ECONOMICS

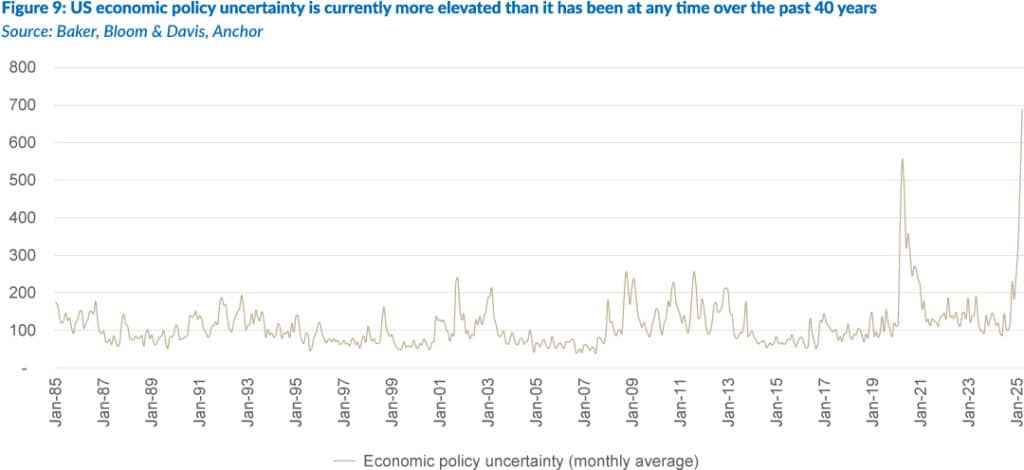

As we enter 2Q25, the global economy is at a critical juncture, reshaped by rapidly rising trade tensions, escalating inflation risks, and a growing shift toward de-globalisation. At the heart of the current disruption lies the US’s imposition of sweeping global tariffs – an aggressive re-escalation of protectionist trade policy that threatens to unwind decades of global economic integration. These are not short-term measures. Trade wars do not blow over in a week or two; they are structural shocks with profound and lasting consequences. The immediate impact of the latest round(s) of US tariffs (and reciprocal tariff measures currently being levelled out by US trade partners) is a widespread jolt to global trade confidence.

History has shown us the dangers of such policies—most infamously through the Smoot-Hawley Tariff Act of 1930, which deepened the Great Depression by triggering retaliatory measures and causing a collapse in international trade. While today’s global context differs—most notably with US unemployment hovering at 4.2%—there remains a serious risk of repeating past mistakes. A shortage of skilled labour could undermine any effort to onshore production, pushing up wages and feeding back into inflationary pressures. This is a scenario that the US Federal Reserve (Fed) is unlikely to welcome, especially as it seeks to stabilise inflation while maintaining economic momentum.

Currently, global markets are reacting with heightened volatility. The broader concern is that this tit-for-tat could rapidly evolve into a full-scale trade war, with retaliatory actions by other nations leading to a global slowdown. The International Monetary Fund (IMF) has revised its global growth outlook lower, citing trade tensions as a key risk. The probability of a US (and thus, by proxy, global) recession, whilst not our current base case, remains a consideration. In a best-case scenario, we are still facing a meaningful slowdown in economic activity worldwide. Beyond the near-term disruption, a deeper trend is taking hold: de-globalisation. Trade relationships, routes, and corporate supply chains are being rewired, not purely for efficiency but for strategic and political reasons. This realignment will take time and is unlikely to be growth-enhancing. While some nations may adapt more quickly, the result will be a more fragmented global economy in which we will all likely be worse off.

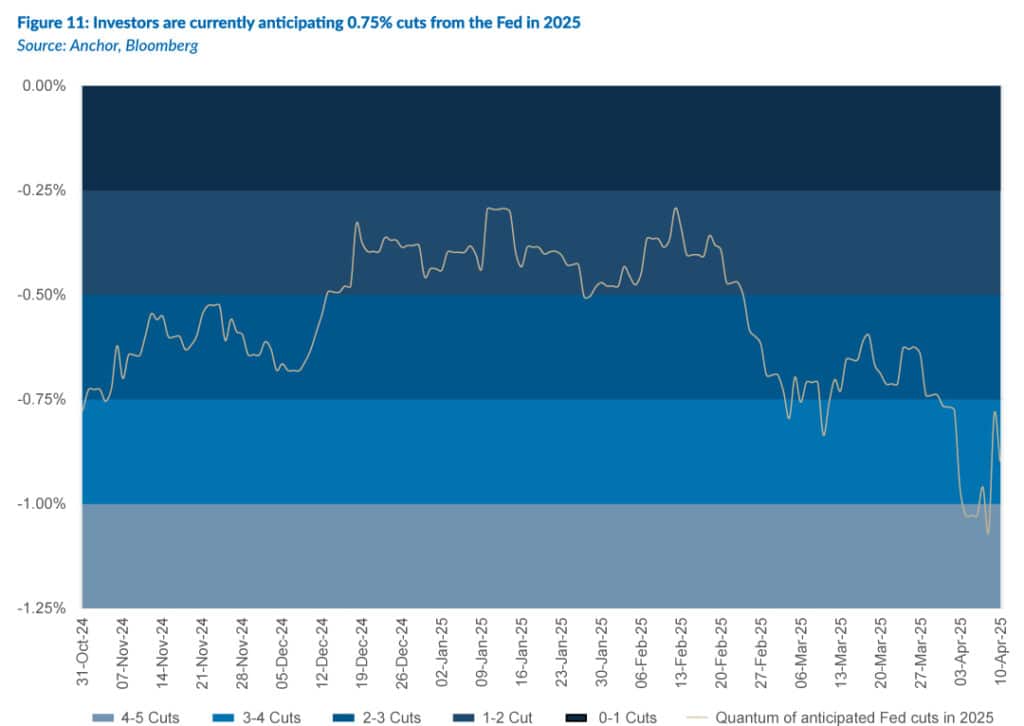

Inflation, which has been stubbornly high in recent years, is expected to persist for another 12 to 18 months before easing back to the US Fed’s 2% target. However, the Fed will have limited room to manoeuvre. Without a recession, it is unlikely to cut rates significantly over the next year. In the meantime, high interest rates will continue to weigh on consumer spending, investment, and confidence. The global policy response will remain constrained as a result – monetary easing is possible but shallow, and fiscal space is tight in many economies.

From a geopolitical standpoint, the US can weather the storm (at least in the short term) better than many of its trading partners. Its vast internal market and economic diversity provide a cushion that many other countries lack. Countries more dependent on trade, particularly those with export-heavy economies, are far more exposed to the immediate fallout. Over the longer term, however, the picture is murkier. Isolationism and protectionism may win votes but rarely deliver sustainable economic prosperity.

For SA, the economic fallout is already tangible. At the time of writing, the US’s recent imposition of a 30% import tariff (albeit postponed for 90 days) poses a significant obstacle to the country’s trade balance and broader economic trajectory. While platinum group metals (PGMs) and gold have been exempted, many sectors remain at risk—particularly automotive manufacturing and agriculture, which now face being priced out of one of their largest export markets.

