Anchor’s unique approach to wealth and portfolio management, our seamless integration of services, and our focus on client service make us the standout choice for high-net-worth individuals (HNWI) and experienced investors.

At Anchor Private Clients, our culture revolves around client service. Our clients are not just a priority; they are our number one priority. This client-centric approach is embedded in the design and structure of our business, our internal processes, and our use of technology. Our wealth and portfolio managers embody this commitment, taking pride in delivering exceptional service and building trusted, long-lasting relationships with our valued clients. We view client relationships as long-term partnerships, a testament to the value we place on every client.

The seamless and efficient integration of wealth and portfolio management is another standout feature of Anchor Private Clients. We operate in a highly regulated industry with multiple regulators and regulations that individually govern the various components of wealth and investment management processes, and this can often fragment or create a silo approach.

Anchor Private Clients stands out in the industry with its comprehensive service offerings. While successful asset allocation and top-performing investment performance are crucial, they are only part of the equation for successful client outcomes. Investing in the appropriate tailored structures and tax-efficient solutions can often have just as significant an impact on client outcomes. The Anchor approach delivers value to our clients by bringing diverse capabilities and offerings to them from within the broader Anchor Group, such as AG Capital, Credo, Wild Dog Capital and Robert Cowen Investments, amongst others. Anchor’s merger with UK wealth and asset manager Credo provides our clients with a powerful UK investment platform. We also have “open source” partnerships with key local and global players, such as Allan Grey, Momentum Wealth, Glacier by Sanlam and Old Mutual International. The breadth and depth of this available ‘toolbox’ result in a best-of-breed approach, ensuring that we can meet all your financial needs.

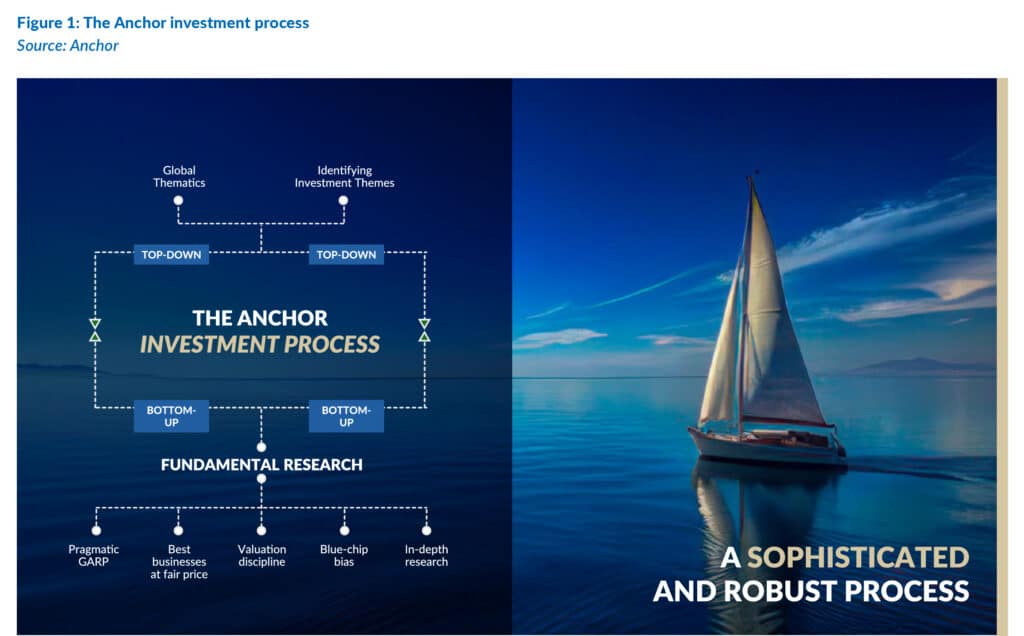

At Anchor Private Clients, our investment engine is powered by a highly experienced and talented team of over 30 investment professionals. With a strong and credible track record, including multiple Raging Bull awards in recent years, the team covers both domestic and global investment processes across a broad spectrum of asset classes. In 2024, the team secured two of South Africa’s top 10 performing funds out of 1,856 funds, a testament to their expertise. Anchor is a pragmatic growth at a reasonable price (GARP) equity manager, reflecting our preference for quality growth companies without overpaying and a practical consideration of value. The blending of both top-down and bottom-up approaches enables consistency and reliability of investment performance.

