ECONOMICS

As 2025 begins, the global economic backdrop remains as convoluted as ever. The year has started with increased volatility in bond and equity markets, signalling a challenging environment that demands careful navigation of complex geopolitical dynamics, domestic politics, and economic uncertainties. Several critical factors—including risk sentiment, the US Federal Reserve’s (Fed) policy decisions, the terminal interest rate, US risk-free rates, and growth disparities between the US and other regions—are poised to significantly influence SA’s interest rates and the rand’s value. These elements will shape foreign capital flows and trade dynamics, including the terms of trade. In addition, Trump’s inauguration as the 47th president of the US has marked a pivotal shift in US policy direction. While many specifics remain uncertain, campaign promises and recent statements from Trump and his team point toward a clear economic philosophy emphasising deregulation, lower taxes, and trade protectionism. Nevertheless, while the shift in overall policy trajectory is unmistakable and likely to have substantial global repercussions, the pace and extent of its implementation remain unclear.

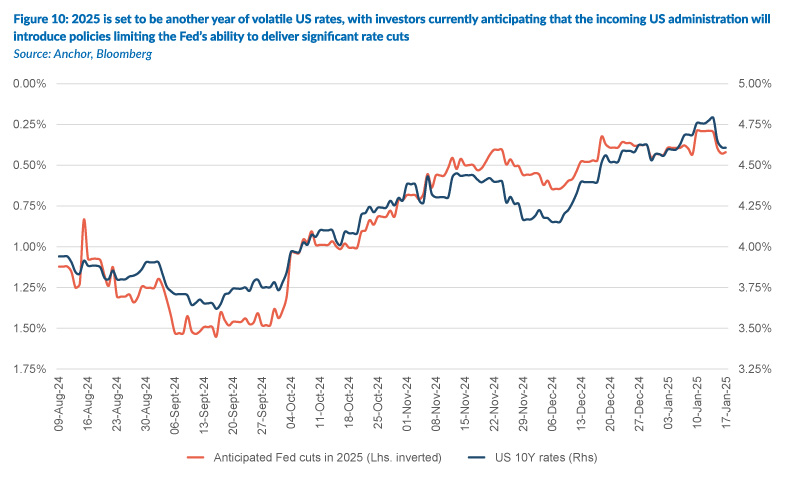

Meanwhile, questions persist regarding the restrictiveness of current US monetary policy, given relatively loose fiscal conditions. Narrow corporate credit spreads and a strong equity market are indicators of this environment. The Federal Open Market Committee’s (FOMC) December decision to cut the policy rate by 25 bpts, coupled with an upward revision of its 2025 core personal consumption expenditure (PCE) inflation forecast from 2.2% to 2.5%, has added to the uncertainty surrounding the neutral interest rate. Diverging opinions within the FOMC further complicate the outlook, as evidenced by four dissenting votes against the December rate cut. The dot-plot median interest rate projection now anticipates two 25-bpt rate cuts in 2025, reflecting some FOMC members’ consideration of the potential impact of future Trump administration policies. Market participants are debating a wide range of scenarios, albeit with most centred mainly around the basis of no rate cuts to two 25-bpt reductions in the federal funds rate. This evolving situation underscores the high uncertainty surrounding the Fed’s terminal rate and the broader economic outlook.

Conversely, China remains focused on safeguarding stable growth during its economic transition, though challenges persist. Investment continues to struggle, weighed down by a prolonged slowdown in the property sector. While private investment remains sluggish, public investment regained some momentum towards the end of 2024, following setbacks in 3Q24. Deflationary pressures are evident, driven by persistent demand weakness. In December, China’s consumer prices rose by just 0.1% YoY, highlighting these pressures and contributing to record-low bond yields in the world’s second-largest economy. This weak inflation reading comes despite months of efforts by policymakers to stimulate demand. In December, China’s leaders announced the adoption of a “moderately loose” monetary policy for the first time in 14 years, alongside a commitment to “vigorously boost consumption.” Monetary policy easing continues as a complement to fiscal support. The People’s Bank of China (PBoC) introduced a decisive easing package in late September to restore market confidence. While these monetary measures provide some relief, robust fiscal efforts are essential for a comprehensive economic recovery. The combination of bold monetary actions and strong fiscal support will be critical for a sustained recovery through 4Q24 and beyond.

Domestically, several factors contribute to significant forecast uncertainty, including potential policy changes from the incoming US administration, the scale and composition of China’s policy stimulus, and the impacts of ongoing global conflicts. We anticipate steady growth in SA’s key export markets and relatively stable terms of trade. SA is expected to be among the few countries where economic growth accelerates in 2025, albeit from a low base, as infrastructure constraints ease, business confidence improves, and interest rates decline. However, policy reforms are likely to remain gradual, and firms may limit capacity expansion due to uncertainty about the long-term political landscape and ongoing structural challenges.

