ECONOMICS

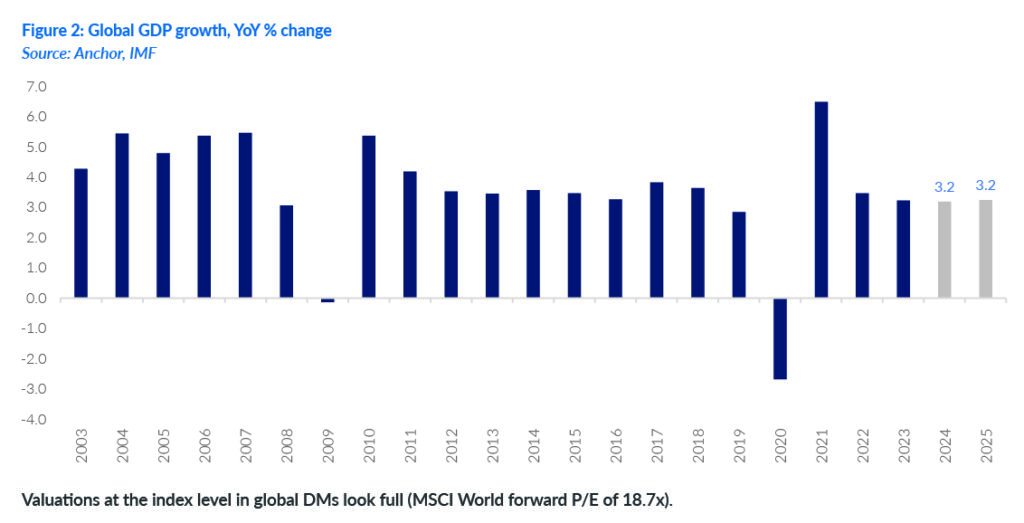

Moving into 2H24, it is reassuring to note that the global economy remains remarkably resilient despite the challenges of heightened geopolitical risk and high interest rates in major developed markets (DMs). Nonetheless, economic growth continues to vary across individual countries, mainly due to robust US economic activity defying high interest rates and a surge in post-pandemic savings supporting the economy. The stronger-than-expected growth in China has also played a significant role in global growth outcomes. The International Monetary Fund (IMF) projects global gross domestic product (GDP) growth at 3.2% YoY for 2024 and 2025, up from a 2023 estimate of 3.1% YoY. This 2024 GDP forecast is 0.2 ppts higher than the IMF’s previous October 2023 forecast due to resilience in the US and several large emerging market (EM) economies and anticipated fiscal support in China. However, it is worth considering that these figures are below the historical average of 3.8% YoY growth from 2000 to 2019 due to high central bank policy rates, reduced fiscal support, and low productivity growth. Evolving risks may also slow global economic activity as the year progresses. China faces ongoing challenges despite a robust 5.3% QoQ annualised expansion in 1Q24. Debt sustainability risks and a struggling real estate sector constrain economic activity in China. Authorities have supported strategic sectors and allocated US$42bn to buy excess property stock to stabilise China’s beleaguered property sector. However, these measures are insufficient to reverse negative trends. China’s recent spurt in growth has been driven by an export-led rebound in industrial activity, which may face obstacles due to steep US import tariffs targeting China’s strategic exports, including electric vehicles (EVs).

The continued divergence in growth outcomes between EMs and DMs has primarily been driven by differences in productivity growth and the impact of high borrowing costs. US fixed-rate debt instruments have helped maintain household balance sheets, while the withdrawal of pandemic-era fiscal support has introduced volatility to short-term growth across economies. Country-specific monetary policies have significantly influenced post-pandemic growth outcomes. A mild economic slowdown is likely, but there is reason for optimism. If central banks can control inflation, a less restrictive monetary policy in late 2024 should stimulate economic activity in 2025. Major Western central banks’ shift towards looser monetary policy supports this outlook. The European Central Bank (ECB) recently cut interest rates, following the Swiss National Bank (SNB), Sweden’s Riksbank, and the Bank of Canada (BoC) earlier this year. Further rate cuts are expected from the Bank of England (BoE) in August and the US Federal Reserve (Fed) in September, contingent on favourable inflation and wage trends. The easing pace will be gradual and dependent on inflation and wage developments. Regardless, downside risks remain – particularly concerning major upcoming elections and growing protectionist policies.

On the local front, in 1Q24, SA’s economic activity contracted by 0.1% QoQ (with a 0.2% decline on the expenditure side), following an upward revision to a 0.3% expansion (previously reported as 0.1%) in 4Q23. Persistent structural challenges, including inadequate logistical infrastructure, limited energy availability, and emerging water scarcity, drove the 1Q24 contraction. Additionally, high interest rates and dampened sentiment across the economy contributed to subdued growth. Looking ahead, we expect inflation to remain subdued, albeit at levels higher than initially envisioned at the start of this year. Core inflation (particularly that of goods) will likely be subdued as consumer demand continues to be constrained by the pressures of elevated interest rates. Nonetheless, inflation remains some way off from the SA Reserve Bank’s (SARB) target of 4.5%. This will likely keep the SARB’s tone hawkish in any near-term remarks. The central bank has remained steadfast in communicating that it will not move the policy rate lower (and thus essentially usher in a rate-cutting cycle) until inflation is under control and sustainably hitting that target. As such, we foresee potential rate cuts materialising towards the end of 2024, depending on the inflation outlook (locally and abroad) and global interest rate developments as we progress further into this year. At this stage, we expect an initial rate cut of 25 bps in November, followed by a further 50- to 75-bp worth of cuts in 2025 and leading into 2026.

