In this note, we delve into the 1H25 and 2Q25 performance of the Anchor BCI Worldwide Flexible Fund. The Fund aims to deliver moderate to high long-term total returns through a flexible, rand-denominated portfolio that invests across global and local asset classes—including equities, bonds, property, and cash. Its core philosophy focuses on undervalued companies with durable competitive advantages, strong returns on capital, and skilled management. The fund can also invest in listed/unlisted financial instruments and use derivatives for efficient management.

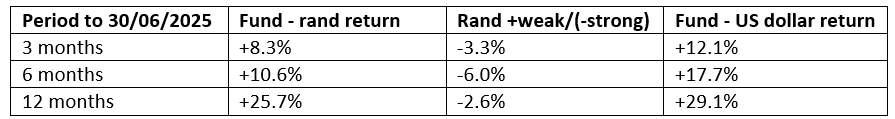

The Fund carries more equity exposure and volatility than a medium-risk fund, but less than a high-risk one. Investors should expect moderate currency, equity, interest rate, and default risks due to global exposure. The Fund is best suited for medium to long-term investors seeking diversified global growth potential. Our investment strategy is to identify undervalued companies with strong fundamentals and growth potential, and to manage risk through a diversified portfolio. The fund has demonstrated strong performance, outperforming the S&P 500 and the FTSE All-World indices. Over the three (2Q25) and six months (1H25) to June 2025, the fund’s returns were 8.3% and 10.6% in rand, and 12.1% and 17.7% in US dollar terms, respectively, surpassing the benchmark indices.

Fund Manager quarterly commentary

The Anchor BCI Worldwide Flexible Fund achieved a 25.7% return over the past 12 months (to end June 2025) and an annualised return of 12.6% since its inception in mid-May 2013. This compares with the benchmark South Africa (SA) CPI +4% returns over the same periods of 6.8% and 8.9%, respectively. The fund’s performance over the past 12 months can also be compared against the S&P 500 and the FTSE All World indices, which were up 11.9% and 13.7% YoY, respectively, in rand terms.

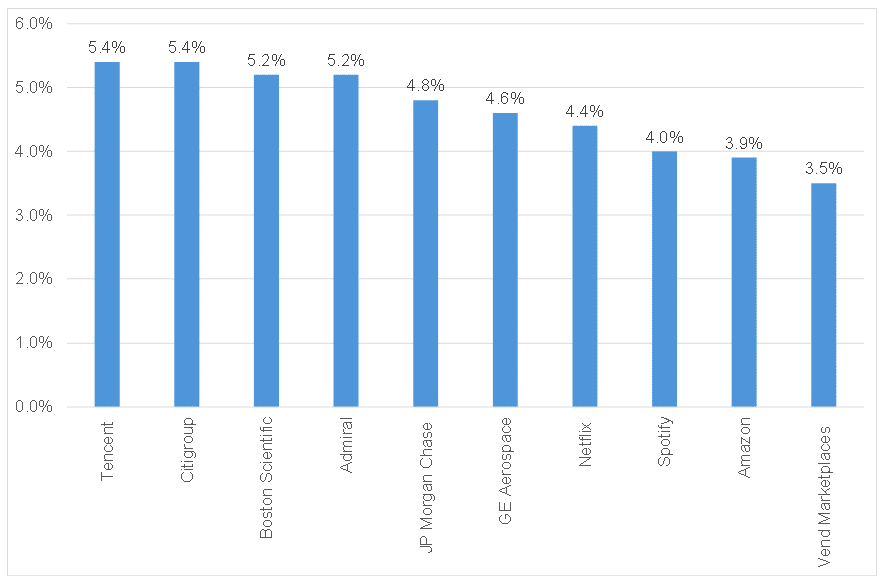

We were buyers of shares in 2Q25, with the major purchases being Constellation Brands and Nike. We also added to our existing stakes in Citigroup and Ulta Beauty. The Fund’s equity content increased from 68.7% at the end of March 2025 (1Q25) to 72.6% at the end of June 2025 (2Q25). The remainder of the fund was primarily invested in rand, along with euro and US dollar money market instruments. Rand hedges decreased (i.e., long rand/short US dollar) to 3.9% of the fund on 30 June 2025 from 11.5% at the end of 1Q25. If you combine these hedges with local cash and minor equity holdings, 16.7% of the portfolio was directly exposed to the local currency at the end of 2Q25. For now, we still prefer to invest any surplus funds into rand, euro and US dollar short-dated instruments. We think of this surplus as ‘future returns in store’. We remain bullish on the long-term outlook for the underlying investments in the fund.

Market commentary

The first half of 2025 was a strange period for global markets. While the S&P 500 and Nasdaq Composite indices closed at record levels, fixed income investors exited US long-term bond funds at the fastest rate since the COVID-19 crisis. Gold futures had the strongest start to a year since 1979, and the US dollar had the weakest start to the year since 1973. These are not the hallmarks of a traditional bull market in assets. If anything, 1H25 pointed to a frayed and fragile environment for investors dominated by uncertainty around tariffs and concerns over rising government borrowings.

This volatile environment did enable us to invest in the two aforementioned US-listed consumer companies (Constellation Brands and Nike). Although we still find overall equity markets to be somewhat expensive, these investments were modestly priced and have the durable qualities that we prize.

Despite the volatile market conditions, the fund performed admirably in 1H25, returning 10.6% in rand terms. This outperformed the S&P 500 and FTSE All World indices, which yielded -0.4% and 3.7%, respectively, in 1H25. The top performers for the fund included Spotify, GE Aerospace, Netflix and Admiral. The weakest performers were Yum China and Amazon.

Currency movements impacted the fund’s 1H25 performance as the rand strengthened by 6.0% vs a weakening US dollar. The table below should help investors understand the fund’s performance in US dollar and rand terms for the past three, six and twelve months.

Figure 1: Anchor BCI Worldwide Flexible Fund performance summary*

Source: Anchor

Figure 2: Anchor BCI Worldwide Flexible Fund’s top-ten equity holdings on 30 June 2025

Source: Anchor

Please contact Anchor with any questions you have regarding alternative investments.

Note: Past performance is not necessarily an indication of future performance. Returns provided are provisional and may be subject to change. Consult the Minimum Disclosure Document for full disclosure on fees, performance, etc. This is available at www.anchorcapital.co.za.