Regardless, SA growth in 2025 should be supported by more vigorous private sector fixed investment bolstered by an expected acceleration in infrastructure spending, which should provide medium-term support. Consumer spending is also likely to improve, benefitting from lower inflation, interest rate relief, and relatively steady nominal wage growth and employment levels. We expect inflation to gradually rise from its recent lows as base effects fade, food inflation normalises, and fuel prices recover following their late-2024 drop. The South African Reserve Bank (SARB) has indicated its intention to lower the repo rate to a “neutral” level, suggesting the possibility of an additional cumulative 25–50 bpts in 1H25 rate cuts. However, the recent rand weakness and the US Fed’s more hawkish stance introduce notable risks to this forecast.

SA EQUITIES

This year, we continue to see reasonable upside (c. +14% YoY) for the JSE, primarily driven by a continued earnings recovery for the domestically focussed equities (SA Inc. counters). The bottom-up view of SA equities is broadly supportive of this scenario. Typically, where we find ourselves currently in SA would be associated with the early stages of an upcycle. Inflation (especially food inflation, which eased to 2.3% for October – its lowest rate in c. 14 years) is moderating, and interest rates peaked in 2024 and are expected to continue declining. The domestic economy is expected to recover this year to record around 2% GDP growth after years of sub-1% growth. SA banks are also well-capitalised, and their books are reasonably clean, meaning that if we get some demand on the lending side, there should be a nice multiplier effect on the economy. Some shorter-term, more cyclical dynamics that should support consumption and the retailers, in general, would be the additional cash injection from the two-pot retirement withdrawals. Additionally, loadshedding is seemingly a thing of the past, and some positive, albeit slow, developments at Transnet should add further fuel to the local “things are getting better at the margin” narrative.

Assuming that the global macro backdrop remains stable this year (a big assumption), we expect the improving SA backdrop to translate into continued double-digit to mid-teen total returns from the domestically focused corner of the market. Most banks (a significant component of the FTSE JSE All Share Index) will likely deliver 10% earnings growth this year (Capitec being the exception with 20% earnings growth expected) and trade on high single-digit dividend yields. Assuming no re-rating, one could expect to see dependable mid-teen total returns.

The discretionary retailers, a much smaller component of the local index, will likely experience a much sharper earnings recovery, pocketing a higher proportion of the two-pot retirement withdrawals (estimated at c. R35bn after tax) with higher operating leverage than the more defensive banking sector. Earnings growth from the discretionary clothing retailers is expected to be around 20% for FY25, coming off a relatively low base from the past few years. Most management teams we have recently interacted with, particularly on the consumer side, have been more optimistic than we have seen in the past. It also appears that the December trading period went well for consumer-focused businesses.

On the industrial side, the messaging has been far more muted. The larger industrial businesses seemingly have not seen much change in their operating conditions, which remain constrained locally. The pickup in domestic activity levels has been concentrated in a gradual consumer recovery.

Looking at the rand hedge shares, it is hard to put the drivers of returns in one bucket, but if there were one, China would most likely continue to have the most significant influence on their performance outcome. The pullback in both Tencent and Naspers/Prosus is a straight derating, and the recent decision by the US Department of Defence (DoD) to place Tencent on a list of companies with ties to the Chinese military is unlikely to have a material impact on the tech giant’s operations. Trading at 14x forward earnings with defensive double-digit growth in operating earnings has been an attractive entry into Tencent (and, by implication, Naspers/Prosus) in the past. At these levels, we expect Naspers/Prosus to be a material driver of returns for the JSE in 2025, given its relative size in the FTSE JSE All Share Index.

We also continue to like the food distribution business Bidcorp, following a year in which its earnings outlook has not deteriorated, and the stock has de-rated from 18x forward earnings to the current 15x. At 15x, that is the cheapest Bidcorp has ever been (outside of the COVID-19 pandemic), which we find interesting.

In terms of the basic materials sector, the drivers of share price performances over the short term seem to be primarily macro-driven, with the fundamental outlook for most businesses not having changed much over the past few months. From a fundamental perspective, it remains to be seen whether the stimulus measures implemented by China’s policymakers will have a material impact on commodity demand. While, in aggregate, the basic materials sector is generally not a sector we like to be overly invested in, there are certain markers that we look out for when deciding on how much exposure to take in our more benchmark cognisant portfolios. The rate of change of free cash flow (FCF) would feature highly on our list of attributes we would like to see, and at present, the gold sector would screen most favourably.