On the political front, it is still too early to draw any concrete conclusions about the effectiveness and efficiency of the GNU and the resultant new Cabinet. Regardless, as it stands, the executive is now in a far stronger position to guide the country’s much-desired (and needed) reform course in critical areas than it has been in many years. At the time of writing, the new Cabinet, on balance, has been viewed positively by financial markets. Bond investors have been particularly encouraged by the continuity in National Treasury, which remains committed to fiscal consolidation. The addition of a deputy minister is also viewed as supportive. The portfolios focused on priority areas for the policy reform agenda have seen several improvements and strong appointments, further bolstering our optimism regarding the positive impact of policy reforms supported by Operation Vulindlela, the policy implementation unit of The Presidency and National Treasury. Despite structural reforms’ complex and protracted nature, this continuity and focus on critical areas strengthen our confidence in the ongoing reform efforts.

The election outcome and GNU are steering SA politics toward the centre. The Radical Economic Transformation (RET) faction will be positioned to the left (or far right, depending on your perspective), libertarians to the right, and a pragmatic centre will advocate for social-democratic policies. This marks the most significant political realignment since 1994. Nonetheless, this new Cabinet is by no means a “silver bullet’’ for the domestic economy – the road ahead will be difficult, fraught with the usual politicking and disagreement amongst the various members of the GNU. Up until the announcement of the new Cabinet, investors had become increasingly concerned about the GNU potentially collapsing at its first major challenge. This, in turn, unfortunately, damaged confidence in the GNU itself and in its ability to influence SA’s economic and political direction positively. This moderation or correction in sentiment (think Ramaphoria 2.0) was necessary in some measure. Market sentiment now better reflects the complexities and risks inherent in SA’s evolving, dynamic coalition landscape.

As such, 2H24 holds the potential for an uptick in the local economy. As interest rates ease and inflation slows, there is the possibility of a boost in consumer spending. Positive developments include progress in energy and rail sector reforms and efforts to address grey-listing concerns. However, inconsistent international relations, infrastructure bottlenecks, and residual policy uncertainty remain constraints to SA’s growth.

SA EQUITIES

As measured by MSCI SA, South African equities delivered a strong 2Q24, up 11.3% in rand and 4.4% in US dollar terms. In 2Q24, the FTSE JSE All Share Index (+6.9%) outperformed both DM equities (MSCI World +2.8%) and the broader EM universe (MSCI EM Index +5.0%). The FTSE/JSE Capped Swix Index, a more commonly used local index performance measure, delivered a similarly solid performance, up 8.2% in 2Q24.

As an investment house, we turned bullish on local equities at the end of 1Q24, citing several technical factors that had set the index up nicely relative to global equities and local fixed income. At the margin, the developments over this past quarter have reaffirmed our positive stance towards local equities, with our 12-month total return of 14% still comfortably above that of global equities (7%). Accordingly, we maintain our overweight stance on domestic equities.

Several factors led to the outperformance of JSE-listed equities during the past quarter. BHP Group’s failed attempt at buying local mining champion Anglo American Plc, if anything, highlighted the extreme value on offer across the local market. The takeover attempt reignited interest in domestic assets as we headed into the 2024 NPEs. The elections, late in the quarter, proved to be the ultimate catalyst to reprice SA assets, which, for once, managed to surprise for the right reasons.

Going into the elections, our base case was for the ruling African National Congress (ANC) to drop below 50% and settle somewhere around 45%, with the controlling balance gained from forming coalitions with smaller, more aligned parties such as the IFP. The final tally, with the ANC’s support plummeting to 40.2% of the vote (vs 57.6% in 2019) and the party losing its parliamentary majority for the first time in democratic history, came in well below our expectations. The NPE results opened up the possibility that the ANC would need to go into a coalition with the far-left (the M.K. party or the Economic Freedom Fighters [EFF]), which would have been interpreted as being market unfriendly. However, the result also opened the possibility of the ANC working with the broadly centrist Democratic Alliance (DA) to form a GNU, thereby taking a step forward in advancing a reform agenda and pursuing a more market-friendly outcome.

It is worth noting that the possibility of the ANC and the DA sharing responsibility in running the country was not even part of our pre-election planning discussions. We interpret this outcome to be as positive as we could have hoped for a few months ago.

The initial response to the NPEs was favourable, with an almost instant repricing of the local risk-free rate (as measured by the generic ten-year government bond) from 12.5% to 11%. The knock-on effect was a re-rating of domestically focussed assets, with the JSE-listed banks being most leveraged to a move in the risk-free rate. The FTSE JSE SA Banks Index ended the quarter 20% higher.

