While the US stock market adage “sell in May and go away” might have been correct in the past, last month proved to be the exception. After hitting a bump in April, following five consecutive months of gains, most major global markets recorded a strong performance in May (MSCI World +4.5% MoM/+9.8% YTD). Gains were driven by buoyant global equity markets as US April inflation advanced less than expected, suggesting that inflation has resumed its downward trend at the start of 2Q24. This boosted financial market expectations for a September interest rate cut. Hopes that the US Federal Reserve (Fed) will start easing rates this year were further buoyed by data showing retail sales were unexpectedly flat in April, suggesting that US domestic demand was cooling, which will be welcomed by Fed officials as they attempt to engineer a “soft-landing” for the world’s biggest economy. US consumer confidence also improved unexpectedly in May following three consecutive monthly declines.

Despite a tough last week of May, the major US indices recorded strong gains last month. MoM, the Dow Jones rose 2.3% (its strongest monthly performance since December 2023), closing the month at 38,686.32 after earlier in May, ending above the 40,000 level for the first time. The S&P 500 gained 4.8%, its best month since February, while the tech-heavy Nasdaq climbed 6.9% MoM, erasing its April losses. The Nasdaq had gained over 11% for the month through 27 May on the back of continued optimism over AI stocks, even reaching an all-time closing high of 16,920.79 on 29 May, but by last week, the index was weighed down as Nvidia and other mega-cap tech counters recorded declines. Despite this, Nvidia was still up c. 27% MoM on the back of impressive results. YTD, the Dow, S&P 500, and the Nasdaq are up 2.6%, 10.6% and 11.5%, respectively.

In US economic data, April headline inflation, as measured by the Consumer Price Index (CPI), rose a less-than-expected 3.4% YoY vs March’s 3.5% YoY print. April core CPI, excluding the erratic food and energy components, advanced by 3.6% YoY vs March’s 3.8% YoY print. MoM, headline and core inflation were 0.3% higher – down from March’s 0.4% rise. April US retail sales rose 0.7% MoM (above market expectations of a 0.4% increase) compared to March’s downwardly revised 0.6% MoM gain. April’s core personal consumption expenditure (PCE), excluding food and energy, a key Fed inflation barometer, increased 2.8% YoY – unchanged from March and broadly in line with expectations. MoM, it rose by 0.2%.

In Europe, major equity markets closed higher in May. MoM, Germany’s DAX rose 3.2% (+10.4% YTD), while France’s CAC closed 0.1% higher (+6.0% YTD). In economic data, April euro area inflation at 2.4% was unchanged from March, while EU annual inflation came in at 2.6% in April, also unchanged from March. Germany’s April inflation rate was unchanged at 2.2% YoY vs March’s revised reading of 2.2%, while France’s April inflation slowed to 2.2% YoY vs March’s 2.3% revised print. Meanwhile, the 1Q24 euro area and EU GDP grew by 0.3% QoQ. In the prior quarter (4Q23), GDP growth had declined 0.1% in the euro area and remained stable in the EU.

The UK stock market also posted another positive performance in May, with the blue-chip FTSE-100 Index rising by 1.6% MoM (+7.0% YTD). The index had closed at an all-time high of 8,445.8 in mid-May but retreated to end the month at 8,275.38. April UK inflation fell to 2.3% YoY vs March’s 3.2% YoY print. However, it remains above the Bank of England’s (BoE) 2% target. April core inflation (excluding energy, food, alcohol, and tobacco) dipped to 3.9% in April from 4.2% in March.

In May, China unveiled stimulus measures to stabilise its beleaguered property market. These measures, however, seem to have fallen short of what is required for a sustainable recovery as China’s equity markets ended mixed with property counters declining while semiconductor stocks rose. After a strong performance in April, China’s equity markets disappointed, with the Shanghai Composite ending May 0.6% lower MoM (+3.8% YTD). However, Hong Kong’s Hang Seng rose by 1.8% MoM (+6.1% YTD). Following two consecutive months of expansion, China’s official May Manufacturing PMI printed at 49.5 vs 50.4 in April as the country’s protracted property crisis continued to weigh on businesses and consumers. The official non-manufacturing PMI, measuring business sentiment in the services and construction sectors, expanded to 51.1, weaker than April’s 51.2 print. The 50-point mark separates expansion from contraction.