At the same time, the larger, more diversified global mining houses look to have found a plateau after a few years of consistent downgrades following the euphoria (or actually fear) in commodity markets after Russia’s invasion of Ukraine and the subsequent underperformance of China’s economy from mid-2022. Diversified miners trade on mid to high single-digit FCF yields, which seem reasonable given their moderately flat FCF growth profile. We prefer Anglo American and Glencore within the diversified mining space – the former for the potential value unlock from a restructure and Glencore for its attractive mix of copper and coal.

From a fundamental perspective, the platinum group metals (PGM) sector still screens as the least attractive for us. However, we concede that they are also the most levered to a change in their underlying basket prices (they are close to cashflow breakeven at spot). However, the long-term outlook for PGMs remains the most uncertain in our coverage universe.

We have little doubt that 2025 will be another year filled with surprises. We have new leadership in the US, which will set the global geopolitical tone. We now need a GNU that delivers on the much-anticipated structural reform to keep investor confidence in SA moving in the right direction. One only needs to look at recent developments in Argentina to see what the global investment community can do when confidence grows in a reform thesis – and SA is brimming with potential.

SA LISTED PROPERTY

After dramatic falls post-COVID-19, the SA-listed property sector has recovered materially over the past two years, even though the domestic-focused counters are well off their highs. This is primarily due to a material devaluation of office space as workers spread their time between the office and the home dining room or study. The earnings base of the sector is back to a reasonably full level, and growth from here forward is likely to be closer to 5% than 10%. At forward dividend yields of around 9% for local counters, property companies look fairly valued relative to recently increased bond yields. So, it is a case of comparing a 9% yield growing at 5% with a 10-year bond yield of 10.5%, which is not increasing.

Our 12-month forward, total return projection for the sector is 11%, which comprises a slight capital increase in addition to the 9% dividend yield. Property fundamentals appear to have bottomed a few months ago, and vacancy levels are shrinking. The office sector has long-term oversupply issues, but negative lease reversions have declined sharply as a full rent cycle has almost worked its way through post-COVID-19. So, net portfolio growth is returning, and the interest cost will decline towards 2H24 (unless, like Growthpoint, hedging has delayed this positive impact). Offshore portfolios are performing better, and growth prospects look reasonable. This sets the stage for constructing a reasonable portfolio with a 7%-9% dividend yield and 3%-5% growth.

DOMESTIC BONDS

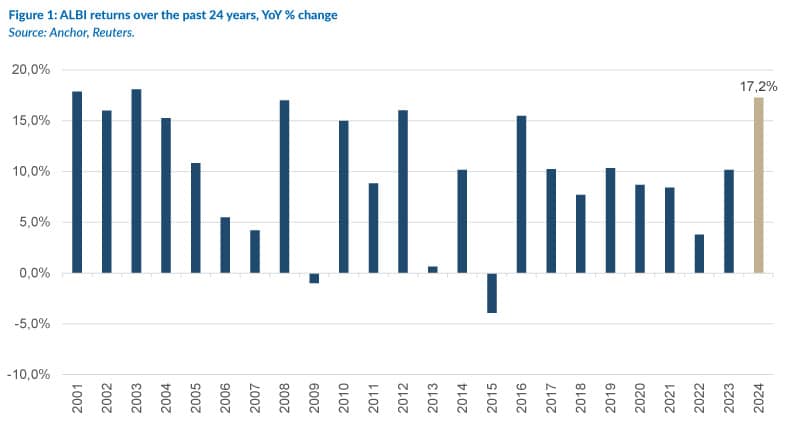

SA Government Bonds (SAGBs) ended last year with a weaker December but still recorded a 17.3% YoY return for 2024 at the SA All Bond Index (ALBI) level. This was the ALBI’s best annual return since 2003. Our outlook for domestic bonds for 2025 is thus more neutral; we believe yields on offer are attractive, especially relative to the still low inflation SA is experiencing (particularly in contrast to inflation rates in comparable developed markets [DMs]), but our bond yields are materially higher.