Recent IMF modelling estimates a direct hit of 0.35 ppts to SA’s GDP growth in 2025 due to these new tariffs. Anchor’s revised forecast has been lowered to just 1.3% growth for the year, before factoring in the growing political uncertainty within SA’s GNU. Treasury’s 1.9% growth forecast and the South African Reserve Bank’s (SARB) 1.7% projection appear increasingly aspirational. Realistically, a sub-1% outcome is now firmly on the table, raising the likelihood of a renewed tax under-collection crisis by 2026. The indirect effects are equally significant. As China and Europe—SA’s largest trading partners outside the US—grapple with the global fallout of US tariffs, demand for South African exports could weaken further. Meanwhile, investor sentiment towards emerging markets (EMs) will likely sour as geopolitical risk premiums rise and capital seeks safer havens.

Compounding these external shocks is the current domestic political uncertainty. The GNU has entered a precarious second phase, with growing ideological rifts and no unified policy direction. The risk of political gridlock is high, and the looming 2026 Municipal Elections—where coalition members will compete against one another—could further destabilise governance. Policy continuity is the most likely path for now, but this is hardly reassuring. Structural reform remains sluggish. Eskom and Transnet have made marginal progress over the past 12 months, but neither is moving fast enough to drive growth or improve investor confidence. The positive consumer sentiment following a more dependable governance period is evaporating—and is unlikely to return in 2025.

Consequently, the SARB’s Monetary Policy Committee (MPC) is treading cautiously. The MPC continues to anticipate that interest rates will stabilise at a neutral level of approximately 7.25%. This implies the possibility of a further 25-bpt rate cut in 2025 (in addition to the 25-bpt cut in January), followed by a prolonged period of stability through 2027. Consequently, the SARB’s latest interest rate decision in March appears to be a temporary pause in the current shallow cutting cycle rather than a definitive end. However, the scope for substantial further easing remains limited. The SARB is positioning for stability, not stimulus, recognising that global volatility limits the scope for aggressive monetary intervention.

The world is entering a more volatile and fragmented economic era. The free flow of trade and capital that underpinned decades of prosperity is being rolled back. This means adjusting to a more volatile, uncertain, and potentially less prosperous world for SA and many other countries. Yet within this uncertainty lies opportunity—if policy reform can be accelerated, if governance can be stabilised, and if international relationships can be managed with strategic finesse. The path ahead is narrow but not closed. Whether SA emerges more resilient or more exposed will depend on global forces beyond its control and its decisions in the coming months.

SA EQUITIES

At a headline level, SA equities experienced a strong 1Q25. The FTSE/JSE Capped Swix Index ended the quarter 5.9% higher. In contrast, the US dollar-based MSCI South Africa Index finished the quarter up 14.2%, comfortably outperforming global equities (as measured by the MSCI World Index), which ended the quarter down 1.7%. That takes the rolling twelve-month total return of the MSCI South Africa to an impressive 31.2%. Following a strong performance and the increased forecast risk, we have lowered our overweight call to neutral on SA equities, with an expected total return of 11%.

However, beneath the surface, the past three months have produced some unexpected outcomes, at least relative to our expectations. Since the formation of the GNU midway through last year, the key driver of the local market has been the domestically focused sectors (so-called SA Inc. stocks). This has resulted in a broad rally across the JSE as SA growth estimates were raised, management teams put out more confident guidance, and local conditions appeared to be improving significantly. In our outlook for 2025, we anticipate this trend to continue, building on the momentum created in the second half of last year, with a gradually improving consumer environment, spurred on by lower interest rates, fuel prices, and additional disposable income from two-pot retirement withdrawals.

These factors underpinned our constructive SA equities view in January, with a total return of 15% for our base case in the Navigator – Anchor’s Strategy and Asset Allocation, 1Q25 dated 25 January 2025. The actual outcome in 1Q25, while at a headline level suggests we were correct in our constructive call on SA equities, saw most domestic-focused sectors act as a material drag on index performance, with the actual performance helped along by a very strong contribution from the gold sector (not in our forecasts).

Entering 2Q25, the outlook for JSE-listed equities is far less certain, with the range of potential outcomes locally and abroad at levels we have not seen in many years. Internally, the inability of the GNU to pass a budget in mid-March cast a spotlight on the fragility of the GNU – with the outcome being a budget passed despite the second-biggest party (the DA) in the GNU opposing it in its current form. This brought into question whether the GNU would survive. At the time of writing, we still do not fully know the outcome, although the GNU will likely survive. The tension between the ANC and DA has had a profound negative impact on domestic assets, which have struggled for traction all year.

With several global cross-currents impacting SA assets, it is almost impossible to tell how much of the recent underperformance of the domestic sectors is less a result of internal factors vs because of SA being caught in the cross-currents of the global economic uncertainty created by the Trump administration.

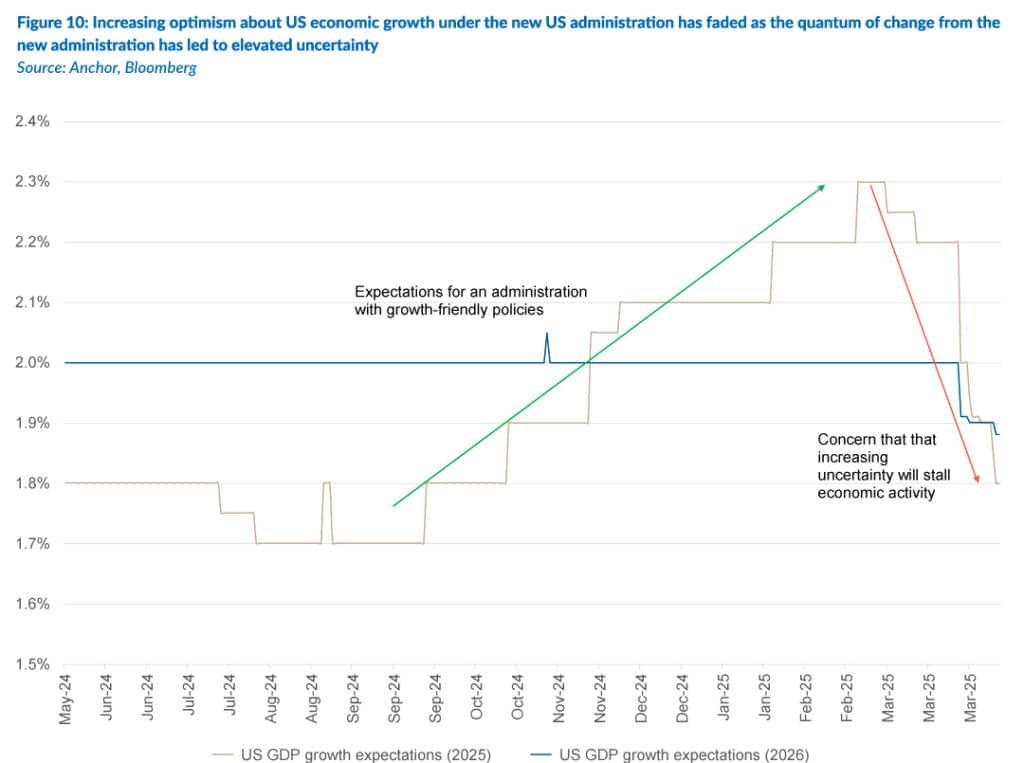

As we entered 2025, there were high expectations of GDP growth north of 2%, with some even suggesting 2.5% was possible. However, by the end of 1Q25, those expectations had dropped to 1.7%, before the impact of the burgeoning global trade war had been considered. The lower-than-expected growth is primarily due to the government’s lack of urgency in implementing the necessary reforms to unlock the economic growth needed to increase employment.

