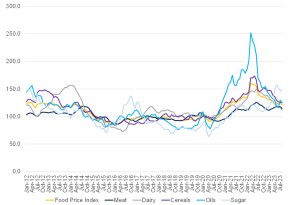

The FAO Global Food Price Index (FFPI), which measures the monthly change in the international prices of a basket of food commodities, declined by 2.1% MoM in August, following a slight increase in July (+1.3% MoM). This latest print is the lowest reading since March 2021 and is also 24% below the all-time high reached in March 2022 after Russia’s invasion of Ukraine. The August drop in the overall index reflected declines for dairy products, vegetable oils, meat, and cereals, despite a jump in FAO’s rice benchmark to a 15-year high following India’s export restrictions. Unfortunately, the sugar sub-index rose 1.3% MoM in August, putting it 34% higher YoY on the back of concerns around the impact of the El Niño weather pattern on global production.

Figure 1: FAO Global Food Price Index, January 2012 to August 2023

Source: FAO, Anchor

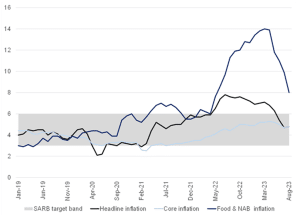

Locally, South Africa’s (SA) August headline CPI print rose for the first time in five months to 4.8% YoY, from 4.7% YoY in July, as expected. The recent deceleration in headline inflation over the last few months has primarily been driven by the strong base effects on fuel inflation, which, as expected, have now begun to dissipate from the August data. This, in addition to some of the fuel price increases we saw in August, was largely responsible for this renewed increase in inflation data. Indeed, the Brent crude oil price has risen by over 25% since late June amid cuts in supply from major producers. Unfortunately, these factors offset further easing in food and non-alcoholic beverages (NAB) inflation, softening from 9.9% YoY in July to 8.0% YoY in August. Except for fruit, all food and NAB categories recorded lower annual rates in August, which still assisted in taking some of the heat off the headline rate. However, this was not enough to counteract the rise in fuel prices and increases in municipal tariffs.

Figure 2: SA inflation, January 2019 to date (YoY, % change)

Source: Stats SA, Anchor

Considering specific individual food price trends in more detail, global dairy prices have decreased mainly due to abundant supplies, in combination with seasonally higher production and a slowdown in imports by China. Locally, unprocessed milk and dairy product prices have increased sharply amid persistent increases in production, transportation, and manufacturing costs. The dissolution of the Black Sea Grain Initiative has seemingly had a minimal impact on global sunflower oil pricing, as prices saw a c. 8% MoM decrease in August. This decline can be attributed to robust exportable supplies from Ukraine (which continues to access EU trade routes) and weakening import demand. Palm oil prices decreased slightly due to higher production in key Southeast Asian countries and lower import demand. Globally, soybean prices dipped due to improved crop conditions in the US, while ample exportable supplies in the international market led to lower canola prices in August compared to July.

Global wheat prices declined in August due to ongoing Northern Hemisphere harvests, leading to increased seasonal availability. Global maize prices experienced their seventh consecutive monthly decrease in August, reaching their lowest point since September 2020. This decline was largely driven by a global surplus supply resulting from a record crop in Brazil and the commencement of the harvest in the US. In contrast, worldwide rice prices continued to surge MoM, registering a 9.8% increase and reaching a 15-year high in nominal terms. This uptick was primarily attributed to India, the world’s largest rice exporter, implementing the aforementioned protectionist policies. These policies caused significant disruptions in the rice market, with supply chain participants either holding onto their stocks, renegotiating contracts, or refraining from making price offers. This ultimately led to most trade occurring in small quantities or relying on previously established agreements. Notably, the impact of India’s export restrictions on global prices was more substantial than the ban imposed on non-basmati milled rice in 2008, as India was the second-largest rice exporter at that time.

Locally, the supply and demand dynamics in SA’s local grains and oilseed market have remained consistent with the previous month in August. The local market is well supplied, thanks to the second-largest maize crop on record, totalling 16.4mn tonnes, and a record-breaking soybean crop of 2.8mn tonnes. Consequently, the primary drivers of local grain and oilseed prices at present are international prices and the exchange rate. Maize prices saw a slight decrease, aligning with trends in the global market despite a weaker exchange rate. In contrast, oilseed prices continued their upward trajectory for the second consecutive month, with sunflower prices rising by 0.2% and soybean prices surging by 7.3% MoM. The strength of soybean prices can be attributed to the depreciation of the rand vs US dollar exchange rate. Following the trends in international wheat markets, domestic wheat prices were lower in August compared to July. Despite well-honed local wheat production (the latest local wheat crop is expected to exceed 2mn tonnes), SA remains a net wheat importer with local demand at c. 3.5mn tonnes. Hence, local prices continue to largely derive from global prices and subsequent exchange rate fluctuations.

In the domestic meat market, prices for most meat categories rose in line with international trends in August, offset by a weaker exchange rate, which translated to higher meat prices. The price of pork increased the most (+9.9% MoM), reflecting reduced slaughters through 1H23 compared to the same period in 2022, followed by beef (+3.4% MoM) and poultry (+3.4% MoM). Poultry and egg prices face substantial upside risk in the coming months due to the current Avian Influenza (more commonly known as bird flu) outbreak, which has already resulted in significant culling that will reduce the supply of eggs in particular.

Overall, if one looks past the noisy global agricultural dynamics, SA has actually had a relatively favourable agricultural season. For example, the 2022/2023 maize harvest is estimated at 16.4mn tonnes – 6% higher than the 2021/2022 season’s harvest and the second-largest harvest on record. The latest forecasts indicate that the soybean harvest could reach a record 2.8mn tonnes. Regardless, as an open economy and net importer of foodstuff, SA’s general food inflation environment remains primarily influenced by global developments.

Whilst there are renewed risks in the global agriculture outlook (and domestically, the increases in fuel prices), we are still optimistic that SA’s consumer food inflation will continue to slow throughout the year into 2024. We continue to closely monitor the upcoming El Niño weather occurrence and the recent floods in the Western Cape. Both events are forecast to have a mild impact on the sector as a whole, thus maintaining production at adequate levels and, by extension, sustaining the current moderation of food prices.