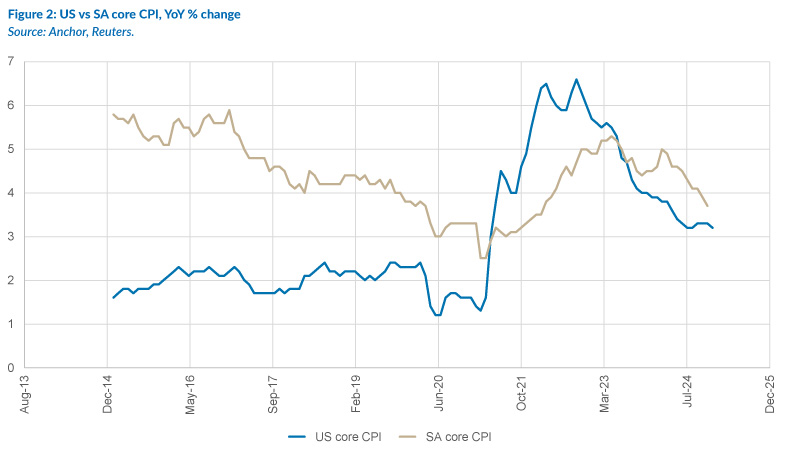

On a real basis, as we enter 2025, domestic nominal bonds are at attractive levels. We note how comparative CPI levels have moved (comparing core vs core). In the mid-2000s, this spread was consistent at approximately 4%. This narrowed during the COVID-19 pandemic and has not yet returned to those mid-2000 levels. We currently see the US vs SA CPI spread closer to 1%.

At the same time, SAGBs offer yields of c. 10.5% in the belly of the curve, and US 10-year treasuries yield 4.7%.

The last quarter of 2024 (4Q24) saw one major news event dominate headlines – the return of Donald Trump to the US presidency. Before the November US Presidential Election, Trump faced several challenges (both on the campaign front and legally) but won the popular vote and the Electoral College by 312 to 226. The fallout for the Democratic Party has only begun, but the market outlook for Trump is focussed primarily on his major electoral promise – to institute tariffs, some as high as 60%.

There is some consensus that these policies will be inflationary. Added to that, there is market scepticism about the ability of the new “Department of Government Efficiency” (DOGE, to be run by Elon Musk and Vivek Ramaswamy) to effectively cut costs while promised tax cuts are also instituted, thus resulting in increasing deficits. The market response to this over 4Q24 was to elevate global bond yields and push back the rate-cutting narrative and cycle.

When writing The Navigator – Anchor’s Strategy and Asset Allocation, 4Q24, dated 14 October 2024, the US rate-cutting cycle was expected (by futures markets) to bottom with a fed funds rate of 2.75%-3.00%. However, currently, the market-implied expectation is for rates to bottom at either 3.75%-4.00% or 4.00%-4.25%. As these expectations of more rate cuts have evaporated, the upward pressure on yields has been palpable, particularly in the US, where 10-year treasuries have reached levels not seen for a considerable period. This has also strengthened the US dollar against most currencies, including the rand. The spillover effect has been a pronounced weakness in SAGBs, leaving them (despite a strong 2024) opening 2025 at valuations that we see as broadly fair.

The outcome of the Trump team’s first 100 days in office will be instructive regarding global positioning in the future. Suppose they successfully implement tariffs with limited spillover to US CPI. In that case, we will likely see a strong US economy continue, and the US dollar will remain on the front foot with little need for rate cuts to stimulate the US economy. However, suppose the market slows meaningfully and growth stalls off the back of implementing tariffs. If this happens, we are likely to see expectations of a return to a deeper rate-cutting cycle.

Given the above combination of risk factors entering 2025, our position in the Anchor BCI Bond Fund is neutral relative to the ALBI. We foresee some of these uncertainties becoming clearer over the first few weeks of February (the Trump team took office on 20 January 2025), and thereafter, opportunities in the duration space will become more apparent.

THE RAND

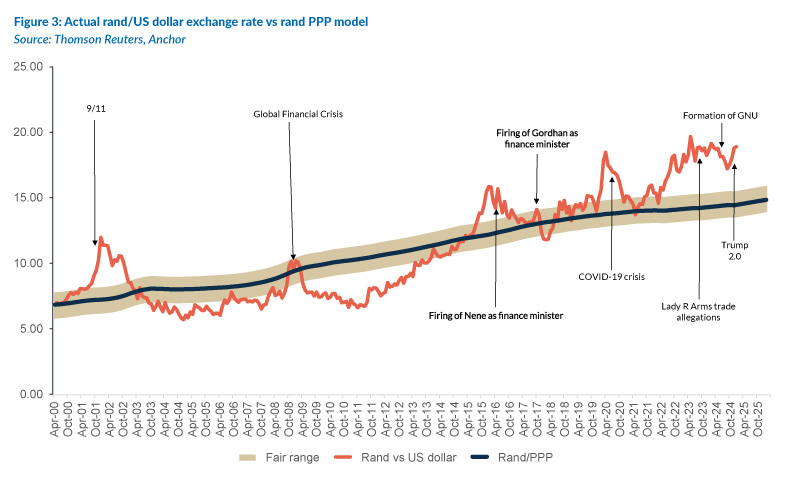

Anchor subscribes to a purchasing power parity (PPP) model for the long-term value of the rand. Any such model clearly shows that the local unit is cheap, as is evident from Figure 3 below. Our modelled fair value of the rand is in the R13.85-R15.85/US$1 range. The currency usually trades away from its “fair value”, and it is reasonable to expect it to remain cheap for the foreseeable future.