While the set-up for domestic equities might not be as attractive as it was a few months ago, assets (currency, bonds and domestic equities) have primarily reacted to the attractive outlook, with many of the P/E multiples having contracted to levels seen this time last year, just before the SA National and Provincial Elections (NPEs). There has been a sharp de-rating across the market, far more than the earnings outlook has changed.

All things being equal, we still expect SA banks to produce upper single-digit earnings growth this year (from 10% a quarter ago), and the P/E multiples have approached the trough they reached during the height of Stage 6 loadshedding in 2023. The outlook, while not as good as a few months ago, is vastly better than 18 months ago, before there was ever a consideration of a country governed by a coalition the DA was a part of. In a similar vein, while SA consumer confidence has been materially dented by the talk of a 0.5% VAT increase and the GNU potentially dissolving, the consumer is still better off today than 18 months ago, with fuel costs coming down, inflation relatively benign and interest rates on the way down with two more 25-bp cuts expected between now and the end of the year. There is also the added benefit of another round of two-pot retirement withdrawals that consumers can access. Given the sharp correction just seen, we continue to find the recent pullback in select banks and retailers an attractive entry point.

Turning to the other half of the JSE, which has relatively little to do with SA’s economic outcomes, the outlook is mixed once again, and the forecast risk is high. Gold continues to break new highs for now and make index returns look commendable. Gold is now close to 14% of the Capped Swix, a size too large for any index-based asset manager to ignore. A few years ago, we saw a similar outcome when the highly cyclical PGM sector went from virtually nothing in the index to maxing out close to 10% (today, it is c. 3.5%).

The JSE is unique in how much exposure in the index is linked to commodities. However, this does lower the quality of the overall index as commodities are notoriously cyclical. Over the years, the gold sector has been no different. While we have moderate exposure to gold, we find it incredibly difficult to isolate the drivers behind the commodity and thus make accurate forecasts on the movements of the gold price. As a house we are underweight the basic materials sector in aggregate, with what appears (at time of writing) a slowing global growth environment, and most industrial commodities linked to global growth, we find little reason to be overweight, outside of a few idiosyncratic investment cases (Anglo American Plc being one).

We continue to find attractive value in Naspers and Prosus, with the discounts having materially widened since the announcement of the Just Eat-Takeaway acquisition, which at c. 5% of market cap, has seen the discount widen by considerably more than that, suggesting the market has already impaired the investment down to zero. Given all the other factors causing equity market volatility, we concede this view is overly simplistic, but we nevertheless view the recent underperformance as interesting. We also do not foresee a direct material impact on Tencent’s earnings due to the trade war between the US and China. There is potentially an indirect impact in the form of lower consumer sentiment in China. However, policymakers are forging ahead with their internal stimulus measures focused on boosting domestic consumption. We see Tencent as one of the best ways to play this theme in China, and even in our global EM portfolio, we have a material overweight on Tencent.

Two other global industrial businesses we have exposure to on the JSE are BidCorp and AB InBev. Neither will be immune to a slowdown globally, but neither are they overly reliant on the US for growth, with globally diverse portfolios.

The overall forecast risk remains high, and should local and global risks simmer down over the next few months, there are very attractive entry points on offer across our market, with many multiples having approached (or round-tripped to) levels last seen pre the formation of the GNU. Our move has been to increase diversification from a more concentrated position in January, placing additional emphasis on the quality of the underlying businesses we own.

DOMESTIC BONDS

SA faces increasing domestic and external pressure to reform longstanding policies that have constrained economic growth. On the domestic front, the tabling of the government’s FY25/FY26 budget was initially postponed, with the African National Congress (ANC) facing strong opposition to further tax increases to finance budget expenditures. The delay highlighted a growing recognition that the ANC’s traditional strategies for addressing fiscal deficits—namely, raising taxes or increasing borrowing—have become politically and economically unsustainable. As a result, expenditure cuts now appear to be the most market-friendly and feasible path forward. Externally, SA has come under renewed scrutiny from the US on several issues. Compounding tensions, the Trump administration initially subjected SA exports to a 30% tariff when entering the US. However, this was later reduced to 10% following SA’s inclusion on the list of countries benefitting from a 90-day pause from higher reciprocal tariffs. All of this has created substantial market volatility for domestic assets – particularly bonds and the local currency – with Anchor believing a more cautious stance is warranted going forward.

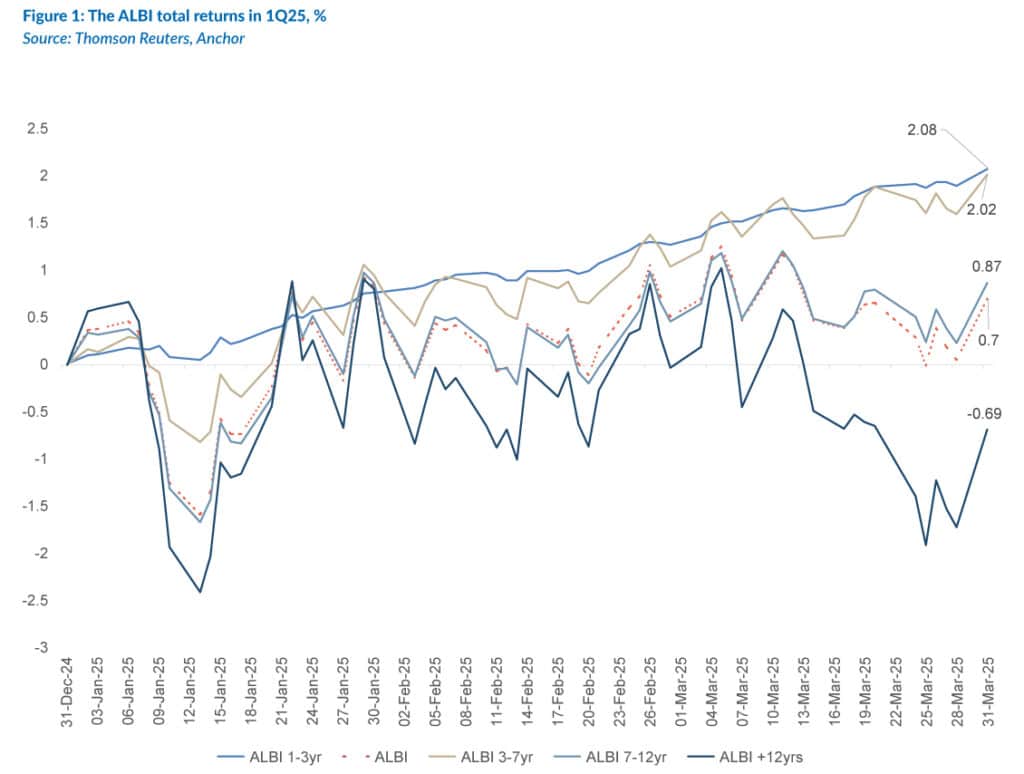

The SA Government Bond (SAGB) yield curve has bear steepened YTD (as at 9 April 2025), reflecting a notable increase in risk premium across the curve. Despite this, the All Bond Index (ALBI) delivered a modest return of 0.7% in 1Q25, with short-dated maturities contributing the most to performance (see Figure 1 for the index and term splits). Deteriorating fiscal dynamics primarily drive the elevated risk premium. Debt-servicing costs have become one of the fastest-growing components of the national budget, and with the debt-to-GDP ratio nearing 80%, the risk of a debt trap is no longer just theoretical. Credit rating agencies like Fitch Ratings remain cautiously sceptical of SA’s fiscal trajectory. While it acknowledges the government’s commitment to fiscal consolidation, Fitch highlights significant implementation risks and persistent structural challenges that could impede progress.

