With risks to the inflation outlook skewing increasingly to the upside, it was not surprising that the South African Reserve Bank (SARB) cautiously kept the repo rate on hold at 8.25% at its second Monetary Policy Committee (MPC) meeting for this year, with the prime rate remaining at 11.75%. The drift higher in headline CPI inflation from 5.1% in December to 5.3% in January and 5.6% in February continues to cause concern for the MPC as upside inflation risks linger. Given that the market all but priced in the decision to hold, the key to the March statement was the overall tone, which was closely watched by market participants across the board to better understand the conditions under which the SARB may consider easing monetary policy.

Developments since the last MPC meeting in January have been somewhat mixed. Whilst headline inflation increased to a four-month high in February, survey-based inflation expectations for the next three years improved in the 1Q24 Bureau for Economic Research (BER) survey published last week. However, the MPC continues to be concerned that these remain well above the mid-point of the target range. Food prices are a particular point of anxiety. While they are continuing to moderate since the highs of last year, risks to the upside are increasing given the various ongoing supply shocks, particularly ahead of the forecast El Niño weather pattern (as already witnessed with large dry spells across the country) and amid relatively large swings in crucial commodity prices (including oil) and the rand exchange rate. White maize futures have risen 9.8% since the start of March, with increasing signs that the dry weather conditions may cause more damage to the summer crop than initially expected. Brent crude oil prices have also edged higher since the January MPC meeting. Whilst SA had a more gradual acceleration in inflation than many peer countries (with a lower peak) since COVID-19, the return to the 4.5% midpoint of the SARB’s target band has been slow and remains at a distance.

On a more positive note, the SARB’s latest GDP forecasts indicate a modest acceleration in growth from this year as various supply-side constraints (particularly loadshedding) relax. The SARB estimates that while electricity shortages took 1.5 ppts off GDP last year, it will moderate to 0.6 ppts this year and 0.2 ppts in 2025. Overall, the central bank forecasts growth at 1.2% this year, improving to 1.6% by 2026. These projections are better than the 2023 outcome but below longer-run averages of around 2%.

Overall, at the current level of rates, the policy stance is considered restrictive, consistent with the inflation outlook and the need to address elevated inflation expectations. Subsequently, we maintain that the SARB’s MPC will not rush to cut the repo rate. Any possible interest rate cuts will likely only materialise towards the end of 2024 and depend on the inflation outlook (locally and abroad) and global interest rate developments as we progress further into this year. Current market sentiment suggests only one interest rate cut of 25 bps this year in SA, possibly two, with the second cut almost fully priced out per our expectations. Over the longer term, we expect the SARB to gradually cut rates from 8.25% to 7.5% through three 0.25% cuts, reflecting the theme of higher interest rates globally.

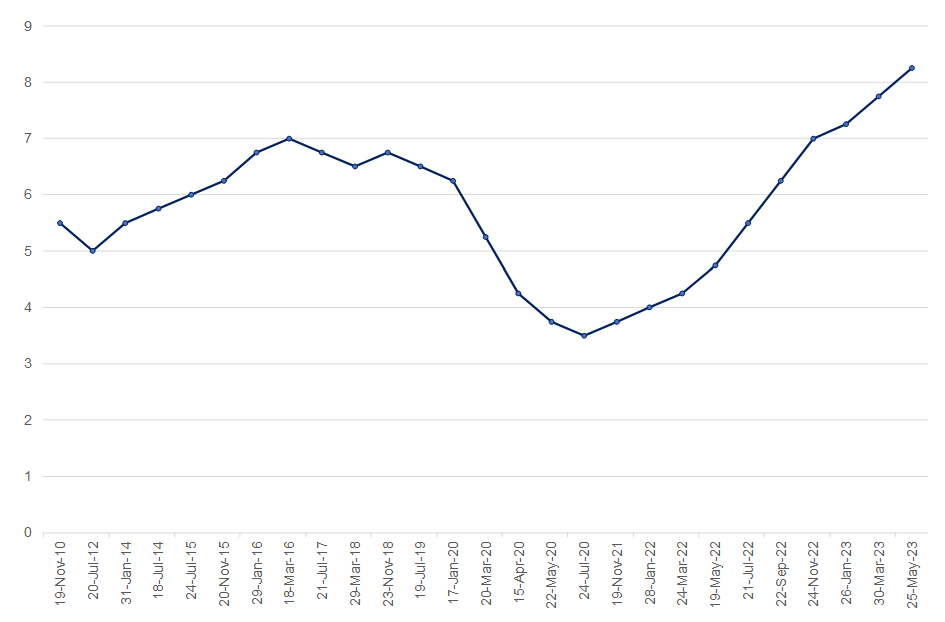

Figure 1: The history of the SARB MPC’s repo rate changes, %

Source: SARB, Anchor