The move higher in SA assets can largely be explained by a re-rating of domestic assets due to the risk-free rate changing. Both moved from extreme levels heading into the NPEs and still screen as cheap compared to any period in post-apartheid SA. The moves to date have seemed orderly and rational.

With the post-election relief rally now largely behind us, attention turns to whether the country and its corporates can capitalise on the incredible opportunity to ignite growth and invite foreign investors (including local assets managers sitting at their maximum offshore exposure limits) back to the JSE.

We remain cautiously optimistic, with the 12-month total return of 14% not considering much-improved earnings prospects. We maintain the view that local bonds offer good value and that earnings expectations have not yet been revised higher despite the outlook for domestic growth having increased vs a few months ago on the back of an improvement in local operating conditions. This has been helped along by a marked improvement in the energy situation (three months of no loadshedding from stage 6 just one year ago) and an improvement in consumer sentiment following a peaceful and orderly election outcome, not to mention a few interest rate cuts expected over the next six months. Changes to retirement savings legislation (the so-called two-pot system) are also expected to add 0.5% to SA’s GDP when it becomes effective later this year.

Our views on SA equities are not without risk, and investors have fresh wounds from 2017/2018 when President Cyril Ramaphosa ousted ex-president Jacob Zuma for the leadership of the ANC and the country. Ramaphosa was perceived as being market-friendly, and domestic equities enjoyed a stellar run, only for the result to be a continuation of the same mismanagement of the economy and state finances that plagued the Zuma administration (and subsequent de-rating of SA equities). Since then, SA has been a perennial underweight in most global and EM portfolios. The investor exodus was felt most acutely in the ratings on local bonds (after SA lost its last investment-grade rating, it was ejected from the FTSE World Government Bonds Index [WGBI], prompting a sell-off in SA government bonds) and the domestically focussed JSE businesses (financials, retailers, property, mid-caps). The risk is obviously that the parties that make up the GNU fail to find a way of working together to kick-start growth. Globally, coalition politics have a poor track record in making timely decisions that satisfy all parties and objectives.

We believe the best way to approach this potential local inflexion point is to keep an open mind and a sharp eye on whether the renewed optimism around governance in SA translates into a durable investment and earnings cycle – attributes that will kick-start a sustained rally in domestic risk assets. While we expect a tough earnings season to July (particularly from the retailers), commentary from corporates on their post-election trading outcomes will be vital in framing earnings expectations going into the back end of this year. In our portfolios, we have maintained our bias towards quality, dependable earnings streams. Still, we have also earmarked several mid-cap counters to watch closely for signs of domestic recovery.

DOMESTIC BONDS

Despite a negative 1.8% return at the index level in 1Q24, South African Government Bonds (SAGBs) demonstrated resilience, bouncing back in 2Q24 to return 7.49%. The result is a YTD return of 5.55%. The curve’s movement has been flattening across 2Q24, which has supported longer-duration bonds. The SA All Bond Index (ALBI) term splits reflect this reality, with the 12-year-plus split outperforming all others. The ALBI duration remains 5.5 years, even with the weighting of the R186 (now the shortest SAGB in the index, maturing in 2026) dropping by c. 20 bps every month as the index is reweighted and reconstituted.

As 1H24 closes, we have seen no interest rate movements thus far. The US Fed and the SARB MPC have kept rates steady year to date, with both central banks highlighting concerns about inflation and the underlying strength of their respective economies.

We previously highlighted SARB Governor Lesetja Kganyago’s drive to reduce the inflation target band, currently between 3% and 6% (with the midpoint currently interpreted as 4.5%). However, any change to the inflation target does require sign-off from the finance minister, although interpretation of the target range is open to the MPC itself.

Our outlook for rates going forward has moderated slightly downwards. We started 2024 with expectations for rates to remain stable through 1H24 and for two rate cuts in 2H24 (we did highlight that the risks to this view were heavily biased towards two cuts becoming one, rather than two cuts becoming three). We now foresee one rate cut through year-end and two more cuts arriving through 2025. We thus expect the repo rate to end 2024 at 8% and to move to 7.5% by the end of 2025.

The outcome of the SA election materialised at the lower end of pre-election polling ranges, with the ANC netting a 40.2% national outcome. Most of its loss of support can be attributed to the rise of former president Jacob Zuma’s M.K. party. Zuma was able to motivate a base in KwaZulu Natal ([KZN] and, to a lesser extent, in Mpumalanga and Gauteng), which saw the party net a total of over 4.5mn votes (14.6% of the ballot). In addition, voter turnout collapsed from over 65.9% in 2019 to 58.6%, further eroding ANC support.

Post-election, the ANC was forced to form a coalition government called the GNU. Fundamentally, the GNU comprises the ANC, DA, and the IFP, as well as a coterie of smaller parties, forming a cabinet of 32 ministers, 43 deputies, the president and the deputy president.

We remain cautiously optimistic. The addition of coalition partners means that government departments have the added oversight of competing parties monitoring one another. Coupled with the absolute return on offer from SAGBs across the curve (with belly bonds offering yields over 11%), we remain confident in a broadly positive medium-term outlook for bond investors.

