Somewhat paradoxically, it is when markets reflect the most uncertainty that it is easiest to take a certain stance on markets. Panic or exuberance are far easier to recognise and respond to with conviction than ambivalence, which requires a far more nuanced approach.

After the market-wide collapse in March of last year, there were several clear trades at play. Technology (tech) companies became the lifeline of the global economy, physical operations faced extinction and global central banks almost certainly had to intervene in what would likely be one of the deepest recessions in history.

Nobody knew exactly what the world would look like in a year’s time (the vantage point we have today) but taking a view at that point also meant that you were spoiled for choice on how to express it.

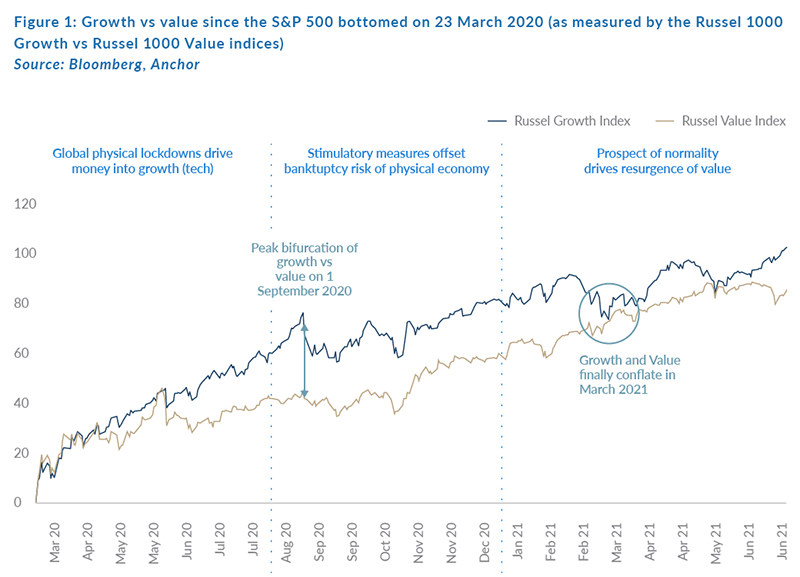

The next six months bore witness to a historical bifurcation of the market, as growth shares (tech) tore away from value shares (physical economy stocks). Growth reached its relative zenith on 1 September 2020, having outperformed value by over 32% (as measured by the Russell 1000 Growth Index vs the Russell 1000 Value Index) since 23 March 2020 (when the S&P 500 bottomed) and driving shares like Tesla to US$883 (+916% over same period) or Zoom to US$568 (+256% over same period).

As the crisis wore on, so the massively accommodative response from governments and central banks would begin to take effect – giving pause to investors who had, until then, ignored physical economy stocks that were pricing in bankruptcy risk despite the impending tsunami of fiscal and monetary support. Further spurned by promising vaccines, value would then stage a monumental comeback in November 2020 – finally conflating perfectly with growth in mid-March 2021.

So what?

Regardless of the tilt of your portfolio, you have likely done well given the absolute direction of the market in aggregate over the past 12 months. Whether you bet it all on tech, caught the value trade, or simply held the S&P 500 – your absolute return likely stands several standard deviations above your longer-term average.

First, as with many previous crises, this reminds us of the importance of embracing the first principle of investing – and that is to stay invested. The cost of panic selling last year, and sitting in cash over the proceeding months, would have had hugely negative ramifications for near-term relative performance and painfully significant implications for your long-term performance once future compounding is considered.

Second, it is a reminder that active managers are well-positioned to leverage the significant dislocations in equities that often crop up because of the unexpected. The broader, passive marketing machine has been effective in cutting the argument short at the fee level even before performance is considered, but this completely ignores the value of the flexibility of an active mandate.