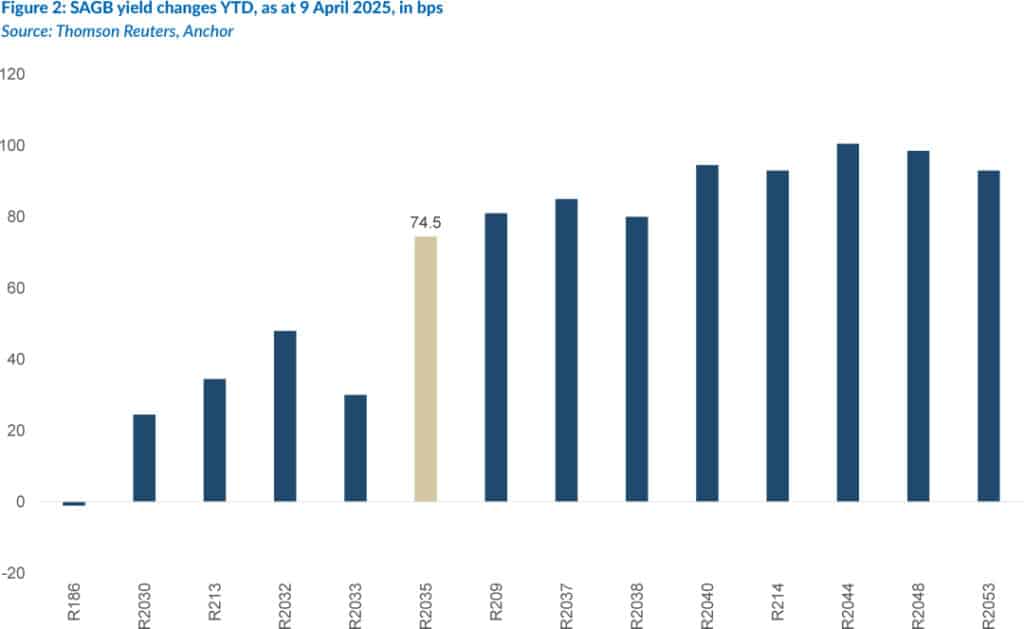

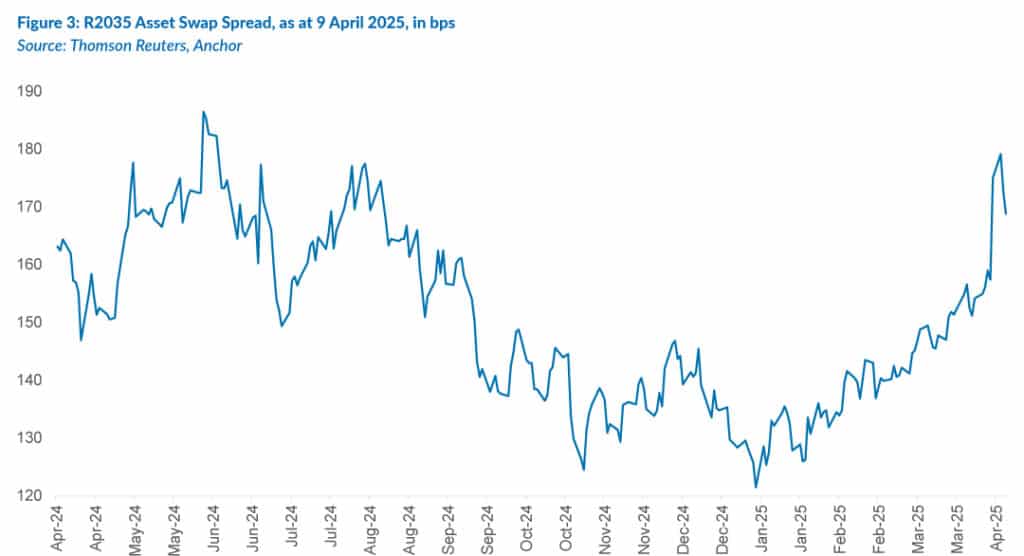

The SA 10-year government bond (R2035) yields rose sharply to 11.06% as of 9 April 2025, marking a YTD increase of 74 bps (see Figure 2). This upward movement in yield reflects heightened investor sensitivity to fiscal risk. An alternative measure of this risk premium is observed through asset swap spreads (ASWs). ASWs have widened considerably across the yield curve in recent months, with current levels approaching those seen during last year’s local election period (see Figure 3 – R2035 ASW).

At Anchor, we have recently strategically concentrated our local bond exposure in many of our domestic portfolios at the front end of the yield curve. This positioning reflects our view that the tariff turmoil will lead to lower inflation locally. The growth effect (from reduced aggregate demand stemming from the tariff turmoil and tax increases) will soon suppress SA inflation.

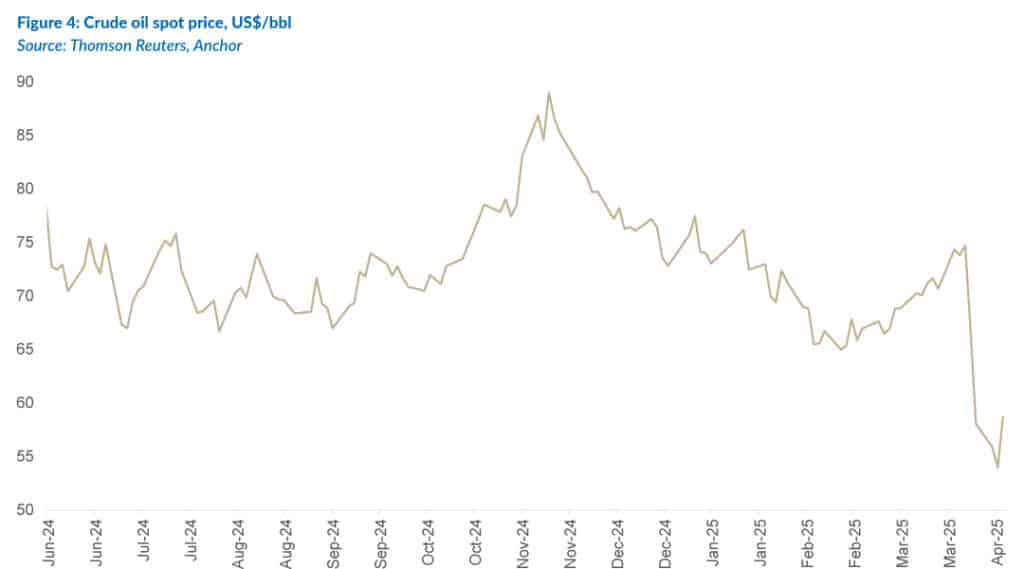

Another factor supporting our front-end positioning is the oil market dynamics. On 2 April 2025, the same day Trump announced reciprocal tariffs on several US trading partners (which he termed “Liberation Day”), OPEC unexpectedly announced an increase in oil production. With the uncertainty and turbulence around tariffs widely expected to soften global growth (potentially tipping some economies into a recession), the oil market is simultaneously digesting an increase in supply and weakening demand. This has led to a sharp decline in oil prices over recent weeks (see Figure x).

