Historically, gold has been a safe-haven asset and has retained its value during economic and geopolitical turmoil. As 2024 unfolds, several factors are converging to shape the trajectory of gold prices. Central banks are increasing their reserves, geopolitical risks are mounting, and macroeconomic signals, especially those tied to interest rates and the US dollar, influence market sentiment. This article explores the key drivers behind gold’s recent outperformance, its relationship with real yields, and the potential impact of shifting global economic dynamics on the metal’s future value.

Gold pricing in Fed cuts, real-yield link rebased

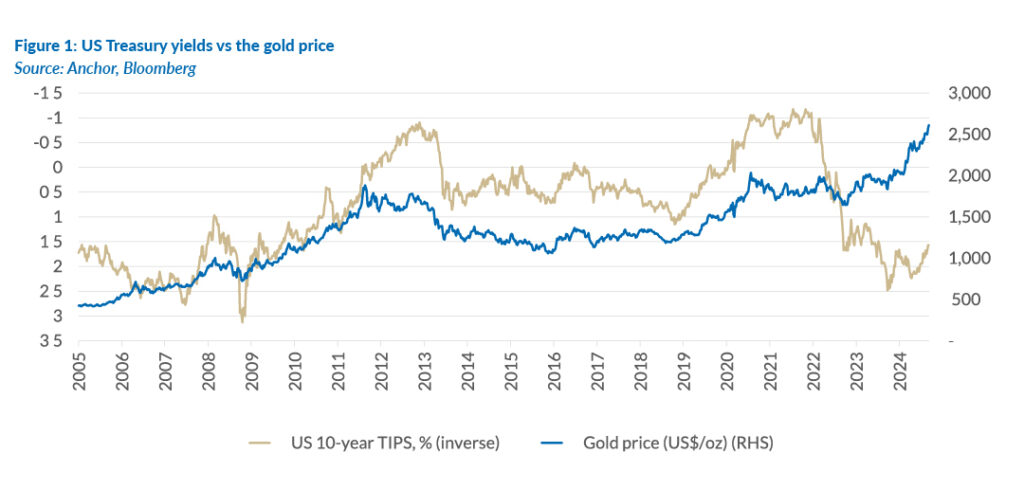

Gold’s recent resilience to rising real yields has surprised many as its traditional inverse relationship with real interest rates seems to weaken, indicating a possible shift in this long-held dynamic. Gold continues to react to changes in real yields, especially the US Federal Reserve (Fed) rate-cut cycle. Markets expect further rate cuts by next year. Gold reflects these anticipated cuts and responds to short-term signals like Chinese economic data, indicating multiple factors at play in the short term. One view is that expectations of lower rates may already be factored into the gold price, and therefore, as the Fed cuts rates, profit-taking could lead to lower gold prices. However, as of the time of writing, the gold price remains stable, if not slightly increasing, after the rate cut cycle commencement. This demonstrates the complex interplay between real yields, market expectations, and global economic signals affecting gold prices.