As we enter the back half of 2024, the significant event risk is the US Presidential Election (slated for Tuesday, 5 November 2024). The first debate was brought forward, resulting in a poor performance from the sitting president, Joe Biden. His age (Biden will turn 82 two weeks after the election), mental acuity, and physical ability to be president were brought into severe focus by a rambling and, at times, incoherent debate performance. Conversely, ex-president Donald Trump has thirty-four felony convictions (the first former US president to be convicted of such), charges of fraud, election subversion, and obstruction hanging over him—a depressing situation for the most powerful nation in the world.

Betting markets reacted sharply post-debate, evaluating a Trump victory in November at 55% likely as at most recent prints. Biden’s odds have dropped sharply, with an increasingly vocal demand for him to step aside before the Democratic National Convention (DNC) to allow the party to coalesce around a new candidate. At the time of writing, Biden resisted these calls and insisted that US voters judge him based on his record rather than an individual debate performance.

We forecast a policy mix under a Trump presidency that is more dollar-positive and inflationary, i.e., leading to higher rates for longer than a Biden (or any moderate Democratic candidate) policy mix. Our positioning remains cautiously optimistic, slightly above the index (the Anchor Bond Fund duration currently sits at 5.9 years vs the index at 5.5 years) to take advantage of the highly attractive yields still on offer in the belly.

THE RAND

The rand strengthened during 2Q24 as investors took a positive view on the outcome of the SA elections. We also note that SA’s trade balance has been positive, which is broadly supportive of the rand. We had expected the rand to average around R18.50/US$1 for much of 2Q24, which appears to have been correct. Looking forward, we think the rand’s prospects will continue to improve, and we see it trading in the R17.50-R18.50/US$1 range for 3Q24.

Projecting the rand’s value in a year’s time is a fool’s errand. This is because the rand vs US dollar exchange rate is one of the world’s most volatile currency pairs and trades well away from any modelled fair value for long periods. We highlight, however, that the rand trades within a R2.50 range to the US dollar in most 12-month periods.

We think that SA screens attractively against its competitor EMs, and it is plausible that foreign investors’ upweighting of the country could significantly boost the rand. However, we are not convinced that such an outcome is imminent. Hence, our forecast is only for muted rand gains at this stage. We think investors might take a wait-and-see approach before buying into the GNU. Still, if the renewal and reform narrative takes hold, domestic financial assets and the rand stand to benefit significantly, much as Brazil’s economy did a few years ago. Our more moderate base case is that the positive trade balance, higher gold price, and a supportive global environment as the US starts to talk about interest rate cuts will see the rand eke out small gains over time.

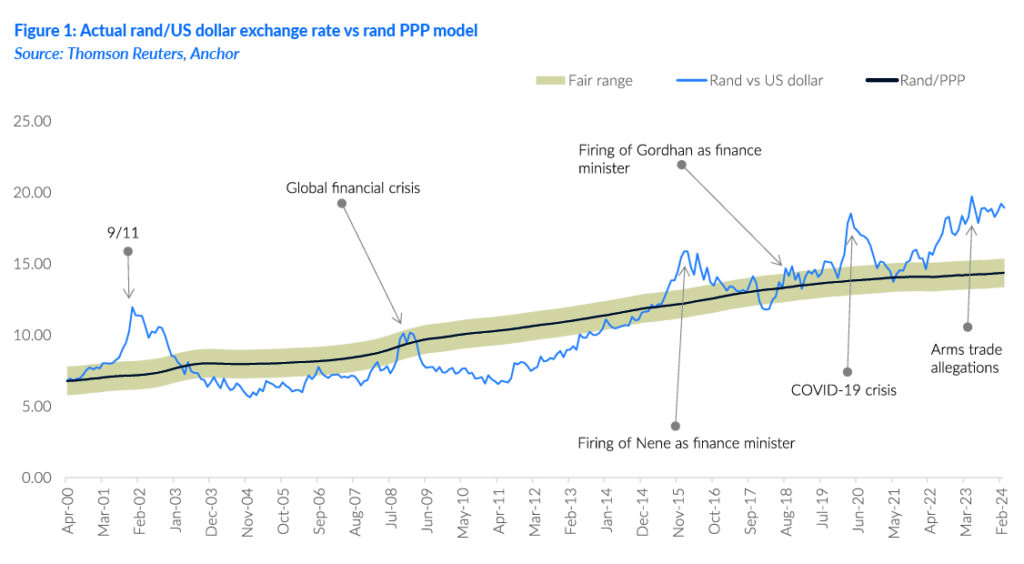

We retain our purchasing power parity (PPP) based model to estimate the rand’s fair value. We have extended this out by three months since The Navigator – Anchor’s Strategy and Asset Allocation, 2Q24 report was published on 17 April 2024. Over our forecast period, we expect inflation abroad to come under control and return towards more normalised levels. This means that our PPP model shows an increasing propensity for long-term rand weakness. As a result, our PPP-modelled value for the rand vs US dollar at the end of the next 12 months is R14.79/US$1 (see Figure 1). We apply a R2.00 range around this to get to a modelled fair-value range of between R13.79/US$1 and R15.79/US$1.