Japan’s benchmark, Nikkei, ended May 0.2% higher, and the index is up 15.0% YTD. Japan’s April headline CPI slowed to 2.5% YoY vs March’s 2.7% print, while CPI was unchanged MoM at 0.2%. Japan’s inflation rate is moving closer towards the Bank of Japan’s target rate of 2%. Core inflation, excluding food prices, rose 2.2% in April compared to March’s 2.6% YoY print.

Commodity prices have increased this year due to supply constraints and surging demand. A relatively broad-based rise in industrial metals has seen the prices of gold, copper, nickel, silver, tin, and zinc soar. Although the gold price fell sharply to c. US$2,340 on 29 May, it was still up 1.8% MoM (its fourth consecutive monthly gain) and has advanced by 12.8% YTD. After four months of gains, Brent crude fell 7.1% in May (+5.9% YTD). The Organisation of Petroleum Exporting Countries (OPEC+) and its partners met on 2 June and agreed to extend its official crude output cuts into 2025. Platinum jumped 10.7% MoM (+4.7% YTD), driven by supply shortages, but palladium declined by 4.1% (-16.7% YTD). According to Johnson Matthey’s latest 2024 platinum group metals (PGM) report, released in May, platinum is expected to face its largest supply shortfall in ten years, while the publication also expects other PGMs to remain in a deficit this year. Platinum, palladium, and rhodium are used in autocatalysts to reduce emissions from car engines, and platinum is also used in other industries, including jewellery and investment. Iron ore prices slipped (-0.6% MoM), undermined by fears of falling demand in China (a top consumer), which reiterated its stance on continuing to control crude steel output this year.

In South Africa (SA), the JSE continued its March and April momentum for most of May but came under significant pressure on Thursday and Friday (30 and 31 May) following the initial National and Provincial Elections (NPEs) results. Investor concerns around the ruling ANC losing its majority and going into a coalition government with far-left populist parties such as the EFF and M.K. (that have threatened to nationalise banks and mines) weighed on the local bourse. It also saw the rand dropping to a one-month low before closing May 0.1% in the red against the US dollar (YTD -2.3%).

MoM, the FTSE JSE All Share Index still managed to eke out a marginal gain of 0.8% (-0.2% YTD), while the FTSE JSE Capped SWIX gained 0.9% MoM (+1.5% YTD). So-called SA Inc. stocks (those with earnings linked to the local economy), such as banks, insurers, and retailers, were the worst hit as the NPE results showed that the ANC would lose its majority by a bigger margin than anticipated. Industrial counters, as measured by the Indi-25, rose 1.7% (+2.9% YTD), buoyed by the performances of rand-hedges such as Richemont (+12.7% MoM), Prosus (+5.8% MoM), Naspers (+3.4% MoM) etc. Resources counters (Resi-10 +0.1% MoM/+6.6% YTD) also advanced, especially gold and platinum shares. The SA Listed Property Index disappointed, ending May 0.4% lower (+1.1% YTD), while the Fini-15 also lost ground – down 0.7% MoM (-7.8% YTD). Highlighting the May share price performances of the biggest JSE-listed shares by market cap, BHP Group rose 5.1% MoM while the second and third-biggest shares – Anheuser-Busch InBev and Richemont were up 2.9% and 12.7% MoM, respectively.

In economic data, SA’s April headline CPI slowed to 5.2% YoY continuing March’s downward trend (5.3% YoY). MoM, April headline CPI advanced 0.3% vs 1.0% in March. Core inflation (excluding food, fuel, and electricity) dropped to 4.6% YoY from 4.9% YoY in March. This latest print means that inflation has moved closer to the 4.5% midpoint of the SA Reserve Bank’s (SARB’s) target band of 3% to 6%. SA retail trade sales beat expectations, increasing 2.3% YoY in March, following a revised contraction of 0.3% YoY in February and 2.0% in January. As expected, with the inflation outlook remaining elevated, the SARB cautiously kept the repo rate on hold at 8.25% at its third Monetary Policy Committee (MPC) meeting for this year.