For SA, a net oil importer, lower global oil prices could further ease inflationary pressures—assuming relative currency stability. This would provide the SARB with additional room to lower the policy rate. Another consideration is the “Fed-put” argument, which is gaining traction as signs of US Treasury market dislocations slowly emerge. This, in turn, will give the SARB additional headroom to cut rates. Against this backdrop, we have strategically shifted more of our domestic bond portfolios toward the part of the yield curve most responsive to monetary policy—the front end.

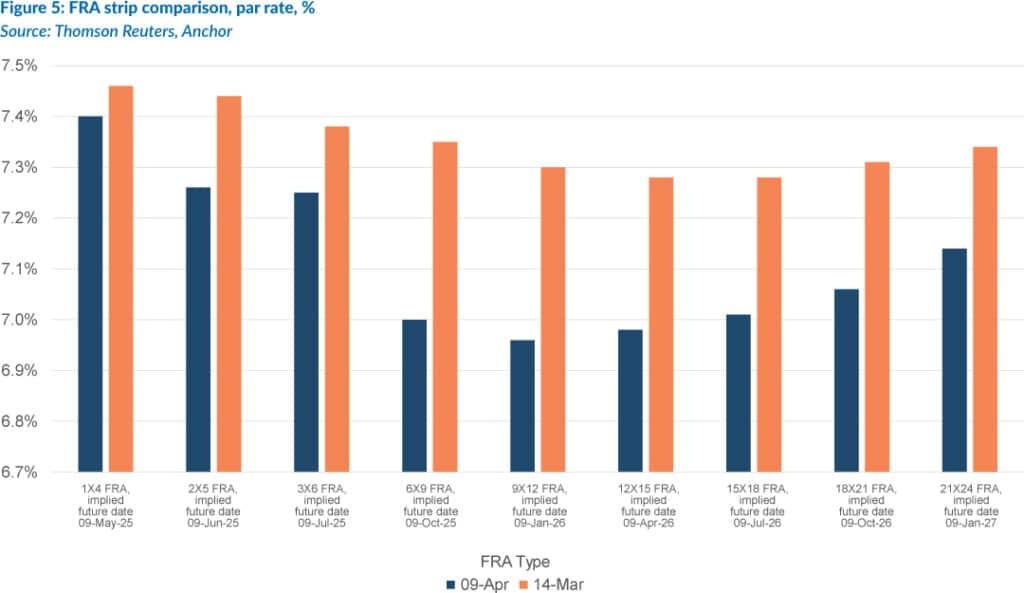

Comfortingly, the derivatives market has started to price in additional rate cuts in SA, as evidenced by the downward movement in Forward Rate Agreements (FRAs). The market now anticipates the policy rate to bottom at 7.00%, down from 7.25% a month ago (see Figure 5). This shift reflects growing confidence in a more easing monetary policy path amid abating inflationary pressures.

SAGBs continue to offer some of the highest yields in the EM universe, both in nominal and real terms. However, these elevated yields also reflect growing concerns around the country’s fiscal sustainability. With local politics on a knife-edge and in the absence of credible, sustained commitments to expenditure reductions and broader fiscal consolidation, a meaningful decline in SAGB yields remains unlikely. Consequently, the yield curve is expected to maintain its steep bias. We estimate domestic bonds will return around 11% over the next 12 months, providing a real return of more than 6%.

THE RAND

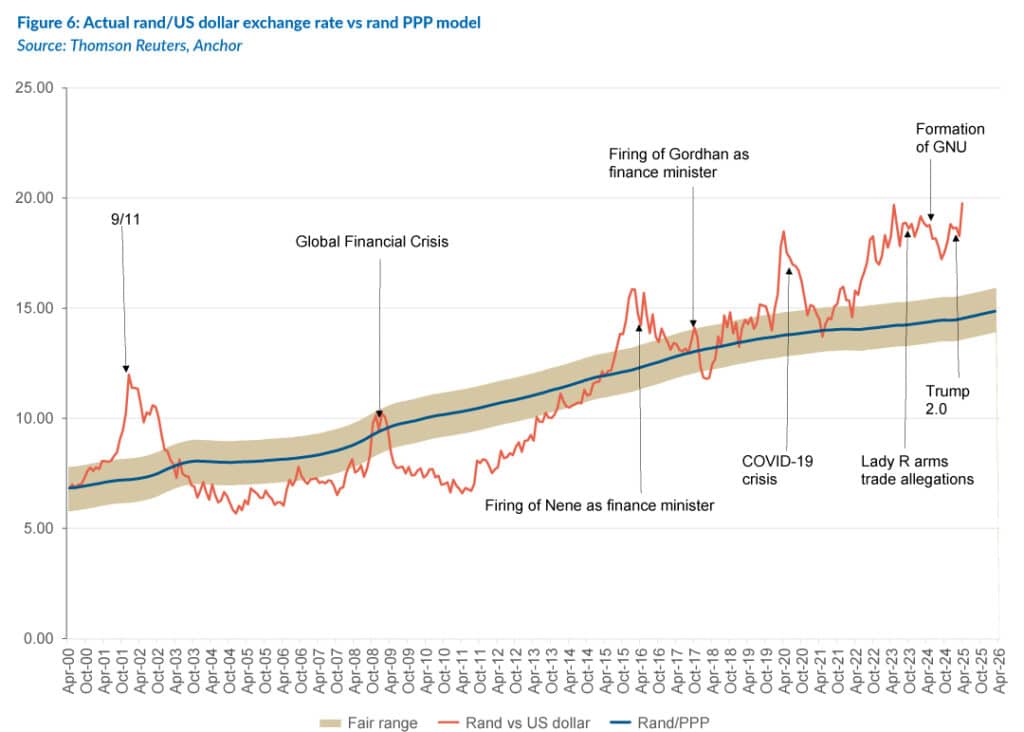

Anchor subscribes to a purchasing power parity (PPP) model for the long-term value of the rand. Any such model clearly shows that the local unit is cheap, as is evident from Figure 6 below. Our modelled fair value of the rand is in the R13.91-R15.91/US$1 range. The currency usually trades away from its “fair value”, and it is reasonable to expect it to remain cheap for the foreseeable future.

The rand faced a double onslaught from the imposition of tariffs by the US and fractures in the GNU destabilising government. These factors have led to increased volatility and uncertainty in currency markets, which has put pressure on the rand. While it is too soon to predict how these events will play out, our base assumption is that sensibility will prevail abroad and domestically.

We are seeing increasing support for the narrative that the US dollar will likely weaken due to the erratic events of late March and early April this year, when the Trump administration implemented a slew of tariffs on countries around the globe. Some analysts expect the euro to strengthen to as much as EUR1.25/US$1. While we are not as extreme in our view, this overhang will likely stabilise and quite potentially support some recovery in the rand.