The domestic and global backdrop means we start with the rand meaningfully weaker than our modelled fair-value range. In previous cycles, US dollar strength has tended to dissipate (and reverse) toward the end of the US rate-hiking cycle. Current indications are that the US Fed will start cutting rates in September 2024 (or later), meaning that we expect to see currency normalisation, with the US dollar giving up some of its gains, in the latter part of this year. Nevertheless, we do not expect the local unit to recover fully, and we are projecting a rand exchange rate in the R17.50-R18.50/US$1 range in one year as domestic issues continue to weigh on the currency. For this report, we have modelled on R18.05/US$1.

We expect the rand to remain particularly volatile, and surprises are inevitable for the remainder of this year.

GLOBAL EQUITIES

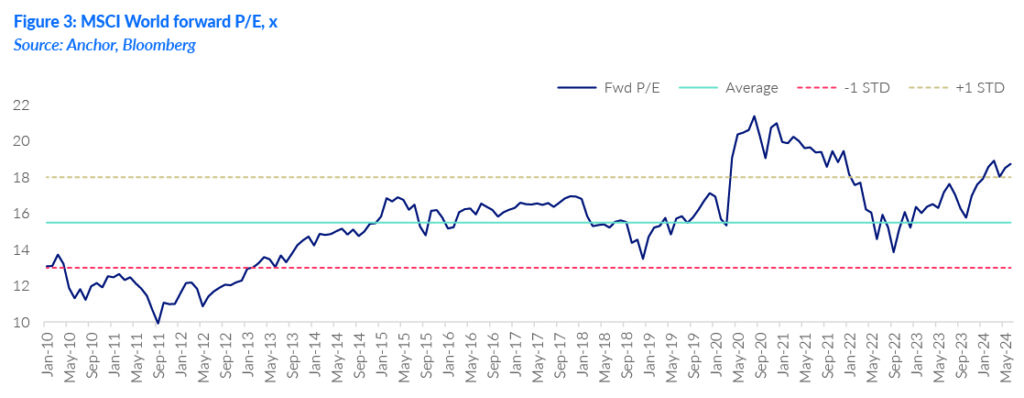

US equity markets have surged by more than 30% since their October 2023 lows, but as valuations approach 15-year highs, it is becoming increasingly difficult to remain bullish. We have downgraded our stance on global equities to neutral and forecast a respectable 7% 12-month US dollar-denominated return. However, there is an increasing chance of a shorter-term correction, given the complacency that is setting in as markets trend upwards.

Below, we detail our bull- and bear-case scenarios for global equities:

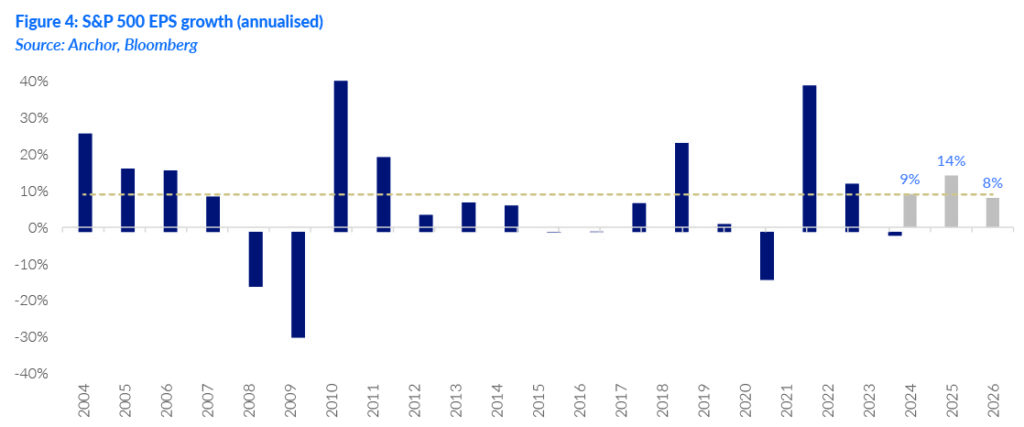

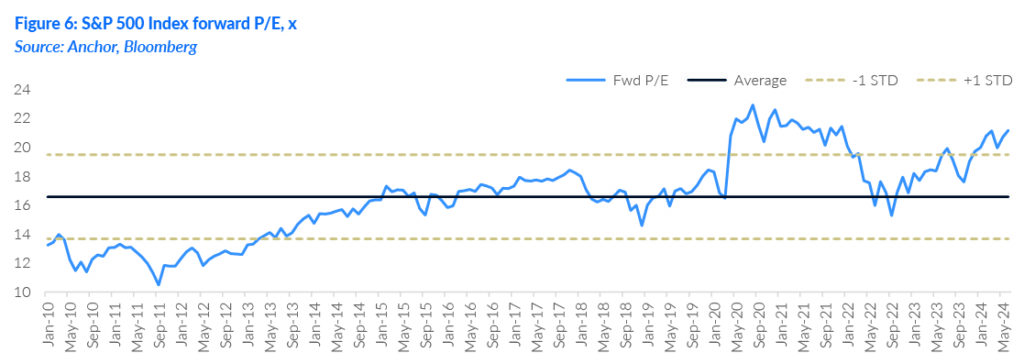

The bull case is centred around strong forecast earnings growth for the next 12 months (14% in the US, which is close to 60% of global equity markets). While the US S&P forward P/E multiple is near 15-year highs at 21x, if the big tech “Magnificent 7” stocks are excluded it declines to 18.2x. This appears justifiable, given the earnings growth outlook for the next two years. US economic growth is powering ahead, and the US Fed looks set to start lowering interest rates in September of this year. If this happens for the right reasons (normalisation of rates and inflation reaching targets rather than slowing economic growth), it will further boost sentiment and earnings growth. Even if there is some multiple compression, a double-digit market return could still be achieved. High interest rates have also seen a flood of money into money-market funds and a portion of this US$6trn could be looking for better returns as interest rates decline.

