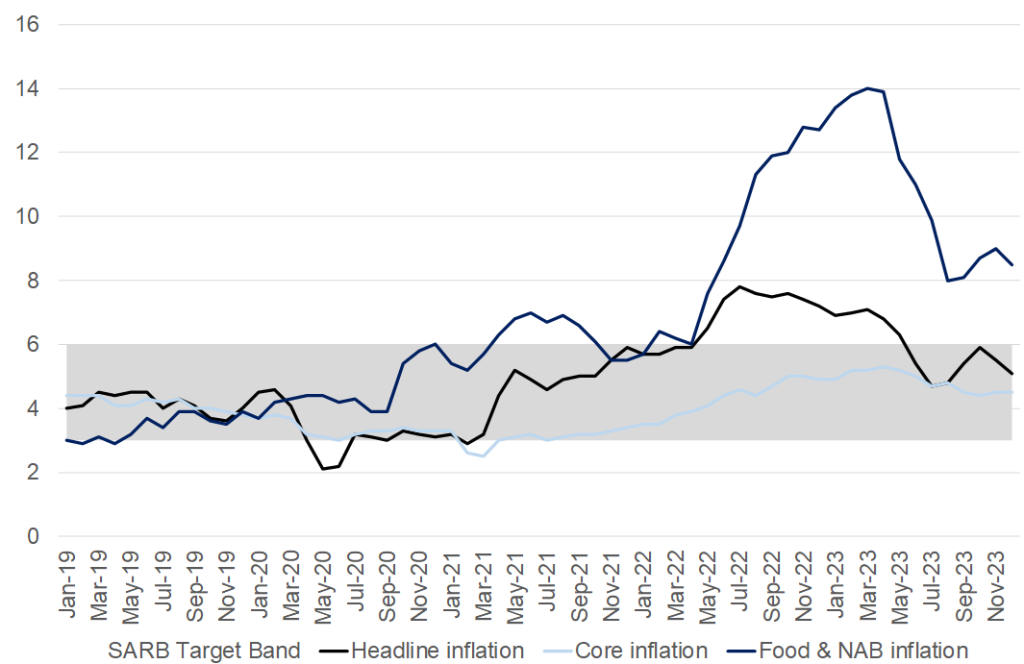

In a welcome improvement for South African consumers, annual consumer price inflation, as measured by the consumer price index (CPI), pulled back in December, easing to 5.1% from 5.5% in November. On a MoM basis, CPI was unchanged in December. Core inflation (excluding the more volatile price categories of food, fuel and electricity prices) remained steady at 4.5% YoY in December despite rising prices for housing and utilities, health and restaurants and hotels. As such, core inflation remains relatively subdued, particularly on the demand side. The average core inflation for 2023 was 4.8%, compared with 4.3% in 2022. Notably, food and non-alcoholic beverages prices decelerated for the first time in four months, printing at 8.5% YoY from 9.0% YoY in November. The decline was supported by ongoing moderation in bread and cereals prices and favourable declines in vegetable prices. Nonetheless, other categories recorded price increases – such as meat prices, which continue to be hampered by poultry prices. The downward trend in fuel prices continued in December, decreasing by 2.5% YoY compared with a 1.8% YoY decline in November. This was mainly due to lower oil prices, which more than offset the slight depreciation of the rand.

Figure 1: SA inflation, YoY % change

Source: Stats SA, Anchor

The 2023 inflation results are wrapped up with the December release. The yearly average inflation rate stood at 6.0%, a decrease from 2022’s 6.9%. In the initial five months of 2023 (January–May), inflation remained relatively high, consistently surpassing 6.0%. However, inflation eased below this threshold for the remaining seven months of the year. The peak inflation rate for 2023 occurred in March at 7.1%, while the lowest was recorded in July at 4.7%. Product categories that concluded the year with annual rates higher than 6.0% in December included food & non-alcoholic beverages (8.5%), restaurants & hotels (7.0%), and health (6.5%).

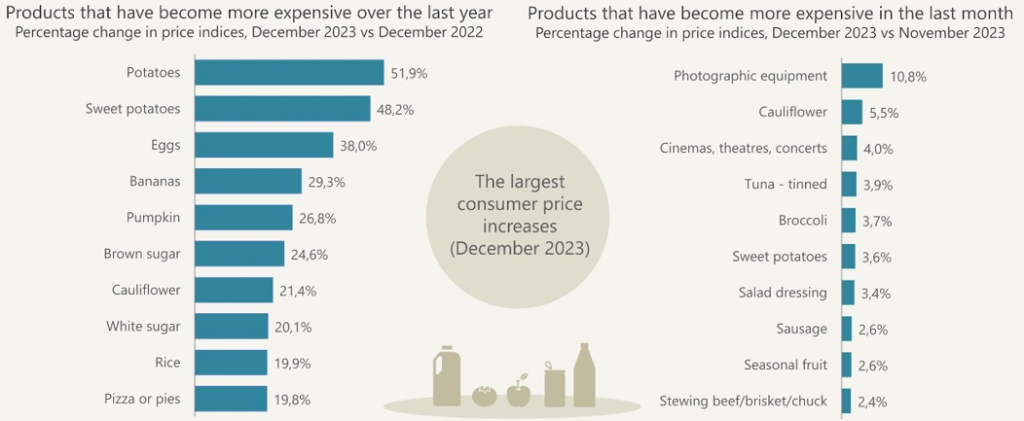

Figure 2: Products that recorded the most significant annual and monthly price increases in December