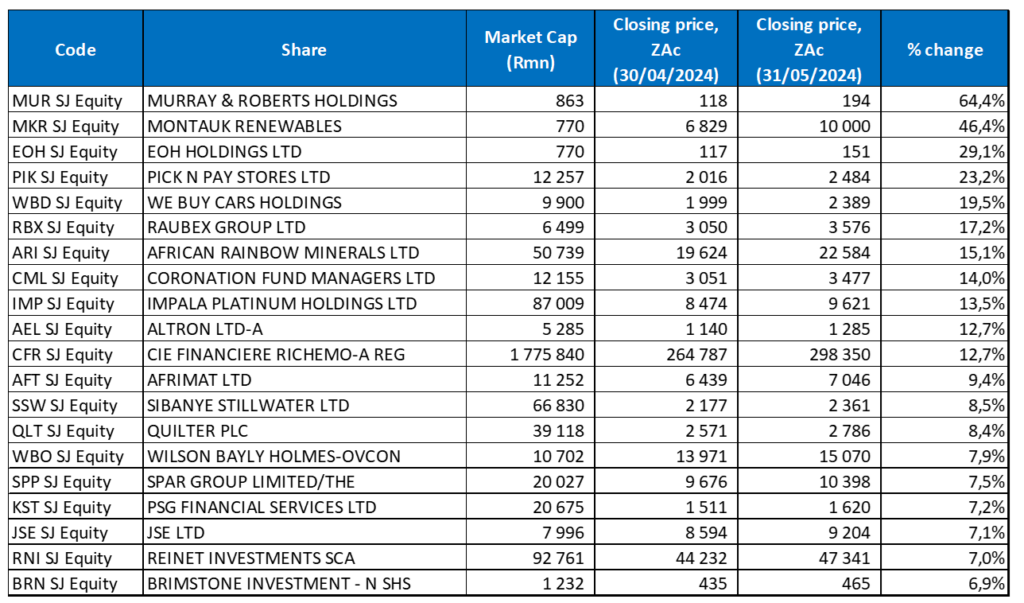

Figure 1: May 2024 20 best-performing shares, MoM % change

Source: Bloomberg, Anchor

Murray & Roberts (M&R; +64.4% MoM) was May’s best-performing share, albeit off an extremely low base (the share price was down 49.5% in 2023). At the end of April, M&R announced that its Terra Nova Technologies (TNT) division had bagged a 51% stake in a JV that has been awarded an engineering, procurement, and construction (EPC) contract with a large copper producer for a mine in South America. The total contract is valued at c. US$200mn. Earlier this year, the Group also released its 1H24 results, which showed that its mining division has new contract terms on the Venetia Diamond Mine contract, which should boost its 2H24 Africa profit. As of 1H24, M&R’s loss-making power, infrastructure, and water (PIW) division has secured two wind projects which are awaiting financial closure, while there is the potential for an improvement in its Renewable Energy Independent Power Producer Procurement (REIPPP) awards. In addition, the business’s substantial restructuring and simplification programme has resulted in a c. 35% YoY reduction in M&R’s head office costs, while its net debt has declined from c. R2bn to c. R247mn.

M&R was followed by renewable energy company Montauk Renewables Inc., listed locally and in the US. Montauk recorded a MoM share price gain of 46.4%. In its FY23 results, released last week, Montauk reported that its total operating revenues fell to US$174.9mn from US$205.6mn posted in FY22, while diluted EPS decreased by 56.0% YoY to US$0.11. Nevertheless, the company said its performance rebounded in 1Q24, and management reaffirmed their positive FY24 earnings guidance in the results call. FY24 revenue is expected to come in between US$195mn and US$215mn compared to the US$174.9mn reported in FY23.

