On 30 October, South Africa’s (SA’s) Minister of Finance Enoch Godongwana delivered the 2024 Medium Budget Policy Statement (MTBPS). The MTBPS plays an important role by providing a mid-year review of fiscal performance around the targets set in the February Budget, noting any reallocations or adjustments to spending that have become necessary since the Budget was approved. Additionally, it recalibrates the Medium Term Expenditure Framework (MTEF), offering insight into shifting priorities and their impact on fiscal planning. The 2024 MTBPS was presented amid a moderately improved economic outlook and the establishment of the Government of National Unity (GNU), which has pledged its commitment to prudent fiscal policy aimed at stabilising debt. Notably, this formed the GNU’s first comprehensive fiscal policy statement just over 100 days into its tenure.

As anticipated, the government remains committed to achieving debt-stabilising primary budget surpluses, with the National Treasury (NT) set to release a discussion document on potential alternative long-term fiscal anchors in March 2025. While some fiscal slippage occurred compared to the 2024 Budget forecasts, it was largely in line with near-term expectations, though it exceeded projections slightly over the medium term. Notably, the MTBPS underscored a strong focus on growth and fiscal reforms. Although spending risks remain, including potential support for state-owned enterprises (SOEs, such as Transnet) and municipalities, the NT has emphasised that it typically avoids direct bailouts for sub-national governments, opting for alternative support measures instead.

Whilst the NT acknowledged that the issue of SOE bailouts persist, no additional funds have been allocated in the budget to address this. State-owned companies continue to face financial strain; despite some notable operational improvements, such as those at Eskom, most large SOEs still report net losses and fail to meet performance targets. Many remain unable to fund their operational and debt commitments fully. The medium-term fiscal strategy focuses on limiting further financial support to SOEs while addressing the debt obligations of Eskom and the South African National Roads Agency Limited (SANRAL) to allow for critical investments in electricity and road infrastructure.

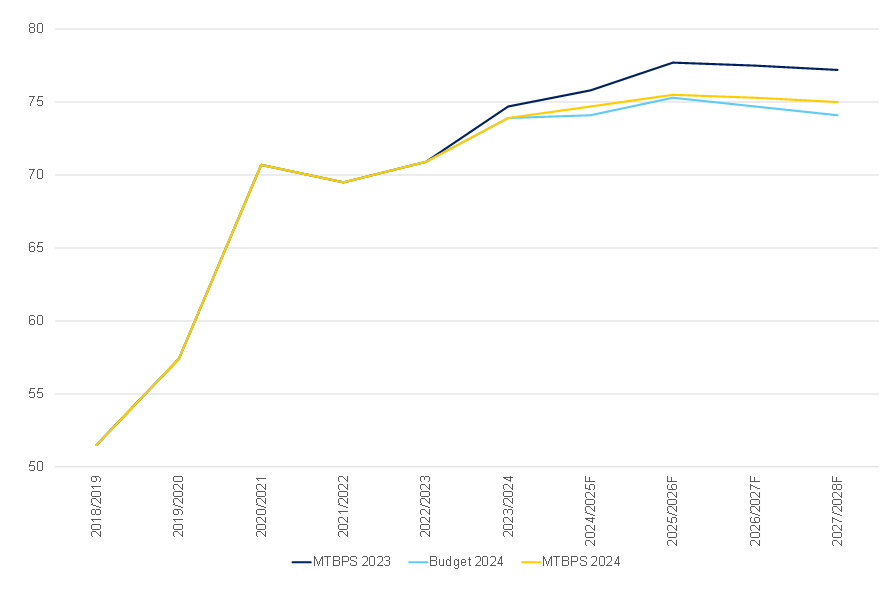

Overall, the fiscal strategy remains steady, yet the extent of slippage, though moderate, is disappointing. The combination of revenue shortfalls and a sharp rise in expenditures has resulted in a wider deficit in the 2024 MTBPS compared to the February Budget Review. Nevertheless, despite this larger fiscal deficit, the deficit trajectory shows improvement over the MTEF. The primary surplus for the main budget is expected to grow over the medium term to support debt stabilisation by 2025/2026, with the main budget deficit projected to decline from 4.7% of GDP in 2024/2025 to 3.4% by 2027/2028. According to the 2024 MTBPS projections, gross loan debt is anticipated to increase from R5.62trn in 2024/2025 to R6.82trn by 2027/2028, influenced by the budget deficit and variations in interest, inflation, and exchange rates. Gross loan debt as a share of GDP is projected to stabilise at 75.5% in 2025/2026.

Figure 1: SA government debt forecasts as percentage of GDP, %

Source: National Treasury, Anchor

Revenue collection remains weak, though spending pressures present a more significant challenge. Gross tax revenue collection is currently below the 2024 MTBPS forecasts, with some recent improvement in corporate income tax (CIT) collections in August. The fuel levy is the only component outperforming the MTBPS forecast, mainly because projections were sharply revised downwards (by R13.4bn) for FY24 due to reduced fuel demand and substantial one-off diesel refunds (R8bn). Out of the R22.3bn revenue shortfall for FY24, other weak areas include VAT, personal income tax (PIT), and customs duties, which have collectively been revised down by R257bn since the February Budget Review.

VAT collection was down 1% YoY in August 2024 – a slight improvement compared with July’s 3% YoY decline. However, it still falls short of the NT’s targeted growth rate of 3.6% YoY, reflecting weak consumer spending for much of this year. A recovery in this category is anticipated in the second half of the fiscal year (October 2024 to March 2025) due to lower consumer debt-servicing costs and withdrawals from the two-pot pension system, which will boost consumer spending power. The NT had initially accounted for just R5bn in tax windfalls from the two-pot pension drawdowns, but as of 29 October 2024, the SA Revenue Service (SARS) has confirmed a direct tax liability of R7.1bn from these withdrawals. This, combined with VAT from increased consumer spending, may result in slightly stronger revenue collection than MTBPS estimates in the VAT category.

Total consolidated expenditure overruns over the MTEF amount to R92bn despite no significant increases in allocations for SOE bailouts or social grants. Key expenditure drivers include R11bn for early retirement measures (an estimated 30,000 public servants are expected to opt for this), wage bill increases totalling R27bn (inclusive of the early retirement rise), R13.3bn for SANRAL debt repayments, R3.5bn for SA National Defence force (SANDF) deployments in the DRC, R16.55bn for higher debt-service costs, and R1.4bn for local government elections. Expenditure growth for FY24 has been revised upwards from 4.4% in the February Budget Review to 5.3% in the 2024 MTBPS.

Looking ahead, the major risks are largely unchanged since the 2023 MTBPS, including lower revenue growth due to anaemic economic growth, a higher-than-anticipated public-service wage settlement, and increased borrowing costs driven by a prolonged high-risk premium. Persistent deficits and accumulating liabilities in other areas of the public sector, such as SOEs, further present risks that may lead to increased demands for budgetary support. Overall, the MTBPS serves as a reality check for those with unwavering optimism regarding the GNU. Debt projections have risen modestly, reflecting lower tax collections and increased spending. While the figures themselves are not overly concerning, and the budget appears credible, there is a growing concern about how this may impact the positive reform narrative fostered since the inception of the GNU.