In this note, we discuss the bullish and bearish arguments around the artificial intelligence (AI) “bubble” from the perspective of the builders and the nerds. The Anchor Global Equity Fund is designed for investors with a vision for the future, seeking long-term capital growth through a concentrated portfolio of high-quality, attractively valued companies across developed and emerging markets.

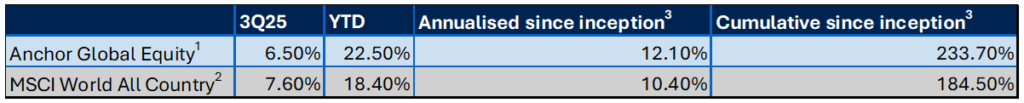

Figure 1: Anchor Global Equity Fund A Class performance summary*

Source: Anchor

Data as at 30 September 2025. Note: Investment performance is for illustrative purposes only.

1. Net of all fees & expenses; 2. All Country World Index. Includes reinvested dividends. All in US dollars. 3. 13 March 2015.

What the nerds are missing about AI

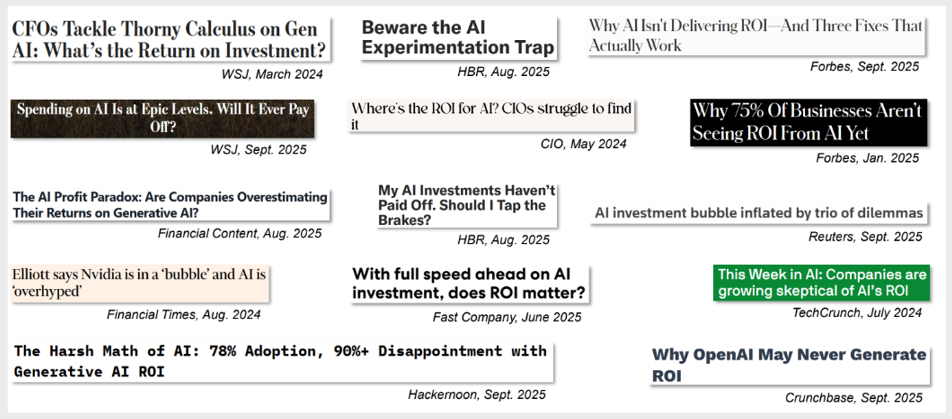

Every day, I come across an article talking about the AI bubble. It is not so much a debate as a statement of fact.

The investment firm Coatue provided a snapshot of this consensus view in their excellent presentation (see Coatue presentation).

Figure 2: If you read the news, AI is in a bubble!

Source: COATUE

Note that the above is for illustrative purposes only and is not representative of all news sources and is not intended to be an exhaustive list of headlines.

