The US 10-Year Treasury receives more scrutiny and press coverage than any other security. Market participants across the board pay keen attention to movements in the US 10-year Treasury yield because this serves as a benchmark for other borrowing rates, such as mortgage rates. When the 10-year yield fluctuates, it can have significant implications across the financial landscape. As such, changes in the 10-Year Treasury yield tell us a great deal about global markets’ view of the economic landscape. Therefore, investors, in turn, attempt to analyse patterns in US 10-Year Treasury yields and make predictions about how yields will move over time.

The US 10-Year Bond (formally known as the 10-Year Treasury Note) is essentially a long-term debt instrument issued by the US Department of the Treasury. It represents a promise by the US government to repay a specified amount of money (the principal) at a predetermined interest rate (the coupon rate) over ten years. The bond pays interest semi-annually until maturity, at which point the investor receives the final interest payment along with the return of the principal. Regarding the specific mechanics of the market surrounding the instrument, the US 10-Year Bond market operates through primary issuance and secondary trading. Via the primary issuance mechanism, the US Treasury conducts auctions to issue new 10-year bonds. These auctions are typically held on a regular schedule and are open to a wide range of investors, including individuals, institutions, and foreign governments. Bids are submitted specifying the quantity of bonds desired and the yield the bidder is willing to accept. The Treasury sets the coupon rate based on the auction results. Once issued, 10-year bonds are traded in the secondary market. This market provides liquidity for investors who wish to buy or sell bonds before they mature. Trading occurs through various platforms, including electronic trading systems and over-the-counter transactions.

US Treasuries (USTs) are generally issued monthly across a variety of tenors:

- <1-year USTs are titled Treasury bills.

- >1-year and <20-year USTs are titled Treasury notes.

- 20- and 30-year USTs are titled Treasury bonds.

The notes and bonds are similar (paying semi-annual coupons), and the bills are zero-coupon discount instruments. As the instruments are issued monthly, the latest issue is termed “on-the-run,” the older issues are called “off-the-run” USTs. When yields for specific tenors (for example, the 10-year) are referenced in the market, the standard understanding is that this reference is to the on-the-run issue.

USTs are a type of bond, and their yield determines their price. The yield-price relationship is inverse — a lower yield results in a higher price and vice versa. At issue, USTs’ prices are at par; however, the yield is dynamic in the open market. The coupon rate for treasuries varies and is determined by the issuance auction. Thus, post-auction, the bond price can vary from par depending on the supply and demand movements for the instruments.

From a macroeconomic perspective, the US 10-Year Treasury holds significant importance in financial markets for several reasons:

- Interest rate benchmark: The 10-Year Treasury yield is a benchmark for interest rates across the economy. It influences borrowing costs for businesses, consumers, and governments, impacting spending, investment, and economic growth. South African investors and financial institutions often use this benchmark to price various financial instruments, including government bonds, corporate bonds, and loans. Changes in the US Treasury yield curve can influence SA’s interest rates and borrowing costs.

- Risk-free rate: Treasury bonds are considered quasi-risk-free assets because the US government backs them. Thus, the interest rate earned can generate discount rates for other investments or more exotic financial instruments.

- Investor sentiment: Fluctuations in the 10-Year Treasury yield reflect changes in investor sentiment, economic expectations, and risk appetite. When the yield rises, so do mortgage rates and other borrowing rates. Conversely, the housing market strengthens when the 10-year yield declines and mortgage rates fall. This, in turn, positively impacts perceptions of economic growth and the strength of the US economy.

