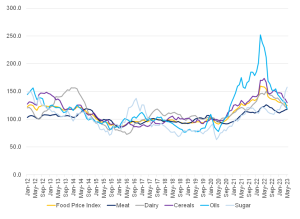

The FAO Global Food Price Index (FFPI), which measures the monthly change in the international prices of a basket of food commodities, declined by 2.6% MoM in May 2023 and by as much as 22.1% from its all-time high in March 2022. May’s MoM decline was underpinned by significant drops in the price indices for vegetable oils, cereals and dairy, which were partly counterbalanced by increases in the sugar and meat indices. Among the sub-indices, the Cereal Price Index (which is crucial as it monitors price movements of grains providing the bulk of the calories that the global populace survives on) declined by 4.8% from April and is as much as 25.3% below its record-high value one year ago. International wheat prices continue to decline, reflecting prospects for ample global supplies in the upcoming 2023/2024 season and the extension of the Black Sea Grain Initiative. Furthermore, world maize prices fell by 9.8% MoM in May. A favourable outlook for 2023/2024 points to a rebound in global supplies, with higher production expected in Brazil and the US (two major exporters), which subsequently weighed on prices. The slow pace of US exports and China’s cancelled purchases also exerted downward pressure on world maize prices.

Figure 1: FAO’s Global Food Price Index

Source: FAO, Anchor

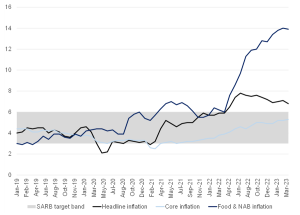

Marking the lowest reading since May 2022, annual inflation in South Africa (SA), as measured by the consumer price index (CPI), slowed to 6.8% YoY in April from 7.1% in March. Inflation eased mainly due to the expected decline in fuel inflation to 5.0% YoY in April from 8.1% in March but also partly due to an unexpected softening in food and non-alcoholic beverages (NAB) inflation to 13.9% from 14.0%. This latest food inflation print hopefully marks the start of a general downward trend, which is expected to underpin the easing of headline inflation too.

Furthermore, notwithstanding the price adjustments as businesses pass on the additional costs incurred for alternative electricity sources during loadshedding, we expect some relief in the coming months from a retreat in agricultural prices, even with the rand weakness. Nonetheless, as expected, core inflation (which excludes the volatile price categories of energy and food) rose 0.1 pp to 5.3% YoY in April, as headline price pressures continue to filter through to the rest of the economy. Unusually, this latest rise in core inflation was driven by services instead of goods.

Figure 2: SA inflation, January 2019 to date (YoY, % change)

Source: Stats SA, Anchor

Whilst this latest CPI print came in lower than consensus expectations of a 7% YoY print, it is important to remember that inflation remains above the South African Reserve Bank’s (SARB) target band of 3%-6%, and risks to the outlook remain on the upside. The rand has depreciated by 11.2% on a trade-weighted basis since the start of this year, and the general expectation is for the local unit to remain weak throughout the foreseeable future, given the many headwinds facing the domestic economy. As such, imported goods inflation will be key to watch. Overall, with the rand’s substantial weakness and markedly higher production and retail costs stemming from sustained, intensive loadshedding, the risk to the inflation outlook, on balance, is still on the upside.

If one considers current food inflation drivers (and subsequent expectations) in more detail, crop prices continue to soften in the global market, backed by easing input and energy costs combined with higher production. As a result, lower feed prices are expected to boost output in livestock markets. In fact, after peaking at over R5,300/tonne in November 2022, white and yellow maize grain prices have declined sharply (by c. 30%) and are now trading at around R3,600/tonne. In combination with a much weaker exchange rate, SA is amongst the cheapest sources of maize globally, trading at US$190/tonne compared to the US price of US$255/tonne. With the latest crop estimate of 16.1mn tonnes and local demand estimated at 11.5mn tonnes, SA will have an ample surplus of exportable maize for the coming marketing season – as such, exports are already commencing. As a result, the expectation is for maize meal prices to decline over the coming three to four months as cheaper maize moves into the supply chain. However, the higher costs of transportation, processing and retailing driven by loadshedding will absorb some of the potential declines in maize meal prices.

Locally, sunflower and soybean prices have followed global trends and have declined considerably since the beginning of the year. Besides lower seed prices, much downward pressure comes from the vegetable oil and meal market. SA remains a net importer of vegetable oils (mainly palm oil), and global markets have plummeted to less than 50% of the levels reached in July 2022 – thus contributing to the decline in local prices. Like maize, local soybeans are trading significantly under export parity prices, providing further relief to the intensive livestock industries, which are also severely impacted by loadshedding. As such, on the meat side, beef carcass prices have declined by around 8% since January and, in May 2023, were more than 10% below May 2022 levels. Prices are expected to dip further in the next three months (mid-May to mid-July) due to seasonality, coupled with additional meat available in the market.

Pork prices have come down rapidly over the first five months of this year, falling by c. 18% since January, although prices remain higher than May 2022 levels. For poultry, the cost of individual quick freezing (IQF) mixed portions (R/kg) was, on average, 20% higher YoY in April 2023. Owing to the prominence of imported products in total poultry consumption, IQF prices are strongly influenced by international markets and exchange rate dynamics, with the sharp depreciation in the value of the rand strongly influencing the current price levels. The continued spread of avian influenza globally could bring additional price risks.

In the vegetable market, prices remain higher than 2020 (COVID-19) levels. Vegetable supplies, in general, have been tight through 1Q23, with a significant share of production reliant on irrigation. Unfortunately, persistently high levels of loadshedding could further impact availability. For fruits, citrus prices will trend lower as the market approaches peak season and availability increases. Whilst most of the SA-produced citrus is intended for export, strict export conditions in the global market will likely see more fruit marketed locally for the current season. This implies a higher-class fruit in the domestic market than is usually available.

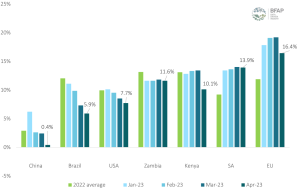

Interestingly, Figure 3 below illustrates that food inflation remains higher in SA when compared to most of our counterparts, bar the EU. Declining food inflation rates have been observed for all of these countries; however, the decline in SA is slower than most.

Figure 3: International food inflation comparison, YoY food inflation rate by country

Source: BFAP

Looking ahead, while inflation may be showing signs of abating, it is still hovering above the SARB’s target band of 3%-6%, and food price inflation is still in the double digits. In addition, SA’s energy crisis, which has worsened this year, is weighing heavily on the country’s already strained economy, presenting more inflationary risks. When delivering the latest Monetary Policy Committee (MPC) statement, SARB Governor Lesetja Kganyago stated that the SARB forecasts that loadshedding alone will shave 2% from growth this year. However, he added that the bank now expects slightly higher than its previously forecast GDP growth of 0.3% YoY for 2023. Unfortunately, SA is one of the few countries with an economy smaller than before the COVID-19 pandemic began.

At Anchor, our clients come first. Our dedicated Anchor team of investment professionals are experts in devising investment strategies and generating financial wealth for our clients by offering a broad range of local and global investment solutions and structures to build your financial portfolio. These investment solutions also include asset management, access to hedge funds, personal share portfolios, unit trusts, and pension fund products. In addition, our skillset provides our clients with access to various local and global investment solutions. Please provide your contact details here, and one of our trusted financial advisors will contact you.