Global Backdrop

1Q19 was dominated by headlines and events, both abroad and domestically, around slowing global growth, the possibility of a global recession, populist rhetoric from politicians, fears of a SA Moody’s downgrade and rolling blackouts courtesy of Eskom. We are therefore relieved that SA avoided a negative ratings outlook from Moody’s and we were positively surprised by the extent of dovishness coming out of the South African Reserve Bank’s (SARB’s) most recent Monetary Policy Committee (MPC) meeting. Eskom continues to be the elephant in the room for any discussion around SA’s economic prospects, while sluggish tax collection and vehicle sales remain symptoms of an economy that is stagnating. Overall, it is therefore difficult to get excited about the domestic economic outlook, with the SARB cutting its economic growth forecast to a paltry 1.3% for 2019. Arguably the SARB has been too optimistic and further downward revisions to our economic growth forecasts are certainly possible.

Globally, economic growth expectations have been trending downwards as well. The US Federal Reserve’s (Fed’s) Federal Open Market Committee (FOMC) surprised at its March meeting when it indicated that it may not hike rates at all this year. This gives some support to bonds, although the slowing economic growth is concerning to us. At the same time, Brexit appears to have spiraled out of control with the UK’s House of Commons seemingly out of touch with the reality in which they have placed themselves. We are clearly seeing the uncertainty hurt the economies of both Britain and the European Union (EU). US President Donald Trump’s increased nationalist rhetoric is also extremely worrying with threats of closing the border with Mexico together with other unsettling discursive language, whilst on a more positive note it does sound like trade negotiations with China are gaining some traction.

Overall, the world economy has been slowing and is likely to continue to do so for the remainder of 2019. The debate seems centered around whether or not we will drop into a global recession. Certainly, global bonds seem to be pricing in a reasonable prospect of this occurring. We are, however, more constructive on the environment and we expect that, while the slowdown will continue, in the end growth will bottom out and a new normal could be established with a slow, but steady growth rate for a while yet. This should provide an attractive backdrop for SA if the country has a sensible election outcome in May and we are able to adopt a more pro-growth set of policies.

South African Equities

We continue to have a positive stance on local equities following the 8% return from the JSE All Share index in 1Q19. Our 12-month projected return is 13%, although there are varied scenarios which could play out over the coming months and which we are observing closely. Being nimble is as important as it has ever been.

Investors in the South African market are going through emotional turmoil at present, with local news getting worse, although the global backdrop is proving to be supportive. Hence, sectoral exposure is increasingly important, and these could be materially differentiated over coming months.

From a global perspective, an increasingly benign backdrop has seen world equities bounce sharply in 1Q19. Importantly, Chinese stimulus looks to be taking effect and a resolution to the terms of trade with the US could provide a further boost. This was in part responsible for the 17% increase in the local resources sector (although there were also commodity-specific drivers) during 1Q19 and the c. 19% increase in index-heavyweight Naspers in the quarter under review. This has also seen a marginally stronger rand, which started the year at R14.35/US$1.

So, at this stage it looks like the rest of the world will be good for our stock market. And this in turn is positive for earnings and share prices of over half of the shares on the JSE. But, back home it is a whole lot more complex. There is no doubt that local economic conditions are under increasing pressure and it’s not going to get better soon.

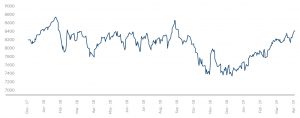

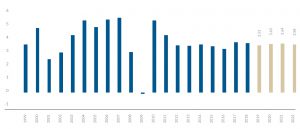

Figure 1: The FTSE/JSE All Share Index performance

Source: Bloomberg, Anchor

SA corporates live in uncertain times and this anxiety is encapsulated in an alarming extract from the recent Phumelela earnings results statement: “The difficulties we faced in the 2018 financial year continued, with political turbulence, labour unrest, criminality, a stagnant economy, low business and consumer confidence, increasing unemployment, higher tax, inflationary administered prices, all a daily fact of business life.”

We are concerned about electricity supply in SA and Eskom’s woes have already seen GDP growth and corporate earnings forecasts downgraded for the year. This will remain a structural impediment to growth for some time to come as final demand, manufacturing, logistics and confidence levels get negatively impacted. Government has made it clear that load shedding is here to stay for some time. In the words of Public Enterprises Minister Pravin Gordhan: “We are a recovering democratic government and load shedding in the result of that. We’ll get it right in the next year or two”. Over half of Eskom’s plants are over 37 years old.

