South Africa’s (SA) precarious fiscal situation has again come under the spotlight with the tabling of the 2023 Medium Term Budget Policy Statement (MTBPS) on 1 November. Whilst the MTBPS typically serves as an update on the primary budget set in February, this year, it carried added significance due to the substantial deterioration in the country’s fiscal health. Although Finance Minister Enoch Godongwana clearly acknowledged SA’s deteriorating fiscal picture, little detail was provided about the exact steps to be taken regarding the promised fiscal correction. That will likely only become clear in the main budget, to be presented in February 2024. Regardless, Godongwana appeared to have largely reassured markets that a credible rebalancing process is underway. Much emphasis was placed on fiscal consolidation being implemented through spending reductions and efficiency measures across government, with the 2024 Budget proposing that fiscal consolidation will be implemented through spending reductions and efficiency measures across government.

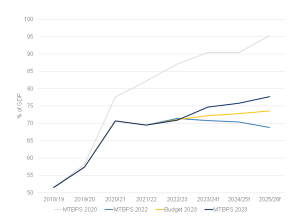

As largely expected, FY23/FY24 revenues are forecast by the National Treasury (NT) to be around R56.8bn lower than projected in Budget 2023. This is primarily because of lower commodity prices, weaker global growth, increased loadshedding and the various logistical constraints that have weighed heavily on mining sector corporate tax collections. The budget deficit is now expected to come in at 4.9% of GDP for FY23/FY24, with debt projected to stabilise at 77.7% of GDP in FY25/FY26, compared to 73.6% in the 2023 Budget. This increase is mainly due to a rise in the main budget deficit. Unsurprisingly, the social relief of distress (SRD) grant will be extended for another year to FY24/FY25 while a comprehensive review of the entire grant system is finalised.

Figure 1: SA government debt forecasts

Source: National Treasury, Anchor

Overall, it appears that, for now, the government has mitigated the fiscal consequences of reduced revenues and overspending on the wage bill by lowering non-wage expenditures. In essence, aside from utilising unspent funds, anticipated underspending, and the contingency reserve, government departments are tasked with absorbing the additional wage expenses through reallocations and effective headcount management, with exceptions made in labour-intensive sectors such as education, healthcare, and the police to safeguard the delivery of essential services.

As such, the 2023 MTBPS has been viewed as slightly positive by the bond market, particularly given the government’s expenditure adjustments to stem the fiscal slippage. Furthermore, NT has announced that the size of weekly domestic bond auctions will be unchanged, which likely implies more switch auctions and/or more funding from the planned Sukuk bond (an Islamic finance debt instrument) and/or floating-rate note auctions. At the end of the day, however, SA’s medium- to long-term fiscal trajectory requires a credible economic growth reform agenda, without which fiscal sustainability will not be possible. Much rests on the hope of forming a coherent and stable government after the 2024 Elections.