ECONOMICS

As we move into the second half of the year, unnerved by rising inflation expectations, central banks across the globe (with the Fed front and centre) have signalled a shift in their monetary policy reaction function with restrictive rates now deemed necessary to bring inflation down to more sustainable levels. Technical recessions (in some cases) and weaker labour markets appear increasingly tolerated as the price to pay for achieving this goal. Naturally, financial markets have not taken kindly to such prospects. Government bond markets have felt the heat – recording a sharp acceleration in their sell-offs across the curve. This is being reflected in swap rates, with pressure for further mortgage rate rises. Furthermore, coupled with the widening in corporate spreads (particularly for high-yield issuers), firms’ borrowing costs are up too.

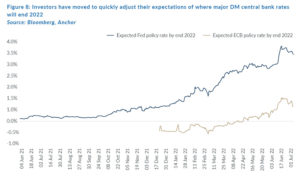

Having guided towards 50-bpt hikes for June and July, the Federal Open Market Committee (FOMC) lifted the Fed funds target range by 75 bpts to 1.50%-1.75% on 15 June. It is now signalling a 75-bpt or 50-bpt hike in July. The new ‘dot plot’ shows a (median) funds target of 3.25%-3.50% by end-2022 and 3.75%-4.00% by end-2023 – the latter 100 bpts above the Fed’s March 2022 projections. Despite the aggressive tightening, the FOMC still sees the US economy expanding. GDP is forecast to grow at an annual rate of 1.7% over the next two years and unemployment is expected to rise only modestly to 4.1% by end-2024, from the current 3.6%.

To us, this appears as an overly optimistic scenario – indeed the US economy would be fortunate to escape with such a ‘softish landing’. Arguably, a larger share of US inflation seems demand-driven, at least relative to Europe, where supply disruptions induced by the war in Ukraine are playing a far larger role. As such, the Fed has been driven to take a comparatively more aggressive stance. US policy is now being tightened through both policy rate rises and exchange rate appreciation. Consequently, this sharp tightening in financial conditions has raised the odds of a recession. At this point, the likelihood remains a roll of the die, although it is key to note that this is not a balance sheet recession driven by a financial collapse. In that sense, the downturn should be a fraction of that of the 2008/2009 GFC and the recent COVID-19-induced downturn. Furthermore, in raising key lending rates, most central banks will have created room to manoeuvre to assist ailing economies should the need arise. Nonetheless, a recession is still a recession – companies and consumers alike will feel the pain should global economic conditions tilt in that direction. In the past quarter (2Q22), financial markets have increasingly focused on the likelihood of a recession and the expectation that a recovery without stimulus will be slow.

On the local front, SA’s economic recovery from the depths of the pandemic-induced lockdowns has generally been faster than anticipated, and some of that momentum has clearly carried over into 1Q22, with the latest GDP print coming in ahead of most forecasts at 1.9% QoQ. However, looking ahead to 2Q22, the general economic outlook is clouded due to the slowdown in economic activity in SA’s key trading-partner countries due to the ongoing war in Ukraine, as well as lockdown restrictions (although now easing) in China brought about by that country’s zero-COVID policy. Furthermore, the recent floods in KwaZulu-Natal also pose a risk to growth, particularly for 2Q22. In addition, we expect the higher interest rate trajectory to be a drag on household consumption and thereby domestic GDP growth.

Interestingly, SA’s inflation environment remains different to that in most developed markets (DMs). Inflationary pressures continue to be driven by global supply conditions via food and fuel prices, with the upward drift in core and services inflation still gradual as expected. On an annual basis, we now project inflation to average 6.5% in 2022. June’s CPI data (to be released in July), which will include the quarterly (2Q22) survey of the weighty rental inflation category (usually regarded as a barometer of demand-pull inflation), will be particularly important from a monetary policy perspective.

Nonetheless, at the time of writing, we believe that the SA Reserve Bank (SARB) will likely hike rates by 50 bpts in July. From there the timing of the remaining rate hikes for 2022 is a bit more uncertain. Either way, we think that there are 100 bpts worth of rate hikes left over the remaining July, September, and November SARB Monetary Policy Committee (MPC) meetings, taking the repo rate to c. 5.75% by year-end. At the end of the day, there is a limit as to how high rates can go. The SARB has to be cognisant of the detrimental impact of a rate-hiking cycle that is too severe on SA’s already strained economy – the average South African consumer remains under increasing price pressures along with the country’s sustained high unemployment. However, we cannot discount the various inflationary upside risks at this point, which would lead to further front-loading of the interest rate cycle. Overall, it is a difficult balance to achieve, and the SARB will be walking a tightrope over the remainder of 2022.