The lack of electricity has damaged the local psyche, so why would you consider buying SA-related shares? If one contemplates the future, there is tremendous potential for an improvement off a low base in the next two years. And markets price for the future as opposed to the present. Any sign of a sustained improvement in local economic conditions could see a material re-rating of SA equities, in advance of earnings growth (which might take some time to follow).

SA turned the corner with Cyril Ramaphosa being elected as ANC president at the party’s elective conference in December 2017. Many positive moves have been made but, not surprisingly, there is strong opposition within a faction of the ANC against moves to curb corruption and revive embattled state-owned enterprises (SOEs). Our base case is for this direction to be sustained and this could see underweight foreign fund managers direct financial flows back into the SA market. However, one needs to watch the balance of power carefully and we would act quickly to pull back from the SA-incorporated shares if we observe strong signs of a reversion to the politics of the past nine years under ex-President Jacob Zuma.

From a sectoral perspective our views are as follows:

- Naspers remains at full weight in our portfolios and we back the core Tencent business as a long-term global play. We do not believe the recently announced Amsterdam listing has a material value unlock. In our view, Tencent now looks fairly expensive, so our expectations are a little more muted after a bounce.

- We still like resource shares and plenty of optionality remains in platinum shares (see Figure 2 below). Resource prices are high and face the prospect of a correction but share prices in this sector are pricing-in a decline. In the event of prices being sustained for a reasonable period, we expect resource shares to be driven higher. We like Anglo American, BHP Group and Exxaro.

- The other big rand-hedge counters have their own specific factors, but we are happy to hold some Richemont and British American Tobacco shares at these price levels.

- The large financial services businesses tend to be fairly mature and market share gains are difficult. Hence, these are quite reliant on GDP growth, which will provide very little in the way of tailwinds over the next 12 months. However, banks in particular are proxies for confidence in the future and foreign money will flow into these stocks in the event of future prospects improving. If things do not improve, credit loss ratios will weigh on future prospects.

- Local retail and industrial shares are cheap as a category and have significant gearing to better GDP growth. We like Bidvest and The Foschini Group. We don’t like the local food producers.

- We also don’t have an appetite for the telecoms industry as the return on incremental capital is low in an industry where companies are forced to continue investing in new technologies and probably spectrum. MTN might well be due for a bounce after a year of bad news.

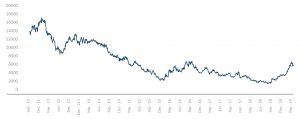

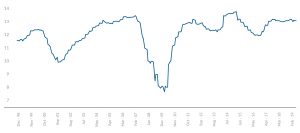

Figure 2: Impala Platinum share price performance, ZAc

Source: Bloomberg, Anchor

In summary, the future is far from certain and various scenarios are possible. The offshore component of the JSE should provide support and, if our base-case of a positive SA scenario unfolds, this could see a material bounce. However, our bets are measured, and we are managing portfolios with one eye carefully on the risks. The imminent May general election should provide us with some direction.

South African Bonds

The bond market had a strong 1Q19, with the SA All Bond Index returning 3.81%. During the quarter, the SA yield curve bull steepened with the belly of the curve strengthening by just over 41bps while the long-end of the curve strengthened by 20bps. The yield on the R186 ended the quarter at 8.59%, having started the year at 8.95%.

The bond rally was sparked by the drastic shift in the global interest rate landscape as major central banks assumed a more dovish tone on their policy stances. This has largely been influenced by the slowing global growth environment. In particular, we have seen the US yield curve inverting which has validated the slow growth/ late-cycle environment, while other DMs have seen their yield curves entering negative territory yet again.

We expect the low DM yield environment to reignite the search for yield with EMs and SA, in particular, benefiting. However, SA has a number of headwinds which may limit its ability to fully benefit from an EM rally. The most prominent of these headwinds is a negative ratings review by Moody’s, which we expect later this year, and the unstable political environment.

We continue to believe that a negative watch from Moody’s is likely, with an increasing probability of a downgrade as economic growth remains stagnant and Eskom remains in crisis mode.

We have revised downward the fair yield of bonds for the next 12 months from 8.75% to 8.70%. This is in sympathy with lower global yields (our fair yield on US bonds now stands at 2.65%) and an upward revision on the fair SA credit spread from 2.25% to 2.50%, while the inflation deferential between SA and the US is unchanged at 3.55%. The summation of the US fair yield, the credit spread and the inflation differential (2.65% + 2.50% + 3.55%) gives a fair yield on the SA benchmark bond of 8.70%. This equates to a 12-month return on bonds of 8.1%, comprising of 8.60% interest carry and capital loss of 0.50%.

