The role of a wealth manager working in a private client environment is not only one of investment management – we also deal with people, and people often require more complex and individualised investment advice. It is human nature to want to buy into the equity market when share prices are going up, and then sell when they go down. Of course, this is not the best approach, and it is here where your wealth manager plays the important role of both advisor and psychologist. I am often asked by potential clients “what returns will you give me if I invest with you?” This is when a potential client has to be informed that the role of a wealth manager requires thought around investment diversification and the impact that this will have on their portfolio returns and a client’s return expectations have to be managed accordingly. Only once this is explained, does a client begin to understand that those return objectives are specific to each investment based on several factors such as geography, currency, liquidity requirements, time horizon, and, most importantly, the type of asset class.

Below we unpack each of the abovementioned factors in more detail:

Geography: Just because we live in SA, does not mean that the bulk of our investments should be in SA. Whilst the JSE has some high-quality businesses, there are far more options available to investors offshore and there is also less of a concentration risk when choosing the right companies in which to invest.

Exchange control is no longer a significant constraint. Currently, each SA citizen over 18 years of age has an R1mn annual single discretionary allowance (SDA) and an R10mn annual foreign investment allowance (FIA), thus providing most private clients with as much offshore, hard currency exposure as they need. Further to this, local feeder funds give clients access to offshore investments in a cost-effective, convenient manner.

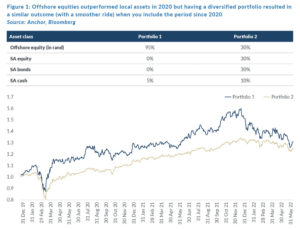

If you were invested in offshore equity markets in 2020 post the COVID-19 crash, your portfolio would have been up in the region of 100% in US dollar terms, making the asset class extremely attractive to investors. This is when a wealth manager’s psychologist role comes into sharp focus as clients who were not fully invested in the market were questioning the diversification of their portfolios and pushing for higher allocations into offshore equities during that time. However, with the benefit of hindsight, we now know that being overexposed to offshore equities in 2022 YTD has been an extremely painful experience given the sell-off in global markets. The higher-than-expected rise in US inflation (May inflation accelerated by a worse-than-expected 8.6% YoY – the biggest US inflation increase since December 1981) and the US Fed hiking interest rates by 0.75% in June caught the market off guard and excessive equity exposure has been punished. However, those clients with a well-diversified portfolio were cushioned from this blow as local cash and fixed income investments performed well comparatively. This has made missing out on some of the excessive gains made in 2020 (post the initial COVID-19 market crash of early 2020) seem a worthwhile trade-off.

From a fixed income perspective, SA is incredibly compelling on a real rate of return basis. SA government bonds are currently yielding c. 10% (the current yield on the FTSE/JSE All Bond Index is 10.1%), which far exceeds the latest (May) SA inflation print of 6.5%. When compared to the low interest rates in the developed world (even with rates currently increasing), this becomes attractive.

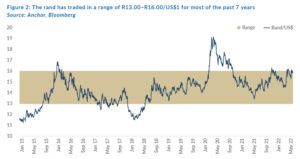

Currency: Whilst we do believe that the rand will depreciate over time, the local unit has traded somewhat range-bound at between R13.00-R16.00 to the US dollar, over the past seven years (see Figure 2).

This relative rand strength has made local investments, particularly fixed income, extremely attractive in recent times. Even the JSE, which underperformed offshore equity markets for many years, has held up well recently. Clients who believe that they need to “externalise funds at all costs” would have benefitted from having an allocation to local fixed income. That being said, Anchor’s view remains that, over time, the rand will depreciate, and our long-term play is to favour hard currency over the rand.

Liquidity: As a wealth manager, there is nothing worse than having to tell a client that they cannot access their money due to the underlying investments being illiquid. Each client has a different set of circumstances, but as a rule of thumb, we would not lock up more than 20% of a client’s investments, depending on the analysis done.

Time horizon: When choosing the correct mix of investments for a client, the wealth manager must understand when the client might need their funds. We know that, over time, equities generally outperform fixed income, but the volatility in achieving this return can result in a negative return at certain stages of the investment cycle. To state the obvious, the investment mix of a young, high-earning professional will differ immensely from the investment mix of a retired single pensioner with only a small nest egg left to live off. More diversification is required when capital protection is paramount, whereas the young professional will be mainly invested in equities.

We can drill down further when assessing the diversification required when investing. For example, fixed income as an asset class is on the lower end of the risk curve, but not all fixed income is the same. Just like equity investments can leave the investor in a negative position at certain stages of the investment cycle, so can fixed income. We take the utmost care to understand when a client might need their money and we can also perform an outsourced treasury function for our clients. Once we understand a client’s expected timelines, we can put together the right mix of fixed income instruments, so that the client has the right combination of different fixed and floating rate bonds.

Asset class: Once geography, currency, and liquidity ratios in a client portfolio have been assessed, the last tool of diversification is the asset class mix that will best suit a particular client. The main asset class choices that investment managers have at their disposal are equities, fixed income/cash, and alternatives.

In general, local and offshore equities generate higher returns over time, but they are also the most volatile asset class. Equities can be a very uncomfortable place to be, especially when the market is correcting, as it is now. Some clients simply cannot stomach the volatility and it is up to us as wealth managers to carefully explain to them the risks and rewards experienced by equity markets over time.

Within the alternative assets space, we generally utilise the following investment alternatives:

- Structured products can de-risk portfolios whilst providing inflation-beating returns. They are generally linked to equity markets but have built-in barriers of protection which are beneficial in a bear market but also reward clients in a bull market.

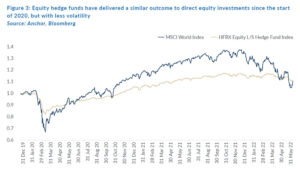

- Hedge funds are more liquid than structured products and most private debt funds, and they allow for both long and short positions. A well-run hedge fund will provide an investor with a much less volatile ride than equities. Using 2020 as an example, hedge funds would not have returned the almost 100% that certain equity funds returned but similarly, the impact of the recent market crash would have been far less severe in a hedge fund.

- Private debt funds are a way of returning inflation-beating returns in hard currency but are relatively illiquid when compared to traditional funds. The correct private debt fund will return offshore high single-digit returns, with a low risk of capital loss. These funds have been stress tested during the COVID-19-induced crash in early 2020 and have held up well given the circumstances. This provides us with the comfort that being invested in the right debt fund can be extremely beneficial to a client that requires de-risking of their portfolio.

Finally, fixed income and cash are considered low-risk investments. Returns are linked to the geographical location of the investment, and, in turn, currency risk applies. After the recent sell-off in global bonds, 3% to 5% p.a. income from an offshore, hard-currency, fixed-income investment is achievable, whereas local fixed-income investments can yield up to 10% p.a. As mentioned, a well-diversified fixed-income solution should have both long- and short-duration bonds, considering the timing of the client’s cash flow needs and the expected rand strength or weakness.

So, going back to the question most clients ask, “what returns will you give me if I invest with you?”, the answer is clearly not straightforward. Asset classes are intertwined, and the investment world is continually changing. Each client is different and will have exposure to a diversified mix of investments depending on their specific circumstances which, in turn, will affect their expected returns. It is our role as wealth managers to understand each client as a unique individual with distinctive circumstances and structure their investments accordingly, with the correct amount of diversification on a risk-adjusted basis.