This is a volatile time, and many risk factors could weaken the domestic currency. However, we believe some recovery is likely, and we expect the rand to end the year closer to R18.75/US$1 than R19.75/US$1. For this report, we are modelling the exchange rate at R18.75/US$1, which reflects our view of a modest recovery through a volatile period.

GLOBAL EQUITIES

Writing an assessment and projection for global equity markets is particularly difficult when markets are swinging wildly from day to day. The actions of US President Donald Trump have unsettled markets. At the time of writing, the MSCI World Index is down around 5% YTD in US dollar terms, and the S&P 500 is down closer to 10%. This relatively benign aggregate masks the massive recent volatility and uncertainty created by recent events.

The biggest indicators of the level of uncertainty are the YTD moves in gold (+22%) and the 8% weakening of the US dollar (a massive move in currency terms). The former reflects investors looking for a safe haven, and the latter is a statement by the market that the US might not be that safe haven it has always been perceived to be.

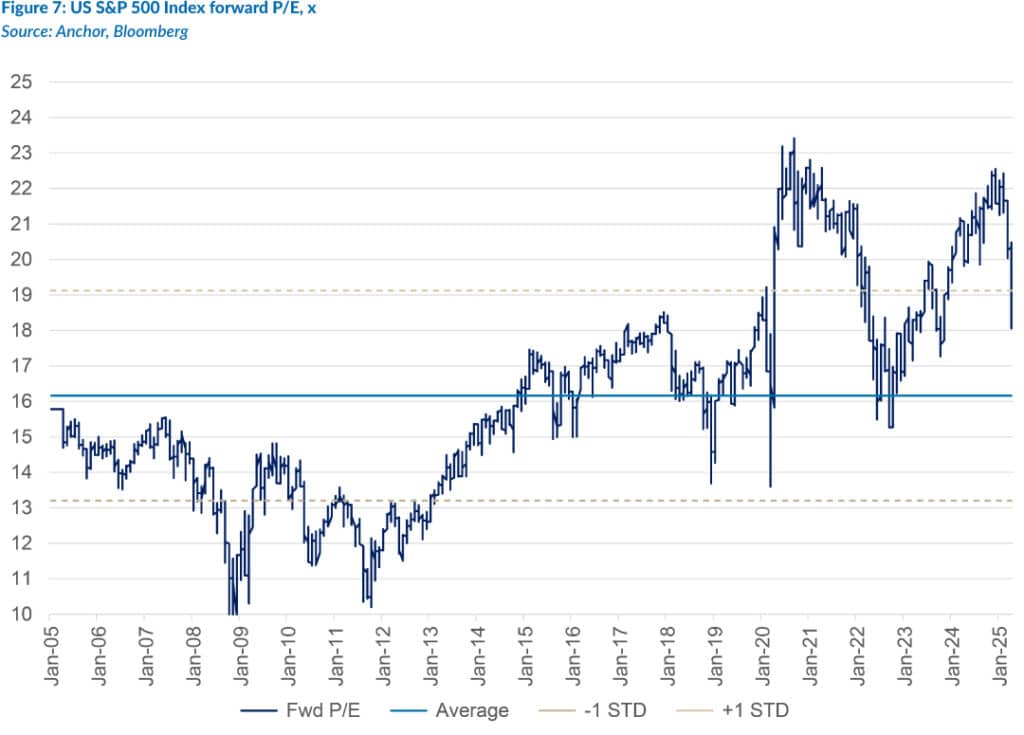

The correction in world stock markets has not taken shares into cheap territory. Equities (particularly in the US) started the year in expensive territory and have now traded down to around the 10-year average. The S&P 500 is trading at a forward 18x P/E (see below), with every prospect that earnings forecasts will be downgraded.

The one certainty about the economic future of the US is that GDP will slow over the next six months as spenders and capital allocators hold back, given the uncertainty created by tariffs. The counterargument to this is that there is plenty of ammunition for regulators and the government to respond and stimulate. The Fed can materially reduce interest rates from historically high levels, and the US government will no doubt cut taxes and reduce regulations. For example, smaller banks will probably be given more latitude in lending money to US consumers. Trump and his financial advisors will argue that they are only partway through their plan, and the good stuff is still to come.

So, what should investors do with an equity hat on?

- For investors with an existing reasonable equity allocation, we would sit tight and not crystallise any losses. We would assess our holdings for companies whose futures have materially changed, but most high-quality companies will survive the current shenanigans and continue to thrive.

- For investors who are underweight equities, we would use this opportunity to increase equity weightings in downlegs of the current market. While the market does not look cheap in aggregate, certain shares are now very attractive. We would follow a phased approach, in the knowledge that the market could fall further before bottoming.

- We would avoid gearing in the current market as further sharp swings are likely due to unpredictable government actions.

- We would add to our holdings of the big tech companies. They have fallen the most in the world as a category. Ironically, they are not materially impacted by tariffs (except for Apple, and even for Apple, there is little day-to-day certainty as to the eventual outcome). The market correction has muffled all the excitement about AI and new technologies. We should not forget that the new AI wave is hugely significant for investments, and you want exposure as an investor. The weaker US dollar will also increase the dollar value of the profits generated elsewhere in the world.

- We would avoid investing in Europe, which has done relatively well this year, partly due to money leaving the US. The European economy is very subdued, and Europe will likely be the loser from the tariff war. Exports into the US will suffer, and cheap Chinese production will flood the rest of the world, including Europe. The strong euro will also put further pressure on profits.

- We would increase our allocation to alternative investments, which include private equity, property, private debt, structured products and hedge funds. In times of uncertainty, these more stable asset classes become increasingly attractive, and declining interest rates make the returns even more attractive. Anchor has a range of alternative private capital funds ideal for times like these.

GLOBAL BONDS

The US Fed has a dual mandate. It must maintain inflation around 2% p.a. and full employment, with the latter assumed to happen when economic growth is optimal. Essentially, the Fed needs to ensure that inflation and economic growth are maintained at optimal levels, and if they are not, the Fed’s main tool to correct this is changing interest rates. Interest rate changes impact bond values, so bond investors tend to focus on changing expectations for future inflation and economic growth.