US dollar weakness could still boost gold

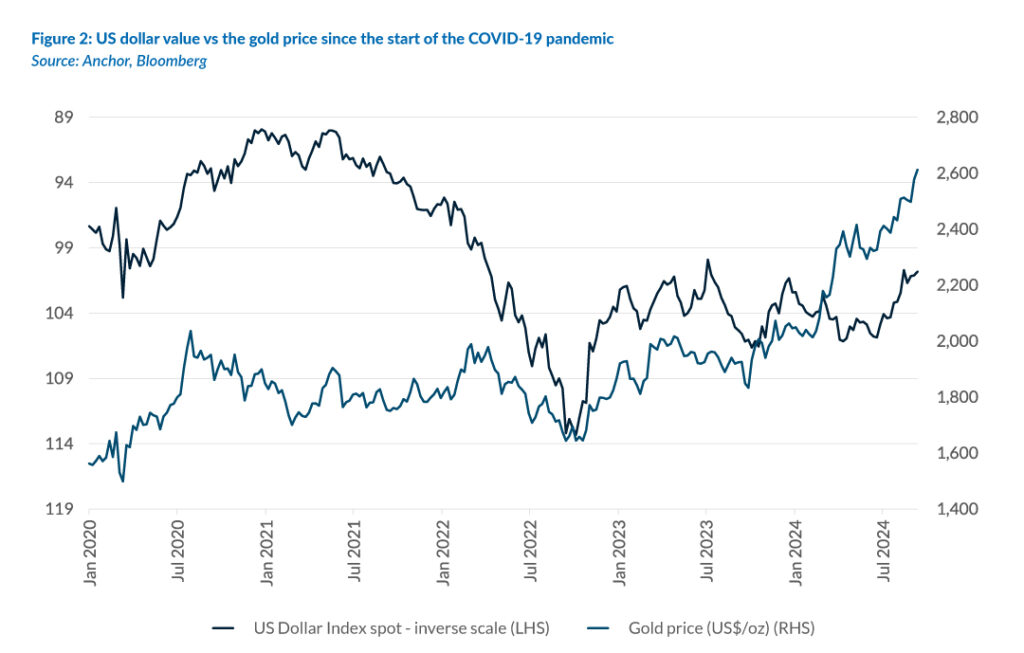

In late February, the sharp rise in the gold price suggested a potential decoupling from its traditional inverse relationship with the US dollar. However, that relationship has since reasserted itself. As we approach the end of 2024, with the US Fed adopting a more dovish stance and cyclical factors weakening, there is a scenario where a weaker US dollar could lead to higher gold prices.

The US economy performed well in the first half of this year, increasing the probability of a soft landing for the US economy. However, with lower opportunity costs, gold stands to benefit due to the Fed’s rate-cutting cycle. Despite recent divergences, the outlook for gold remains positive, particularly if the US dollar weakens further in 2024 as the Fed continues its dovish stance.

Mined-gold output could reach record levels in 2024

Bloomberg expects 2024 global gold output to increase by 2.5%-3%, potentially setting a record. Key players in the gold mining industry, including Canada, Côte d’Ivoire, Ghana, and Papua New Guinea, are driving this output increase. In Canada, new mines like IAMGOLD’s Côté and Equinox Gold’s Greenstone Gold are expected to significantly increase gold production, further solidifying Canada’s position as a top producer. In Côte d’Ivoire, the opening of Endeavour Mining’s Lafigue mine is expected to boost production growth. Côte d’Ivoire has become a significant contributor to the West African gold supply, and this new mine should help support further expansion in the region. Ghana, the largest gold producer in Africa, is expected to benefit from increased production at Newmont’s Ahafo mine and the ramp-up of AngloGold Ashanti’s Obuasi mine. Meanwhile, Barrick Gold’s Porgera mine in Papua New Guinea has resumed operations and is anticipated to contribute significantly to the global gold supply. With these new projects coming online and existing operations ramping up, 2024 is shaping up to be a record year for mined gold output, supported by key advancements in Canada, West Africa, and the Pacific region.

