There is a generally held belief in investing that there is no more powerful force than the power of compounding. Albert Einstein referred to it as the eighth wonder of the world, noting that, “he who understands it, earns it … he who doesn’t … pays it”. Without questioning this statement (after all, Einstein was a smart guy and the notion is absolutely true), it implies that we have to stay invested. By this I mean that we can only benefit from the power of compounding if we are invested long enough to see it work its magic

During several recent conversations with non-financial (and even some financial) folk, I’ve been struck by how poorly many of us understand compounding – not only what it is but also what it can do over an extended period. So that we’re all on the same page: compound returns are the returns you earn on the returns you’ve already earned. In other words, if you invest R100 and earn a return of 10% in the first year, you earn R10 and have R110 at the end of that year. If you earn a further 10% in the next year, you earn R11. You’ve earned a return on the original R100 you invested and the R10 return you earned last year.

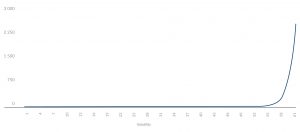

Over many years this is an extremely powerful force, just ask the man (according to legend) rewarded by a Chinese emperor with one grain of rice doubled for every square on a chess board. There was not enough rice in China to pay him. The emperor, like many of us, did not grasp the power of compounding. One grain of rice doubled for every square on a chess board (there are 64) results in 18,446,744,073,709,551,615 grains of rice. That’s 18 quintillion grains of rice. To put that in context, there are an estimated 7.5 quintillion grains of sand on earth (deserts and beaches included). Figure 1 below illustrates the effect of the doubling.

Figure 1: The power of compounding returns

Source: Anchor

The important point to note from Figure 1 is not the absolute number, but rather the massive change in the number from year 56 to year 64. Imagine if this was your investment. It seems as though the value doesn’t move for 56 years then, suddenly, it takes off. This is what happens when we stay invested for long periods.

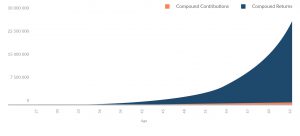

The South African stock market has returned an average of around 14% per year since data began being recorded. If you are 55 years old today and had been investing R1,000 per month since age 25, you would have just under R6mn today.

If you keep making that same R1,000 monthly investment for the next ten years and stay invested until the age of 65, you would have around R24mn with which to retire. In other words, over the additional ten years you would have contributed only R120,000 but your investment value would have increased by R18mn. Over the 40 years of contributing to your investment, you would have invested R480,000 and earned over R23mn in compound returns.

Figure 2: Contributions vs compound returns

Source: Anchor

This is a pretty handy outcome. Unfortunately, it’s one few people achieve.

If the power of compounding is the most powerful force in investing, then staying invested is the most difficult thing in investing. We have numerous behavioural biases (pre-existing inclinations or ideas that influence the way we see things and make decisions), which make us almost wired not to remain invested.

We tend to withdraw money at the time of greatest pessimism (the current environment is a good example, as is the GFC of 2008); we place too much emphasis on our most recent experience; and we experience losses far more intensely than we experience gains.

These are just a few of the behavioural biases we face as investors.

The best way for us to overcome these is to treat our portfolios as truly long-term investments. This means we buy with a long-term view, we don’t get swayed by short-term headlines and price movements, and we always refer to our original goal – taking advantage of the power of compound returns.

There are many examples throughout history that show the value of this approach. The 2008 crash is one and the drop in the market during the fourth quarter of 2018 is another. The pain of 2008 is well known. During the last quarter of 2018, the market was down nearly 10%. Many investors felt the pressure and chose to pull their money out of the market. Since that point in mid-December, the market is up over 13%. Since the 2008 high (i.e. not the bottom of the crash), the market is up over 70%. Those who withdrew their money at the height of the pain during either example, had the worst experience and suffered material losses. Those who rode out the volatility and remained invested, made back well more than they were down. A long-term view and focus on the original goal paid off.

One of the reasons clients pay us to manage their money is to ensure they don’t get sidetracked on the journey to achieving their long-term goals. We understand that the journey is fraught with obstacles and change. We are here to help you navigate that change and to benefit from the magic of compounding returns.