The Anchor Global Equity Fund for example, which invests in some of the world’s most exciting growth stories, came into its own last year as several secular trends (e.g., ecommerce) were accelerated – returning 81% in US dollar terms for the year. We also introduced a Recovery Portfolio in April 2020, positioned to leverage the apparent overreaction in physical economy stocks, which has since returned 92% in US dollar terms as compared to the S&P 500’s 49% return over the same period.

The appropriate inclusion of such active strategies in your portfolio can deliver meaningful alpha through time, and hence certainly warrant consideration on the basis of sensibility of strategy and thematic factors. Their unilateral exclusion in the pursuit of cost savings carries an opportunity cost that can dwarf the fees saved.

So where to from here?

There is no getting around the fact that the market has not just fully recovered after last year’s sell-off but has rallied and become more expensive. This is true of every sector (from tech to energy), and every factor (whether growth or value). Although we are still able to identify several instances of excessive pessimism, equities in general are no longer pricing in catastrophe and investment opportunities are both fewer and less attractive relative to last year.

We have likely entered a phase of consolidation, where the market in aggregate will not find meaningful direction as we transition from the earlier stages of a recovery to post-crisis normality. Finding alpha in a low beta year will always be a more difficult task, but with a little pragmatism and proactivity we still think it will be possible.

Let us discuss how…

Opportunity at the lower end of the quality spectrum

The market is a risk pricing machine. [ Outcome ] x [ probability ] = [ Price ] is a neat, if not grossly oversimplified, representation of how equities are priced.

In the earliest stages of the pandemic, any business that depended on the physical movement of people looked to be in dire straits. Even a high-quality, relatively unindebted franchise such as Starbucks at one point saw its share price down almost 40%, which would only go on to fully recover 8 months later.

As central bank liquidity measures and fiscal support programmes came online, and as the physical movement of consumers began to restart, so investors would begin to price in the prospect of a return to normal trading conditions. In fact, as we will explore later in this article, the best operators in a segment (like Starbucks) would go on to command premium valuations.

Per the equation above, Starbucks’ share price reflects the now apparent reality that the business of serving premium coffee at convenient locations has a bright future – but of course, not all physical businesses have yet reached this point.

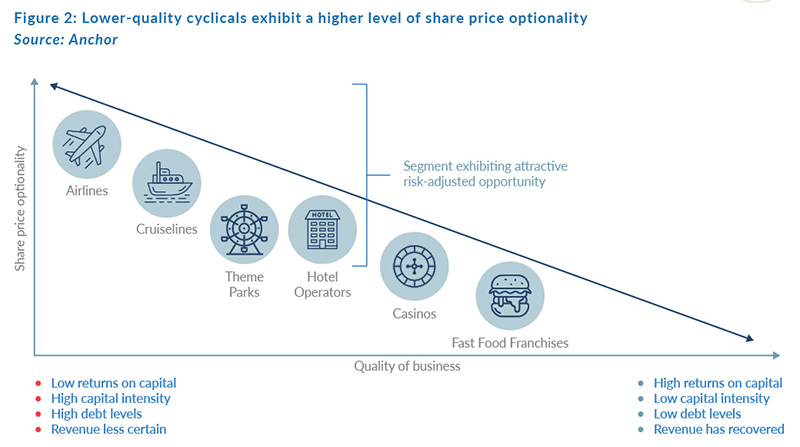

While Starbucks is now able to serve its consumers in-store again, the airlines, cruise lines, and the hotels and casinos that service these travellers have not yet staged a meaningful recovery. Adding insult to injury, it is these same, more cyclical businesses which demand a much higher level of capital investment and structural debt – thus exacerbating the negative impact of a loss of revenue on their solvency.

By way of example, Carnival Corporation’s (a cruise line operator) market cap is still 23% lower vs 1 January 2020, even though the S&P 500 sits a heady 32% above the level it traded at on the same date. Although the broader market is pricing in the probability of vastly improved trading conditions, lower-quality businesses, which still face near-term operating challenges, have been left behind – and we feel this is probably a good investment opportunity.

