ECONOMICS

As we move into the last quarter of this year, central bank policy remains the nucleus theme across financial markets. Overall, there appears to be an increasing view amongst monetary policymakers that the time has come to sit back and allow previous tightening to work through the economy. With activity slowing notably in the eurozone (EZ) and the UK and inflationary pressures easing, the need for the Bank of England (BoE) and the European Central Bank (ECB) to pause seems greater than in the US, where output and employment growth remain surprisingly strong. However, despite general growth concerns and easing price pressures, central bankers (even in the US) have been at pains to stress that policy rates are likely to remain at a restrictive level that would dampen economic activity for some time. For all intents and purposes, this is a necessary evil to ensure that the disinflation process is sustained and that inflation timeously returns to targeted levels (2% in the US, the EZ and the UK; 4.5% in SA). To put it in simple terms, there does not appear to be any rush on the part of monetary policymakers in any of these regions to cut the policy rate.

Locally, SA’s precarious fiscal situation has again come under the spotlight, with the upcoming Medium Term Budget Policy Statement (MTBPS) looming on 1 November. The latest estimates point to this year’s revenue shortfall amounting to around R50bn-R60bn, with further spending pressures on the horizon as the politicking begins in earnest as next year’s elections draw closer. From a long-term perspective, the root causes of SA’s fiscal woes are long-standing and relatively familiar to most investors: persistently low growth, inefficient and misaligned policy, poor performing SOEs, political instability in key metropoles, chronic underinvestment by the state in key infrastructure projects, and poor decision making on government expenditure (particularly during the state capture years), to name a few. However, from a more near-term perspective, a variety of other factors have compounded SA’s fiscal challenges, such as lower commodity prices, lower revenue collection, Eskom and public sector wage increases, the expected continued roll-over of the Social Relief of Distress (SRD) Grant and increasing borrowing costs. Whilst the consensus is that SA’s fiscal story is indeed deteriorating at pace this year, we will unlikely get the complete picture in November’s MTBPS – that will only become fully clear in the main budget, which will be presented in February 2024. Regardless, Finance Minister Enoch Godongwana must convince the market in November’s MTBPS that a credible rebalancing process is indeed plausible.

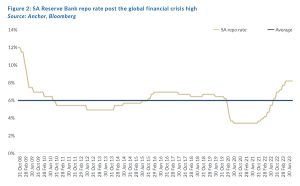

On the monetary policy front, SA’s near-term inflation outlook has deteriorated due to two successive large petrol and diesel price increases and a severe breakout of avian influenza (more commonly known as bird flu) that has raised concerns about chicken and egg prices. At the same time, the intensity and duration of the upcoming El Niño weather event pose an upside risk to food inflation. Nonetheless, the SARB’s Monetary Policy Committee (MPC) has continued to look through the first-round inflation impact of these supply-side shocks and left the repo rate unchanged (for the second meeting in a row) at 8.25% at the September MPC meeting. However, it remains a hawkish pause, as the balance of risks remains to the upside. During the MPC’s last two meetings, near-term prospects for the global economy have been broadly unchanged. Whilst global inflation has broadly eased over the year, any further slowdown is beginning to look less certain.

In addition, in SA specifically, loadshedding continues to hamper the economy, and prices for commodity exports continue to weaken. In the near term, stronger El Niño conditions threaten the agricultural outlook, while global climatic events present additional risks. Energy and logistical constraints remain binding on the growth outlook, limiting economic activity and increasing costs. As such, the renewed upside risks from rand weakness and higher global fuel and food prices will likely keep the possibility of modest further tightening alive in the last MPC meeting for the year, which will be held in November.

SA EQUITIES

The JSE (as measured by the FTSE/JSE Capped Swix Index) ended the quarter 3.8% lower, bringing the YTD return slightly into negative territory (-0.2%). Interestingly, since its 2023 peak, towards the end of January, the JSE is down c. 8.0%, with most negative returns occurring in August and September. We maintain our neutral relative rating on JSE-listed equities with a 12-month total return expectation of 12%, only marginally ahead of our expectation for fixed-income returns (11%). Notably, the expected total return assumes zero multiple expansion and is driven entirely by our aggregate earnings expectations of 12% growth.