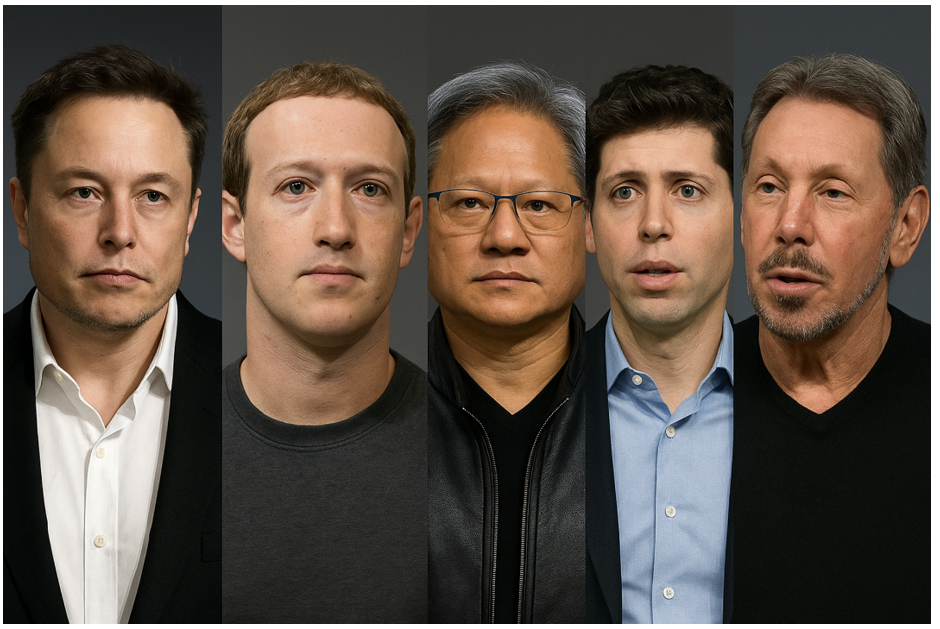

The bullish side of the argument is driven by the builders, including Elon Musk (Tesla), Mark Zuckerberg (Meta), Jensen Huang (Nvidia), Sam Altman (OpenAI – the company behind ChatGPT) and Larry Ellison (Oracle). These builders are among the greatest value creators in history. The image below was, unironically, created by ChatGPT.

Collectively, the builders are spending hundreds of billions of dollars on data centre infrastructure, like the OpenAI/Oracle Stargate project in Abilene, Texas, pictured below. The site is the size of 600 football fields, with 500,000 Nvidia graphics processing units (GPUs) and 1.2bn watts of capacity. If we think of this facility as an ‘intelligence factory’, and the human brain runs on 20 watts, then you might say that Oracle is creating the equivalent of 60mn human brains!

The Stargate project is slated to have four additional locations, and all the major hyperscalers (Microsoft, Amazon, Meta and Alphabet) have their own projects under construction. That is before you get to enterprise and sovereign projects. The size and scope of the AI buildout are beyond comprehension.

Figure 3: The OpenAI/Oracle Stargate project in Abilene, Texas

Source: OpenAI

The bearish side of the debate is dominated by the media and people like me…nerds. Fund managers are not builders (spreadsheets do not count!) – we are observers and, all too often, scoffers. I am a qualified chartered accountant and a CFA charterholder. I build 1,000-line spreadsheets, and I play chess. I have outstanding nerd credentials.

But I am going to break ranks with the nerds; I think the builders are right and the nerds are wrong on AI.

For as long as I have been involved in markets, the nerds have missed the big ideas.

There has always been a long list of objections:

- “Too expensive”

- “They don’t make any money”

- “Too much debt”

- “The founder is reckless”

- “Competition is going to kill them”