SA EQUITIES

Following a relatively defensive start to the year in 1Q22, during which the JSE outperformed most global indices when measured in US dollar terms (1Q22: JSE Capped Swix +16% vs the S&P 500 Index -4%), the outcome for 2Q22 saw that outperformance deteriorate as the commodity exposed local index sold off in unison with global markets and the broader commodity complex. Nevertheless, YTD, the JSE still stands out as a relative outperformer, with the Capped SWIX Index down 10% in 1H22 vs the S&P 500’s 20.6% 1H22 decline. Most other global indices, and asset classes, have fared worse, however, we note that some of the tailwinds keeping the local index elevated are looking vulnerable as we head into 2H22 and global growth expectations are revised lower.

We often begin our Navigator quarterly reviews of the JSE by reminding readers of the key drivers and general composition of the JSE, an exchange that has changed dramatically over the years. We typically reduce the index down to three broad silos – the basic materials sector, rand-hedge industrials, and the domestics sector. Internally, we break each of these sectors down to their narrower subsectors when building portfolios and creating return expectations. Things seem to be getting narrower in the SA economy and the JSE. The index is getting more concentrated, with only one standalone listing to speak of in the past four years. On 27 June, diversified retailer, CA Sales Holdings (PSG Group is one of its biggest shareholders) was listed on the local bourse. This was the first SA-centric business to list on the JSE (excluding unbundlings and foreign corporates with secondary listings in SA) since Libstar was listed back in May 2018. This narrowing of the overall index has resulted in far more reliance being placed on getting the big macro variables right (more of a top-down approach) than purely bottom-up stock selection.

Over 2Q22, our decision to treat the relative outperformance of the JSE with caution proved to be correct as the JSE underperformed global indices meaningfully. However, as the local index has pulled back, so once again relative value has started to emerge. On our models, we see an attractive upside on the JSE 12 months out, with our total return expectation of 15% one of the largest total return expectations we have forecast in recent memory. As a sanity check to our thinking, we note that the JSE is currently trading at a P/E ratio of 8x – its lowest valuation multiple since the depths of the COVID-19 pandemic in March 2020. On our forecasts, the key drivers of these returns over the next year are moderate earnings growth from the domestic sectors, particularly banking, for which we still forecast double-digit EPS growth, coupled with below-average valuations. The SA banks are key beneficiaries of the rising interest rate environment if inflation remains under control and rates do not rise at too fast a pace, resulting in their loan books materially deteriorating.

Going into 2Q22, we had expected a total return 12 months out of 10%, with most of this return (c. 6%) coming from our expected upside to fair value in Naspers and Prosus. We viewed the other index constituents as being fairly priced, but the Naspers/Prosus complex, at absurdly high discount levels, stood out for us as a key driver of returns for the next 12 months. Pleasingly, this expectation did not disappoint, with a 24% return for the quarter and adding 2.2% to the total index return. Over the quarter, the discounts at which Naspers and Prosus trade relative to their underlying investments narrowed materially, and, more importantly, the discounts narrowed for the right reasons. For the first time, since the transformation of Naspers into a global technology holding company, management has come up with a concrete plan to unlock shareholder value. There have been several hits and misses along the way, the highest profile being the controversial listing of subsidiary, Prosus, in Amsterdam. However, the decision to gradually sell down their largest investment, Chinese tech giant Tencent, and buy back stock while discounts are high should be interpreted, in our view, as a great outcome for shareholders. It is a low-risk way of achieving the desired outcome of narrowing the discount and letting management spend more time focusing on core assets and less time trying to find ways to address the discount issue. Following the outperformance, our 12-month return expectation for Naspers has moderated somewhat, however, we still see material upside, even from these levels. According to our models, Naspers and Prosus could still be material contributors to index performance over the next 12 months.

