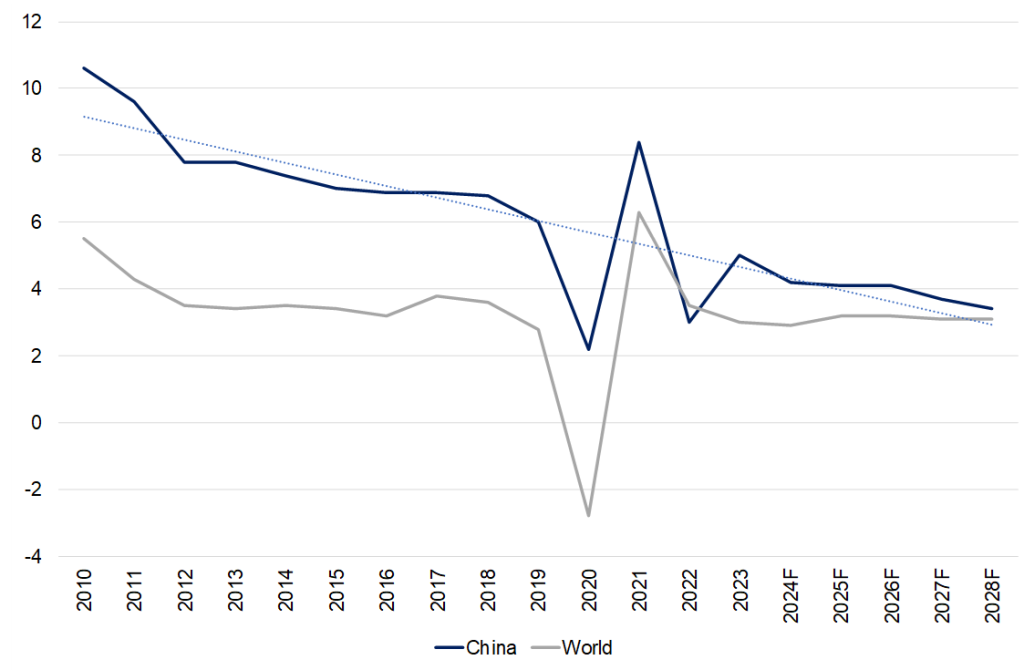

China’s economy averaged a 5.2% YoY GDP growth rate in 2023, slightly above the official 5.0% target. However, China’s recovery has been far shakier than many analysts and investors had expected. By and large, expectations were that the world’s second-largest economy would post a strong recovery post-COVID-19. These expectations quickly dissipated as 2023 progressed, with weak consumer and business confidence, mounting local government debts and slowing global growth weighing heavily on jobs, activity, and investment. Overall, China’s growth is slowing in the face of cyclical and structural headwinds. In the near term, the continued spillover from the pandemic, the deep contraction in its real estate sector (which in recent decades has driven China’s high growth rate, accounting for c. 20% of activity according to the IMF), and weaker global growth are leading to significant drags on growth. At the same time, a secular decline in productivity growth and demographic headwinds (amid geoeconomic fragmentation pressures) are weighing on China’s medium-term growth prospects.

Figure 1: China vs world real GDP growth, YoY % change, 2010 to 2028F

Source: IMF, Anchor

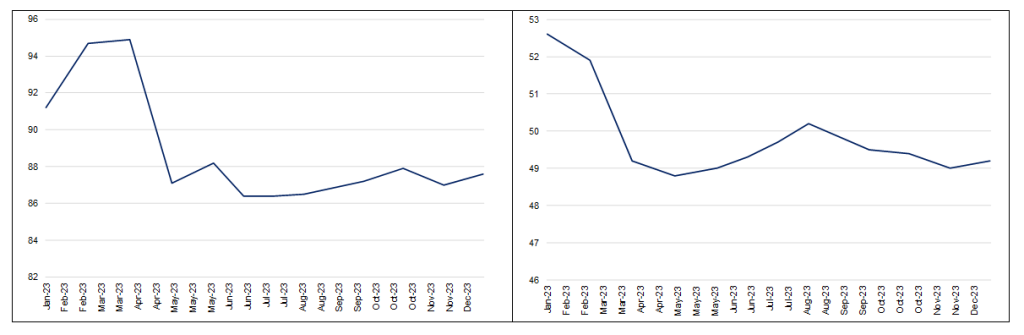

Without a doubt, China’s growth slowdown is deepening. For 2023, almost every economic indicator (think exports, manufacturing, real estate, consumption, credit, and stock markets) has disappointed. Furthermore, China’s surveyed urban unemployment rate inched up to 5.1% in December 2023 (4Q23) from 5.0% in 3Q23, the lowest jobless rate since November 2021. The highly contested youth unemployment rate in China (for 16-24-year-olds) stood at 14.9% in December 2023. That figure excluded students and can be compared to the 21.3% print in June before the National Bureau of Statistics of China (NSB) suspended releasing such data for five months.

