In this note, we delve into the 2Q25 performance of the Anchor Global Equity Fund A Class, look at the impact of tariffs on global markets and discuss the paradox of artificial intelligence (AI). The Fund is designed for investors with a vision for the future, seeking long-term capital growth through a concentrated portfolio of high-quality, attractively valued companies across developed and emerging markets.

The fund primarily invests in equities, including preference shares and equity-like instruments, and may also gain exposure via collective investment schemes (CIS). Its high equity exposure makes it more volatile than other risk-profiled portfolios, with the potential for strong returns over time, but also a greater risk of capital loss in the short term.

Given its international focus, the fund is exposed to global risks such as currency fluctuations, political and macroeconomic uncertainty, tax and liquidity issues, and market transparency limitations. As a result, the fund is best suited for investors with a minimum five-year horizon who are comfortable with higher volatility and willing to stay invested through market cycles.

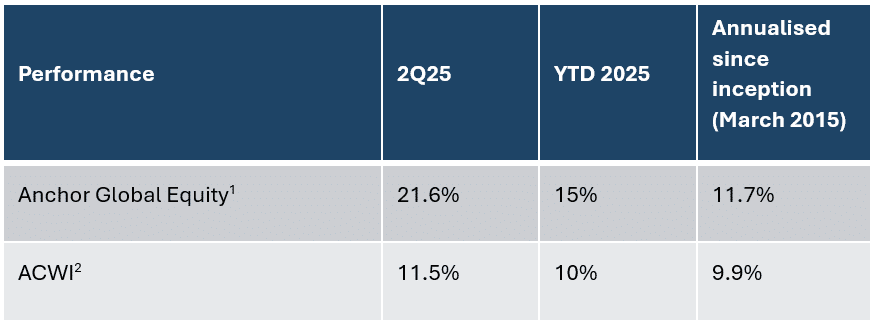

Figure 1: Anchor Global Equity Fund A Class Performance summary*

Source: Anchor

1. Net of all fees & expenses.

2. All Country World Index. Includes reinvested dividends. All in US dollars.

Tariff lessons

Barely three months have passed since the “Liberation Day” massacre (2 April 2025), when US President Donald Trump unveiled reciprocal US tariffs on the world. Reuters reported the Trump administration struggled to design reciprocal tariffs because each of the 186 members of the World Customs Organization applied different duties. Take a moment to reflect on how you felt about the world and markets then, vs how you feel today. Be honest!

It is remarkable how swiftly people transition from fear and panic to complacency and tentative bullishness, which is my current read on sentiment. While the memories are fresh, it is crucial to absorb the lessons learnt to avoid repeating the same mistakes in the future.

There are several important lessons from the last few months:

- The best times to invest will always feel like the worst times. It is not supposed to be easy!

- The specifics of the situation are less important than the repeating patterns of human behaviour.

- Every crisis is different.

- Every crisis feels like it could be “the big one”.

- Bearish pundits receive the most airtime, and they always sound smarter than the ‘naive’ bulls.

- Shares are never considered cheap enough to buy at the bottom.

- The system works. Not perfectly, not as timeously as we would like, but it works. It is in nobody’s interest for the world to end. So, it does not.

- The market bottoms and turns before the crisis is fully resolved. Global tariff rates still have not been finalised, but the S&P 500 is at all-time highs.

This reflects two truths: 1) Markets are forward-looking; and 2) markets prefer bad news that is certain vs bad news that is uncertain. The fear of the thing is worse than the thing itself.

I would estimate that less than 1% of clients capitulated at the bottom. Well done for holding firm! For those who did capitulate, I would offer counsel and encouragement. A whole cohort of investors sold at the bottom during the global financial crisis (GFC) and spent years in anguish as the market refused to pull back enough to let them back in. The past cannot be undone; do not let it stop you from participating in the hundreds and thousands of percent returns available over your investing lifetime. Get back on the horse!

It also gets easier with experience – the longer you are exposed to the market, the more you see the patterns of human behaviour repeat. Note: Easier, not easy!

The Paradox of AI

I recently came across two outstanding presentations focused predominantly on artificial intelligence (AI). The first was from tech veteran Mary Meeker (see: Trends – Artificial Intelligence), the second was from investment firm Coatue (see: Coatue – EMW 2025).

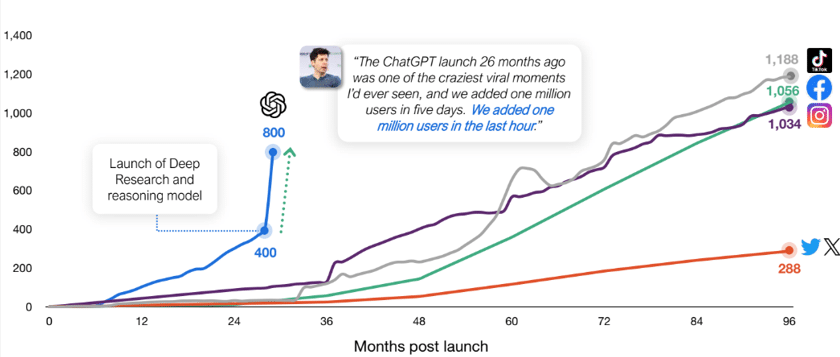

The chart in Figure 2 below from Coatue is particularly striking – there is something profoundly different about AI vs what we have seen before. AI is scaling far more rapidly than the social networks did, despite having zero network effects (i.e. people do not invite their friends and family to join ChatGPT).