Undoubtedly, the most crucial call for us to get right from here is our positioning in the basic materials sector. There has been a considerable derating in that space throughout 2Q22 as inflation fears seem to have subsided (with the sector being a key beneficiary of inflation) and growth fears seem to have taken hold. Fears around a deteriorating global growth outlook will likely result in a paring back in expected demand for some of SA’s key export commodities. The one noticeable exception is export coal, of which there is a clear shortage in the West as energy security is front and centre of the ongoing war in Ukraine and the sanctions against Russia. Using current Bloomberg consensus analyst forecasts for the sector, it is screening as extremely cheap. Free cash flow (FCF) yields are above 20%, and, following the recent pullback (in some instances of as much as 30%), it results in our total return expectations, just from capital returns, to reach into the teens. However, should the growth outlook deteriorate further, and commodity prices continue to pull back, we should start to see meaningful cuts to the dividends we expect to receive from this sector. A big cut to dividend forecasts is not our base case, however, it is a risk that is building in the sector and one we are taking seriously.

Balancing the view that the commodities seem to be selling off on growth concerns is the role that China plays in the global demand for commodities. Currently, China seems to be a counter-cyclical force in commodity demand, with the economy going through a period of monetary easing and increased fiscal stimulus following a period of (self-induced) weak economic growth. We saw, in 2008/2009, the role China played in lifting overall growth levels following the GCF, and we think there is a good chance of that scenario playing out once again. We would also like to reiterate that certain, much larger, structural supply and demand forces are at play in the commodity complex. We know that governments the world over are determined to transition to a greener, cleaner world. However, as Europe is fast discovering, this transition, while highly resource-intensive (copper, zinc, nickel, lithium etc.), will likely happen over a much longer period than initially thought. The longer-term demand case for commodities remains robust, and, importantly, global mining businesses have spent most of their FCF in the post-GFC world on prioritising shareholder returns and not increasing their capacity. Those forces underpin longer-term bullish arguments for owning the sector, however, over the short term, fears around a deteriorating global growth backdrop could increase the volatility in the sector and ultimately result in dislocated prices. Our base case is that this sector is currently offering good value, and over 12 months we expect it to be a meaningful contributor to overall returns on the JSE.

SA LISTED PROPERTY

The SA-listed property sector has suffered a similar fate as equities this year, with the SA Listed Property Index (SAPY) down 8.2% YTD and by 10.5% in June. We view this as a macro-driven decline as opposed to property specifics and yields are now very attractive. Forward dividend yields of more than 10% are achievable, with the likes of Redefine approaching 14%. We think the derating is overdone and our 11.7% projected 12-month return incorporates a slight re-rating on top of a juicy dividend yield.

Over the course of the last few months global risk aversion and recessionary fears have increased. This has seen SA bond yields increase to historically high levels and the 10-year SA government bond is hovering at around 11%. SA has also not done itself any favours and the rolling electricity blackouts are no doubt negative for sentiment generally and especially so for property. It is not great for your tenants if they cannot keep the lights on. Higher yields on government debt have had a negative impact on property share valuations as the dividend yield has become relatively less attractive.

There is no doubt that SA property shares are cheap and selected counters are trading 30%-50% below fair values. Shares are trading in a range of 20%-40% below published net asset value (NAV). However, this must be viewed in the context of all SA assets being cheap – we have highlighted bond yields and the likes of Absa and Nedbank are trading at 8%-9% forward dividend yields. In better times, our projected returns could be 20% or higher, but it will take a change in global sentiment for SA listed property to get back to reasonable valuations.

We have not downgraded our forecasts for property earnings in the last few months and SA retail sales are fairly robust. In addition, a weaker rand is positive for aggregate property sector earnings with about 40% of earnings in other currencies (although the rand is primarily stronger against the US dollar, as opposed to the euro, the major functional currency).

So, there is a strong underpin to share values after the dip in recent months and with a 10%-plus dividend fairly certain, the risk/return equation for property looks attractive over the next 12 months.

DOMESTIC BONDS

2Q22 has been a period of pronounced underperformance in SA government bonds (SAGBs). From a small positive return in 1Q22, 2Q22 has ended with SAGBs weaker across the curve. Yields have been pushed higher by Russia’s ongoing war on Ukraine, the continued and consistent high inflation prints emerging from DMs, and DM equity risk-off sentiment which has resulted in all risk assets selling off in unison – SAGBs have not been exempt from this.

Domestically, political issues came to the fore once again:

- The worst round of loadshedding (stage 6) since 2019 due to continued poor maintenance combined with strike action which left Eskom unable to meet the country’s power requirements, especially during winter when demand is elevated.