Since November, the rand/US dollar exchange rate has been dominated by spillover from the US rather than domestic factors. US President-Elect Donald Trump is a strong proponent of introducing tariffs on goods imported to the US. A consequence of these proposed tariffs is that the US dollar has strengthened dramatically against most currencies. We have accordingly seen the rand, the euro, the British pound, and other major currencies weaken dramatically against the dollar over the past few months. The Trump policy mix is also expected to be mildly inflationary for the US, making for higher US interest rates. Consequently, the market has been paring back its expectations of interest rate cuts. A couple of months ago, the markets expected 3 or 4 US interest rate cuts of 0.25% each. However, now financial markets are questioning whether we will see just one US interest rate cut in 2025. Higher US interest rate expectations make for a stronger dollar and a weaker rand. This has exacerbated the rand weakness we have seen of late.

Anchor remains of the view that SA’s domestic fundamentals are gradually improving. Whether we look at the Government of National Unity (GNU) that is defying expectations and holding together, Eskom, which has kept the lights on for much of the past year, or improving business sentiment, it would seem that circumstances on the ground are better than they were a year or two ago.

Despite current market sentiment, we believe the strong reaction to expected tariffs and inflationary policy is overdone. We think the market is very pessimistic about its interpretation of the outcome of these policies and their implications for the broader global economy. As a result, we believe that we are toward peak negativity for US interest rates and dollar strength. We note that some research houses are discussing a further 5% strengthening of the greenback from current levels. That said, we think that over the next year, some of this negativity will reverse, and the rand will recover some lost ground. For this report, we are modelling the exchange rate at R18.25/US$1.

GLOBAL EQUITIES

Global equities continued a second consecutive year of around 20% returns in 2024 (vs 24% in 2023). The bull market is intact due to strong underlying economic momentum (particularly in the US) and double-digit earnings growth forecasts. We have been positive on equities for most of this period, but we have recently moved into more neutral territory as valuations have reached extremes. Early in my career, I learned not to fight a bull market, but there is certainly reason to be aware of potential risks and become more cautious.

Most global investment banks are hesitant to call an end to the current bull run, and 2025 year-end forecasts for the S&P 500 (currently at the 6,000 level) are primarily in the range of 6,200-6,600. This implies a 3%-10% return. We expect a 6% return for the calendar year (CY) 2024, but with an unusually large range of potential outcomes (-20% to +12%), which we will explain in this article.

The investment world has changed somewhat over recent months, as Trump’s bluster, outbursts, and sometimes seemingly absurd intentions have been broadcast. Tariffs, tax cuts, and anticipated higher spending have increased inflation expectations, and bond yields have risen to reflect these changes in expectations. US 10-year government bond yields shot towards 5%, the highest in the past two decades. One certainty is that Trump will continue to spring surprises, and the market has become jumpy, not knowing what to expect next. As Larry Fink, the CEO of BlackRock, indicated in a recent interview, he can construct an argument for bond yields to be 3.75% or 5.25% one year out. These two different trajectories can result in very different equity market outcomes.

The more bullish view is premised on the fact that most Trump policies are pro-growth and based on clearing the barriers for company and economic growth. In addition, artificial intelligence (AI) has changed the trajectories of many companies, and animal spirits abound. A new phase of capital investment in infrastructure to support this trend has begun. This can fundamentally change the aggregate prospects of US companies. Companies perceived as AI beneficiaries trade at lofty valuations, materially pulling up the average. Bulls argue these valuations are justified given the growth prospects, and the median valuation is not materially higher than historical means.

So, growth prospects look good, but one must assess what is priced in as the market is aware of all the above. A misstep or seed of doubt in the growth mantra can quickly be punished by a 10%-15% decline in market levels. Capital investment in AI has exploded, and markets will begin to assess whether the profits to justify this investment will follow. Recent company results, like those released by Adobe, have indicated they are battling to differentiate in the new AI world, even though their material investment produces sexy products and outcomes. However, these new technologies are also spawning new competitors, and they might well be losing market share. AI might be more commoditised than expected.

Then comes the other economic outcomes of Trump’s charge for growth. The US dollar has strengthened by c. 10% against most major currencies in 4Q24. This means offshore profits convert to less US dollars for global US-based companies. In addition, higher interest rates mean the anticipated decline in interest costs will take longer to materialise. Both could take the shine off company earnings growth in the coming quarters and year.

Higher US government bond yields are historically not good or bad for equities. Equities have gone up when bond yields increase if they are due to stronger economic growth. The opposite has also been the case, as higher rates increase the cost of capital, which theoretically lowers the current value of future cash flows.