Another share under significant pressure over the past few years, EOH Holdings, was May’s third best-performing share, recording a 29.1% MoM gain. Last month, the company released a SENS announcement, which sparked media reports that conflict might be brewing at an EOH boardroom level. EOH informed shareholders that it “has been approached by certain shareholders regarding the succession plan for the board”. It noted that “the board is engaging further with the shareholders. Pending further announcements, shareholders are advised to exercise caution when dealing in EOH securities,”. Then, this past weekend, EOH announced a shake-up in response to mounting shareholder impatience with the company’s operational and stock market underperformance. The latest strategy includes expanding its iOCO and international unit, cutting unnecessary costs and changing leadership if required.

EOH was followed by Pick n Pay (up 23.2% MoM). Shares in the local retailer rose, which is a likely sign that investors are confident in the new CEO, Sean Summers’ turnaround plan. Pick n Pay also confirmed that the founding family and controlling shareholder (Ackerman Investment Holdings) will give up their voting rights next year as part of a rights offer to raise R4bn to assist the struggling retailer. The announcement was made after the Group released weak FY24 results on 27 May, driven by a substantial trading loss at Pick n Pay, which overshadowed the strong performance of its Boxer business. Turnover rose to R112.3bn from R106.6bn posted in FY23, while its diluted loss per share stood at ZAc659.98, compared with an EPS of ZAc242.54 recorded in the previous year.

WeBuyCars, Raubex Group, and African Rainbow Minerals (ARM) followed with MoM gains of 19.5%, 17.2%, and 15.1%, respectively. WeBuyCars, which was spun out of Transaction Capital and listed in April, released its first results since the listing. The company’s core headline EPS rose 21.1% to ZAc119.9 in the six months to 31 March, while revenue increased by 15.9% to R11.4bn. Infrastructure development and construction materials company Raubex reported robust FY24 results, which showed that its revenue advanced by 13.8% YoY to R17.43bn, while headline EPS increased 21.3% YoY to ZAc476.3. Last week, ARM said it had closed an agreement to acquire a 15% stake in Surge Copper Corp. for a total amount of c. R55mn.

Coronation Fund Managers (+14.0% MoM), Impala Platinum (Implats; +13.5% MoM), and Altron Ltd. (+12.7% MoM) rounded out the ten best-performing shares for May. In its 1H24 results, released last month, Coronation reported a revenue increase of 4.3% YoY to R1.89bn, while basic and headline EPS for the period stood at ZAc200.5 vs ZAc6.2 in 1H23. In May, Implats announced it had selected Siyanda Resources and Bokamoso Consortium as black economic empowerment (BEE) partners for its Rustenburg and Bafokeng operations in an R9bn transaction that will include community and employee share-ownership schemes. Post-transaction, its BEE partners will hold a 13% stake in Implats and the Bafokeng business it acquired in 2023. Finally, tech company Altron reported FY24 results, which showed that its revenue declined 2.3% YoY to R8.3bn while it posted a diluted loss per share of ZAc42.0 vs ZAc1.0 recorded in FY23.