- President Cyril Ramaphosa’s personal dealings came back to haunt him with the revelation that a burglary at his Phala Phala game farm was covered up and a large quantity of cash (allegedly US$4mn) stolen. At all levels this weakens his political power especially since the president has not yet adequately responded to the allegations.

- Severe water shortages in the Eastern Cape (particularly in Nelson Mandela Bay) have put additional pressure on already fragile coalition politics in that part of the country.

- The release of the final part of the report by the Judicial Commission of Inquiry into Allegations of State Capture headed by Chief Justice Raymond Zondo. The report’s release has applied further pressure on the president as well as senior members of the governing ANC, given their deep knowledge of what was happening at the time.

The abovementioned confluence of issues has occurred alongside global pressures resulting in SAGBs posting a loss this quarter of 3.71% at the All Bond Index (ALBI) level.

Central bank action globally is being driven by heightened inflation fears. Locally, the SARB has also shown its willingness to hike rates aggressively, if needed, with the repo rate now 125 bpts higher than the low it reached during the COVID-19 pandemic. Currently, the repo rate is at 4.75% – the range of views for the repo rate’s level at end 2022 is wide, with some expecting as little as 75 bpts worth of hikes to others forecasting hikes as high as 175 bpts. Considering that domestic inflation has printed above the target band in May, we believe this range of estimates to be fair.

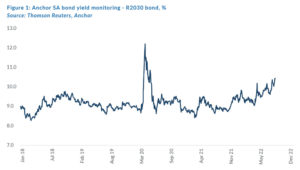

As above, the R2030 benchmark bond is currently yielding over 10.5% – the weakest it has been in the post-COVID period. Considering the shortening duration of the bond over that two-year period, we remain constructive on SAGBs, and we believe that there is potential capital appreciation as well as a highly attractive yield on offer.

In The Navigator: Strategy and Asset Allocation, 2Q22 report, dated 12 April 2022, we highlighted the risks to this view – these risks remain. Looking forward, the risks of a recession, globally and domestically, are elevated from previous levels. The possibility of central bank action to combat inflation resulting in low growth, which would have a negative impact on SAGBs, has increased materially.

At current levels, the ALBI yields 11%, if a recession were to materialise, we believe yields could weaken by c. 100 bpts, this would imply a return to end 2022 of -0.5% to 0% and a one-year return of about 5%. The range of outcomes for SAGBs is thus wide looking forward over the next 6-12 months. However, over a 3-year horizon, current yields present an attractive entry point for investors looking to earn income over time.

THE RAND

The South African rand is supposed to be a high beta currency that moves significantly as investor appetite for EMs ebbs and flows. We have seen the rand weaken to R16.25/US$1 as markets price in the increasing probability of a US recession. This, coupled with devastating loadshedding, is putting the rand on the back foot.

Projecting the rand’s value in a year’s time is a fool’s errand. The rand vs US dollar exchange rate is one of the world’s most volatile currency pairs and trades well away from any modelled fair value for long periods. We note, however, that the rand trades within a R2.50 range to the US dollar in most 12-month periods.

The loadshedding will ease and a little rand recovery might be expected. Much depends on the stance one takes towards the US being able to avoid a recession. In the absence of a US recession, the rand has scope to strengthen towards our fair value range of R14.50-R15.00/US$1. A recession has historically been bad for the rand and a level of R17.50/US$1 is certainly plausible if a US recession does happen.

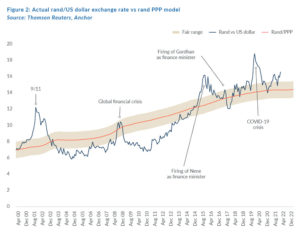

We retain our purchasing power parity (PPP) based model for estimating the fair value of the rand and we have extended this out by three months since the publication of The Navigator – Anchor’s Strategy and Asset Allocation, 2Q22 report on 12 April 2022. Our PPP-modelled value for the rand vs US dollar at the end of the next 12 months is R14.15/US$1 (see Figure 2). We apply a R2.00 range around this to get to a fair-value range of between R13.15/US$1 and R15.15/US$1.

We expect that much of the remainder of 2022 will be difficult for the rand and levels around R16.00/US$1 are to be expected. The markets will be more volatile than normal and a level of R17.50/US$1 also remains plausible in recessionary scenarios. We think that the rand will trade outside of the PPP level for a while.