In analysing the underperformance of JSE equities, we find that this is mainly attributable to a sharp deterioration in domestic earnings estimates for calendar year (CY) 2023, with the impact of loadshedding adding further headwinds to an economy that has muddled along for the best part of 10 years. The slump in domestic earnings, coupled with cyclically high interest rates in SA and abroad, has resulted in us paring back exit multiples across the various sectors and companies, making forecasting the market’s future trajectory extremely difficult. We concede that certain scenarios, mainly driven by top-down, more macro-related factors, could see a healthy rebound on the JSE, the most notable of which is linked to the outlook for the US economy and the trajectory of global interest rates.

The current high cost of capital domestically and abroad is having a visible impact on the overall rating of the domestic market. Considering the operational underperformance of many bellwether SA companies, with cyclically low margins (some even loss-making) and low ratings due to cyclically high interest rates, the current market set-up could become very interesting. Twenty-twenty-four could see a complete reversal of that trend; with interest rate cuts expected in 2H24 and the worst of loadshedding behind us, we could see a powerful return combination of a lower cost of equity and a strong earnings rebound. Under this scenario, we could see index returns of over 20%. On any visible signs of this scenario playing out, we would likely see a relatively quick repricing of the local market. However, we note that data worldwide over the last few months has, if anything, moved in the opposite direction.

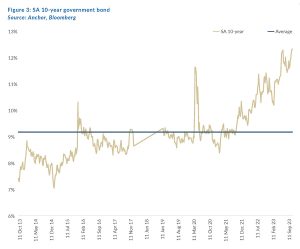

The best illustration of the point is the ratings of the local banking sector. When viewed in isolation, our local banks look extremely attractive. In aggregate, investors should receive earnings growth in real terms over the next three years (reasonable forecast horizon), with c. 50% of that paid out in the form of dividends and a forward rating of less than 8x earnings (a forward dividend yield of 7.3%). The more technical analysts will point to the price-to-book value of banks trading at 1.2x, held up by Capitec (4.5x) and FirstRand (2x). In aggregate, this looks like good value at a 30% discount to the last ten years and good operational execution. However, when one considers that SA 10-year bonds are trading at 12.4%, a 34% discount to the past decade, the reason for the banks trading at such big discounts becomes clearer. The cost of capital has risen too much.

We believe domestic equity valuations will continue to be suppressed while the cost of capital remains cyclically high and growth remains elusive. Without sustained economic growth, the incentive to buy equities when the return hurdle is as high as it is will not be big enough to drive a meaningful rerating in aggregate. The global macro environment has undoubtedly played an outsized role in creating this scenario, as our companies have dealt with a low-growth environment for most of the past decade. However, as mentioned above, there is a good chance that we are currently at a cyclical low point for JSE-listed equities, and it would not take much to see a meaningful outperformance from here. We will continue to wait patiently for evidence of this playing out.

DOMESTIC BONDS

In 3Q23, South African government bonds (SAGBs) returned a negative 2.37% at a FTSE/JSE All Bond Index (ALBI) level. This follows a weak 2Q23 performance when the index produced a negative 1.53% return.

Yields across the curve have entered cheap territory, with the belly bonds returning over 12% and the long-end bonds returning over 13%. With the forward rate agreement (FRA) strip no longer assuming any SARB rate hikes until mid-2025, we maintain that further rate hikes will do more to curtail growth rather than control inflation or defend the local currency. However, we caution that further rate hikes may occur due to the hawkish tilt of the SARB MPC (which is in tune with the US Fed announcements).

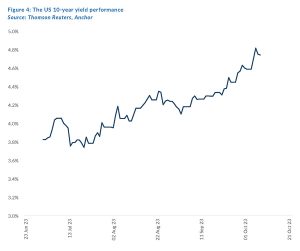

While local bonds’ 2Q23 performance was driven by domestic factors (growth, loadshedding and the “Lady R” controversy), 3Q23’s performance has been driven by the steady climb in US rates, with the US 10-year yield climbing from 3.83% to 4.57% over the quarter.

Inflation remains a concern, with the Brent crude oil price rising to near US$100/bbl; domestically, the petrol price has also seen back-to-back increases. This has resulted in the August core and headline inflation levels ticking 0.1% higher to 4.8% YoY.

Inflation remains a concern, with the Brent crude oil price rising to near US$100/bbl; domestically, the petrol price has also seen back-to-back increases. This has resulted in the August core and headline inflation levels ticking 0.1% higher to 4.8% YoY.