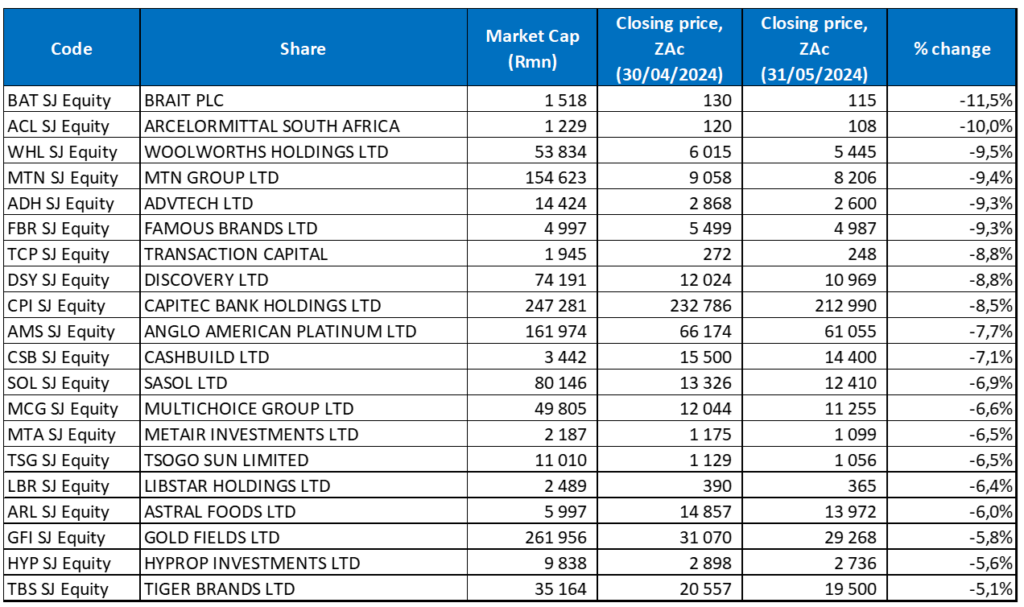

Figure 2: May 2024 20 worst-performing shares, MoM % change

Source: Bloomberg, Anchor

Investment holding company Brait Plc, which has not had a good year (its share price is down 36.8% in the year to the end of May), recorded a MoM share price drop of 11.5%, making it the worst-performing share in May. The board has approved an inter-conditional recapitalisation plan that includes a fully underwritten equity capital raise of up to R1.5bn. The plan also includes three-year extensions of the maturities of its bonds to December 2027 and the repayment or settlement adjustment to its convertible and exchangeable bonds.

ArcelorMittal SA (AMSA) was in second place, and while its share price rebounded in April (+7.14% MoM), it was down 10.0% MoM in May. In February, the company deferred the suspension of its long steel business for up to six months based on commitments made by the government and Transnet, which AMSA said had bought these operations some time. The steel maker threatened to close some of its operations due to infrastructure inefficiencies with electricity, rail, and ports. More recently, it was caught up in global strike action regarding emissions from its operations, and last month, it undertook to minimise its climate risks. However, some lobby groups have alleged that it was struggling to attain this.

May’s third worst-performer, retailer Woolworths (-9.5% MoM), dropped 7.2% on Thursday (30 May) after releasing an FY24 trading update. The update revealed that the retailer expects its EPS and HEPS to fall by over 20% YoY due, in part, to the inclusion of the David Jones business and profit on its disposal realised in its FY23 results. Woolworths will release its FY24 results on or about 4 September.

Woolworths was followed by telecoms firm MTN Group (-9.4% MoM), which dropped c. R14.9bn of its market value on 14 May after it reported a c. one-fifth drop in 1Q24 revenue as the company dealt with a mix of macroeconomic and geopolitical headwinds that negatively impacted its financial performance for the period. The Group’s service revenue fell 18.8% YoY to R42.9bn in 1Q24 as the macro environment remained challenging amid local currency devaluations in some of its key markets like Nigeria. MTN’s total subscribers increased by 1.0% YoY to 287.6mn, while active data subscribers rose 7.8% YoY to 149.2mn. Moreover, active Mobile Money (MoMo) monthly active users (MAUs) advanced 6.2% YoY to 65.5mn. Fintech transaction volumes increased by 18.3% to 4.8bn and transaction value rose by 11.2% to US$72.3bn. MTN also revised its expected capex (ex-leases) deployment for 2024 to R28bn-R33bn due to a decline in MTN Nigeria’s expected spending.

Private school operator ADvTECH and restaurant Group Famous Brands (both down 9.3% MoM) followed. Famous Brands reported weaker annual results for the year ended 29 February 2024. The results showed that its revenue rose 8% YoY to R8.0bn, while its headline HEPS was down 5.0% YoY to ZAc465. Famous Brands owns well-known local quick-service restaurants such as Wimpy, Steers, Debonairs, and Fishaways. The company also said it sought to divest from its non-core assets as weaker consumer spending dampened demand. The Group said its results were negatively affected by lost revenue due to increased at-home dining during the Rugby World Cup and a poor peak tourism season for KwaZulu-Natal. It noted other adverse effects were deteriorating infrastructure, including port delays, water outages, and higher insurance, food and fuel costs.

