Inflation expectations are a pivotal yet often overlooked factor in shaping a country’s economic outlook. They essentially refer to the rate at which consumers, businesses, investors, and policymakers anticipate rising prices. Various factors can shape these expectations, including current inflation trends, economic conditions, central bank policies, and broader economic forecasts.

When consumers expect prices to rise, they tend to spend more in the present rather than delay purchases, boosting current demand and driving up actual inflation. Conversely, if they anticipate falling prices, they might delay spending, reducing demand and potentially leading to lower inflation or deflation. Similarly, these expectations also influence wage negotiations, which workers and employers factor into future inflation. If high inflation is expected, workers demand higher wages to maintain their purchasing power, which in turn raises production costs for businesses and can lead to higher prices, perpetuating a cycle of inflation. In this sense, inflation is often referred to by economists as self-fulfilling, i.e., the phenomenon where people’s expectations about future inflation influence their economic behaviour in a way that causes those expectations to come true.

Businesses also incorporate inflation expectations into their pricing strategies. If they foresee rising inflation, they might increase prices pre-emptively to safeguard profit margins, contributing to the actual inflation rate. For central banks, such as the US Federal Reserve (Fed), inflation expectations are a key indicator for setting monetary policy. Rising expectations may prompt central banks to raise interest rates to curb economic activity and control inflation, while low expectations might lead to lower rates to stimulate spending and investment. As such, investors play a crucial role in the economic landscape as they must consider inflation expectations when deciding where to allocate their money. Higher expected inflation can drive investment in assets that hedge against inflation, like real estate or commodities, whereas lower expectations might boost interest in fixed-income securities. Inflation expectations also influence bond yields and financial markets. Higher expected inflation usually results in higher bond yields, increasing borrowing costs and potentially slowing economic growth.

Moreover, a large degree of the credibility of central banks hinges significantly on their ability to manage inflation expectations. Consistently maintaining inflation near the target builds credibility, helping to anchor expectations and making it easier for the central bank to achieve its objectives with less aggressive policy measures. If expectations become unanchored, it can lead to more volatile economic conditions and necessitate more drastic interventions. Thus, inflation expectations are pivotal in influencing behaviours and decisions across the economy, playing a fundamental role in determining actual inflation and overall economic stability.

Locally, in 2001, the South African Reserve Bank (SARB) commissioned the Bureau for Economic Research (BER) to conduct a quarterly survey to measure inflation expectations and other macroeconomic variables related to inflation. This survey covers four social groups: analysts, business professionals, senior trade union representatives, and households – as each group offers a unique perspective and impact on inflation. The results from this survey are one of many factors the SARB’s Monetary Policy Committee (MPC) considers when deciding on interest rates. The MPC becomes concerned if inflation expectations rise, if they significantly exceed the midpoint of the SARB’s 3% to 6% target range, or if other inflation indicators worsen. For example, as mentioned previously, rising inflation expectations can lead to higher wage demands as workers seek compensation for anticipated higher future inflation. Similarly, businesses may increase their prices if demand is strong. To prevent these higher expectations from becoming a reality, the SARB may need to raise interest rates. Conversely, if inflation expectations and other indicators decline, the opposite actions might be taken.

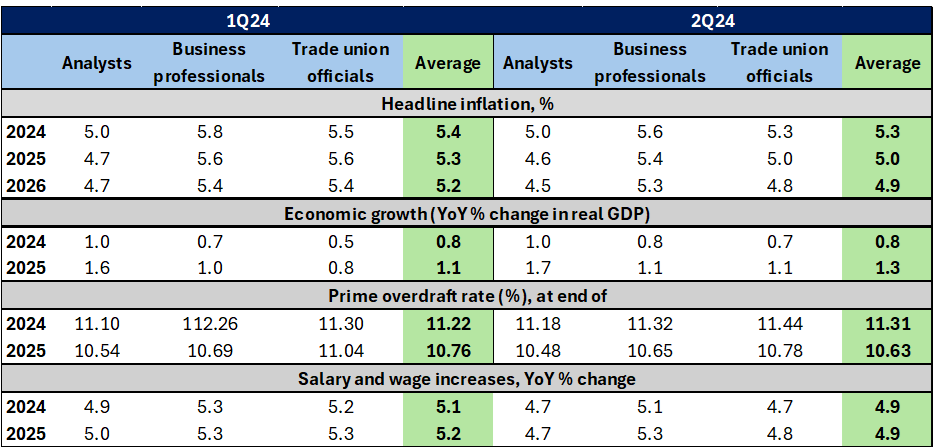

The 2Q24 BER survey of inflation expectations reveals that in South Africa (SA), these expectations have gradually started to decline. In 2Q24, average inflation expectations for 2025 and 2026 decreased by 0.3%, settling at 5.0% and 4.9%, respectively. All social groups reported lower inflation expectations during the quarter, with labour unions showing the most significant improvement. Their expectations for 2025 and 2026 dropped sharply by 0.6 ppts to 5.0% and 4.8%, respectively. The expectations from businesses decreased modestly, remaining at 5.4% for 2025 and 5.3% for 2026. Analysts’ expectations also fell slightly, making them the only group to anticipate inflation reaching the midpoint of the SARB’s target range within the next two years. Notably, average long-term (5-year) inflation expectations further softened, dropping 0.4 ppts to 4.9%, marking the first reading below 5.0% since 2021. Furthermore, on average, the various survey respondents lowered their forecast of the increase in salaries and wages in 2024 and 2025. Expectations are now for wages to rise by 4.9% in both years, compared to expectations of slightly above 5% previously.

Figure 1: A summary of the BER inflation expectations survey

Source: BER, Anchor

This continued easing of inflation expectations is a positive development for the SARB MPC ahead of its meeting on Thursday, 18 July. However, the MPC will likely remain concerned that the expectations of businesses and labour unions, which play a significant role in price formation, remain in the upper half of the target range over the longer term. We anticipate that the MPC will keep the repo rate unchanged next week. The central bank has remained steadfast in communicating that it will not move the policy rate lower (and thus essentially usher in a rate-cutting cycle) until inflation is under control and sustainably hitting that target. As such, we foresee potential rate cuts materialising towards the end of 2024, depending on the inflation outlook (locally and abroad) and global interest rate developments as we progress further into this year. At this stage, we expect an initial rate cut of 25 bps in November, followed by a further 50- to 75-bp worth of cuts in 2025 and leading into 2026.