Our brains have the incredible propensity to forget or block out lived traumatic periods or memories. This process is called dissociation. Dissociation is your brain’s unconscious defence mechanism to protect you from emotional pain.

The ability of my brain to call upon this extremely beneficial dissociation mechanism seems very much alive and well. Just four years on from the start of the traumatic and world-changing event that was COVID-19, I find myself unable to remember it clearly and strangely thinking that it was not that bad. And, at the most extreme, I sometimes question whether it was real or just a dream.

The industry that most felt the impact of COVID-19 was life insurance. These companies are run by some of the most brilliant people, the actuaries with spreadsheets that factor in just about every possible eventuality. The global pandemic sat on those spreadsheets with a 0.0027% probability of ever happening. And when a black swan event like COVID-19 happens, the obvious knee-jerk reaction is to price life and disability as if this event might occur regularly in the future. And so, just when my dissociation mechanism is helping me block out the trauma of COVID-19, I see the latest monthly debit for my life and disability run through my account, and my daydream snaps to an abrupt end.

An interesting thing about life insurance is that most people who have it see it as an asset on their balance sheets. However, it is of no more value than car insurance, and yet, for some bizarre reason, a person who is considering changing or cancelling their life cover immediately resorts to the “what if” something happened to me tomorrow scenario, which would result in this “asset” I have been religiously committed to for so many years, being worthless. Life and disability insurance are valuable tools to cover us in the most vulnerable years of our lives. But it should be viewed as no more than that.

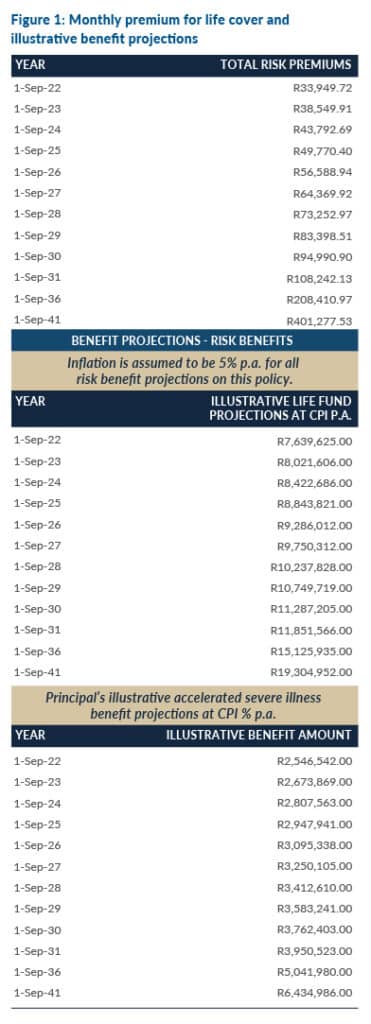

Recently, I interacted with a brilliant professional who was complaining about his premiums having skyrocketed to R38,000/month. After a simple cash flow and risk analysis, it was established that his balance sheet was enough to support his retirement. When it was suggested that he cancel his policy, he immediately resorted to the “what if” and “what a waste of all those years of contributions”. I then paged through to page 8 of his policy schedule (in Figure 1 below), which showed that his monthly premium for dramatically reduced cover would be R73,000/month.

The above tables helped move the conversation from a “what if” scenario to one where we instead put together a plan based on known facts, which is that a premium of R73,000/month will be unaffordable in five years. There was a possible slight gap in his balance sheet value for the next 12 months, so we took out a fixed 12-month term cover for the same value as his existing cover at one-third the price of his current premium.