The bear case is that sustained decade-high interest rates will eventually take their toll on segments of the economy, and economic growth starts to falter. If this is accompanied by stubborn inflation, the Fed might have less latitude to reduce rates to stimulate economic growth. With high starting multiples, there is the potential for some meaningful downside in markets. Markets are priced for perfection; anything less will put pressure on equities. The first signs of this might be lower-than-expected payroll numbers as employers start expressing some caution regarding the future. Uncertainty regarding the US Presidential Election in November could also reduce risk appetite. The market could be especially sensitive to inflation reports and earnings performance in the coming months. Thus, stock selection becomes especially important.

The market is largely dismissing the bear case, and the VIX index (which measures US stock market volatility) is at very low levels. At the beginning of the year, investment banks were, in aggregate, forecasting an S&P 500 level of 4,600 at year-end 2024, and most are still constructive on equities as the S&P powers through 5,500. Underinvested fund managers are hating this bull market!

Given the scenarios above, our approach is to remain invested in equities but to be selective with valuations and stick to quality companies that can grow through the economic cycle. Passive index-level investing is riskier, given the very expensive tech shares concentration. Very few active asset managers have matched the index over the past 12 months, but this has the potential to reverse over the next 12 months. There is also an argument for shifting some exposure to Japan and Europe, as lower valuations and earnings upgrades provide a positive backdrop.

The market dynamics of the past six months are interesting. Half of the 12% return of the S&P 500 has come from the top-six tech shares, with 3% of this 12% return coming from Nvidia, which recorded a share price increase of 150% in 1H24 and is now the second-biggest company by market cap in the world – at over US$3trn. The remaining 494 companies contributed 6% of the 12%. In 2Q24, most sectors were negative, with sparse returns outside technology. Perhaps this reflects some of the caution expressed in the bear case above, but it has also provided a breather and allowed earnings to catch up with valuations.