Figure 2: ChatGPT is growing faster than anything we have seen before, the number of monthly active users (MAU) post-launch (mn)

Source: Coatue

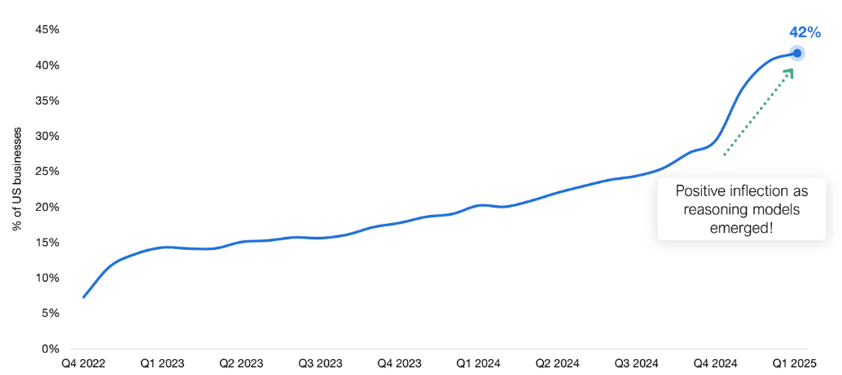

Companies have had just over two years to wrap their heads around AI. They are starting to accelerate adoption (per the Coatue chart below), which means AI’s impact on our everyday lives is only going to accelerate and deepen.

Figure 3: The inflexion is evolving beyond just consumer use cases, share of US businesses with paid subscriptions to AI (Ramp estimate)

Source: Coatue

But what does this mean for the man in the street?

I came across an article in the Australian Financial Review, which discusses a union pushing for workers to have the right to refuse the use of AI. The report captures the anxiety some might be feeling about AI.

However, in my view, the union workers’ thinking is flawed: there may be a choice, but it is a false one. AI is analogous to the productivity revolutions brought about by the steam engine, electricity, or the internal combustion engine. Imagine you meet a farmer with a 100,000-acre farm who is about to harvest his crop with a pair of hand clippers. You ask why he does not use a combine harvester, and he replies, “Nah, I’m good; that new-fangled technology stuff isn’t for me.” Clearly, that is his right and his choice, just as the Amish choose not to live a modern lifestyle. If he is a subsistence farmer, he will barely scrape by and will live a life that is essentially unchanged from hundreds of years ago. If he is a commercial farmer, he will be rapidly outcompeted and will lose his farm. Said differently: if you want to live in modern society, there is no choice; you have to use the tools of modern society.

But like the advent of electricity, I would rather frame AI in a positive light. The more you use AI, the more you realise how useful it is. AI will help people to accentuate their best qualities. The top-performing lawyers, nursery schoolteachers and therapists will be those who use AI to complement and enhance their existing strengths.

I will even go a step further: in a world of abundant intelligence and productivity, attributes that are human and things that are scarce are likely to become exponentially more valuable.

However, I have already seen instances where people are using AI as a substitute for their thoughts. Ironically, people could become dumber as they have more intelligence at their disposal. I do not want to listen to someone regurgitate a speech written by ChatGPT. If I said that this commentary had been composed by AI, I guarantee nobody would read it.

People who refuse to use the machines (AI) will face an existential threat. Equally, people who do not bring the best of themselves and their humanity to bear will be just as redundant.

This is the paradox: to survive and thrive, you will have to become outstanding at using the machines to allow your unique humanity to flourish.

Investing in the age of AI

We are entering a period of profound change. The next decade will be extraordinarily rich with multi-bagger opportunities. I suspect ‘sensible’ portfolios could deliver disappointing returns; by construction, this (almost) always has to be true, but it could be even more so over the next decade. Investors may need to take more risk than they would otherwise like. There are going to be brutal bear markets. It is not supposed to be easy!

Companies that understand the paradox and can balance the opposing ideas of abundance/intelligence and scarcity/humanity are likely to be the most successful. The same is true for investors.

Bearish pundits will continue to make the case for perpetual fear. I believe that history will repeat, and the optimists, the bulls, the bold will win the AI era. Long may the bulls prevail!

Please contact Anchor with any questions you have regarding alternative investments.

Note: Past performance is not necessarily an indication of future performance. Returns provided are provisional and may be subject to change. Consult the Minimum Disclosure Document for full disclosure on fees, performance, etc. This is available at www.anchorcapital.co.za.