Investment holding company Transaction Capital (-8.8% MoM) reported poor interim results for the six months ended 31 March 2024. Its revenue declined to R981.0mn from R1,295.0mn posted in 1H23, while its diluted loss per share stood at ZAc178.3.

Discovery, Capitec Bank, and Anglo American Platinum (Amplats) rounded out May’s worst-performing shares with MoM share price losses of 8.8%, 8.5%, and 7.7%. Discovery’s share price dropped c. 7% on 14 May after President Cyril Ramaphosa said he planned to sign the National Health Insurance (NHI) Bill into law on 15 May. The share price has since recovered slightly, although it still ended down in May. Meanwhile, Capitec Bank, along with SA’s other banking counters, were pulled down on Thursday (30 May) by investor concerns around which parties the ANC would choose as its coalition partners, with a worst-case scenario for the financial services sector being the ANC teaming up with populist, far-left parties such as the EFF and M.K. to form a government. MoM, banks such as ABSA and Standard Bank managed to post gains, but Nedbank and FirstRand ended May with minor MoM losses, while Capitec was the worst performer among the banks in May, following its standout performer in April (+11.1% MoM) when it released strong FY24 results.

Figure 3: Top-20 best-performing shares, YTD

Source: Anchor, Bloomberg

YTD, the best-performing shares featured twelve of the year-to-end April’s best performers, with eight shares entering the best performers club in May – M&R, Raubex, Richemont, Wilson Bayly Holmes Ovcon, Quilter, Aspen, Barloworld, and Reunert.

Mid-tier gold producer Pan African Resources bumped Multichoice (+38.9% YTD) from the top spot with a 46.9% YTD gain after its share price rose a further 5.3% in May on the back of a record recent gold price and solid production numbers. Last month, the miner said it expects to achieve the upper end of its production guidance despite ending some of its Evander gold mine operations. In its revised FY24 production update, Pan African Resources narrowed its production guidance to between 186,000oz to 190,000oz, while its all-in sustaining costs (AISC) guidance was maintained at between US$1,325/oz to US$1,350/oz.

Another gold miner, Harmony (+42.9% YTD), came in second place. Both shares also tracked the gold price, which has hit record highs this year. A stronger gold price (+12.8% YTD in US dollar terms) and a weaker rand (-2.3% YTD) significantly enhance the gold companies’ bottom lines.

Multichoice was in third spot – gaining 38.9% YTD. In February, French broadcaster Canal+, which at that stage owned a 35.01% stake in Multichoice, submitted a non-binding offer (a cash consideration of R105/share) to acquire all of MultiChoice’s issued ordinary shares that it does not already own (subject to obtaining the necessary regulatory approvals). However, MultiChoice rebuffed the offer as undervaluing the business before asking Canal+ to sweeten the deal. Canal+ then raised its offer to R125/share on 5 March, valuing the deal at c. R35bn. Canal+ has continued buying Multichoice shares, increasing to the 50% mark. It announced three transactions in May, increasing its stake in Multichoice to 45.2% from 40.8% in April. The current Canal+ offer at R125/share is with the MultiChoice board and is awaiting approval.

Multichoice was followed by M&R and Raubex (both discussed earlier) after their strong May performances, which brought their YTD gains to 30.2% and 29.0%, respectively.

AngloGold Ashanti (+26.6% YTD) followed Raubex with Anglo American and Altron (both up 25.4% YTD) in seventh and eighth places. Last month, AngloGold reported an increase in 1Q24 gold production, with its full-year production also expected to rise. The gold miner realised a 2% YoY gold production increase to 581,000oz, driven mainly by higher recovered grades, partly offset by lower tonnes processed. Anglo American’s rejection of BHP’s offer and request to extend the 29 May deadline saw its share price retreat 3.8% MoM, although the counter has remained among the top performers YTD. BHP has indicated that it will not make a hostile bid for Anglo, so this will likely end its pursuit of Anglo.