Sticking with Carnival as the example, its monthly cash burn rate sits at US$500mn per month against total liquidity of US$9.3bn, meaning that the company will likely be able to return to full fleet operations by next year without further shareholder dilution.

Given that cumulative bookings for 2022 sit meaningfully ahead of 2019 (pre-pandemic) levels, we believe that in twelve months’ time sentiment towards Carnival (and other similarly afflicted stocks) will have improved markedly – and their stock prices will gain accordingly as the market starts to price in a higher probability of a better outcome as compared to the status quo.

Own the winners …

The pandemic has acted as both a catalyst and an accelerant for change, where many secular shifts and trends have experienced a multi-year progression in less than 12 months. Global ecommerce penetration shot up from c. 15% of total retail trade to 20% (equal to 5–6 years of progress at previous rates), social media user growth rates almost doubled, and digital advertising spending actually grew in a year when total advertising spend shrank by almost 5%.

If the markets were sprint hurdles, the companies positioned ahead of these shifts have cleared two in a single leap, while those left behind have just crashed into the bar and have little prospect of getting back into the race.

Competitive sectors will likely become more concentrated, with the winners likely to command premium valuations and, from an investor’s perspective, it is important to position yourself accordingly.

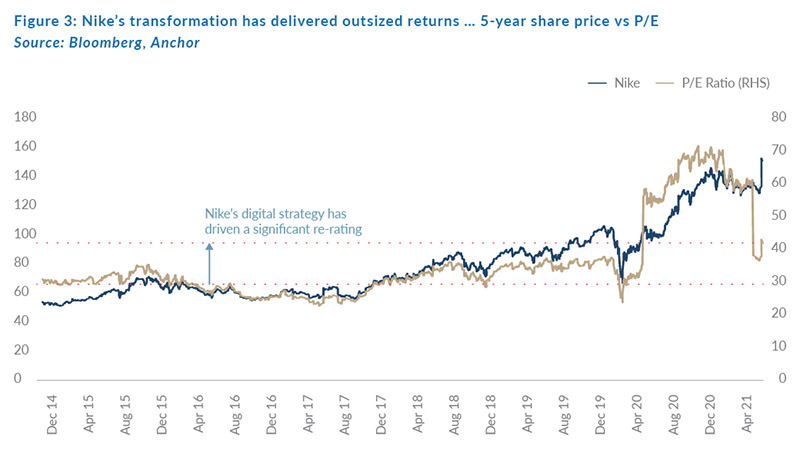

Nike is a great example. In 2015, the company announced the mass closure of 95% of its wholesaler accounts (including Amazon!) and it committed to investing in an ambitious direct-to-consumer strategy that would give Nike complete control over its brand – from factory to foot. At that point, Nike’s wholesale business accounted for 76% of revenues and digital sales for just 4%. Fast forward to today, and digital sales now account for > 33% of sales – with that statistic expected to surpass 50% by 2023.

The effect of this sales mix shift has a tremendously positive impact on Nike’s profitability, with higher realised average selling prices (ASPs) set to drive gross margins from 45% to closer to 50% over the next few years. More importantly, however, Nike has successfully transitioned to Retail v2.0 – in the process future-proofing the brand’s go-to-market strategy and taking direct ownership of the relationship with its customers.

The thing is, Nike was not exactly a value stock in 2015 – on average trading at 30x trailing earnings. This, combined with its 10%-15% earnings growth profile, certainly would not have suggested that the stock would return 200% over the next 5 years. But it has.

This is likely a harbinger of things to come in the markets over the next decade. Those firms that have spent the past decade transforming their business models to suit Business v2.0 will not just outperform their competitors, they will usurp them. Their multi-year head starts have earned premium ratings (i.e., an ultra-low cost of capital) that will allow for continued investment at a pace and scale that will not be possible to compete with.