Figure 2: China consumer (Lhs) and business confidence (Rhs), YoY % change, 2010 to 2028F

Source: NBS, Anchor

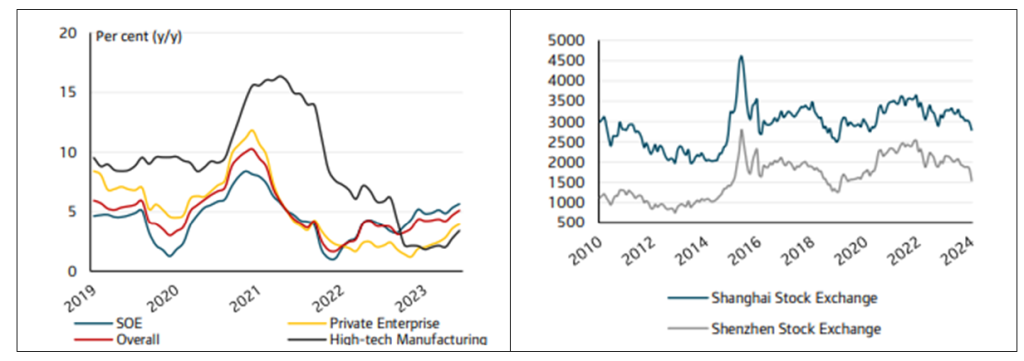

Figure 3: China industrial production (Lhs) and mainland China equity prices (Rhs), YoY % change, 2010 to 2028F