Source: Stats SA

Looking ahead, inflation is likely to rise in the short term, but we believe that the general trend for this year will be downwards. For January, rising inflation will be primarily due to fuel price base effects. There may be a further uptick in the inflation print for February as the Central Energy Fund (CEF) data on 23 January pointed to a higher-than-expected fuel price adjustment at the beginning of February because of higher oil prices and a weaker rand vs US dollar exchange rate. Nonetheless, we continue to view food prices as a key upside risk given the various ongoing supply shocks, particularly ahead of the forecast El Niño weather pattern and amid relatively large swings in crucial commodity prices (including oil) and the rand exchange rate.

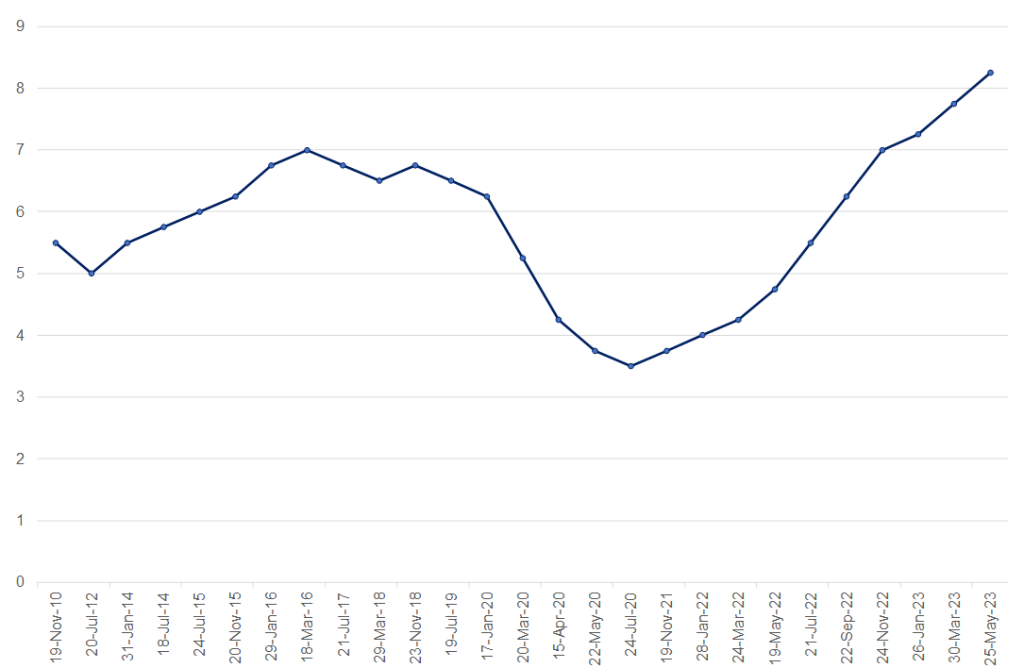

Against this backdrop, as expected, the South African Reserve Bank (SARB) cautiously kept the repo rate on hold at 8.25% at its first Monetary Policy Committee (MPC) meeting for the year, with the prime rate remaining at 11.75%. Given that the market all but priced in the decision to hold, the key to the 25 January statement was the overall tone, which was closely watched by market participants across the board to better understand the conditions under which the SARB may consider easing monetary policy. Although headline inflation is on an easing trajectory, the SARB remains understandably cautious. According to the Bureau for Economic Research (BER), survey-based inflation expectations deteriorated closer to the top end of the target range in 4Q23. Average expectations for 2024 and 2025 rose 0.2 ppts and 0.3 ppts to 5.7% and 5.6%, respectively. Meanwhile, the exchange rate has drifted weaker since the last MPC meeting. The MPC remains concerned about possible upside price shocks from supply chain disruptions at the Red Sea and the current heightened geo-political tensions.

Figure 3: The history of the SARB MPC’s repo rate changes, %

Source: SARB, Anchor

Overall, we maintain that interest rates have peaked and will remain at current levels for some time. The forward-looking real interest rate is already high enough for the prevailing economic backdrop, with inflation forecasts remaining inside the target range and demand-driven and wage inflation remaining modest. Any possible interest rate cuts will likely only materialise towards the end of 2024 and depend on the inflation outlook (locally and abroad) and global interest rate developments as we progress further into this year. Overall, risks to the inflation outlook have deteriorated – geopolitical tensions have worsened, and the deteriorating performance at our key ports adds uncertainty to the future inflation path. Due to these various risk factors, we believe the MPC will not rush to cut the repo rate.