As the saying goes, there are only two certainties in life: death and taxes! Unfortunately, often these two go hand in hand and most people have no idea as what to do or what is expected when a death occurs. At RCI, with 37 years of looking after families and their wealth, we have built up a fount of knowledge as to what happens when someone passes away and the process that unfolds thereafter. Below, we highlight the main points of the process, which is usually complicated and lengthy, to give the reader an idea of what is involved.

Wills

The process starts (hopefully) with the drawing up of a will. If someone dies without a will, he/ she dies intestate and this makes the process even more complicated!

So, when do you need a will? When you have assets and important people in your life. Why do you need a will? To leave your assets as you see fit to the chosen important people in your life.

When writing a will you need to consider the following: Who will inherit your estate, who will be the executor/s, will you establish a trust in your will and, if so, who are the trustees, what are your assets and do you want to leave anything in particular to one heir or a number of heirs? An individual must remember that a will can be changed at any time as you go through different circumstances and phases in your life so your first will is not necessarily set in stone.

Estates

An estate is the total of all your assets less your liabilities i.e. anything you possess in your own name less your debt or borrowings. What is not your estate? Very simply put, whatever assets you have accumulated which are NOT in your name e.g. in a Trust.

Someone dies, what happens next?

The process starts as soon as there is a death. A funeral home is called in to prepare the deceased’s body for burial or cremation and, most importantly, to obtain a death certificate from Home Affairs. The process of winding up an estate, can only start once a death certificate has been issued. In Figure 1, we show the important people involved in winding up an estate and below we highlight each person’s role in the process.

Figure 1: The people involved in winding up an estate

Source: RCI

You – This is the person responsible for making sure an estate is wound up. It is often a close family member or friend of the deceased.

The Executor is the person named in the will as being responsible for winding up the estate. An Executor has to be above 18 years of age, and You and the Executor may or may not be the same person. A professional institution such as a bank, financial advisor etc. can also be the Executor. If the deceased has nominated an individual then, upon date of death, that person may make use of a third-party to assist with the duties of an Executor of the estate.

Often the Executor appoints an Administrator, who is a professional at winding up estates. Since the process is specific and complicated it is preferable not to do it yourself.

The Administrator deals with the Master of the High Court (Master), who is pivotal in approving the winding up of the estate. An estate cannot be wound up (except for very small estates), without the Master’s consent.

As indicated by the flow of the circle in Figure 1 – You deal with the Executor, the Executor outsources the administration of winding up the estate to the Administrator, the Administrator deals with the Master, the Master reverts back to the Administrator who reports back to the Executor, who then comes back to You unless you are the Executor.

Essential documents in an estate

There are several documents required to start the process of winding up an estate as well as documents produced to finalise said estate. These documents include: A valid and original will, the death certificate and deceased’s records are supplied by You, a letter of executorship from the Master, SARS provides a tax-clearance certificate after tax returns have been submitted and the Executor lodges a Liquidation and Distribution (L&D) account, drawn up by the Administrator, with the Master.

Timeline

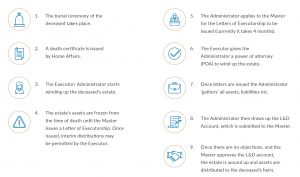

Currently, the time taken to wind up an estate in Gauteng is c. two years. In Figure 2 and below, we summarise the sequence of important events:

Figure 2: Sequence of important events

Source: RCI

Costs

There are several fees/costs to be paid by an estate:

- Executors’ fees: There is a statutory fee of 3.5% of the estate’s value charged by the Administrator.

- A final tax amount (of the deceased) has to be paid to SARS

- Estate duty: The first R3.5mn of an estate is exempt from estate duty, however, from R3.5mn to R30mn is taxed at a rate of 20%, while R30mn-plus is taxed at 25%. If a spouse inherits, no estate duty is payable until that person’s death and the R3.5mn rolls over to the surviving spouse.

What can RCI do?

- We run the process for you – this entails dealing with you, being the Executor and/ or dealing with the Executor/ Administrator and ensuring that progress is made in winding up the estate as timeously as possible.

- We also negotiate the Administrator’s fees and we try to reduce this cost.

- We create a legacy file to hold all relevant information related to the deceased’s estate.

We understand the people involved in a deceased estate and the process but, most importantly, we know how money works in winding up an estate. We have found that each person’s situation is unique, and one needs to understand how all the above applies to your individual circumstances.

In this note we have only scratched the surface of a very complex subject so we would suggest contacting RCI directly if you would like to have a conversation about any of the above-mentioned processes.