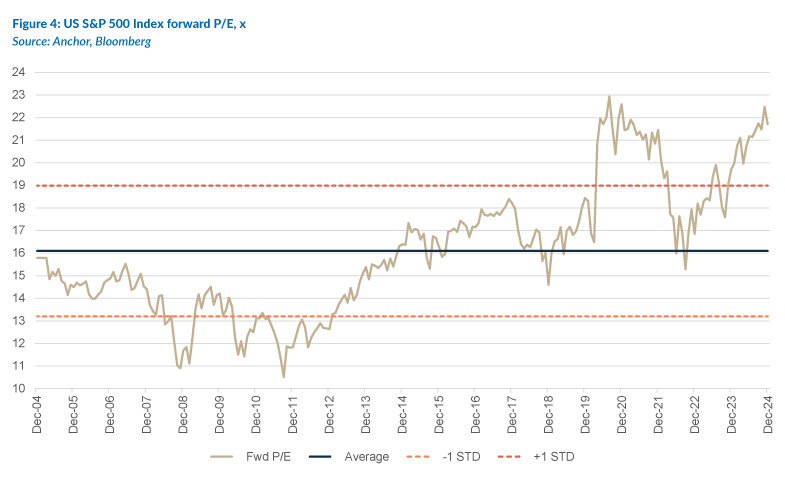

Figure 4 below shows that the forward 22x PE multiple in the S&P 500 is approaching the most expensive levels in two decades. This alone is a good reason for caution.

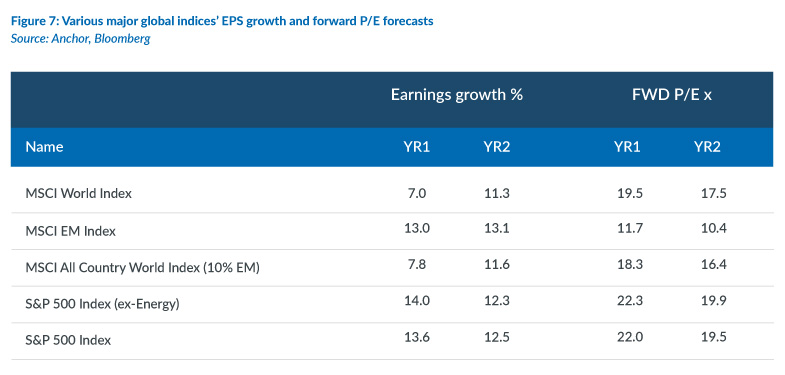

The biggest driver behind equity markets is earnings growth, and market expectations are for strong growth in the US into 2025 (+14%) and 2026 (+12%) as inflation slows, oil prices subside, and interest bills decrease.

There is no doubt that AI-driven optimism has buoyed markets, but high valuations have now extended far beyond the Magnificent Seven stocks (Apple, Microsoft, Alphabet, Nvidia, Meta Platforms, and Tesla), which led the market in 1H24.

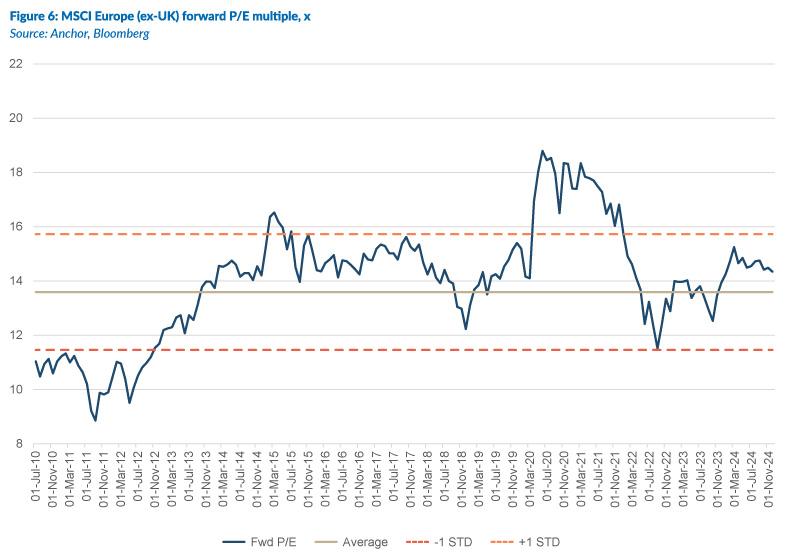

The market conditions explained above are mainly attributable to the US, which comprises over 70% of global market capitalisation. While most DMs globally have performed reasonably well in 2024, the European market rating is only marginally above its longer-term average.

The table below shows the earnings growth and ratings of the various market indices.