In the previous edition of this article, we highlighted that while yields remain attractive, they must be tempered by the caution that the near-term horizon covers some risk events. This quarter has seen (1) “higher-for-longer” rates become enmeshed in expectations and (2) SA’s precarious fiscal situation come to the fore. This combination has weakened global bonds and further weakened SAGBs. At current levels, the fixed-income universe is increasingly attractive. Nominal bond yields are such that for total returns to be negative over a 12-month outlook would require a c. 200-bp bond yield weakness over the period (at an index level). Our view is thus cautiously optimistic with a neutral duration positioning in the Anchor Bond Fund. This positioning retains the attractive yield outcome attainable in SAGBs while defending against the downside risks in yield climbing.

Similarly to our global bonds outlook, we can calculate a range of outcomes depending on the 12-month forward yield. The ALBI currently has a duration of 5.6 years; thus, every 1% yield increase results in a negative c. 5.6% total return. Our base case is that yields will not drive either way and that 12 months out, we are in a similar position to where we currently find ourselves. Given the above, we have expectations of double-digit 12-month return outlooks in SAGBs from current levels.

THE RAND

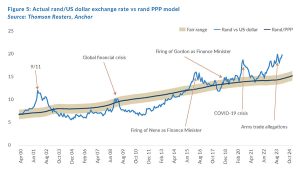

Throughout 2023, the rand has weakened due to a stronger US dollar, risk aversion and domestic economic and political malaise. We had expected the rand to trade in the range of R18.25-R19.00/US$1 for much of 3Q23. In retrospect, it spent much of the past quarter within this range, ending 3Q23 at R18.90/US$1. Looking ahead, we think the rand’s prospects have deteriorated, and we now see it trading in the range of R19.00-R20.00/US$1 for 4Q23.

Projecting the rand’s value in a year’s time is a fool’s errand. This is because the rand vs US dollar exchange rate is one of the world’s most volatile currency pairs and trades well away from any modelled fair value for long periods. We note, however, that the rand trades within a R2.50 range to the US dollar in most 12-month periods.

The indicators for the fair value of the rand are continuing to worsen. We note that the current account will likely deteriorate further as our export commodities see prices decline while imported oil is more expensive. Financial markets are focusing on SA’s worsening fiscal situation and questioning the government’s ability to achieve a sustainable primary surplus by 2025, if at all. We expect the global environment to gradually become more supportive, but foreign central banks are pushing that out into the future. In 2024, it looks like the strong dollar will persist. Therefore, we expect the rand to continue to trade with a negative overhang.

We retain our purchasing power parity (PPP) based model for estimating the rand’s fair value. We have extended this out by three months since The Navigator – Anchor’s Strategy and Asset Allocation, 3Q23 report was published on 13 July 2023. Over our forecast period, we expect inflation abroad to come under control and return towards more normalised levels. This means our PPP model shows an increasing propensity for long-term rand weakness from next year. As a result, our PPP-modelled value for the rand vs US dollar at the end of the next 12 months is R15.15/US$1 (See Figure 5). We apply a R2.00 range around this to get to a modelled fair-value range between R14.15 and R16.15/US$1.

The domestic and global backdrop means we start with the rand meaningfully weaker than our modelled fair-value range. In previous cycles, US dollar strength has tended to dissipate (and reverse) toward the end of the US rate-hiking cycle. Current indications are that the US Fed will reach peak rates toward the end of 2023, meaning that we expect to see currency normalisation, with the US dollar giving up some of its gains in the latter part of next year. However, we do not expect the currency to recover fully, and we are projecting a rand in the R19.00 to R20.00 range against the US dollar in one year as domestic issues continue to weigh the rand down. For this report, we have modelled on R19.30/US$1.

We expect the rand to remain particularly volatile, and surprises are certain in the year ahead.

GLOBAL EQUITIES

GLOBAL EQUITIES

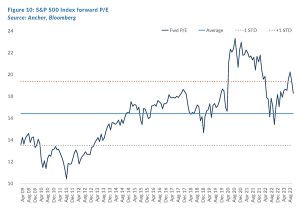

As expected, the global equity march slowed in 3Q23 (DM indices were down 3.5%), and we expect a continued grind in the short term. The combination of higher rates, higher oil prices and a stronger US dollar are putting pressure on US company earnings. With current valuations at above-average levels (MSCI World Index forward P/E of 16x), we expect a below-average return from global equities over the next 12 months (our base-case projection is 7% in US dollar terms).