Central bank gold buying could remain robust

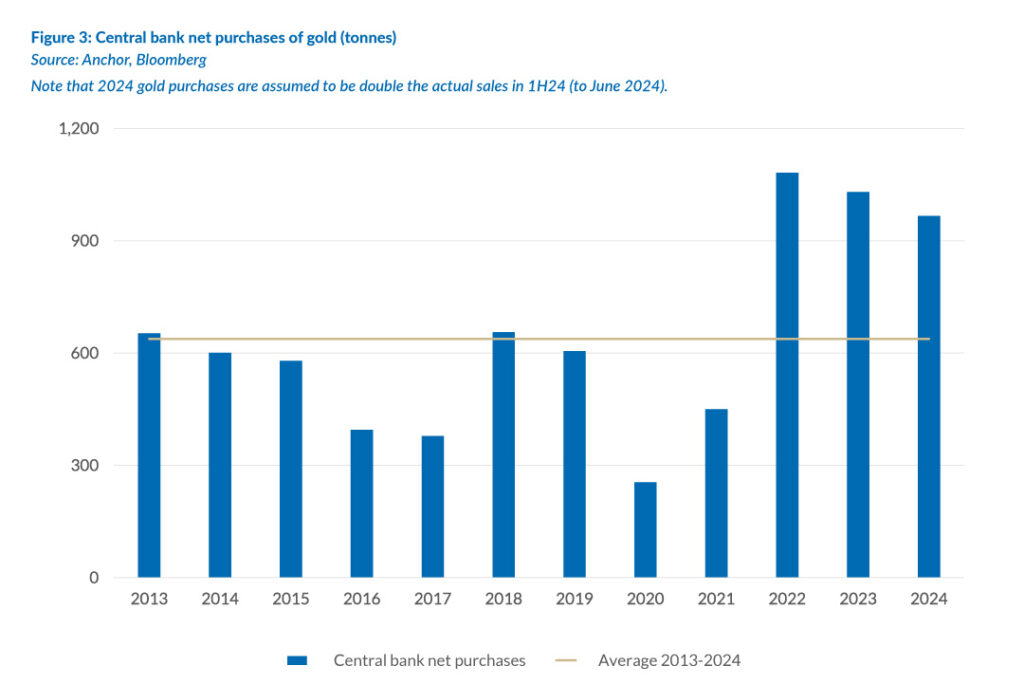

Central banks have been significant players in the gold market, making record-high purchases in recent years. In 2022, they bought 1,083 tonnes of gold, followed by 1,037 tonnes in 2023. Buying 483 tonnes in 2H24 would total 967 tonnes for 2024, 52% above the 2013-2024 average. This reflects a trend of increasingly viewing gold as a safe-haven asset. Central banks’ demand for gold is expected to remain strong over the next 2-4 years. Developing and emerging economies’ central banks continue to view gold as a hedge against inflation and currency devaluation. China and India were active buyers in 2023 and 1Q24, with other nations like Kazakhstan and Turkey also reinforcing this trend by acquiring sizeable amounts of gold to bolster their reserves. Developing countries, with economies more exposed to global shocks, are drawn to gold for its ability to preserve value during crises. Its performance in times of volatility drives robust demand among central banks. Despite some predicting a slight tapering of purchases, overall momentum remains strong due to the need for economic stability. Persistent inflation, currency risks, and political uncertainties make gold central in reserve portfolios. While the growth rate of purchases may decelerate slightly, central-bank gold buying will likely remain a robust market feature for the foreseeable future, reflecting the enduring appeal of gold as a strategic asset in uncertain times.

Gold holdings can grow in emerging and sanctioned countries

From 2023 to 2024, Russia, China, and India significantly increased their gold reserves due to geopolitical tensions and efforts to diversify away from US dollar assets. Sanctions following its invasion of Ukraine left Russian producers with limited international markets, leading them to sell gold domestically. By early 2024, Russia’s gold reserves stood at approximately 2,350 tonnes, making gold a key element in its financial strategy.

China added over 300 tonnes of gold between 2022 and mid-2024, bringing its reserves to around 2,262 tonnes. This reflects China’s ongoing strategy to reduce its dependence on the US dollar and mitigate global financial risks. India also increased its gold holdings, adding approximately 18.5 tonnes in 1Q24 to a total of 760 tonnes. Like China and Russia, India views gold as a means of diversifying its reserves and reducing exposure to US dollar-denominated assets.

Conclusion

Geopolitical tensions, central bank demand, and macroeconomic signals will influence the outlook for gold in the remainder of 2024. Its future performance may depend on US Fed rate cuts, and central bank buying continues to provide support as a hedge against global uncertainties. Nevertheless, potential headwinds remain, especially if the Fed continues cutting rates as expected. Record gold production in 2024 could also increase supply, potentially moderating price increases. Despite this, gold continues to be valued for its stability during economic volatility and is expected to remain a key asset for central banks and investors. Real yields, central bank demand, and global economic conditions will influence gold’s performance over the coming months.