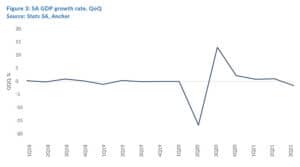

After the first wave of the COVID-19 pandemic hit in early 2020, triggering a collapse in global economies and financial markets alike, central banks across the globe responded by rolling-out unparalleled levels of stimulus measures. The SARB was no different, cutting the repo rate by a cumulative 300 bpts in response to the onset of the pandemic. All in all, the extraordinary amount of monetary policy easing in 2020 supported the SA economy in its recovery from the depths of the COVID-19 induced slump. Since lowering the repo rate to record lows in 2020, the SARB maintained these highly accommodative monetary policy settings through most of 2021. However, with inflationary pressures mounting, and global economic activity having recovered faster than initially expected the policy challenge for monetary authorities is shifting from solely supporting the economy to aiding the recovery, whilst also managing inflation risks and keeping inflation expectations anchored. Consequently, the SARB’s MPC hiked rates by 25 bpts at its November MPC meeting in what we believe was a pre-emptive move to signal its commitment to anchoring inflation expectations, and to prevent falling behind other key global central banks such as the US Fed (failure to do so would be highly detrimental to the rand). As such, our interpretation is that one hike now probably softens the need for more drastic action later.

In the November MPC post-announcement Q&A session, SARB Governor Lesetja Kganyago clarified that, given the nature of the upside risks to the inflation outlook, the MPC should not necessarily have to wait for second-round effects to materialise as this might leave it too late. It is, however, a fine line to manage, with no clear consensus on either side. This is evident by the fact that the MPC itself had no clear consensus in the November meeting, with three members voting for the rate hike and two members voting to keep the repo rate on hold. Nonetheless, the return to a rate-hiking cycle has now officially begun, with the key question being how fast the pace of normalisation is going to be.

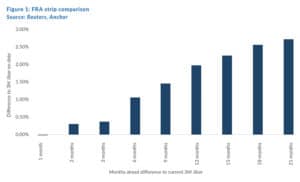

In this respect, there is a considerable difference between analyst consensus and financial market expectations as expressed in the forward rate agreement (FRA) market. Figure 1 below shows the difference between the current 3-month Johannesburg Interbank Average Rate (JIBAR) and the par rates for relevant future dates (1,3,6 months ahead etc.). At the time of writing, the FRA market was fully discounting further rate hikes worth about 180 bpts over the next 12 months. Given that the SARB will have six meetings between now and the end of 2022, this implies some mix of 25-bpt and 50-bpt hikes. We continue to believe that the SARB will hike carefully and incrementally by 25 bpts each, in the region of 3 to 4 hikes (thus a cumulative level of around 75-100 bpts) for 2022.

Whilst volatility in FRA market rates is not unusual, we view the current FRA market pricing as being too hawkish especially given that SA’s inflation rate is well within the SARB’s 3%-6% target range and is expected to remain around the mid-point of that target range over the medium term. Furthermore, SA’s current account surplus helps to cushion the risk of a big exchange rate response to external shocks. Generally speaking, the pace of tightening implied by the FRA curve is in contrast to the SARB’s stated preference for gradualism in the face of uncertainty. Therefore, whilst we agree that we are now officially entering a hiking cycle, we believe that the pace of normalisation will be gradual as overall economic growth remains muted with significant downside risks ahead and consumer inflation is generally muted outside of the effects of fuel price shocks. The MPC itself appeared to offer some forward guidance in its November statement when it said that “… given the expected trajectory for headline inflation and upside risks, the committee believes a gradual rise in the repo rate will be sufficient to keep inflation expectations well anchored …” even as it stressed the continued data dependency of its future decisions.

Nonetheless, it is difficult to know exactly what the MPC defines as ‘gradual’ as this can be interpreted in many ways. However, as mentioned previously, we do see further repo rate hikes proceeding at a modest pace at magnitudes of 25 bpts at alternate MPC meetings, particularly given that survey-based inflation expectations remain anchored at the mid-point of the SARB’s target range. Still, it is important to note that the MPC is clearly concerned about upside inflation risks. Therefore, a further increase in upside risks to inflation, a further weakening of the rand or a clear manifestation of second-round inflation effects at the CPI level or signs of a de-anchoring of inflation expectations from the mid-point of the target range could accelerate the front-loading of the tightening cycle. Thus, the above-mentioned factors will require careful monitoring.

Interestingly, the SARB’s quarterly projection model (QPM) has forecast 10 interest rate hikes of 25 bpts each (including the one delivered at the November meeting) to the end of 2023. This was, however, slightly less hawkish than at the September MPC meeting, when the QPM embedded 11 hikes of the same magnitude. Whilst the QPM remains a critical input into the overall monetary policy process, as stated by the most recent Monetary Policy Review, the QPM “… it is not equivalent to the MPC’s role … “ – which at the end of the day is to carefully assess the balance of risks in a highly uncertain environment.

Consequently, it is important to further note that the QPM also does not directly factor an employment variable in its calibration. Employment has significantly lagged the overall recovery in economic activity and could form another factor that the MPC will closely monitor in its deliberations (even though employment is not a formal policy objective of the SARB). Thus, this should further support a gradual normalisation path. Therefore, we maintain a more dovish approach than most, and we believe that the SARB will hike carefully and incrementally by 25 bpts each, in the region of 3 to 4 hikes (a cumulative level of around 75-100 bpts) for 2022.