Anchor Agri-view

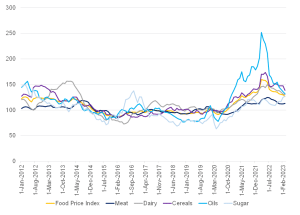

The FAO Global Food Price Index (FFPI), which measures the monthly change in the international prices of a basket of food commodities, averaged 126.9 points in March 2023, down 2.8 points (2.1%) from February. It marks the twelfth consecutive monthly decline since the index peaked one year ago. Moreover, during the past twelve months since March 2022, the index has fallen by as much as 20.5%. The March decline in the index was led by drops in the cereal, vegetable oil and dairy price indices, while those of sugar and meat increased.

Figure 1: FAO’s Global Food Price Index

Source: FAO, Anchor

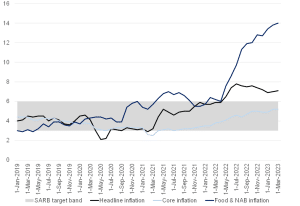

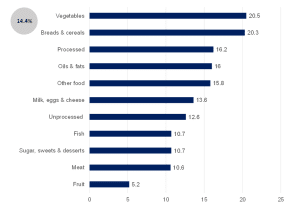

Locally, in another upward surprise, the rate of increase for South Africa’s (SA) March headline CPI accelerated to 7.1% YoY from 7% YoY in February. Stubbornly high food price increases were yet again at the forefront of this latest increase, remaining upwardly sticky and contributing about one-third of the rise in the headline reading. Price growth in the food subcomponent rose at the quickest pace in fourteen years (+14.4% YoY), led by marked price increases for milk, eggs and cheese, and fruit and vegetables. However, we believe that food prices will remain a significant source of uncertainty in the coming months, given the time-varying nature of leads and lags from lower crop prices (for example, white maize futures are down about 35% from their peaks in October 2022) to shelf prices and the increasingly hard-to-quantify effects of loadshedding. Furthermore, there is early evidence of mounting El Niño risks, which could generate fresh upside food pressures in 2024 if this climatic phenomenon materialises strongly towards the end of this year.

Positively, the transport subcomponent, where the rate of increase slowed to 8.9% YoY amid softer (annual) price increases in fuel, helped to keep the overall rise in headline CPI more muted. Furthermore, quarterly rental inflation remained subdued, indicating that demand-pull inflation remains contained. Moreover, it is worth noting that core inflation remained stable at 5.2%, in line with market expectations. Overall, after scratching through the numbers, about half of the rise in domestic food prices is due to rand weakness, and the rest to rising domestic costs – particularly loadshedding and other input costs to the agriculture production process, including transport costs. These costs, in particular, are tricky to quantify and consequently forecast. With core goods and food higher in the near term, we turn more towards the SA Reserve Bank’s (SARB’s) forecasts that headline inflation for 2023 will average around 6% this year. On a monthly basis, we will see the headline number duck back under the upper end of the target range. However, the exact timing remains the big question.

Figure 2: SA inflation, January 2019 to date (YoY, % change)

Source: Stats SA, Anchor

If one considers current food inflation drivers (and subsequent expectations) in more detail, crop prices, particularly, have been easing in the global market, driven by lower input and energy costs. However, given the weak exchange rate, this downturn in inputs, energy and crop prices is yet to filter into the local SA market. Furthermore, other factors such as fuel prices and loadshedding add costs across the value chain and thus further contribute towards food inflation. Whilst in 1Q23, the weakening of the exchange rate has prevented lower international grain and oilseed prices from fully filtering through to the domestic market, local prices for maize and soybeans are expected to ease further based on expectations of a bumper summer crop. As such, in anticipation of the surplus locally, maize and soybean prices are trading significantly below export parity – with maize declining the fastest. Typically, commodity price movements have a tag time of around 3 to 4 months to reflect in retail food prices. Thus, there could be some relief in the food price inflation numbers from this particular subcategory in the coming months.

The livestock and dairy markets are also experiencing a downturn in prices globally. Whilst international prices for poultry have been decreasing steadily, the global decline has also been offset by the weaker rand in the local market. In the domestic dairy market, despite the declines in global prices, the increase in input costs continues to offset price gains in milk and dairy products. Furthermore, dairy production is expected to decline in the coming months on the back of increased input costs due to loadshedding, high feed costs and various other supply chain disruptions.

On the meat side, the decline in grain and oilseed prices will provide some relief for the livestock industry via lower feed prices. Nonetheless, beef exports are still being dampened by biosecurity issues, leading to depressed weaner prices. Overall, this recent extended period of high feed prices, coupled with said biosecurity challenges, has reduced stocking and slaughter volumes. In the vegetable market, the delayed season (caused by heavy rains over the summer) has kept prices relatively high into March, however, producer prices have begun to ease in April, which should filter through to lower consumer prices. Nevertheless, over the medium to long term, high input prices and the impact of loadshedding on irrigation will put pressure on planted areas and thus supply volumes into the market. For fruit specifically, retail prices will be primarily determined by seasonality (as per the norm), and the impact of loadshedding – the additional costs around electricity generation are reducing the economic viability of storing fruit for out-of-season sales.

Figure 3: SA March food inflation by component, YoY % change

Source: Stats SA, Anchor

Looking ahead, headline CPI inflation should ease in the coming months, despite this latest upside surprise. Even after the rise in Brent crude oil prices following OPEC’s announcement on cutting supply, base effects should see fuel inflation falling further in the months ahead, carrying a strong disinflationary effect. Food inflation, in particular, should start to moderate, especially given the strong base effects. That being said, with ongoing bouts of loadshedding and inflation expectations drifting higher, uncertainty around the path of CPI inflation is higher than usual. While the in-target medium-term inflation forecasts high and restrictive forward-looking real rates, weak demand-pull inflation and even the SARB’s Quarterly Projection Model (QPM) support the case for the central bank not tightening rates further, this latest inflation overshoot will fuel the SARB’s concern about the perpetual upward inflation forecast revisions, even though they are short term in nature and with the medium-term trajectory continuing to drift around the mid-point of the SARB’s target range. Therefore, despite this latest inflation data strongly implying that demand-pull inflation pressure remains contained, it increases the likelihood of further tightening.

Concerningly, the latest data from the National Credit Regulator show early signs of mounting consumer debt distress in 4Q22, with a noticeable rise in fresh overdues on consumer loan contracts, a record number of credit applications, an elevated rejection rate and a decline in the value of credit granted after adjusting for seasonal factors. Moreover, after the SARB’s 375 bps of rate hikes since late 2021, we are not surprised to see evidence that consumers are increasingly struggling to repay their debt on time. Unfortunately, we expect these trends to have worsened in 1Q23.

At Anchor, our clients come first. Our dedicated Anchor team of investment professionals are experts in devising investment strategies and generating financial wealth for our clients by offering a broad range of local and global investment solutions and structures to build your financial portfolio. These investment solutions also include asset management, access to hedge funds, personal share portfolios, unit trusts, and pension fund products. In addition, our skillset provides our clients with access to various local and global investment solutions. Please provide your contact details here, and one of our trusted financial advisors will contact you.