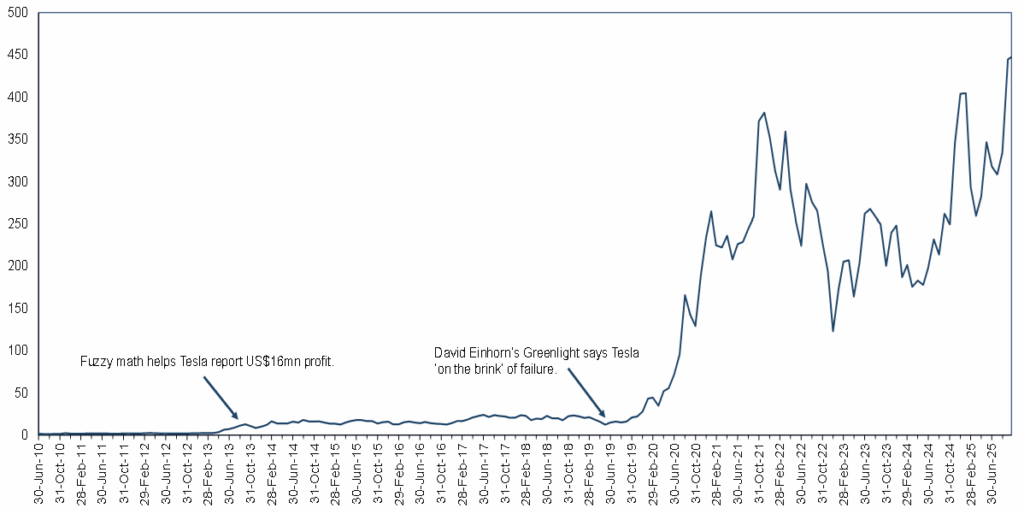

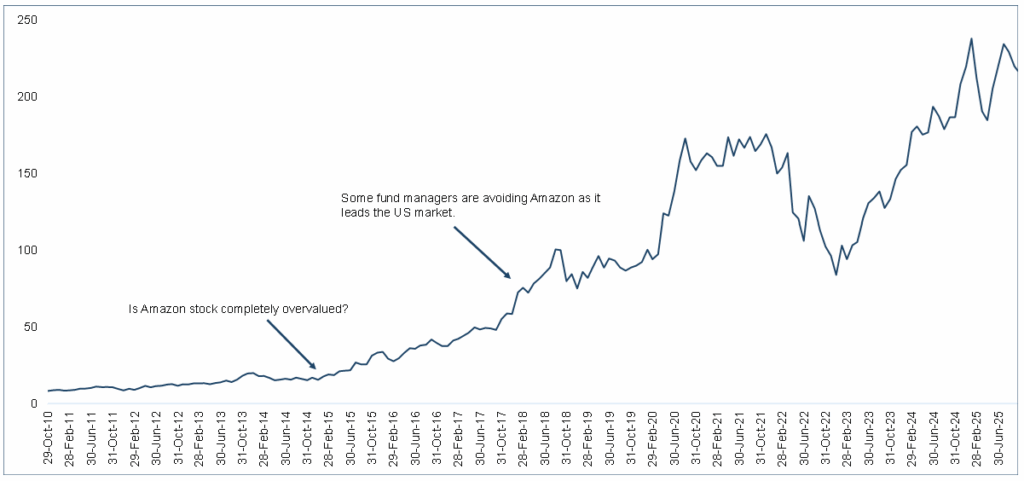

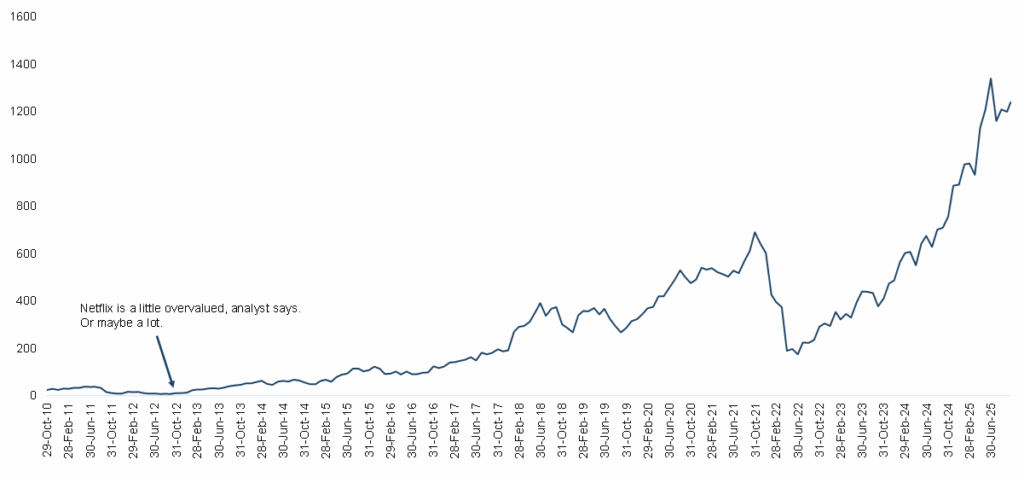

Consider the share price charts of Tesla, Amazon and Netflix below, with examples of negative media headlines before their share prices rose hundreds or thousands of percent.

The nerds are (almost) always wrong on the biggest ideas.

Figure 4: Tesla share price, US$

Source: Bloomberg, Anchor

Figure 5: Amazon share price, US$

Source: Bloomberg, Anchor

Figure 6: Netflix share price, US$

Source: Bloomberg, Anchor

The nerds are smart. Very smart. But I believe they miss the point for three reasons.

First, they are too logical, and they always have to appear measured and serious. As a result, they lack imagination about what is possible. Amazon was just a bookstore, and Netflix was just a DVD rental company. Even venture capitalists who are wired to think big can dramatically underestimate the upside. In a 2010 investment memo, Bessemer Venture Partners outlined their most bullish scenario for an investment in Shopify – they believed there was a 3% chance it would reach a US$400mn market capitalisation by 2016 (vs US$30mn at the time of investing). Incredibly, by the end of 2016, Shopify had a market cap of US$3.8bn – almost 10 times their most optimistic guess! The story gets even more interesting: at the time of writing, Shopify had a market cap of over US$220bn – that is 550 times their wildest bull case! The nerds tend to over-emphasise numbers and under-emphasise people – particularly builders, like Shopify founder Tobi Lutke.