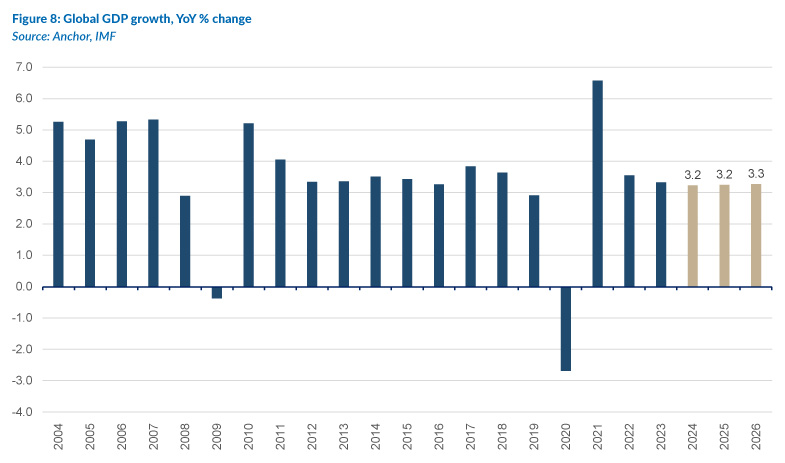

The economic reality shown in the chart below indicates reasonable and accelerating global GDP growth. US GDP growth looks to register around 3.2% for 2024; many were forecasting a recession last year, but strong US national and local government spending has provided a big boost.

GLOBAL BONDS

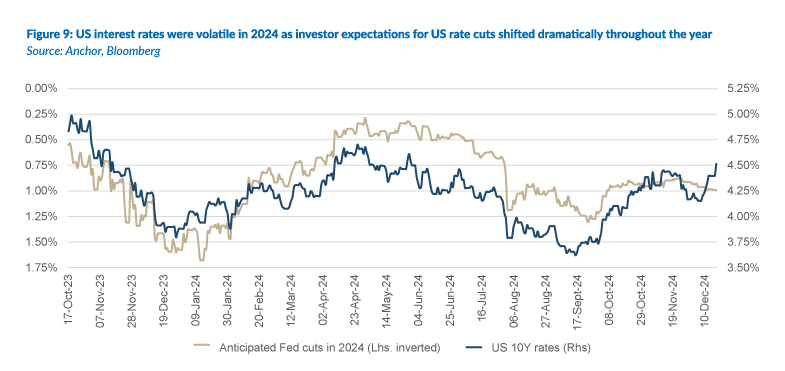

In 2024, the US Fed cut rates for the first time since the COVID-19 pandemic, delivering three interest rate cuts that cumulatively shaved 1% off the official central bank rate. Before the Fed rate cuts, the fed funds rate was as high as it had been in almost two decades (5.33% p.a.). US interest rates typically act as a proxy for the “cost of money”, and as such, most assets are valued relative to this rate. With US interest rates relatively elevated, investors were extremely focused on the Fed’s actions, which resulted in some fairly large swings in expectations as investors fixated on the trajectory of inflation and employment data and how that might influence the Fed’s actions. Towards the end of the year, the US elections also significantly impacted investor expectations for Fed policy as they rushed to try and extrapolate the economic and inflationary impact of policies the new administration might implement.

We anticipate that 2025 will be another year with a heightened focus on the Fed. As such, we expect US rates to move in a reasonably broad range again. As the new US administration takes office in January, investors will begin to discover if new policies and their impact on inflation and government spending align with current expectations.

We expect US inflation to continue its “normalisation” trajectory in 2025, allowing the Fed to cut rates by at least 0.5% for the year.

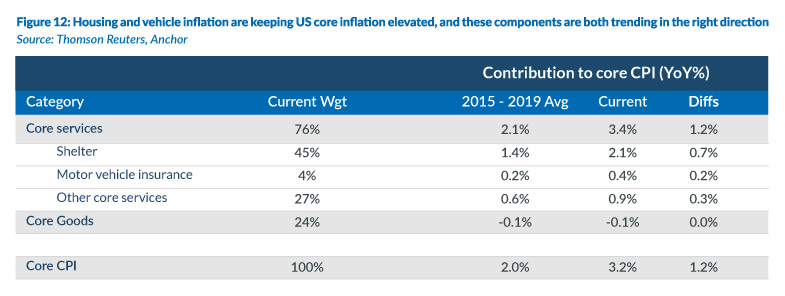

Housing and motor vehicle insurance are major inflation components that remain elevated relative to their pre-pandemic level. Recent monthly US inflation data suggest that those components have moderated towards a level that will keep US core inflation on its current normalising trajectory.

While we anticipate some inflationary policy from the Trump administration, we expect it to be predominantly transitory and not as material as investors are currently pricing. As such, the Fed will be able to cut rates more than is presently baked into expectations.