GLOBAL EQUITIES

After a very tough first half of 2022, global markets are 20%-30% cheaper than at the beginning of the year, depending on which indices investors reference. Most shares are below their pre-pandemic levels (January 2020) and many buying opportunities are emerging. An uncertain global market outlook has shaken investor confidence and we expect high volatility to be sustained and it is unclear when the market will bottom. It always is.

However, we have now reached price levels at which we would be happy to be a buyer of shares on a further dip on a 12-month view. It is quite conceivable that markets will be c. 15% higher in 12 months as global interest rate increases have peaked and the market looks forward to the next phase of the cycle. The risk is that it takes a little longer than 12 months, which we believe is a risk worth taking. As we wait, the companies we own will become fundamentally more valuable as they generate cash, invest in their businesses, and buy back shares.

Very simply, a drop of this magnitude is generally followed by an above-average next 6-12 months as when fearful, the market typically prices in an outcome worse than what materialises. Investing now feels very uncomfortable, but this is when good businesses can be purchased at attractive values.

Most importantly, share-specific opportunities surface which have not been available for the past year or two. This scenario is good for some companies and bad for others. The high inflation environment is great for quality companies with pricing power, which is the focus of our investment philosophy. Many “value” or defensive/lower-quality companies have held up well and could be a drag on index returns going forward. This is a time for doing less rather than more, as markets find their levels, but we are continually reassessing the thesis for all our investments to assure us of their durability.

A very rapid change in the economic outlook has occurred over the past six months. Only six months ago the market was not expecting a rise in US interest rates in the first half of 2022. Fast forward six months and we are in the midst of an aggressive rise in interest rates, with the market already pricing in interest rate declines as soon as 2023! Economists and strategists are, in aggregate, particularly bad at forecasting the short-term future.

Market commentary and expectations are broadly negative with consistent and consensus themes; sustained high energy prices, as well as high and sticky inflation, leading to sustained interest rate increases which drive down economic growth and result in earnings downgrades. The common message is that this will drive the last leg of the bear market and see a further leg down. We highlight the consensus expectation that analysts will downgrade earnings forecasts and hence they will come as no surprise. It is surprises that move markets, not the actual events themselves.

We would be more bullish if valuations were lower, as they have come from elevated levels at the start of the year. Valuations 5%-10% lower would fully incorporate potential earnings downgrades and would approach “banging-the-table” levels. The risk to our thesis is that earnings downgrades are bigger than expected. The market is now priced for a moderate decline in economic activity and the risk is that the US Fed overshoots in the short term. However, if the US economy gets throttled too quickly, we could well see the Fed “chicken out” and hold back on further action. US inflation numbers will be watched closely. We expect that US inflation has peaked and will decline back to normal levels over the next 18 months, however, inflation is a lagging indicator and will remain frustratingly high for the next few months.

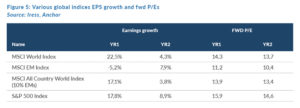

Figure 3 below shows the MSCI World Index forward P/E multiple, which is now at a more digestible 15x. With earnings growth of above 10% in the past six months and indices declining, the market is over 25% cheaper than it was six months ago, and certain sectors are 20%-50% cheaper. We have shifted from growth companies all being given the benefit of the doubt to an environment where a premium is placed on certainty and the premium for growth is the lowest in the past five years.

Some comfort also comes from the fact that US households and corporates started 2022 with strong balance sheets and relatively low debt levels. World GDP growth is projected to be reasonable this year, but Bloomberg consensus data have projected 3.6% world GDP growth this year – downgraded from the earlier 4.4% consensus growth forecasts for 2022. There is a risk this could be lower. DM interest rates are also coming from close to zero and we do not expect them to be increased to unpalatable levels. The absolute levels of projected interest rates will still be average to low by historic levels and still at levels where a reasonable ROE can be earned on new capital investments.

We also favour small exposure to emerging markets (EMs), particularly China, whose listed shares have risen sharply in recent months, as we projected in our The Navigator: Strategy and Asset Allocation, 2Q22 report, dated 12 April 2022. In contrast to the US, China is stimulating its economy to drive growth and the government has, for the first time in 12 months, made market-friendly statements. This has seen a sharp bounce in Chinese shares off their extreme lows, although they still trade at record-low valuations relative to their US counterparts. Geopolitical uncertainties are the highest they have been in decades, but the upside optionality and risk/reward equation favour some portfolio exposure.