Source: STB

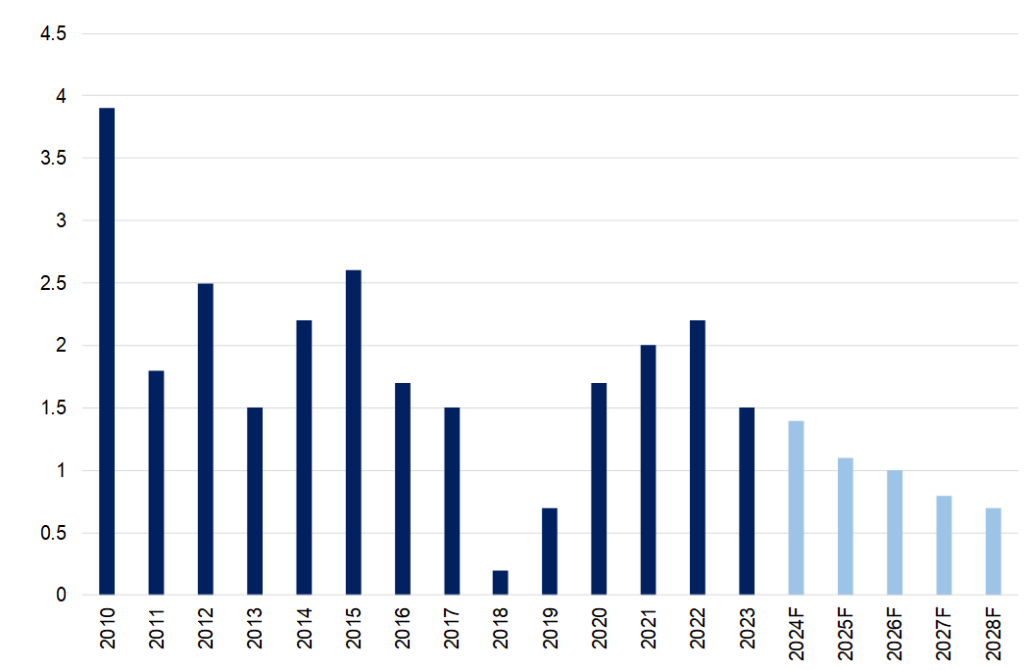

Figure 4: China’s current account balance as a percentage of GDP, 2010 to 2028F

Source: IMF, Anchor

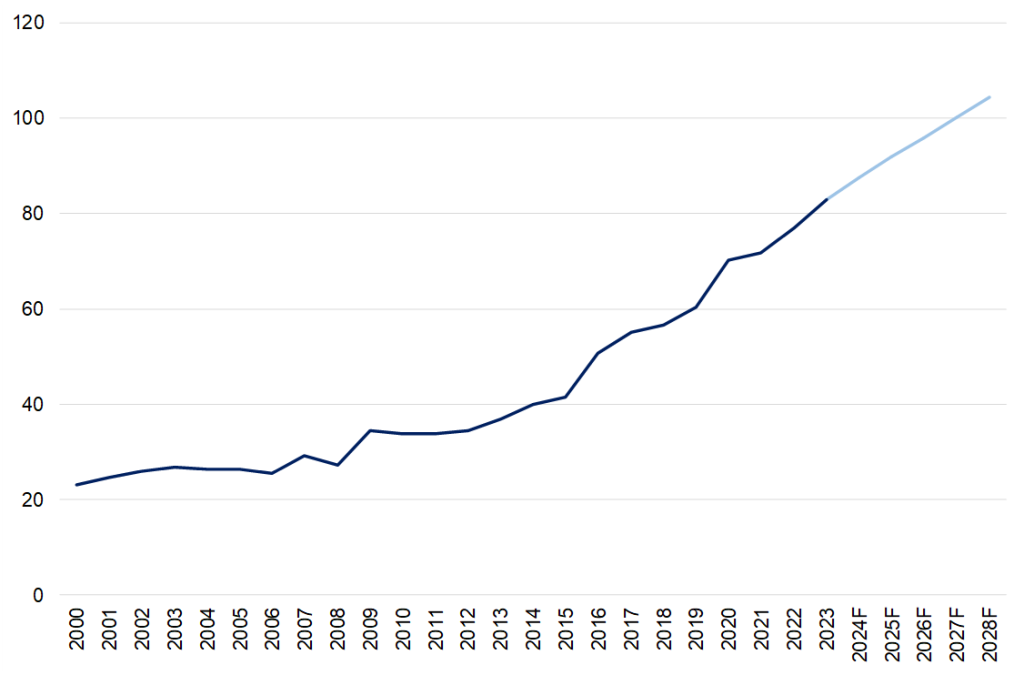

Figure 5: China’s general government debt as a percentage of GDP, 2010 to 2028F

Source: IMF, Anchor

It is becoming increasingly clear that China’s structural policy trends cloud its medium-term growth prospects. Furthermore, productivity growth remains weak, driven by low-productivity state-owned enterprises (SOEs) and diminishing business dynamism. The absence of reforms to ensure fair competition between SOEs and privately owned firms further exacerbates the issue. Moreover, due to growing geoeconomic tensions, SOEs are under pressure to excel in strategically vital sectors and technologies, adding to their already heavy burden. Efforts to standardise domestic markets and curb anti-competitive practices at the local level have primarily relied on voluntary compliance by local governments. Additionally, non-market factors increasingly influence credit allocation, with credit policies using lending targets to bolster specific sectors. The recent introduction of a “traffic-light” system for capital allocation suggests a trend towards more directed guidance from China’s authorities for private capital allocation.

Thus, China’s economic weakness is clearly becoming more of a structural story rather than simply a cyclical downturn that bottomed out in 2023. The question then is, what would it take for China to continue growing at the Chinese authorities’ desired rate? Policy insiders expect Beijing will maintain a similar growth target of around 5% this year, but that may be a tall order even with additional stimulus. Looking further ahead, for China to continue to maintain growth rates of 4% to 5% p.a., the choice for Chinese authorities is relatively stark – to look past the shallow policy surface of economic rebalancing instituted through base effects and the usual forced investment stimulus and instead pursue genuine and sustainable economic rebalancing and restricting. Given the current state of economic affairs, pumping up economic growth through investment stimulus and maintaining rapid credit growth is becoming less and less effective as China’s economy matures.