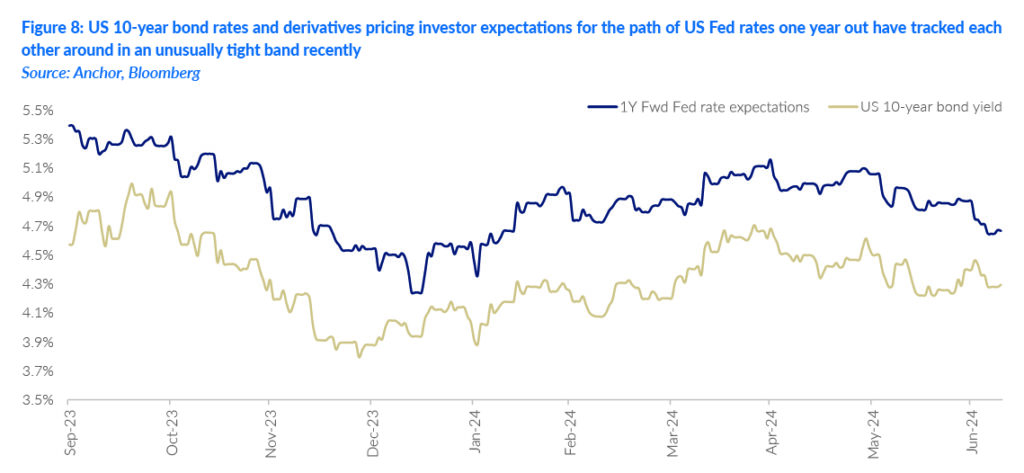

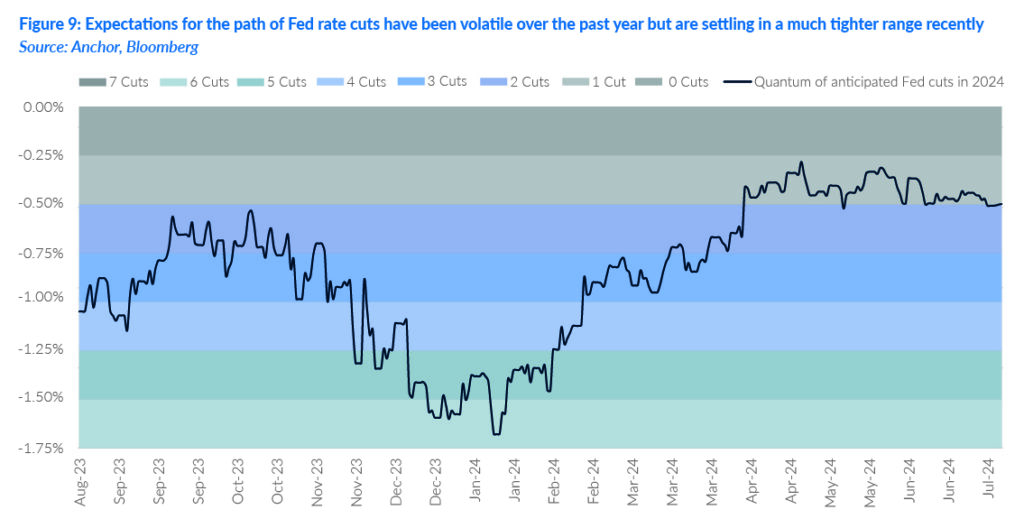

The message sent by the US Fed is key to market performance. Interest rates are now at historically high levels (5.25% from close to zero only 18 months ago), and expectations of interest rate cuts this year have declined from six to two (which equates to 1.5% of rate cuts vs 0.5%). This is because the decline in inflation has stalled somewhat, and the US economy has remained much stronger than anticipated (until recently). In other words, the Fed does not feel compelled to cut rates to avoid a recession. This is good news, and at this stage, it appears the management of the interest cycle has been exceptional. Economy doomsayers have been confounded, and strong US government expenditure has aided this process. If the economy slows, the Fed has plenty of ammunition to provide interest rate support.

Equity alternatives are considerably more attractive than they have been for the past decade, with money market funds offering 5%-plus in US dollar returns and US 10-year treasuries trading at yields above 4.3%. If you are prepared to give up some liquidity or take a little more credit risk, yields of 6%-9% are available. In Anchor’s alternative investment offering, we are targeting double-digit US dollar-denominated returns. Higher rates also mean that the high-dividend yield shares in the US have become relatively less attractive, as a 3% dividend yield is not what it used to be if I can get 3% “in the bank”.

The economic reality in the chart below shows reasonable and accelerating GDP growth. US GDP growth has surprised in 2023 and looks set to register around 2.4% for 2024; many were forecasting a recession this year, but strong US national and local government spending has provided a big boost.

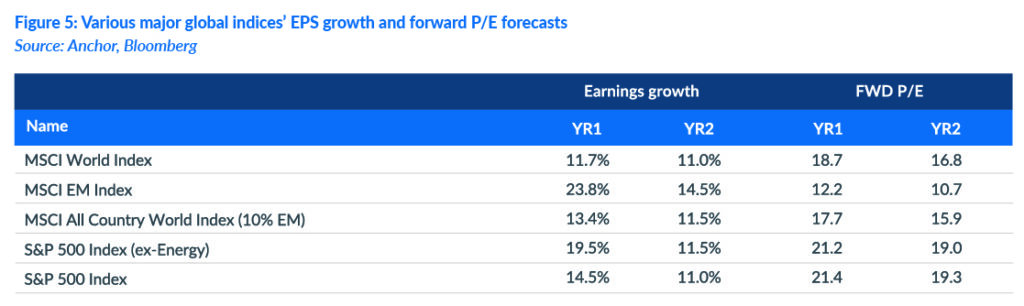

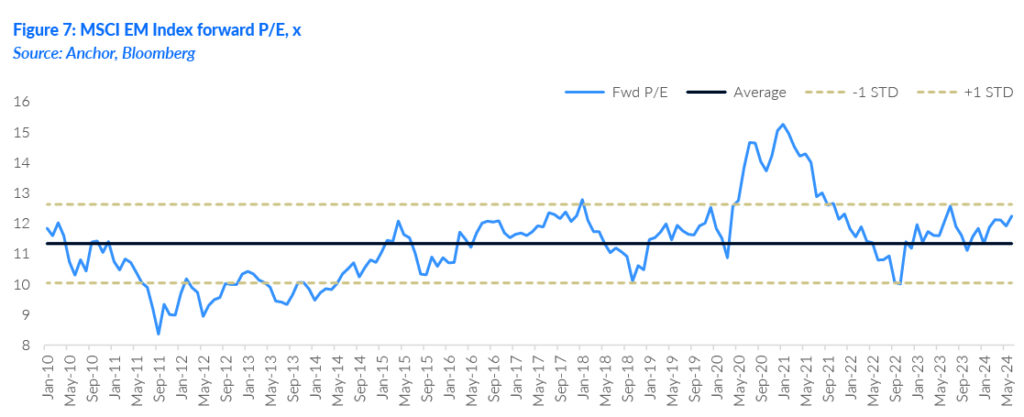

Valuations at the index level in global DMs look full (MSCI World forward P/E of 18.7x).

The most important determinant of markets is earnings, which have proved resilient in the face of higher interest rates. While many companies have been negatively impacted, those that have been able to pass on the inflation pressures have flourished. In 2023, US earnings growth recorded a 1% YoY decline. However, double-digit US dollar earnings growth should resume in 2024 and beyond, which is positive for equities. Declining interest rates and increasing earnings are a positive concoction when looking further to 2H24 and beyond.