Figure 5 shows the relative value of EMs (forward 11x P/E), where we expect growth to be the strongest in year-two.

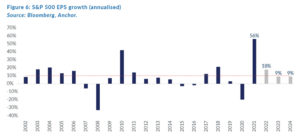

The simplest and most compelling argument for equity ownership is the graph below, which illustrates the 9% US dollar-denominated annual earnings growth rate for the past 20 years. Market returns follow earnings growth (plus dividends) over time, and any investor should be delighted with an annualised return of this magnitude. As indicated above, Bloomberg consensus data could well be downgraded, but we would argue that, while analysts might have to catch up, most fund managers already have this baked into their expectations. Lower-than-projected earnings growth in 2022 and 2023 would probably see a bigger earnings growth rebound in 2024.

It feels risky talking about positive double-digit 12-month market returns in the face of economic headwinds, and it is. Things could turn out worse than expected in the short term, and the market awaits the US 2Q22 earnings season with trepidation. Subdued earnings and prospects statements could drive specific shares (and maybe the market) even lower, and, for new money, we would deploy capital in tranches. However, our inherent belief is that trying to time the market in the short term is fairly random, and we focus on the long-term values of quality businesses. Many good companies are now trading at below their long-term fair values, and we would be even more compelled to buy these shares in the event of further short-term downside.

One last point is that US 10-year bond yields trade at around 3%, which is probably a fair level. At a forward 16x P/E, US companies are, on average, trading at a 6.25% yield on earnings (1/16). The differential is 3.25%, a fair reward for taking equity risk over bonds. When the equity outlook is poor this differential has historically got much higher but trying to time the absolute bottom often results in missed opportunities. From a long-term perspective, we are happy to buy around these levels.

GLOBAL BONDS

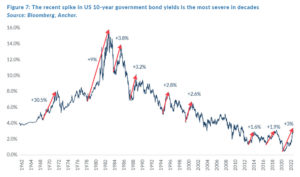

Not since the US was grappling with inflation in the teens, during the 1980s have we seen such an extreme and prolonged spike in the 10-year funding rate of the world’s reserve currency (the US dollar). With US inflation at 40-year highs, still surprising to the upside and proving stickier than anticipated, US 10-year government bond yields recently touched 3.5%. This was the first time it happened since the US sovereign debt rating was downgraded in 2011, when politicians haggling over the country’s budget caused a government shutdown. The yield on the benchmark bond has fallen in recent days, dropping below 3% at the start of 2H22 as investors try to quantify the likelihood that aggressive monetary policy tightening by global central bank will catalyse a recession.

It is fairly clear that the path for major DM central bank rates for the next few months is higher, at a pace that is quicker than we have seen in decades and that is already factored into investor expectations for short- and medium-term rates.

However, the crux for deciding the outcome for investors in global government bonds over the next twelve months comes down to how quickly inflation will respond to tightening monetary policy. The quicker inflation starts to subside, the more likely it is that central bankers will be able to take their foot off the brakes before economic momentum stalls. Unfortunately for the central banks, a large part of the inflationary problem is a cost-push one, particularly as it relates to food and energy prices. Therefore, slowing demand to a level that meets the current constrained supply would almost certainly require them to inflict meaningful economic destruction, so they will be hoping that supply disruptions are at least partially resolved sooner rather than later, without the central banks needing to do all the heavy lifting. The possible outcomes are:

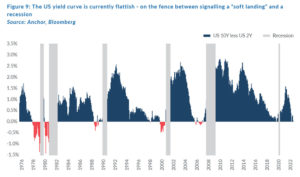

- Some supply-side resolutions dovetail with tightening monetary policy to manufacture a “soft landing” and avert a US recession or severe slowdown.

- In this instance, US policy rates should settle around 2%–2.5% and an upward sloping yield curve would result in US 10-year yields of 2.75%-3.25%.

- Monetary policy needs to do all the heavy lifting, with policy rates overshooting their neutral level and heading towards 3.25%–3.75% and catalysing a recession that would require the Fed to reverse course and loosen monetary policy.

- In this instance, we are likely to see some yield curve inversion as investors start to factor in a lower-growth trajectory and more accommodative monetary policy, driving US 10-year bond yields back towards 2%–2.5%.

With US 10-year bond yields currently hovering at around 3%, we see investors still pricing in a pretty decent chance of a “soft landing”.