Equity alternatives are considerably more attractive than they have been for the past decade, with money market funds offering 5%-plus in US dollar terms and US 10-year treasuries trading at yields of over 4.7%. If you are prepared to give up some liquidity or take a little more credit risk, yields of 6%-9% are available. In our alternative investment offering, we are targeting double-digit US dollar-denominated returns. Higher rates also mean that the high dividend yield shares in the US have become relatively less attractive, as a 5% dividend yield is not what it used to be if I can get 5% “in the bank”.

It is important to put the YTD performance of global markets in context. Almost all the action has been from the technology and AI-related sectors, where price appreciation has been more than 50%. The average share in the US S&P 500 Index is down YTD, and attractive valuations exist across many non-tech sectors. We remain positive on equity markets over a medium-term basis, as the next phase of the economic cycle will boost US earnings (as rates eventually decline and the strong dollar cools off).

Hence, while the moves in the market index level look strong, there is still much potential catch-up for the rest of the market. The outlook for the general market is reliant on how the economic cycle continues to play out. Global bond yields have been rising of late as the prior expectations of interest rate cuts in 2023 have faded. Inflation remains strong, the US economy is proving resilient, and the US Fed is insistent that there will probably be more interest rate hikes in the remainder of this year. The key risk is that the Fed goes too far, and the economy suffers late in the cycle.

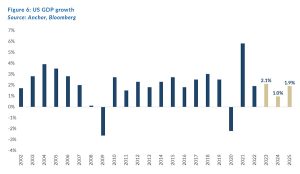

The economic reality shown in the chart below also makes us a little more cautious about equities – growth is more robust, and the economic cycle has been extended by six months compared to expectations at the beginning of the year. US GDP growth has surprised in 2023 and looks set to register around 2% YoY growth for 2023; many were forecasting a recession this year, but strong US national and local government spending has provided a big boost. The result, however, is that 2024 GDP forecasts are now looking relatively muted (+0.9% YoY) as the impact of higher interest rates starts to bite.

Global DM valuations at the index level look full (MSCI World forward P/E of 16x).

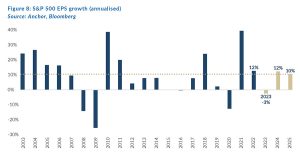

The most important determinant of markets is earnings, which have proved resilient in the face of higher interest rates. While many companies have been negatively impacted, those which have been able to pass on the inflation pressures have flourished. US earnings growth in 2023 is projected to record a 2% YoY decline. However, double-digit US-dollar earnings growth should resume in 2024 and beyond, which is positive for equities. Declining interest rates and increasing earnings are positive concoctions when looking further into 2H24 and beyond.

The S&P 500’s forward P/E is 18.2x (see table below). Multiples often increase when earnings dip as long as the future outlook is more positive. EMs are much cheaper and have strong recovery potential.

The S&P 500’s forward P/E is 18.2x (see table below). Multiples often increase when earnings dip as long as the future outlook is more positive. EMs are much cheaper and have strong recovery potential.

This is shown graphically in the chart below.

EMs have been a letdown in 2023, as the much-vaunted Chinese recovery has been disappointing. Chinese government stimulus has been less aggressive than in previous cycles, but the government could act more decisively in the next six months. EM valuations are cheap, and a shift in sentiment could see a sharp rise, but current sentiment is extremely negative. An exciting opportunity is the Chinese AI stocks, which have not shared the same reaction to the rapidly evolving future. This is despite many of them having invested heavily in this space over the past decade.

GLOBAL BONDS

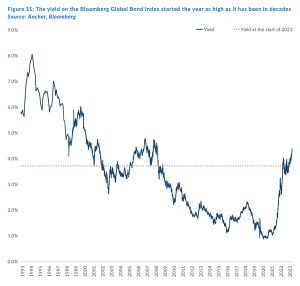

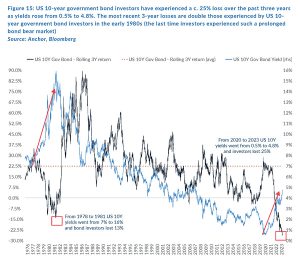

After the worst global bond market sell-off on record in 2022, investors entered 2023 with the prospect of some of the most attractive developed market (DM) bond yields in decades.

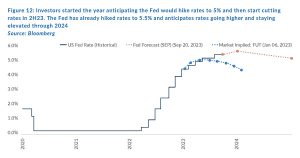

This year, DM economic activity has remained surprisingly resilient (particularly in the US), keeping inflation stubbornly high and requiring DM central banks to hike rates higher than anticipated. Central bankers have also sent the message that they will likely have to keep rates elevated for much longer than investors had expected.