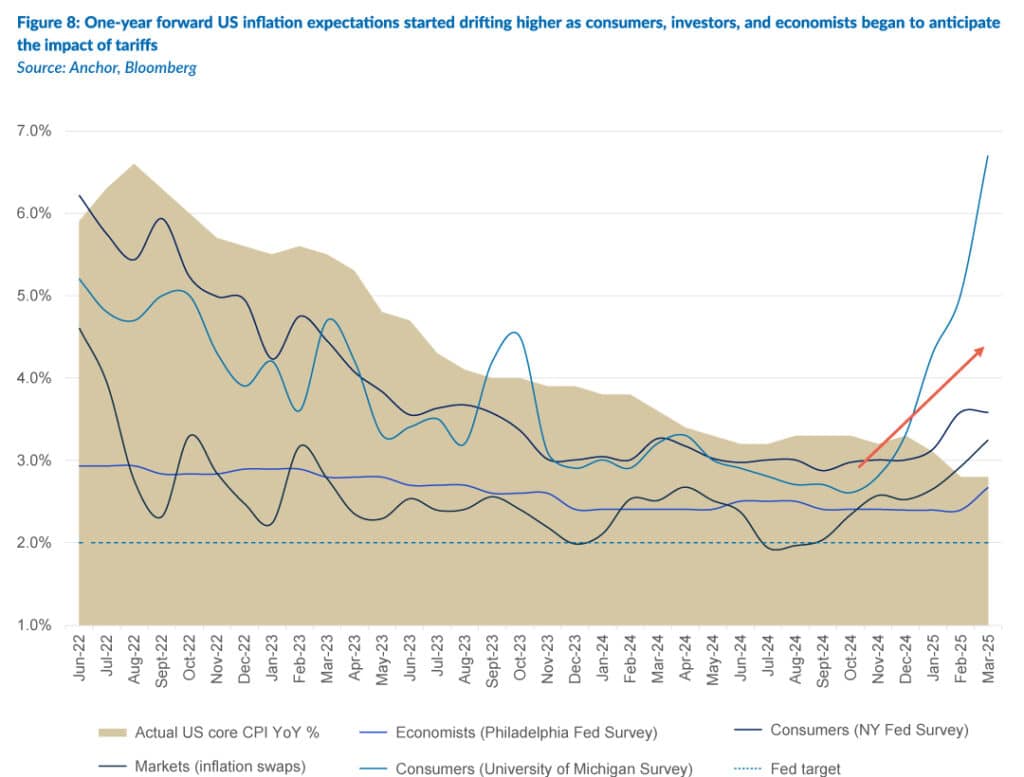

As the prospect of a Republican-controlled US Congress led by President Donald Trump became increasingly likely towards the end of 2024, economists, consumers and investors changed their expectations for future inflation. Most began anticipating inflation to drift higher, mainly due to tariffs increasing the prices of goods imported into the US. This expectation for higher future inflation happened despite observed US inflation trending back from elevated post-pandemic levels.

The prospect of higher inflation coincided with expectations for improving economic growth, with economists anticipating that the new US administration would deliver an environment supporting economic growth and asset values. This combination of expectations (higher inflation and stronger growth) led investors to believe that the Fed could maintain interest rates at elevated levels for longer, weighing on bond prices. Within a few weeks of Trump taking office on 20 January this year, the reality set in that the transition to a more supportive economic environment would be achieved with significant change and uncertainty.

Economists are now starting to revise their expectations for future US economic growth lower on the basis that the uncertainty will freeze decision-making and lead to lower investment and consumption.

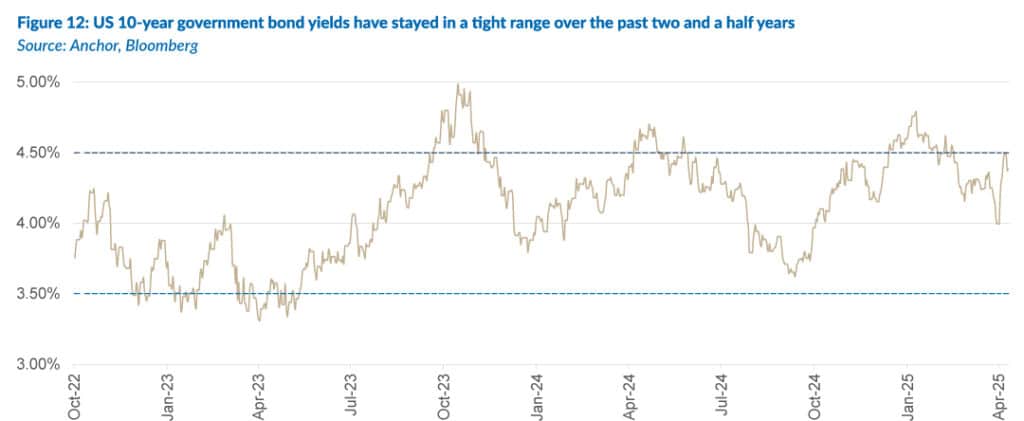

This has led to a conundrum for the Fed, which must potentially deal with higher inflation while economic growth (and employment) deteriorates. For now, the lowered expectations for economic growth are insufficient to cause the Fed to need to think about supporting economic growth with reduced rates, so our expectation remains for only moderate interest rate cuts over the next year. We believe current bond yields already reflect this reality, and we do not anticipate meaningfully lower US 10-year government bond yields in response to Fed cuts of around 0.75%-1.0% over the next twelve months.

As such, we expect US 10-year government bond yields to remain within the 3.5% to 4.5% p.a. range they have stayed in for most of the past two and a half years, likely remaining marginally above 4% p.a.

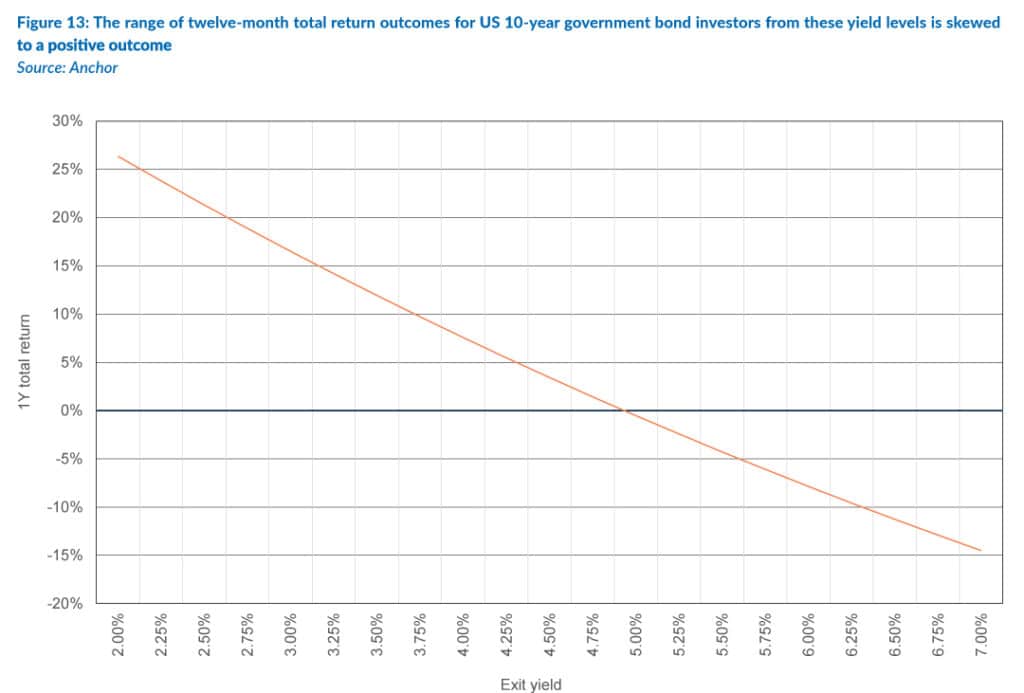

This leaves investors with a positively skewed range of outcomes for a holding period over the next twelve months, with a relatively low probability of a negative total return from current levels. Our base case is that US 10-year government bond investors will achieve a total return of c. 5.5% in US dollar terms over the next twelve months.

US investment-grade corporate bonds have seen this credit spread bounce off historic lows as uncertainty about the future has increased the possibility of defaults. Investors now earn a higher yield premium for taking on the default risk associated with high-grade lenders than they have earned since 2023. This removes some of the potential for future capital losses and leaves us more sanguine about the prospects of these bonds. We do not anticipate much tightening of credit spreads over the next twelve months and only a marginal softening of rates. As such, our base case is that investors in this asset class will achieve a total return of c. 6.0% over the next twelve months, predominantly in the form of income.