The narrative is similar for winners in other segments including Amazon, PayPal, Alphabet, Facebook, Netflix, and Apple. These names will continue to be meaningful positions across Anchor’s various mandates for this reason, as we expect the returns which these companies will generate for shareholders will again beat the market, in aggregate, by a significant margin.

Waiting for the great growth pullback …

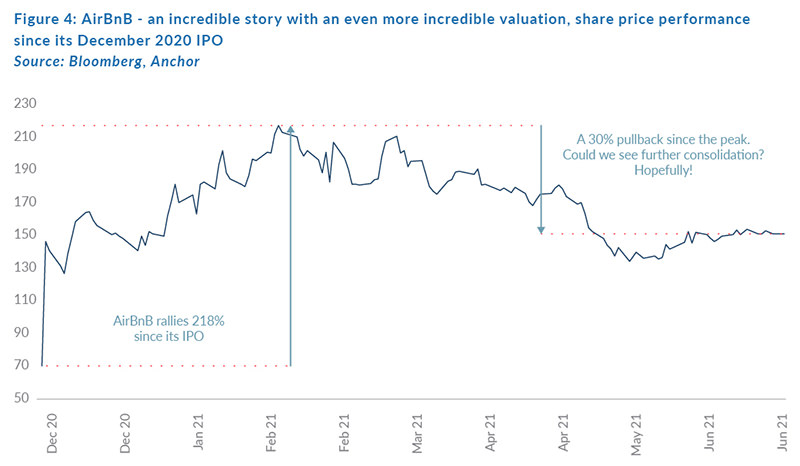

Over the past 18 months, the market has certainly been conducive for the IPO of a great growth story. Many that were already listed have also come into their own over the same period, and for good reason.

Historically low interest rates (i.e., low discount rates!) and a once-in-a-lifetime global physical lockdown, both coming into effect at the same time, is the financial equivalent of a shot of adrenaline for high-growth tech companies which are destined to become highly profitable in years to come should they sustain their revenue momentum.

Some will make it there, but many will not – and the current valuations in the growth space mean that the stakes for investors are high. The counteracting forces of powerful secular acceleration, and current stock prices which discount the cash flows many years out, create a tricky path for market participants to navigate.

We are by our nature growth-oriented investors. The empirical evidence from decades of capital market activity suggests that we are in the right camp, as the overwhelming driver of returns over time is earnings growth and not valuation. However, valuation is how you control risk – and we prefer to take reasonable risks rather than buying growth at any price.

It is not an exact science. The best we can do is to build a view of the future using reasonable assumptions, and to discount the outcome at a reasonable discount rate. If the resultant valuation compares favourably with the firm’s current market price, we will be buyers.

As you will observe from Figure 1 above, the prospect of monetary and fiscal normalisation has already tugged at growth valuations twice since January. As yields continue to normalise from abnormally low levels, we believe that at some point in the near future, growth stocks will look an order of magnitude more attractive than they do now. This will be an opportune time to buy the names we are watching but cannot quite justify for inclusion just yet (see the AirBnB share price in Figure 4 below!).

Proceeding pragmatically, and proactively

The transitionary phase in which the market currently finds itself, brings with it a tension between shorter-term trades and longer-term investments as they compete for space in our portfolios, and achieving the appropriate blend requires a healthy degree of pragmatism.

As physical economy stocks continue to rebound, and while the best growth names consolidate, we will maintain a proactive approach in shifting our factor exposures as these conditions evolve.

Currently, the apparent optionality in lower-quality cyclicals is attractive in the context of a relatively expensive market – especially as the headwinds of the pandemic start to fade and pent-up consumer demand starts to flow.

Additionally, and much as was the case in the now bygone decade, the dominant players who have restyled their business models to suit the new digital landscape will further assert their already considerable dominance.

Lastly, when good stories command even better valuations, we believe it prudent to be patient – and such patience may well pay off over the next few months as global liquidity normalises and speculation gives way to a slightly more risk-averse atmosphere.

As always, we will endeavour to recognise trends early and to react decisively.