In the dynamic landscape of personal finance, individuals are increasingly seeking avenues that not only secure their financial future but also provide tax-efficient solutions. One such powerful tool in South Africa’s investment arsenal is the Retirement Annuity (RA). This article explores some of the advantages of RAs, with a focus on tax efficiency and other compelling benefits that make them a smart choice for savvy investors.

Understanding the Basics: What is a Retirement Annuity?

A Retirement Annuity is a long-term savings vehicle designed to help South Africans build a nest egg for their retirement years. Governed by the Pension Funds Act, RAs offer a disciplined and structured approach to retirement planning. Investors contribute via either a recurring debit order or lump sum payments, creating a pool of funds that is invested to grow for the long-term.

Tax Efficiency – The Cornerstone of Retirement Annuities

One of the most significant advantages of investing in a Retirement Annuity is the tax benefits on offer. All contributions to RAs are tax-deductible, meaning investors can reduce their taxable income by the amount invested, up to certain limits. This not only provides immediate and meaningful tax relief, but also encourages a disciplined approach to long-term savings.

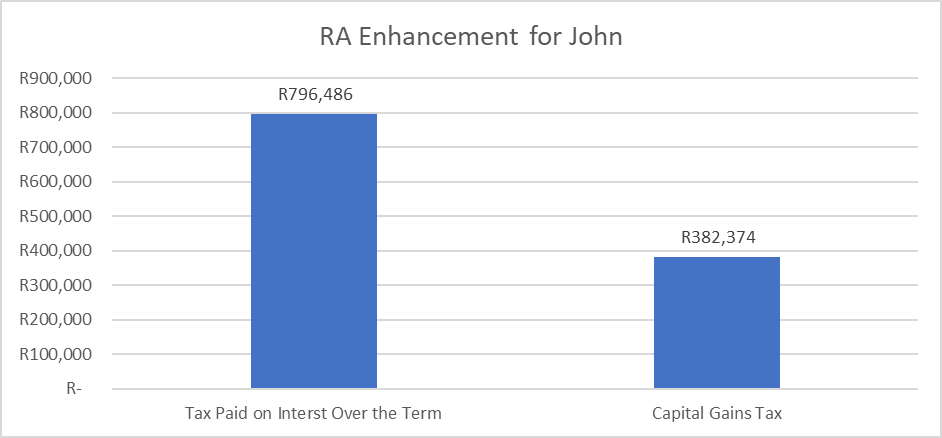

Furthermore, the growth within the RA is entirely tax-free. Unlike many other investment vehicles, the returns generated within the RA are shielded from capital gains tax, dividends tax, and tax on interest. The tax efficiency significantly enhances the compounding effect, allowing investors to accumulate more wealth over the years. Let’s take a practical example-

John and Mike are 30 year old, twin brothers.

Both invest R120,000 per year into a balanced portfolio using a recurring monthly debit order for their savings. John invests via an RA while Mike invests directly into the Balanced Fund. What happens at age 55?

Assuming the funds returns an average of 9% per year, then John and Mike would each have a value of just over R10mil at age 55 (assuming Mike pays the tax out of his own pocket every year allowing the capital to grow at the same rate as John).

So what’s the big deal if they get to the same point?

Over the 25 years Mike would have paid a whopping R800,000 in tax while mike would have paid nothing. Even more compelling is that Mike’s investment is still pregnant with Capital Gains. This means that when he sells the investment to fund income at retirement, he still has to pay Capital Gains tax at a cool R 382,000 (assuming 1/3rd of the portfolio is made up of capital gain, and Mike’s average rate of tax is 30%).

That’s a difference in value of R1,1mil on tax alone. These are all of course assumptions, but I have been quite generous to Mike. In reality the tax savings could be even higher.

Tailoring Your Investment Strategy

Beyond tax efficiency, Retirement Annuities provide investors with the flexibility to tailor their investment strategy. Individuals can choose from a range of investment portfolios based on their risk tolerance, investment horizon, and financial goals. Whether one prefers a conservative approach with a focus on capital preservation or a more aggressive strategy targeting higher returns, RAs can be customized to suit individual preferences.

Plan your future: Explore the Retirement calculator!

Safeguarding Against Market Volatility

Another compelling aspect of Retirement Annuities is their ability to mitigate the impact of market volatility. The long-term nature of these investments allows individuals to weather short-term market fluctuations and benefit from the compounding effect over time. This stability is particularly crucial when considering the unpredictable nature of financial markets.

Accessing Your Nest Egg at Retirement

Upon reaching retirement age, investors can start reaping the rewards of their disciplined savings. A portion of the accumulated funds can be taken as a lump sum, providing retirees with financial flexibility. The remainder is typically used to purchase a life annuity, ensuring a steady income stream throughout retirement. It is also useful to note that if you decide to leave SA you are able to cash in your RA after reaching 3yrs of being a non-SA tax resident (subject to tax).

A Smart Choice for Long-Term Wealth Creation

In conclusion, the appeal of Retirement Annuities in South Africa extends far beyond their tax efficiency. These investment vehicles empower individuals to take control of their financial future, offering a combination of tax benefits, flexibility, and stability. In many cases retirement money is actually the only money left to fund retirement as the other more liquid investment have been used to fund lifestyle assets and business interests etc. South African Retirement Annuities are an invaluable tool to assist in building a robust foundation for a comfortable and secure retirement.