Paper company Sappi Ltd and Prosus rounded out the top ten YTD performers, with gains of 21.1% and 20.4%, respectively. In its 2Q24 results, Sappi indicated that its sales fell to US$1.35bn from US$1.44bn posted in 2Q23, while its diluted EPS dropped 58.3% YoY to USc5.0. Still, its operating performance was slightly ahead of expectations, with EPS excluding special items 9% higher YoY, while earnings before interest, taxes, depreciation, and amortisation (EBITDA) excluding special items for the March quarter was up 10% at US$183mn. This was due to an improved pulp segment and significant cost savings, including a 9% YoY decline in cash fixed costs following the closure of its Stockstadt and Lanaken mills in Europe.

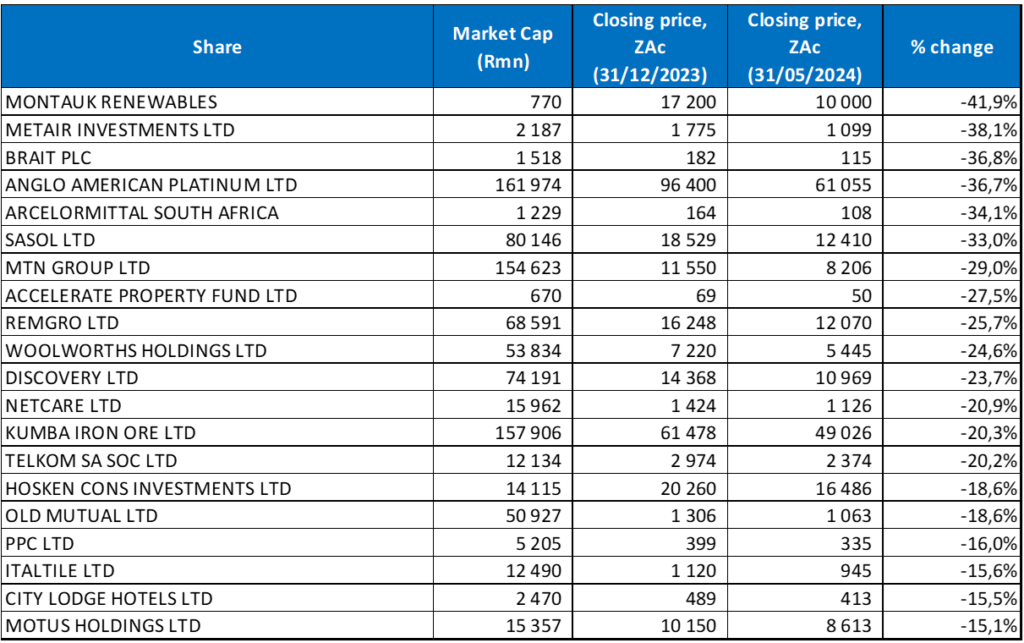

Figure 4: Bottom-20 worst-performing shares, YTD

Source: Anchor, Bloomberg

YTD, there was also an overlap between the April worst-performing shares and the worst-performers to the end of May, with fifteen shares remaining and five new entrants to the worst-performers grouping, including Montauk, Hosken Consolidated Investments, Old Mutual, Italtile, and City Lodge Hotels. Montauk (discussed earlier) was the worst performer YTD, declining 41.9%. It was followed by battery and vehicle component manufacturer Metair Investments (-38.1% YTD), which recorded another poor share price performance in May – it fell by a further 6.5% MoM. Investment holding company Brait Plc came in third. Brait was also May’s worst-performing share, with an 11.5% MoM drop in its share price.

Brait was followed by Amplats, AMSA, Sasol, and MTN Group, which recorded YTD declines of 36.7%, 34.1%, 33.0%, and 29.0%, respectively. In May, Anglo American announced a radical restructure: It will unbundle its 79%-owned Amplats and sell or demerge diamond miner De Beers. In a statement, the Anglo CEO said, “We expect that a radically simpler business will deliver sustainable incremental value creation through a step change in operational performance and cost reduction.”

Accelerate Property Fund (-27.5% YTD), Remgro (-25.7% YTD), and Woolworths (-24.6% YTD) rounded out the worst-performing shares YTD.