Anchor’s quarterly strategy and asset allocation report is aptly titled The Navigator, an appropriate moniker for the wealth manager’s responsibilities and experience. As wealth managers, we navigate investment waters where tailwinds, headwinds, shifting currents, various cloud formations, and constellations might guide us to finding our true north or lead us to perdition. On our seaborne investment journey, seagulls loudly compete on policy pronunciations and valuation calls. We may even encounter the occasional mermaid whose enchanting call might result in delight or loss (the Greek hero Odysseus famously asked his crew to fill their ears with wax to avoid hearing the sirens’ deadly songs while he was tied to the ship’s mast so he might listen but not jump overboard).

Continuing this nautical metaphor, specific requirements exist to remain Anchor-ed amidst investment storms. A wealth manager’s toolkit includes technical expertise, knowledge, and experience, all of which are applied to separate the noise from the important and relevant information. The output is funnelled through the filter of an investor’s mandate and risk tolerance/capacity, revealing the investable universe within which an individual investor’s portfolio will be constructed and the desired financial outcomes sought.

Our role as wealth managers is to closely monitor market movements and identify the primary levers between market sentiment, technical analysis, macroeconomic fundamentals or a combination of these. This ensures we are always prepared to navigate the most treacherous underlying currents, including the waves of emotions experienced by all stakeholders – the client, investors in general, and the wealth managers themselves.

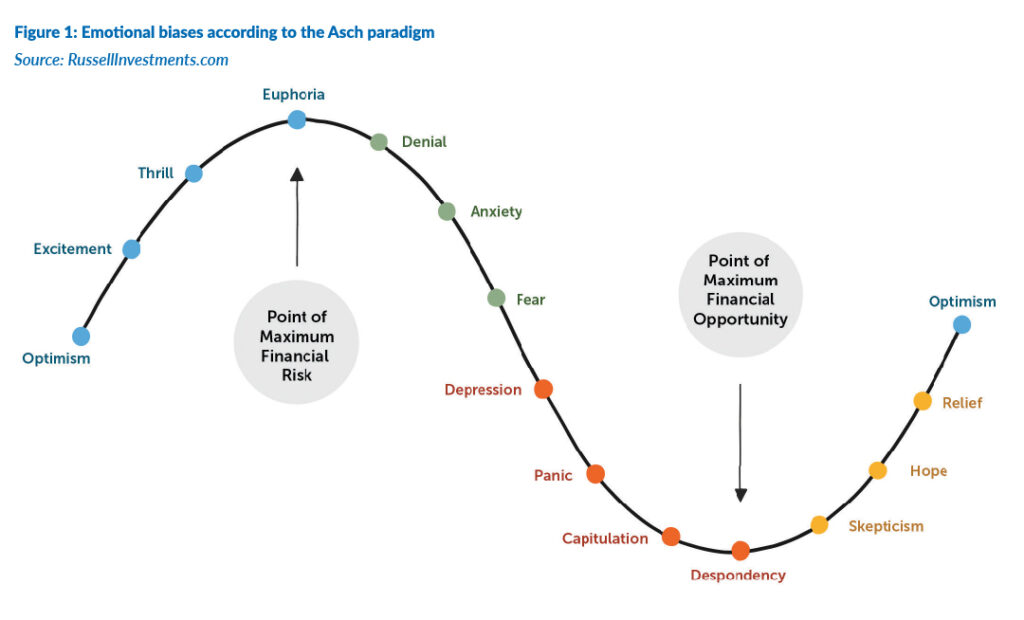

Herd mentality is imprinted on us as a fundamental derivation of benefits evident in animals – safety in numbers, quick action, and reduced stress via extra sets of eyes. The Asch conformity experiments, or Asch paradigm, were a series of social psychology studies performed by Solomon Asch in the 1950s, revealing how people are willing to ignore reality and arrive at wrong conclusions to conform to the majority group. In the investment world, herd mentality manifests in an individual’s emotional response to market volatility and economic cycles – accentuating volatility through momentum. The astute wealth manager must recognise and navigate the below sets of emotional reactions from the market, their clients, and themselves as asset allocators.

Understanding emotional biases is critical to the wealth manager’s ability to offer investors a robust, steady, and appropriately set course towards a stated objective.

Some of the well-known emotional biases include:

- Loss aversion bias: Holding on to loss-making investment to avoid recognising your losses.

- Overconfidence bias: Placing exaggerated trust in one’s ability and blaming factors other than oneself for subsequent failures.

- Status quo bias: Preferring to leave things as they are rather than make a change, even when necessary.

- Endowment bias: Magnifying the value of an asset we own.

- Regret-aversion bias: Avoid making a judgement for fear of taking a wrong decision.

- Conservative bias: A difficulty in moving from long-held opinions.

- Confirmation bias: Magnifying whatever reinforces an individual’s existing beliefs.

- Hindsight bias: Believing we could have foreseen and predicted past events.

- Anchoring and adjustment bias: Being influenced by an initial reference point to draw conclusions on any new situation.

The above biases are coupled with an increasing need for immediate gratification, where we are hardwired to respond positively to instant gratification whilst our logical self attempts to reason. A shift from multiple generations experiencing longer-term collective efforts (the post-world wars’ reconstruction, continental and global institutions, etc.) to the rise of obsessive consumerism and a growing ability to impact consumers’ behaviour through effective marketing aimed at offering a sense of validation from peers in mere seconds, has contributed to blurring the meaning of long and short term as critical inputs to the investment framework.

A well-defined investment strategy, staying the course of a well-defined and tested thesis, time in the market vs timing the market, dollar-cost averaging, active monitoring, and effective diversification are some tools a successful wealth manager relies on to navigate an investor’s portfolio.

For most people, the ability to sustain their standard of living post-retirement is a significant source of uncertainty and anxiety. This may lead to either an ‘ostrich effect’ (a cognitive bias to avoid information that is uncomfortable or negatively perceived and ignore the problem or not to feel discomfort) or an action based on fear, which is usually incoherent and destructive. That is where the wealth manager’s crucial role comes into play. Wealth managers can provide comfort through a measurable plan that can be monitored, tested, and adjusted over time by offering a steady hand and a knowledge-based approach. Over and above the intellectual stimulation engendered by applying a growing body of knowledge to market conditions, the profession can meaningfully affect individual and generational wealth outcomes as few other professions do.