We anticipate some inflationary policy from the Trump administration but expect it to be predominantly transitory …

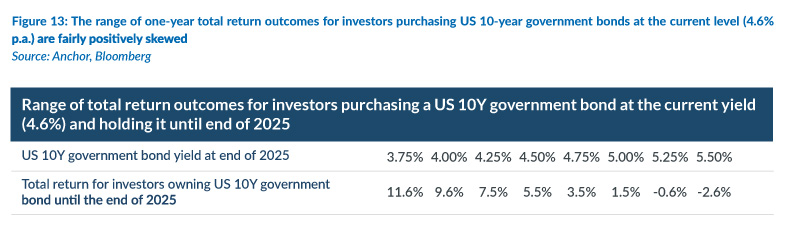

Given that US rates are already elevated, we think this bakes in a good margin of safety for US government bond investors, with the range of one-year outcomes for investors skewed towards a positive return.

Our 2025 base case is for a 5.5% total return in US dollar terms for investors buying US 10-year government bonds at the current 4.6% p.a. yield.

US investment-grade corporate bond spreads are as low as they have been in at least 25 years, which we think will act as a headwind to that segment of the global fixed-income market as the current elevated cost of borrowing weighs on borrowers, increasing the possibility of defaults. We anticipate that a slight increase in credit spreads will leave US investment-grade credit investors with a marginally worse one-year total return (5% in US dollar terms) than US 10-year government bond investors.

GLOBAL PROPERTY

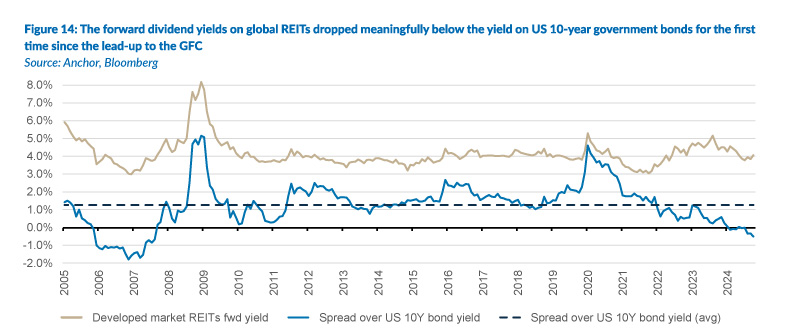

The global property sector had a disappointing 2024 (FTSE/EPRA NAREIT Global Property Index +1.6% YoY) in a generally tough year for interest rate-sensitive investments, with US rates spiking into year-end. This happened in anticipation of the incoming Trump administration introducing policies that could have an inflationary impact, making it challenging for the US Fed to cut rates meaningfully. US real estate investment trusts (REITs) fared better than their global peers (MSCI US REIT Index +9% YoY), with strong performance from the segment of the REIT industry most directly geared towards the AI boom, data centre REITs (Digital Realty Trust +25% YoY), and some of the “old economy” segments which rallied from depressed levels, including Office (Boston Properties +12% YoY) and Retail REITs (Simon Property Group +27% YoY). The re-rating in some parts of the REIT market, alongside a rise in interest rates, has pushed the spread between the anticipated dividend yield on global REITs and the US government’s 10-year borrowing rate meaningfully into negative territory for the first time since the lead-up to the global financial crisis (GFC).

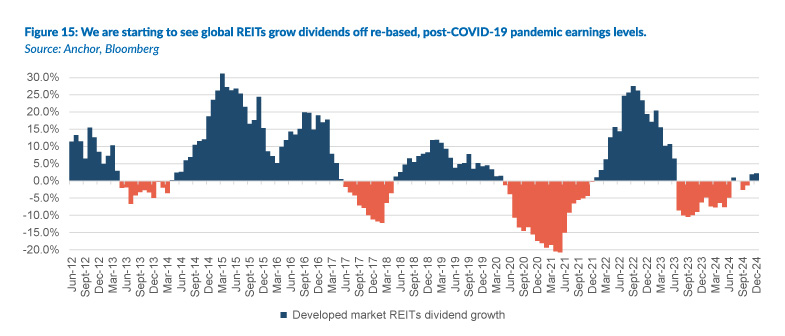

The relatively unattractive REIT yield is somewhat mitigated by the fact that we have recently seen signs of growth in dividend yields. This is a positive development, considering such growth has been largely absent for the past couple of years as incomes have rebased in the wake of the COVID-19 pandemic disruptions.

We anticipate slightly lower US interest rates to unwind some relative overvaluations in global REITs, though not nearly enough to warrant any re-rating. This will likely leave global REIT investors relying on current yields (c. 4% p.a.) with a small earnings growth (from an incrementally more challenging base) to deliver a total return of c. 5% in US dollar terms.