The US Federal Reserve (Fed) kicked off its two-day June policy-setting meeting on Tuesday (18 June) and, on Wednesday (19 June), the Federal Open Market Committee (FOMC) released a statement noting that it left borrowing costs unchanged (as expected), but signalling that it was ready to cut rates in the future if it became clear that global growth was weakening.The Fed last increased the benchmark interest rate in December 2018.

Going into the meeting, interest rate markets were pricing in a 0.25% cut at the Fed’s next meeting (scheduled for the end of July) and another 0.25% by year-end. This compared to the median Fed members’ guidance from their previous statement (20 March) of a 0.25% hike by year-end.

The Fed statement highlighted the following main points:

- The Fed removed its language from the previous meeting that it was going to be “patient” – signalling that it was ready to act if the global economy showed signs of softness that was likely to impact on the US economy.

- The bank guided down its forecasts for inflation by 0.2% for this year (2% -> 1.8%) and 0.3% for next year (1.8% -> 1.5%), although it guided its expectations higher for US GDP growth.

- The Fed also changed its view of what it thought the neutral rate was from 2.8% -> 2.5% (effectively saying that the current monetary policy is not really as accommodative as it had previously thought).

- In addition, the US central bank decreased its view of long-term full employment, suggesting that it was likely to occur once unemployment reached 4.2%, not 4.3% as they had previously thought (the current rate is 3.6%). The Fed added that it doesn’t expect wage hikes to create meaningful inflationary pressure.

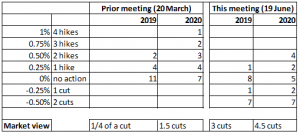

- The Fed published an updated “DOT Plot” (a chart indicating the individual FOMC members’ view of the likely path of interest rates over the next few years) and these showed a fairly meaningful shift towards rate cuts:

- 3 months ago none of the FOMC members thought a cut was appropriate this year or next – now 8 of the 17 members think at least one cut is appropriate this year and 9 believe at least one cut is appropriate by the end of next year.

- 7 or the 8 members that believe interest rates should be cut this year also believe that two cuts would be appropriate.

Figure 1: The US Fed DOTs

Source: Bloomberg, Anchor.

Note that data in the table indicates the number of FOMC members that expect the corresponding number of interest rate hikes/cuts in that year.

Other notable comments made during question time included the following:

- The Fed indicated that it will act to sustain US economic expansion.

- It noted that risks have increased to the downside.

- The US consumer is in good shape, according to the Fed.

- Fed Chairman Jerome Powell was clear that he has a legal mandate to stay in his job for 4 years and intends to see that period out (he still has 2.5 years to go). This was in response to reports that US President Donald Trump had looked into whether Powell could be fired.

In terms of market reaction to the Fed announcement and comments, equity markets barely responded as it seems high expectations were already priced in. Bond markets strengthened slightly, with the US 10Y bond yield now <2%. The US dollar weakened by about 0.5%