In this outlook we have been cautious of the SA political environment and government’s ability to tackle the real problems facing our country. To the extent that there are positive developments on this front, significant gains might arise. We remain neutral on domestic bonds, although we see some risks of a positive surprise.

South African Listed Property

The SA listed property market has again been a bumpy ride for investors in 1Q19. There was some cause for encouragement as the index returned over 9% in January after the annus horribilis that was 2018. However, February and March saw those gains being eroded again.

The problem that the sector faces is the same as the SA economy as a whole. The pedestrian and slowing pace of growth has taken away a vital pillar in the property investment thesis. As SA companies report 2018 results the evidence of this is tangible. Growthpoint, the sector heavyweight, did manage to increase dividends by 4.5% YoY and guided towards a similar trend for 2019. However, closer analysis shows that this is derived from the offshore element of the portfolio, development profits locally, and profit on disposals. Smaller and more focused local property companies that are not able to pull these levers have reported income and distributions going backwards, sometimes at rapid rates.

In addition, factors such as trying to salvage Edcon and the part landlords have had to play/ pay in this process, an oversupply of office space, and Brexit effects on those property companies with UK assets, have obviously not helped. One local property company we interviewed said that the way to think about growth prospects in the next year was that in order to lock-in inflation plus contractual escalations, when leases were up for renegotiation, large reductions in base rentals often had to be a bargaining chip. These negative rental reversions could be up to 20%. This means that if 20% of the buildings are renegotiated annually this rental stream would reduce by 4% (20% x 20%). For the 80% of leases that were ’in force’, contractual escalations were approximately 7% – so growth of 5.6% at the portfolio level. This means that the growth outlook is very low single-digits, in this instance 1.6% (5.6%-4.0%).

However, we do believe that income and yield will now be a greater part of the total return prospects for the sector going forward. Yields of SA counters – and indeed the JSE listed companies that have property assets offshore – have risen to levels and spreads that have not been seen often and tend not to last indefinitely.

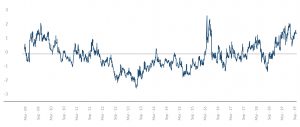

Figure 3 below shows the rise in a blended historical yield comprising Growthpoint and Redefine, SA’s two largest property stocks, in equal weightings.

Figure 3: SA 10-year bond yield v 50% Growthpoint 50% Redefine blended yield

Source: Bloomberg, Anchor

In Figure 4 below, this blended yield is then compared to the 10-year bond yield, and the spread is currently nearly 2%, levels last seen around the global financial crisis (GFC), the euro crisis, and “Nenegate.”

Figure 4: The spread between Growthpoint, Redefine blended yield and the SA 10-year bond yield

Source: Bloomberg, Anchor

The Rand

Projecting the rand’s value in a year’s time is a fool’s errand. The rand vs US dollar exchange rate is one of the world’s most volatile currency pairs and trades well away from any modelled fair value for long periods of time. We note, however, that the rand trades within a R2.50 range to the dollar in most 12-month periods.

We retain our purchasing power parity (PPP) based model for estimating the fair value of the rand and we have extended this out by three months since our last publication. Domestic inflation has been averaging about 4% to 4.5% of late and is likely to average about 5% for this calendar year. In response to SA’s more benign inflation outlook, we have adjusted the inflation differential with the rest of the world down to 3.5%. This has lowered our forecast for the rand somewhat.

Our PPP-modelled value for the rand vs US dollar at the end of the next 12 months is R13.25/$1. We apply a R2.00 range around this to get a fair value range of R12.25-R14.25/$1.

It is reasonable to expect that, as a more positive EM environment develops (in response to lower global interest yields), we will see the rand move towards the mid-point of the range.

We note that the rand ended 1Q19 at R14.47/$1, which is above our fair-value range. Therefore, whilst we are positive on the prospects of the rand to recover, the movements will remain random depending on both global and domestic events. For modelling purposes, we have used the R13.25/$1 midpoint of our range.

Figure 5: Actual rand/ US dollar exchange rate vs rand PPP model:

Source: Bloomberg

Global Equity Markets

We are neutrally disposed towards global equities with a 12-month projected 5% dollar-denominated return. Given our expectation of a stronger rand over the next 12 months, we expect a higher rand return out of domestic equities than global equities. However, our conviction levels for SA equities are not high enough for us to suggest moving equity exposure back to SA for longer-term investors.