While we think there is a reasonable chance that a year from now many of the supply chain bottlenecks are resolved and we have collectively found ways to meet the world’s food and energy needs despite the challenges created by the war in Ukraine, we suspect that those supply-side adjustments will come too late to prevent the Fed hiking to a point of meaningful economic damage. As such, we expect US 10-year bond yields to be discounting a slightly lower growth trajectory and some monetary policy easing, leaving them at a yield of c. 2.75% 12-months out. This should provide investors in US 10-year government bonds with a 12-month total return of around 3%. As always, the possibility of achieving a slightly better outcome in global government bonds remains for those investors willing to explore opportunities in different geographies and maturities.

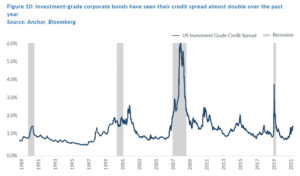

Moving onto global corporate bonds, these have borne the brunt of both the spike higher in interest rates and the widening of credit spreads which, for investment-grade corporate bond issuers, have jumped from 0.8% to 1.5% over the past 12 months.

While the blowout in credit spreads has been fairly severe, the level remains below that seen in most recessions, and with an increasing possibility of the Fed causing some meaningful economic damage in their efforts to get inflation under control, it seems reasonable to expect a moderate amount of additional widening in credit spreads. Much of this widening in credit spreads is likely to be offset by slightly lower government bond yields, leaving investors in US investment-grade bonds with only negligible capital losses combined with a healthy yield of c. 4.7% to deliver a total return over the next 12 months of 4.5%.

GLOBAL PROPERTY

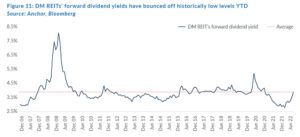

After a stellar year for the global property sector in 2021 (FTSE/EPRA/NAREIT DM REIT Index +27% YoY), DM-listed property has seen its fortunes reverse sharply along with other risk assets in 2022, joining DM equities in reaching a bear market (-20.3% YTD) in the first half of the year following a 17% QoQ drop in 2Q22. The fall in real estate investment trust (REIT) share prices, with very little adjustment to the anticipated fundamentals (particularly the expected dividends), has caused a large spike in the forward dividend yields for this asset class.

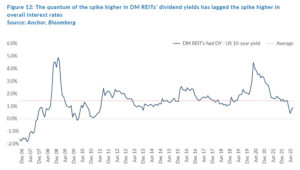

Unfortunately, despite the precipitous drop in their share prices YTD (and the resultant spike in expected yields), the overall yield environment has deteriorated at an even faster pace. As such, DM REITs are trading at a lower premium to US 10-year government bonds than they have historically averaged.

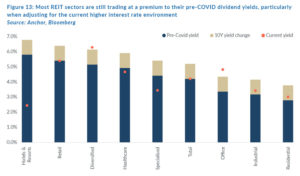

This means that most DM REIT sectors are still trading at a forward dividend yield that is lower than pre-COVID levels, after adjusting for the fact that we are now in a higher interest rate environment.

The office sector stands out as one that is looking moderately cheaper than its peers on a relative basis, particularly given the already elevated vacancy rates in this sector. However, obviously, the jury is still out on how much of an impact we will see from permanently higher work-from-home (WFM) levels. Given the uncertainty, a lower valuation is perhaps justified, particularly considering that the office sector’s fortunes are also linked to employment levels, which potentially stand to suffer as central banks aim to tackle inflation, with the economic forecasts from members of the US Fed having recently started to factor in higher US unemployment rates.

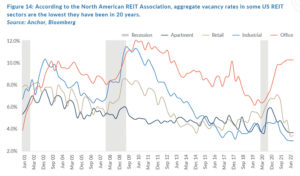

With REITs perhaps still on the pricey side of fair value, based on the higher interest rate environment we find ourselves in, we think that there is a possibility that yields will need to compress slightly to adjust for this. There is also a possibility that as economic activity slows, we will need to see vacancies creep higher in a few sectors where they are currently at the lowest level, they have been in the past twenty years.

We think these headwinds should be more than offset by rental growth which should be easy to achieve in the current high inflationary environment. The combination of these factors we believe will deliver aggregate capital growth of c. 2.8% which will combine with a yield of 4.2% for a total return for investors in global listed real estate of c. 7% in US dollar terms.