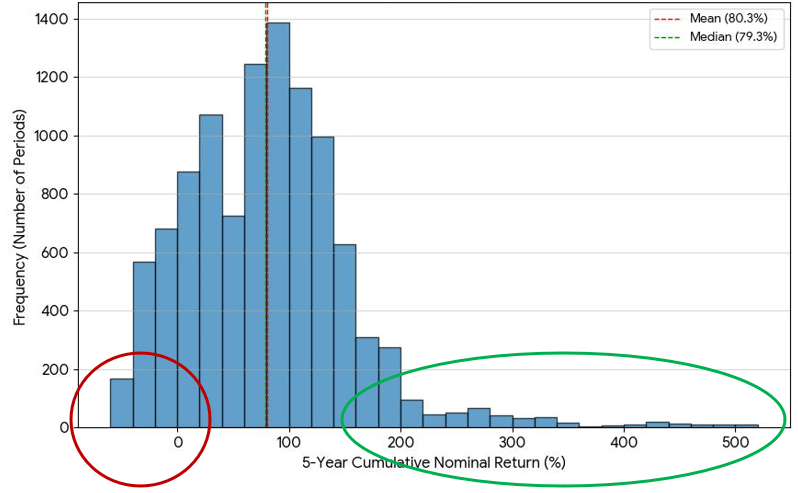

Second, and related to the first point, the nerds tend to have a negative bias. It may be industry dogma or possibly a consequence of suffering through multiple bear markets over the past two decades. Nobody wants to be the sucker who bought at the top, and everyone is constantly waiting for the next shoe to drop. Regardless, this logic is at odds with market history. The chart below (once again thanks to ChatGPT and Gemini) shows the historical distribution of rolling 5-year returns for the Nasdaq (widely considered to be a ‘risky’ index filled with technology companies). Most investors spend the bulk of their time worrying about the possibility of negative returns (red circle) and almost no time thinking about the much more likely scenario of positive returns, and the possibility of extremely high returns (green oval). I would also note that it is the builders – Tesla, Nvidia, Amazon, etc. – that create the right tail of the distribution!

Figure 7: The distribution of NASDAQ rolling five-year nominal returns

Source: Nasdaq, Federal Reserve of St Louis

Third, Oscar Wilde said it best, “A cynic is a man who knows the price of everything and the value of nothing.”

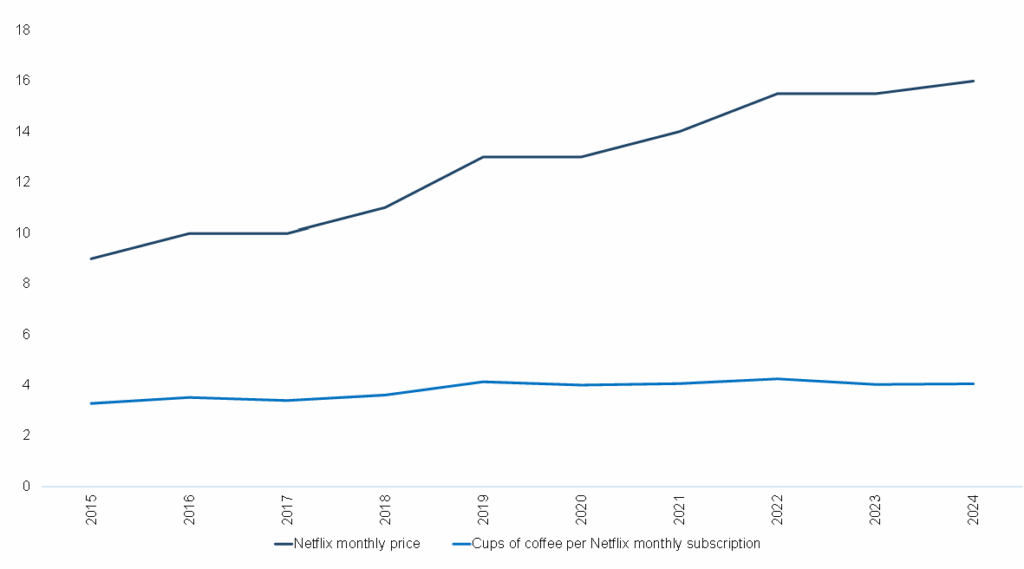

Particularly in their early years, great companies often create more value than they capture – this is called consumer surplus. Take the example of Netflix. Over the past decade, a Netflix monthly subscription was priced at the equivalent of just 4 cups of Starbucks coffee. Given that the average US subscriber spends 30 hours per month watching Netflix, they are effectively paying just US$0.50 per hour, which is ludicrously cheap.