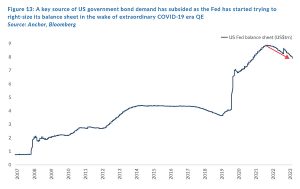

At the same time, the supply/demand dynamics for US government bonds have worsened, with the US Fed trying to normalise the size of its balance sheet after a dramatic COVID-19 era quantitative easing (QE) programme.

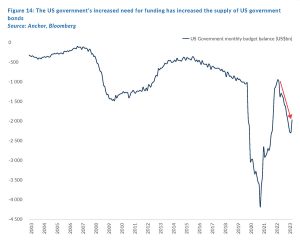

The supply of US government bonds has accelerated as the US government’s budget deficit has ballooned on the back of government stimulus programmes adopted during the COVID-19 crisis.

Deteriorating supply/demand dynamics and the prospects of US central bank rates remaining higher for longer have resulted in continued upward pressure on US 10-year government bond yields, resulting in the worst bear market in US long bonds going back at least 50 years.

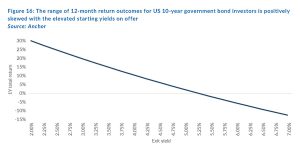

The aggressive bond bear market over the past three years is now in the rearview mirror, and we must decide what investors can expect over the next twelve months. For bonds, the outcome is purely mathematical – we plug our forecast of the yield that US 10-year government bonds will be trading at 12 months from now into the calculation and out pops the total return (the combination of price change and coupon income) that investors will experience over the next 12 months.

We assume that current yields are unsustainable. We anticipate that US 10-year government bond yields will head lower over the next 12 months (though not in a straight line), leaving them at c. 4.2% p.a. one year hence for a total return of 9% in US dollar terms for US 10-year government bond investors over that one-year horizon.

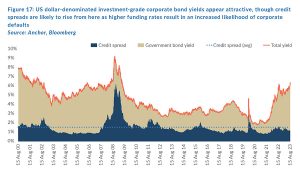

The picture is slightly more complicated for US dollar investment-grade corporate bonds investors. The similarity is elevated starting yields, but a component of that yield is the credit spread investors earn for taking on the risk that corporates default on their debt. As yields rise, the prospect of higher funding costs generally increases credit spreads as investors demand more compensation for the increased possibility of some corporate defaults. Rising credit spreads result in capital losses for corporate bond investors (all else being equal).

We have not yet seen a meaningful increase in credit spreads, but we anticipate this will start to happen over the next 12 months as credit conditions deteriorate. The combination of government bond yields narrowing by around 0.5% and credit spreads widening to about 1.6% (slightly above their average over this century) will result in aggregate investment-grade corporate bond yields of c. 6% p.a. one year from now, delivering a total return for investors in that asset class of c. 8% in US dollar terms over the next twelve months.

GLOBAL PROPERTY

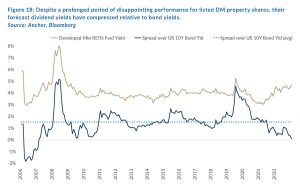

Global DM-listed property shares followed global risk assets lower in 3Q23 (-6.8% QoQ), underperforming global DM stocks (-3.4% QoQ) for the sixth consecutive quarter. Despite the prolonged underperformance of listed commercial real estate companies, they have seen their aggregate forecast dividend yields compress relative to global bond yields, leaving them with the lowest yields relative to US 10-year government bond yields since 2007.

We anticipate that some of this relative yield advantage will return in the form of lower US government bond yields, which we forecast could fall by around 0.5% over the next twelve months. However, even factoring in that adjustment, forward dividend yields are still c. 1% below their long-term average, suggesting they are still overvalued relative to other yielding assets.

Putting aside the valuation argument, we think the asset class’s cyclical headwinds, including significantly higher funding rates and tightening funding conditions, pose earnings and liquidity risks for many of these companies. Some of the biggest sectors, including office and retail real estate investment trusts (REITs), continue to face structural challenges. These are related to evolving online practices like remote working and online shopping, where COVID-19 disruptions have made it difficult to figure out how far that adjustment still has to run.

The starting forward dividend yield of 5.1% provides a decent underpin to the prospective returns for investors, and the inflation environment should provide a decent tailwind to operating income growth in the short term. Nevertheless, we anticipate that most of the earnings growth will be offset by a derating in valuations in the asset class as it adjusts to the higher-yield environment, delivering investors a total return of 5% in US dollar terms over the next twelve months.