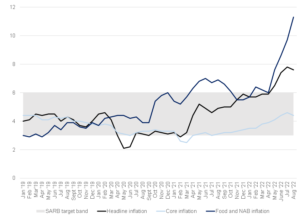

In recent months, moderation in many commodity prices (notably food and fuel prices) has boded well for the likely easing of global inflation pressures. Indeed, South Africa’s (SA’s) headline CPI inflation eased slightly from 7.8% YoY in July to 7.6% YoY in August, printing lower than market expectations. While the major driver of the lower CPI print was fuel inflation, as was broadly anticipated, August core CPI inflation also came in much softer than expected at 4.4% YoY – down from July’s 4.6%. The downside surprise in core inflation was partly owing to a modestly smaller increase in public transport costs than was initially forecast, amid the sharp mid-year increase in taxi fares (surveyed outside their regular quarterly schedule). Car prices also increased slightly less than expected.

The key upside stemmed from the food and non-alcoholic beverages inflation category, which printed at 11.3% YoY and came in above expectations. Price pressures remain relatively broad-based across the food basket, with ‘bread and cereals’ inflation rising sharply to 17.8% in August from 13.7% in July, accounting for most of the rise in food inflation. Overall, the outlook for SA food price inflation remains highly uncertain. Global food prices have eased in recent months, with the UN Food and Agriculture Organisation’s (FAO’s) Food Price Index down 13.5% YoY in August from the peak it reached in March 2022, but the timing of when this starts to filter through to local shelf food prices is difficult to estimate.

Figure 1: SA inflation (%), YoY

Source: Stats SA, Anchor

With fuel inflation set to ease further over the coming months, this latest data print supports our view that SA’s inflation peaked in July at much lower levels than many other emerging markets and advanced economies. That said, we expect headline inflation to return to the SA Reserve Bank’s (SARB’s) target range only in 3Q23. Whilst the August print may reduce investors’ concerns about pervasive upside inflation risks, it is too soon to become complacent about the general inflation risks – inflation is still a long way from the mid-point of the SARB’s target range.

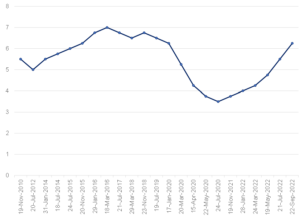

As such, it came as no surprise that the SARB’s Monetary Policy Committee (MPC) hiked the repo rate by a further 75 bpts at its Thursday (22 September) meeting, taking the repo rate to 6.25%. Neither the 2Q22 GDP contraction nor the easing of inflation in August influenced the MPC’s planned interest rate normalisation meaningfully. Whilst we still expect inflation to trend lower and second-round inflation to remain relatively subdued, as it stands, there are enough indicators of stronger price pressure to keep the SARB hawkish, especially given its resolve to avoid underestimating the pervasiveness of inflation, such as several other central banks have done including the US Federal Reserve (Fed). This includes tentative indications of stronger wage growth as well as stronger core consumer and services inflation, even if all these metrics are currently still at tolerable levels.

Figure 2: The history of the SARB MPC’s repo rate changes, %

Source: SARB, Anchor

However, with headline CPI likely to remain above the SARB’s target range for an extended period and global financing conditions continuing to tighten and weighing on the exchange rate, we expect the SARB to continue to tighten robustly. Thus, we believe there is the likelihood of a 50-bpt hike in the last MPC meeting for 2022, which takes place in November. Still, this call may be a little premature as we await further inflation data and guidance from other key central banks across the globe.