approximately 25% (in US dollar terms) over the past year and is expected to continue to grow at that rate over the next few years. The company has a market capitalisation of $1.4bn and trades on a price to earnings ratio of 77.

Do you think this stock is a “Buy” or an “Avoid”?

I have a confession to make. The information above pertains to 2009 and the company in question is MercadoLibre. Despite widespread economic malaise in Latin America (and outright collapse in Venezuela) over the last decade, the stock has been a stupendous winner, rising almost 20- fold.

Don’t feel too bad if you put it in the “avoid” pile. I did – in 2009! For most of the past 10 years I found good reasons to scuttle an investment in what turned out to be an exceptional performer. For the bulk of that period, Latin America looked like a mess and the stock appeared expensive (at least by conventional metrics). Peter Lynch understood that orthodoxy can get in the way of outstanding returns:

“Investing in stocks is an art, not a science, and people who’ve been trained to rigidly quantify everything have a big disadvantage.”

Thankfully, all is not lost; the future is full of baggers lying in wait. And the next MercadoLibre might just be … MercadoLibre. Ecommerce penetration in Latin America is at a nascent stage, comprising only 3.5% of the overall retail market. This compares with 14.7% in the US; a surprisingly low number with substantial headroom for growth. It is not inconceivable that MercadoLibre could one day reach a market capitalisation of $100bn. As Jeff Bezos, founder and CEO of Amazon likes to say in his shareholder letters, “It remains Day 1.”

Just as important as identifying potential baggers, is holding onto them through thick and thin. As Chris Mayer points out, “you need time” and “you should be a reluctant seller” in order to fully benefit from baggers in your portfolio. Peter experienced this first- hand in his fund:

“The typical big winner in the Lynch portfolio generally takes three to ten years to play out.”

The final hurdle for achieving bagger nirvana is … ourselves. Mayer highlights that “You need a good filter”, referring to the deluge of noise (usually negative), which gets thrown at the investor on a daily basis and can unsettle even the most battle-hardened among us. There are always valid reasons to be pessimistic about the economic, political and social outlook. As surely as a broken clock is right twice a day, the pessimists will have their short-term victories.

As surely as a broken clock is right twice a day, the pessimists will have their short-term victories.

But it is the optimists that triumph in the end. Lynch knew which camp he wanted to be in:

“Unless you’re a short seller or a poet looking for a wealthy spouse, it never pays to be pessimistic.”

Peter would focus on companies, not the stock market or the economy. Peter would be on the hunt for baggers. And Peter would choose to maintain an optimistic outlook.

That’s what Peter would do.