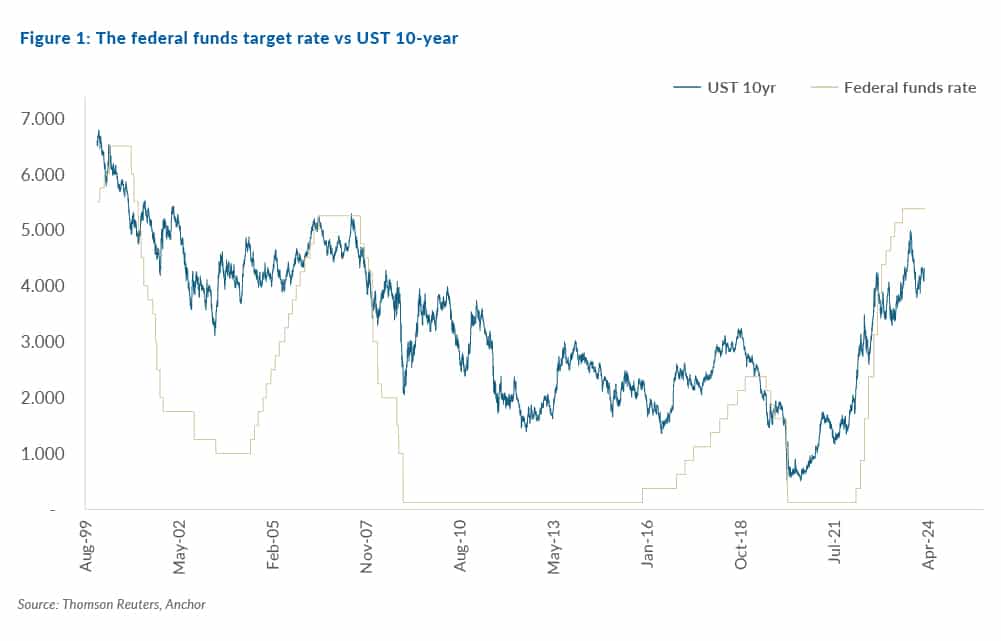

- Policy expectations: Investors monitor the yield on treasuries to gauge the market view on long-term interest rates and the likely route policy rates (in this case, the Fed funds rate) will take over the period.

- Global market sentiment: The US 10-Year Treasury is regarded as a barometer of global market sentiment and risk appetite. Its yield fluctuations can impact global financial markets, currencies, and capital flows, reflecting broader trends in investor confidence and geopolitical developments.

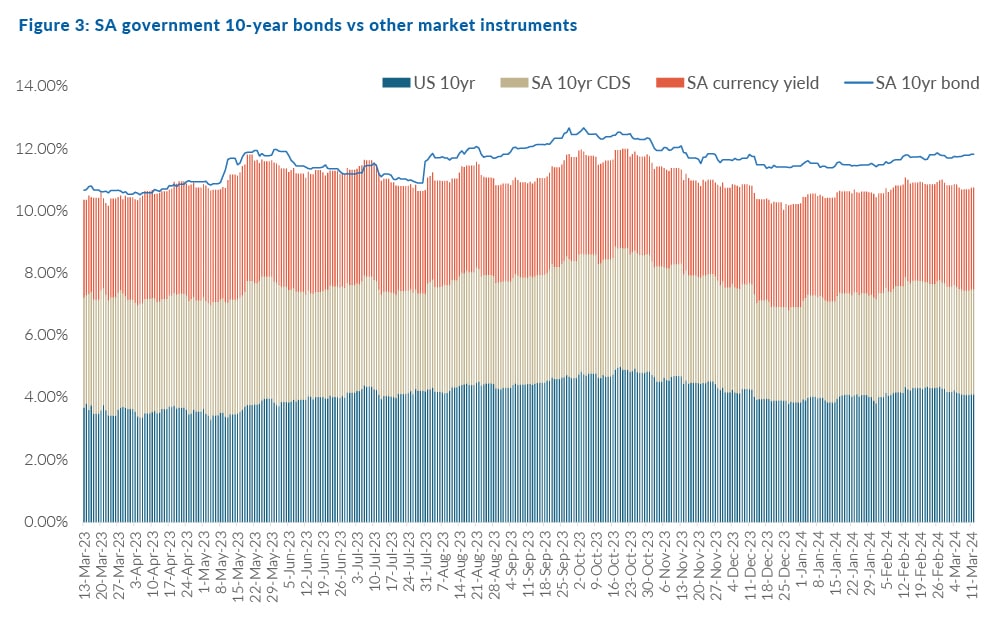

- Capital flows and investment: South African investors closely monitor US Treasury bond market developments as part of their global investment strategy. Changes in UST yields can affect the attractiveness of South African assets relative to US assets, impacting capital flows into and out of the country. Additionally, shifts in global investor sentiment driven by UST market dynamics can influence foreign direct investment and portfolio flows into SA.

