In the realm of personal finance, the tax-free savings account (TFSA) stands as a pivotal yet often underappreciated instrument. Its ability to significantly impact one’s path towards financial freedom should not be underestimated. The TFSA distinguishes itself by offering unparalleled tax advantages, primarily by exempting all earnings — interest, dividends, or capital gains — from taxation. This is in stark contrast to other savings vehicles like retirement annuities (RAs), which offer immediate tax relief on contributions but do not provide the same tax-exempt growth.

Contribution Limits and Effects

An individual can contribute up to R36,000 p.a. to a TFSA, with a lifetime limit of R500,000. While these limits might seem restrictive, the absence of taxes on the account’s growth can result in significant savings, especially when considering the impact of compound interest over time. The power of compounding interest in a TFSA is substantial. The earlier you start contributing, the more time your money has to grow. Regular contributions, even if they are small, can add up over time.

Flexibility in Withdrawals

Unlike certain retirement accounts, TFSAs offer the flexibility to withdraw funds anytime without incurring taxes. This aspect makes TFSAs an excellent choice for both short-term savings goals and as part of a long-term investment strategy. While you can withdraw money from your TFSA anytime, doing so reduces the potential for compound growth. Consider your TFSA as a long-term investment and try to avoid early withdrawals.

Tax-Exempt Growth

The most significant benefit of a TFSA is the exemption of any gains from taxes within the account. This includes interest, dividends, and capital gains, which can accumulate tax-free over time. This feature is particularly beneficial for long-term investments, as it allows the power of compounding to work unhindered by tax implications.

Comparative Analysis: TFSA vs Taxable Investments

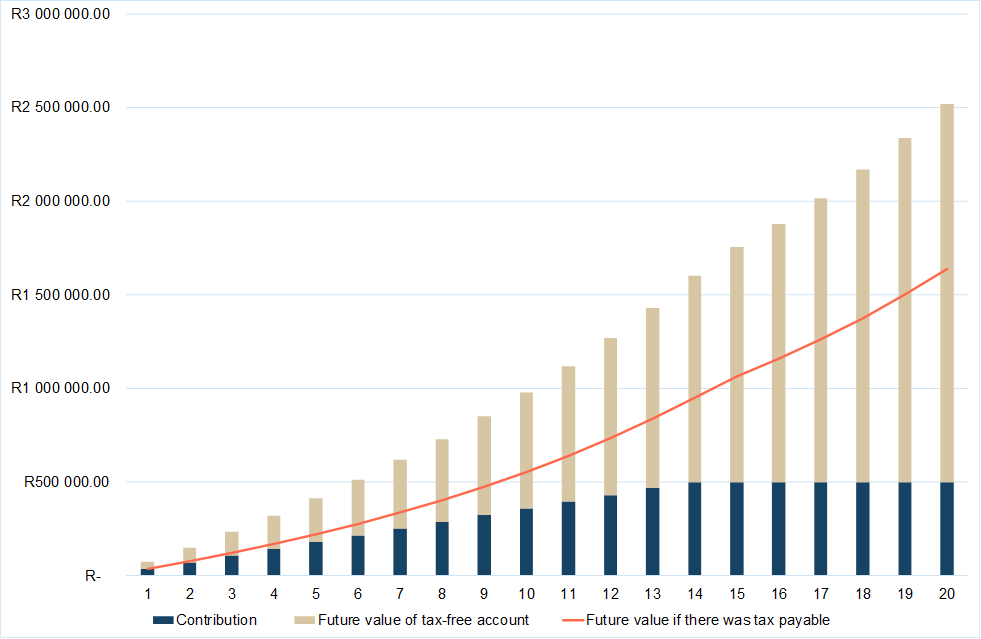

The benefits of a TFSA are best shown by way of example. Below, we have a projection of a TFSA based on the following assumptions:

-

- An individual contributes the annual maximum of R36,000.

-

- We cease contributions when we reach the overall lifetime limit of R500,000.

-

- We assume a 10% p.a. growth rate and an inflation rate of 6% p.a.

-

- To illustrate a comparison, we assume an overall 25% tax rate on returns.

Figure 1: Example of a TFSA vs a taxable investment over 20 years

Source: Anchor

Boost your TFSA returns: Try our calculator!

Countering Common Misconceptions

A common argument is that a TFSA is not worth it as investor returns fall below interest and capital gain thresholds. This argument is correct for the first five years of the tax-free investment; however, this changes as time goes by, and the compounding effect sets in, as seen in Figure 1 above.

Strategies for maximising the tax benefits of TFSAs

Estate Planning Benefits

As mentioned, funding a spouse’s TFSA has estate planning advantages. Since assets in a TFSA are not subject to estate duty and do not form part of the deceased’s estate, contributing to a spouse’s TFSA is an effective way to transfer wealth tax efficiently upon death. This strategy ensures that a significant portion of one’s wealth can be passed on to the next generation without the burden of estate taxes.

Contributions to a TFSA on behalf of a spouse

In South Africa (SA), gifting money to a spouse for their TFSA contribution is exempt from donations tax. This allows the family’s breadwinner to fully utilise their and their spouse’s TFSA contribution limits, doubling the family’s tax-free investment capacity. It is a practical approach to maximising the family’s collective tax-free savings.

Opening a TFSA for Children

A less commonly known strategy is to open a TFSA in a child’s name from the time they are born. Although the contribution limits remain the same, starting early significantly enhances the power of compound interest. This is a prudent way to save for a child’s future expenses, such as education or a first car, while enjoying the tax-free benefits. A parent or guardian would manage the account until the child reaches legal age.

Concluding Perspective

The TFSA is not merely a tax-advantage savings tool but a strategic instrument for achieving financial freedom. When leveraged effectively over time, its unique tax benefits can lead to substantial investment growth, far exceeding the limitations set by annual and lifetime contribution caps. By integrating TFSAs into a diversified financial plan, individuals can maximise their savings potential and accelerate their journey towards financial independence.