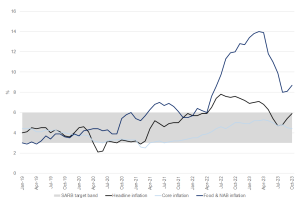

Surprising to the upside, October’s CPI printed at 5.9% YoY, up from 5.4% in September and above market expectations. The main drivers of this acceleration were food and non-alcoholic beverages (NAB), housing and utilities, and transport costs. Core inflation (which strips out the more volatile price categories of food and energy costs) continued its downward trend for the seventh consecutive month, printing at 4.4% in October, just below the midpoint of the South African Reserve Bank’s (SARB) target range. Price pressures were generally contained across the core basket – an encouraging signal for the current inflationary outlook.

Concerningly, inflation in food and NAB rose to 8.7% YoY from 8.1% YoY in September. This reflected a sharp increase in the prices of fruit and vegetables, which jumped to 23.6% from 15.3% in the previous month. This outweighed the moderation of inflation in bread and cereals as well as meat and fish prices. Vegetable prices surged 7.1% MoM in October, resulting in inflation in this category rising to 23.6% YoY in October from 15.3% YoY in September. Stats SA highlighted that increases in potatoes, tomatoes, and sweet potatoes primarily propelled the surge. The degree to which this upward pricing trend will continue remains uncertain, although recent Potatoes SA data suggest moderation in potato prices through November due to improved supply conditions. Regardless, the Agricultural Business Chamber of South Africa (Agbiz) attributes the jump in select vegetable prices to the impact of loadshedding on irrigation, which it expects to ease in the coming months, given the general improvement in electricity supply and the increase in the agricultural sector’s electricity generation.

Positively, egg prices, boosted by a severe avian flu outbreak, have already started to ease. While prices of the various poultry products have generally been drifting higher amid this avian flu outbreak, the impact remains far more muted than for egg prices. October CPI also witnessed a substantial surge in fuel prices, which experienced a 11.2% YoY rise compared to the 1.5% YoY increase observed in September. The surge was predominantly attributed to elevated oil prices during October and the rand’s depreciation, influenced by the prevailing narrative of fiscal deterioration. These factors collectively fuelled an uptick in transport inflation, reaching 7.4% YoY in October and marking a notable rise from the 4.2% recorded in September.

Figure 1: SA inflation, YoY % change

Source: Stats SA, Anchor

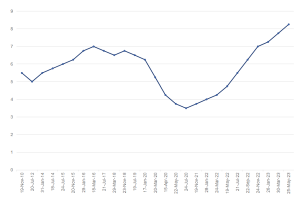

Against this backdrop, as expected, the SARB looked through the first-round inflation impact of these supply-side shocks and kept the repo rate on hold at 8.25% at their last Monetary Policy Committee (MPC) meeting for the year, with the prime rate remaining at 11.75%. This latest MPC decision supports our view that the inflationary effects of these current supply shocks are transitory and, as such, do not warrant an immediate policy response. In the past, the MPC has consistently signalled its intention to look through temporary price fluctuations and focus on the medium-term outlook for inflation and growth. Nonetheless, given that inflation expectations remain above the mid-point of the target range and tend to show high sensitivity to food inflation, the tone of the MPC statement remained hawkish, with the MPC cautioning about the significant upside risks to the inflation outlook remaining. Should these risks materialise, the MPC emphasised that it remains vigilant and stands ready to act.

Figure 2: The history of the SARB MPC’s repo rate changes, %

Source: SARB, Anchor

Looking ahead, we believe inflation will start to ease in November, primarily due to an expected fall in petrol prices and a further moderation in core inflation. As Brent crude oil prices moderated, fuel prices fell by 6.0% MoM in November. The current over-recovery data from the Central Energy Fund suggest that another big fuel price cut is likely in early December. However, we see food prices as a key upside risk given the various ongoing supply shocks, particularly ahead of the forecast El Niño weather pattern and amid relatively large swings in crucial commodity prices (including oil) and the rand exchange rate.

Regardless, as the year comes to a close, we believe that interest rates have reached their peak and will remain at current levels for some time. The forward-looking real interest rate is already high enough for the prevailing economic backdrop, with inflation forecasts remaining inside the target range and demand-driven and wage inflation remaining modest. Any possible interest rate cuts will likely only materialise towards the end of 2024 and depend on the inflation outlook (locally and abroad) and global interest rate developments as we progress into the new year.