- Currency markets: Movements in the UST bond market can impact currency markets, including the rand exchange rate. Changes in US interest rates and yield differentials between USTs and South African government bonds can affect the relative attractiveness of each currency, influencing exchange rate movements. Moreover, shifts in global risk sentiment driven by UST market dynamics can impact the demand for EM currencies like the rand.

As such, the UST market forms a crucial underpinning to the global financial system. Movements in the price of any UST (but more specifically, the 10-year point) have drastic implications for the price of other assets as the UST is a barometer for the broader economic health of the US (and, by extension, the world) economy.

It has long been established that Fed funds target rates directly impact UST rates. As the Fed funds rate is cut/hiked, longer-term UST rates are also impacted in a direct relationship. Longer-term UST rates are often viewed as an expectation of average Fed funds rates. There are some methodological difficulties in this approach, i.e., those investors who expect to be rewarded for the term itself (so-called term premium). Any analysis of USTs as an expectation of the future must also make some assessment of the market price of term premium.

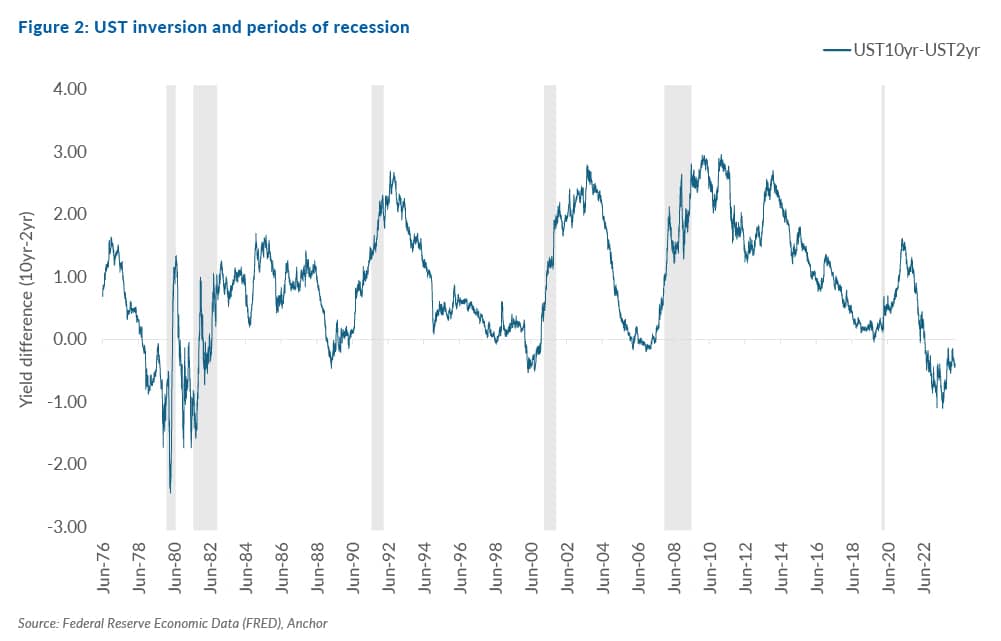

One key curve parameter tracked by markets is the difference between 10-year and 2-year UST yields. When this becomes negative (i.e., the short-term rate is higher than the longer-term rate), the curve is said to be inverted. Market participants often view inversion in 2v10 rates as a signal of impending recessions.

While the UST market has great importance domestically, it is also important globally. As the US dollar serves as the currency of global trade, so do USTs serve as the benchmark for global fixed income. In this way, all other bonds’ relative attractiveness is based on their relationship with the UST market. At Anchor, we model SA government bonds’ (SAGBs) attractiveness by monitoring the underlying market – visible instruments that can be bought (or sold) to replicate the underlying risk of SAGBs. This is a critical input into our decision-making regarding the outlook for SAGBs.

The UST outlook is a crucial indicator whose movement Anchor closely monitors to understand how it reflects domestic and global economic conditions, policy expectations, and market sentiment. Its issuance and trading mechanics and its influence on interest rates and broader economic trends make it an essential instrument for investors, policymakers, and economists.