The S&P 500 Index’s one-year forward P/E is 21.4x (see table below). Multiples often increase when earnings dip if the outlook is more positive. EMs are much cheaper and have strong recovery potential.

This is shown graphically in the chart below.

EMs have started to look interesting recently as global investors look for value. The Chinese market has begun to show some green shoots after being considered uninvestable a year ago. As a result, some of the best companies in the world are trading in single-digit P/E multiples – a stark contrast to the US. EM valuations are cheap, and a sentiment shift could lead to a sharp short-term rise. An interesting opportunity is the Chinese AI shares, which have not shared the same positive reaction to the rapidly evolving future. This is despite many of them having invested heavily in this space in the past decade.

GLOBAL BONDS

Over the past year, the US government’s 10-year funding rate has consistently been above 4% p.a. We think it is reasonable to assume that this could be considered the “new normal”, or perhaps more correctly, the “old normal” as we move away from the unrealistically low funding rates of the post-global financial crisis (GFC) era. This transition to more realistic global long-term funding rates has coincided with a period of historically high DM inflation and high cash rates. The prolonged spike in inflation and the return to more subdued inflation levels have dragged on for longer than most had anticipated, making it an exceptionally tough period for forecasting the path of global central bank rates. As US Fed Chair Jerome Powell succinctly stated in his recent press conference, “a broad range of outcomes all remain plausible” for the path of US Fed rates.

Typically, economists would expect US long-term interest rates to be more sensitive to shifting expectations for future economic growth, with shorter-term rates more sensitive to investor expectations about the short-term path of US Fed fund rates. Over the past nine months, though, those rates have tracked each other around in an unusually tight band.

Given the level of uncertainty around the path of US Fed rates and, at least over the recent past, the volatility that has caused in US 10-year government bond yields, US 10-year government bond investors have experienced some uncomfortable levels of capital volatility. We believe, though, that the level of volatility in Fed rate expectations will decrease as investors become more pragmatic about the pace of inflation and Fed fund rate normalisation.

Our conclusion is that the US 10-year borrowing rate will remain above 4% but likely trade in a much tighter band. This should give investors a total return of around 4% to 5% in US dollar terms over the next twelve months.

High-grade corporate bond investors still receive historically low additional yields for taking on the default risk associated with corporate bond investments. As such, our anticipated total return outcome over the next year (5%-6%p.a.) is roughly in line with investments in US government bonds.

GLOBAL PROPERTY

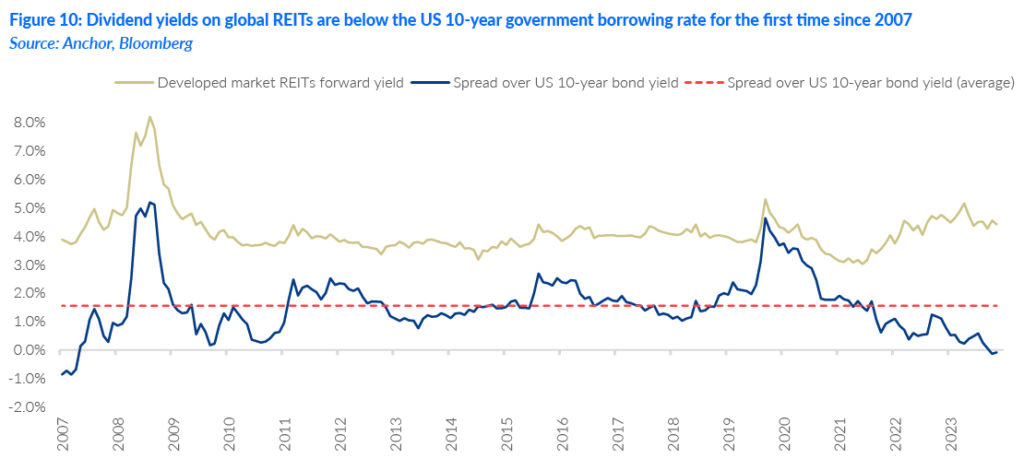

2024 YTD has been all about mega-cap US tech stocks, and pretty much everything else has lagged. Listed property shares found themselves at the back of that distant chasing pack, and real estate investment trusts (REITs) in the S&P 500 were the only sector with a negative performance at the halfway point of 2024 (-2.4% YTD). Despite this underperformance, for the first time since 2007, DM REITs now have aggregate one-year forward dividend yield expectations (4.3%) below US 10-year government bond yields.

Given our expectation that the current long-term US dollar funding rates are probably at an appropriate level, it is unlikely that a significantly lower funding environment will push spreads back towards their historical average (c. 1.5%). So, we have low conviction that a meaningful re-rating will drive returns in the sector. That means investors will need to rely on the dividend yield and the growth of those dividends for their total return. There also remains the prospect of a small de-rating to restore relative spreads. There are lots of structural undercurrents that are impacting rental growth differently across the various commercial real estate sectors. However, we think we are near the point where the traditional sectors have largely worked through negative rental reversions and started digesting higher borrowing rates. Thus, we believe there is a reasonable prospect of seeing some dividend growth over the next few quarters. The combination of those factors should result in an aggregate total return of c. 6% in US dollar terms over the next twelve months in global DM REITs.