A rebound in 1Q19 (S&P 500 up 13%) reversed the decline of 4Q18. World markets are still a few percentage points below their October 2018 highs and 12-month returns are up in the low single-digit range.

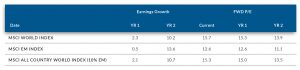

Figure 6 and 7 below show the valuation metrics for world markets.

Figure 6: World Index valuations

Source: Bloomberg, Anchor

Figure 7: US S&P 500 forward PE multiples

Source: Bloomberg, Anchor

Figure 6 above shows that global equities are moderately priced and in line with 10-year averages (S&P 500 forward PE of 17x). We believe that markets can still deliver reasonable returns from these valuations, but much is dependent on the direction of earnings forecasts. Recent volatility suggests that the market is uncertain as to whether the already lengthy positive global economic cycle can be extended further. This cycle has been unusual in many ways, with the longest period of extremely low interest rates in history and we are currently at a fairly low absolute level of US rates for a pause in the interest rate hiking cycle.

The International Monetary Fund (IMF) is still forecasting very steady world GDP growth for the next few years – of around 3.5% as shown in Figure 8 below. This presumably suggests that the US and other major global players will manage the rate cycle appropriately and there will not be any major disturbances to the world order from factors such as Brexit and the US-China trade spat.

Figure 8: World GDP forecasts

Source: IMF

If global growth remains fairly robust, then US earnings are likely to remain strong and consensus earnings forecasts for the US are in the region of 10% p.a. for the next three years, as shown in Figure 9 below. This is above the 20-year average of 7%-8% p.a.

Figure 9: S&P 500 EPS growth

Source: Bloomberg

If the earnings growth projected above materialises, then we would expect global stock markets to deliver healthy returns. However, our outlook is a little more conservative as risks have certainly heightened in the last 12 months and the world is at present unusually reliant on the actions of political leaders (Trump, Brexit, Chinese stimulus and oil-producing countries).

It is also worth noting that the average operating margins for companies are close to historic highs (see Figure 10 below). This suggests that volume/ economic growth is required to drive meaningful earnings and that companies are more vulnerable to a slowdown. However, we do believe margins are sustainable at a structurally higher level given the size and big margins of the major technology companies, which have massive market shares and deliver services at much lower costs (e.g. media through Facebook and Google as opposed to newspapers).

Figure 10: S&P 500 operating margin

Source: Bloomberg, Anchor

The graphs and projections shown above all point to a fairly benign and comfortable outlook. However, this belies the fact that growth projections are being downgraded and growth is being questioned. With German exports showing the worst slump in six years, the ECB pledged more cheap funding for banks and pushed out its expectation for rates hikes from this year to next, also taking a knife to the region’s 2019 growth forecast (to 1.1% from 1.7%). The Fed also struck a dovish tone.

In summary, we remain fairly positive and we believe that global economies can continue growing and markets can continue to deliver fair returns, but markets are starting to show late-cycle characteristics.

Within sectors there is likely to be a shift to more defensive sectors given risks to growth and as rates peak, so dividend yields become relatively more attractive. Structurally, we are staying long technology companies as they continue to generate massive cash flows, steal customers away from traditional players, reinvest and create the future and build massive moats around their businesses.

Global Property

The year started with global DM REITs delivering their best quarter since 2010 (up over 15%, in aggregate), thanks to the twin tailwinds of a recovering risk appetite and collapsing interest rates which reignited the search for yield. The majority of the 1Q19 performance came from a re-rating of REIT yields by about 0.5%, with almost half of that re-rating coming from the premium investors were willing to pay for income as the search for yield intensified. Our expectation is that, as fear subsides and central banks stave off any chance of an imminent recession in DMs, half of the incremental premium investors have recently been willing to pay for yield will disappear and bond yields will move back towards the levels they were at around the beginning of this year. That should be enough to unwind about 70% of the re-rating we’ve seen YTD. We think earnings growth should still be around 5% in aggregate and, with an average dividend yield of around 4.1%, that should leave investors in global property with a total return in US dollar terms of -0.4% over the next twelve months.

The re-rating in yields disproportionately favours low-yielding REITs (sectors such as residential, office and industrial), relative to the higher yielders like retail and healthcare REITs and, as such, we expect the de-rating to have the biggest impact on those high-yielding sectors too. Under this scenario, we think that healthcare and retail REITs could deliver positive total returns in US dollar terms over the next twelve months, with the caveat being that retail REITs are still digesting structural changes in shopping habits and oversupply issues, particularly in the UK.