Figure 8: How many cups of coffee does a Netflix subscription cost? US$

Source: Bloomberg, Anchor

The value to the consumer is clearly much higher than the US dollar amount that they are paying. This has driven enormous subscriber growth and given Netflix plenty of pricing power, which is arguably still untapped. Over time, Netflix has gradually captured an increasing amount of this value creation, which has filtered through into its financials and its share price. The nerds only appreciate the value after it is reflected in the financial statements.

I believe these AI investments could ultimately create the largest consumer (and enterprise) surplus in history – by orders of magnitude. That surplus is not fully reflected on financial statements yet, which the cynics scornfully point out. However, as with Netflix, the companies that create the most value will be able to capture at least part of that value.

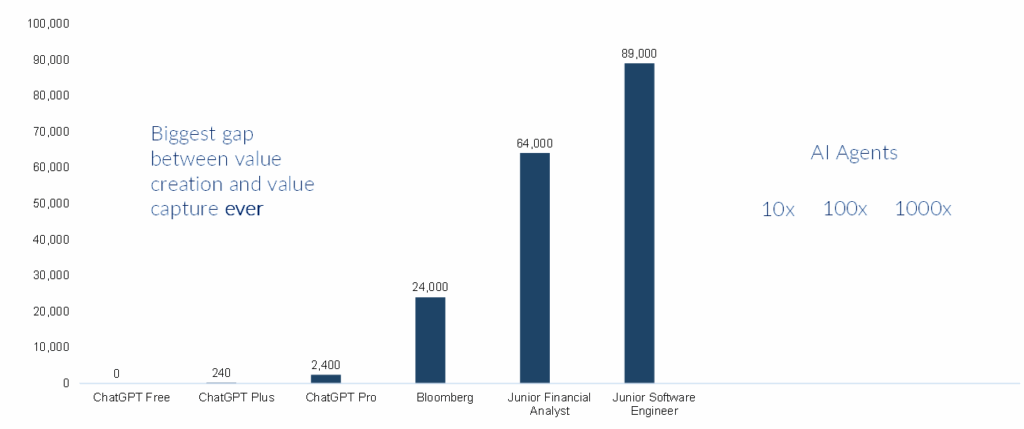

Figure 9 below illustrates the idea. On the left of the horizontal axis, you can see the annual cost of the different ChatGPT packages. I pay for a Bloomberg license, which costs about US$24,000 p.a., which, while not exactly cheap, increases my productivity enormously – it is probably as valuable as several junior financial analysts. Next, you have the annual cost of a junior financial analyst and a junior software engineer in the US. Companies are already using AI to do this work. Even ChatGPT Pro is stupendously cheap compared to these salaries – it is like a Netflix subscription costing the same as a sip of coffee!

That is before we introduce AI agents. For now, I have a one-to-one relationship with ChatGPT; I type a prompt, and it answers. But what happens when I have 10 AI agents that can act autonomously for me? What about 100? Or 1,000? If I multiply that US$89,000 figure by 1,000, that is US$89mn worth of value creation. Over time, it is logical to expect that the builders will capture some of this value surplus.

Figure 9: How much is ‘intelligence’ worth – annual cost in US dollars

Source: Bloomberg, Anchor

Could we be in a bubble? It is difficult to have one with everyone on the sidelines screaming “Bubble!” and feeling comfortable (even confident) not participating. In a real bubble, it will absolutely eat you up to see your idiot neighbour, who cannot even spell AI, get filthy rich speculating in the market. 99% of people will not be able to resist the urge to get involved. We are not even close to that scenario yet, but it is certainly possible that we get there. Regardless, we will take it one day at a time.

AI remains a generational opportunity. Despite my nerdiness, in the Anchor Global Equity Fund, we are backing the builders, not the nerds.

Please contact Anchor with any questions you have regarding the fund.

Note: Past performance is not necessarily an indication of future performance. Returns provided are provisional and may be subject to change. Consult the Minimum Disclosure Document for full disclosure on fees, performance, etc. This is available at www.anchorcapital.co.za.