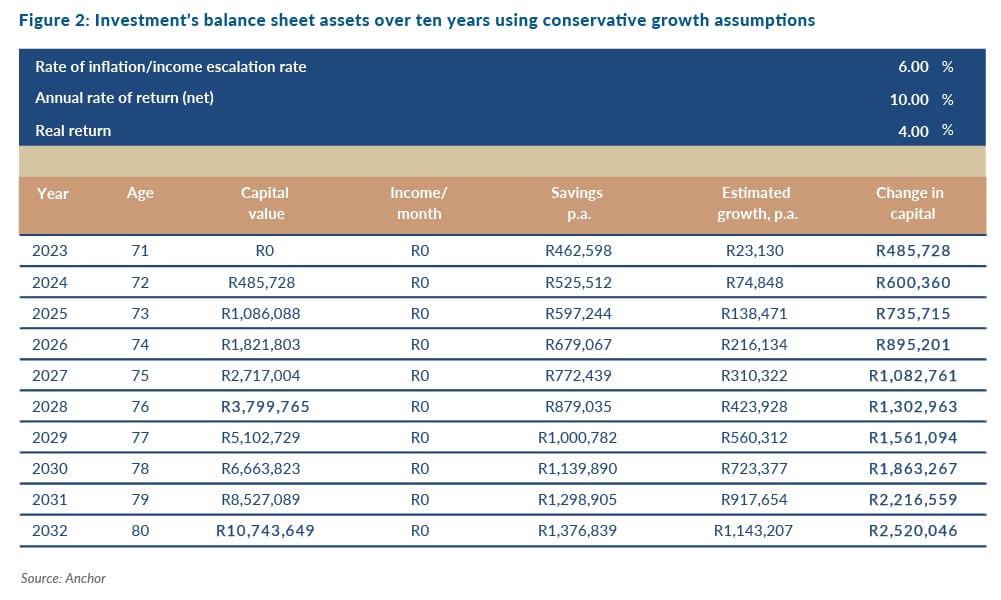

We then devised a plan to help him deal with his feeling of loss and contribute the equivalent premium amount into an investment. With conservative growth assumptions, we showed a balance sheet asset of R3.8mn in five years and, astonishingly, an asset of R10.7mn in 10 years.

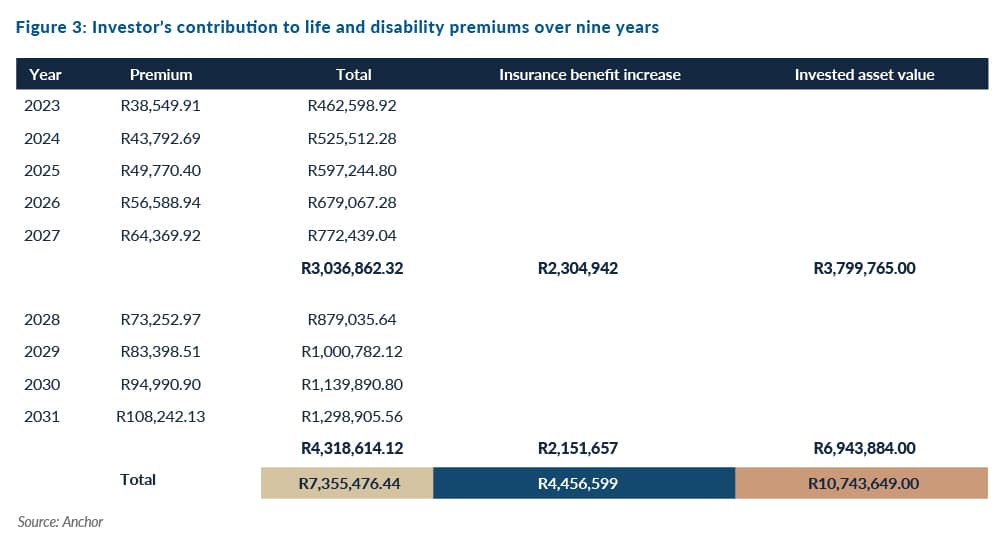

If this person had continued contributing to his life and disability premiums for the next ten years, he would have paid a total of R7,355,476 in premiums for something worthless on his balance sheet.

If, like many, you are seeing a dramatic increase in life and disability premium costs becoming an ever-growing burden, please contact us. We would love the opportunity to potentially turn this expense line into a balance sheet asset which will significantly benefit you and your family.