The type of growth strategy China chooses to pursue is becoming an increasingly contested and discussed topic globally- particularly as global constraints continue to tighten. As trade-orientated conflict continues to increase globally (particularly among the likes of the US, the EU, China, India and Japan), the results will become increasingly painful for countries such as China that rely on large trade surpluses to balance weak domestic demand with a significant overreliance on manufacturing to drive economic growth. This is primarily because, without sustained trade surpluses, there are only two real ways a country can balance excess supply and weak demand. The first way is via a disruptive and untenable domestic production collapse – such as in the US during the 1930s Great Depression when the country struggled to resolve its significant trade surplus in a contracting global economy. This was exacerbated by trade and currency policies structured to protect individual nations while adversely affecting neighbouring countries (or beggar-thy-neighbour policies). The second way is to boost domestic demand as quickly as possible.

For China to sustain its high growth rates in the coming decade without keeping its investment and manufacturing shares of GDP at current levels, the only viable option is to increase its GDP consumption share significantly. Although some Chinese economists and policymakers contend that there is no immediate necessity to transition from heavy reliance on investment to a more consumption-driven growth model, a prevailing view among most Chinese economists is that such a shift is indeed imperative. From a straight arithmetic perspective, the widely lauded Carnegie Endowment for International Peace think tank estimates that if China wanted to maintain GDP growth rates of 4% to 5% (the generally assumed target), the country’s central authorities would have to engineer policies that caused consumption to grow by at least 6%–7% p.a., with investment growing at roughly 1% p.a. Simply put, any lower consumption growth rate would mean that China would not be able to rebalance its economy within a decade and still maintain current GDP growth rates. With consumption in China growing at roughly 4% p.a. before the pandemic (and much less since), is a 6%–7% growth in consumption even possible? As it stands, no country in history at China’s current stage of economic development has prevented consumption from decreasing, let alone driving it to increase at such a rate.

While it is not impossible, it will be incredibly difficult for China’s authorities to rebalance the economy in such a way. A decrease in investment growth equates to less infrastructure spending – which has formed China’s economic policy crux for a long time. The only real way to accelerate consumption growth sustainably is to get household income growth to accelerate through transfers — either directly (such as through wages and other income) or indirectly (i.e., through a stronger social safety net). Due to China’s unique structural set-up, the government is the only sector that can facilitate and pay for such transfer levels. Bear in mind that China has two levels of government: the Beijing central government and local governments. Considering the structure of the payment system and social welfare schemes in China, coupled with Beijing’s clear stance against absorbing diverse debt and adjustment expenses, it is highly improbable that Beijing will be inclined to shoulder the entirety of transfer costs – particularly through central government borrowing. That leaves local governments to shoulder the burden. However, the task of transferring such a significant portion of assets from local governments will pose considerable challenges. Such extensive transfers will spark political controversy and necessitate a comprehensive overhaul of various elite business, financial, and political entities at the local and regional levels.

Given that China’s economy has been shaped over four decades by both direct and indirect transfers from households to support manufacturing and investment (manifested through accessible and inexpensive credit, limited wage growth, an undervalued currency, excessive infrastructure expenditure, a fragile social safety net, and other explicit and implicit means) it would be exceedingly surprising if China’s manufacturing competitiveness and its capacity for large-scale infrastructure investment were not deeply intertwined with these transfers.

The question then remains: where does that leave China? Unless the rest of the world’s nations are prepared to alter their strategic economic objectives to align with China’s growth aspirations, current global constraints suggest that China cannot expand its share of global GDP without significantly curbing investment and manufacturing growth rates. The sole feasible approach to accomplish this without a drastic decline in GDP growth would entail a substantial increase in consumption growth. This, in turn, would necessitate a reversal of the historical trend of transfers, with the government being the only sector capable of funding such transitions. In addition, it would require either a transformation in the structure of China’s government (highly unlikely) or (as has been the case in most other countries that have faced this issue) an acceptance of much lower growth rates to come.

As such, any signs of ‘green shoots’ in the Chinese economy will only raise false hopes of a recovery as structural economic constraints (vs cyclical) and additional political dynamics continue to prevent a sustainable growth rebound. The consolidation of power at the top of China’s government structures has further stifled any policy debate or more ‘open-thinking’ just as China’s past growth engines have begun to stutter. As a result, there seems to be very little that China’s authorities will (or can, for that matter) do to reverse the country’s declining growth trend.