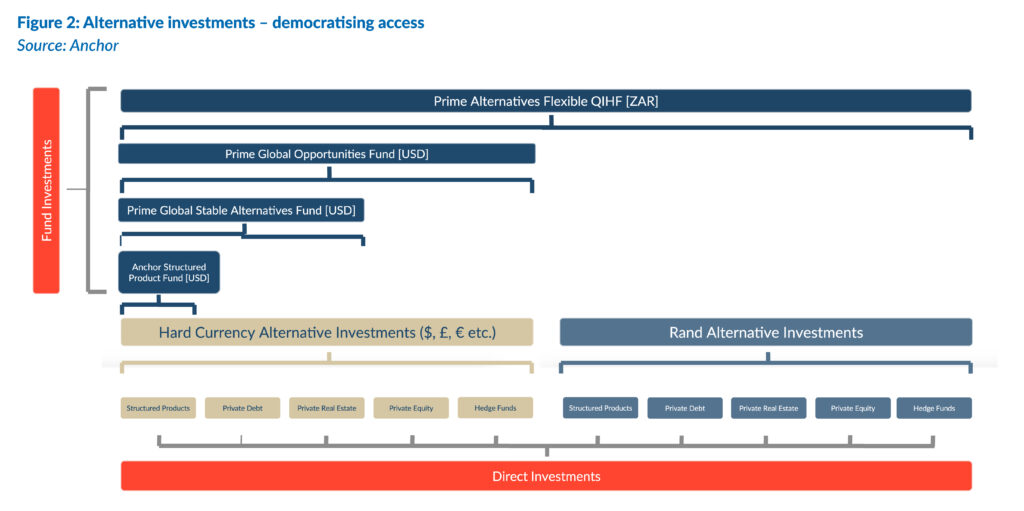

Alternative investments are a key focus area at Anchor Private Clients, with a strong competitive advantage in both its capability and offering. Alternative investments are generally defined as investments that fall outside the traditional categories of equities, bonds, and cash. This broad category includes a wide range of assets, each with its own strategy, risk profile, and return potential.

The growth of alternative investments is significant for investing in 2025 and beyond. Alternative investments are becoming an increasingly important component of their wealth for experienced investors and HNWIs, particularly in sectors such as private equity, hedge funds, private debt, real estate and structured products. According to PwC, global assets under management (AuM) are expected to top US$145.4trn in 2025, nearly double the US$84.9trn in 2016. The same research forecasts that alternative investments will reach US$21.1trn by 2025, representing 15% of all AuM. The value proposition is simply access to markets that have, until relatively recently, not been available to most investors. These alternative investments offer enhanced risk-reward metrics while diversifying the correlation and hence behaviour of the portfolio relative to traditional major equity indices such as the S&P 500.

Anchor Private Clients offers a comprehensive range of alternative investments, including private equity, hedge funds, private debt, real estate, and structured products. It is important to note that each investor’s needs are unique, and our wealth managers are here to provide individual advice on which of these solutions are appropriate for your investment portfolio.

“Financial planning matters at every stage of life and level of wealth. Our research confirms that a professionally created plan offers a roadmap to achieve financial goals—but perhaps the most compelling insight for us in this data is the positive impact it can also have on one’s life and sense of wellbeing.” – Anthea Tjuanakis Cox, Head of Financial Planning at Morgan Stanley

Effective financial planning not only safeguards and grows wealth but also fosters peace of mind, confidence, and an enhanced sense of well-being. A recent study by Morgan Stanley Wealth Management found that having a financial plan in place results in greater confidence and satisfaction amongst HNWIs, who describe their financial outlook as ‘prepared’ and ‘hopeful’. Notably, 74% of respondents believe that working with a professional advisor is essential, underscoring the strong recognition of the value that expert guidance brings to the financial planning process. With Anchor’s client-centric approach and expertise, we set ourselves apart in delivering exceptional outcomes for our clients.