GLOBAL PROPERTY

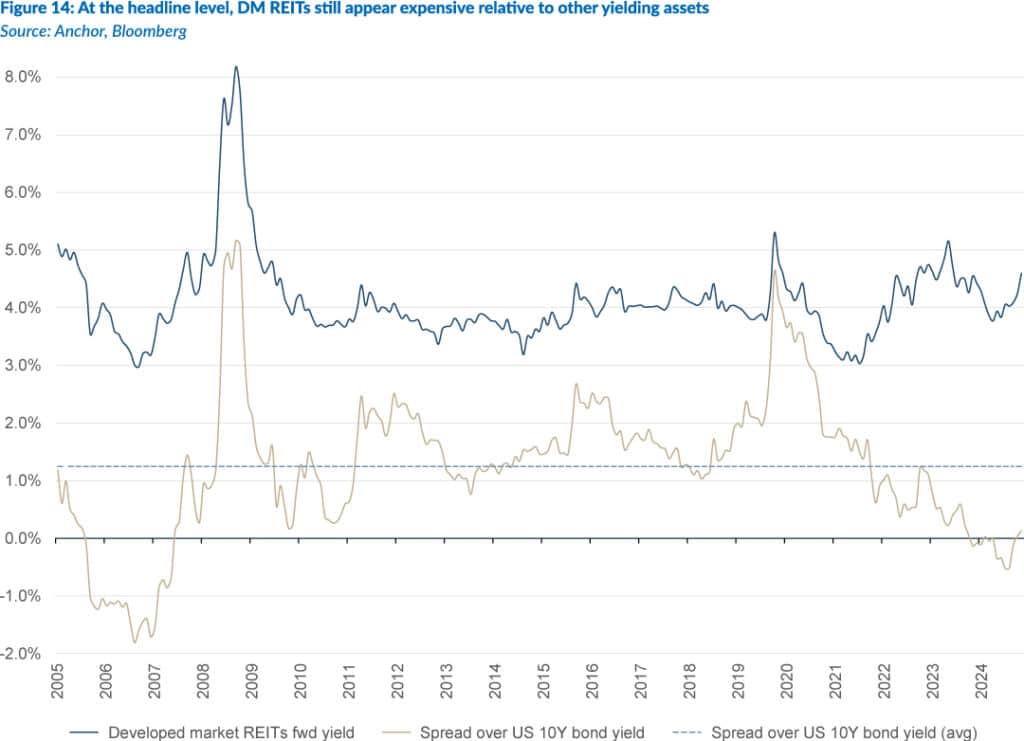

Globally developed market (DM) listed property had a decent start to the year, with the FTSE/EPRA NAREIT Global Property Index rising by 1.5% in 1Q25. However, recent market turmoil, particularly the spike in US yields, has weighed on this asset class. At the headline level, DM real estate investment trusts (REITs) still appear expensive relative to other yielding assets.

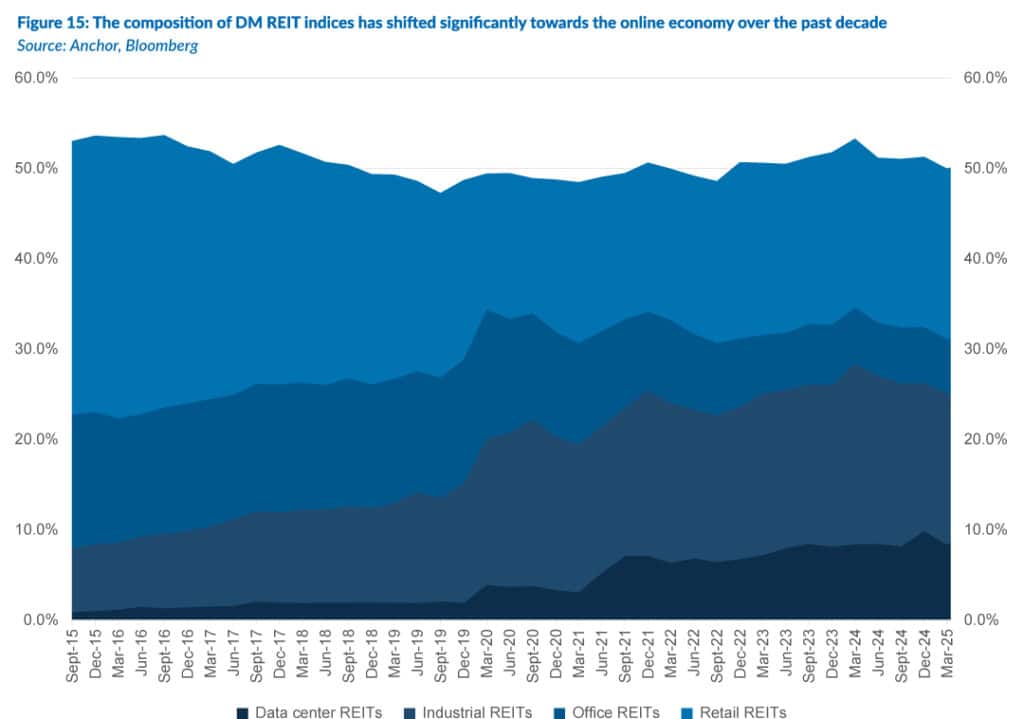

The headline view belies significant shifts under the surface, where the composition of the DM REIT indices has experienced a dramatic transformation over the past decade, reflecting a similar change in economic activity from offline to online.

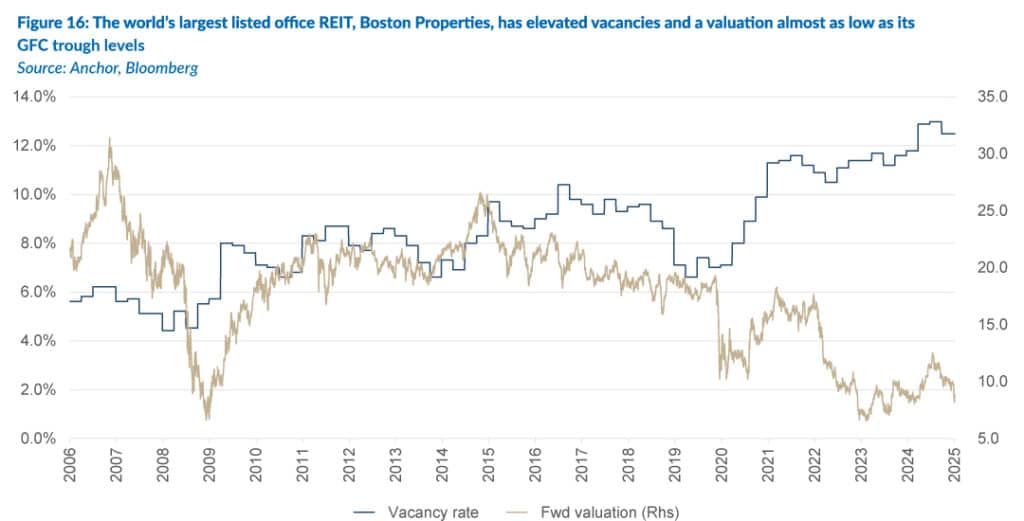

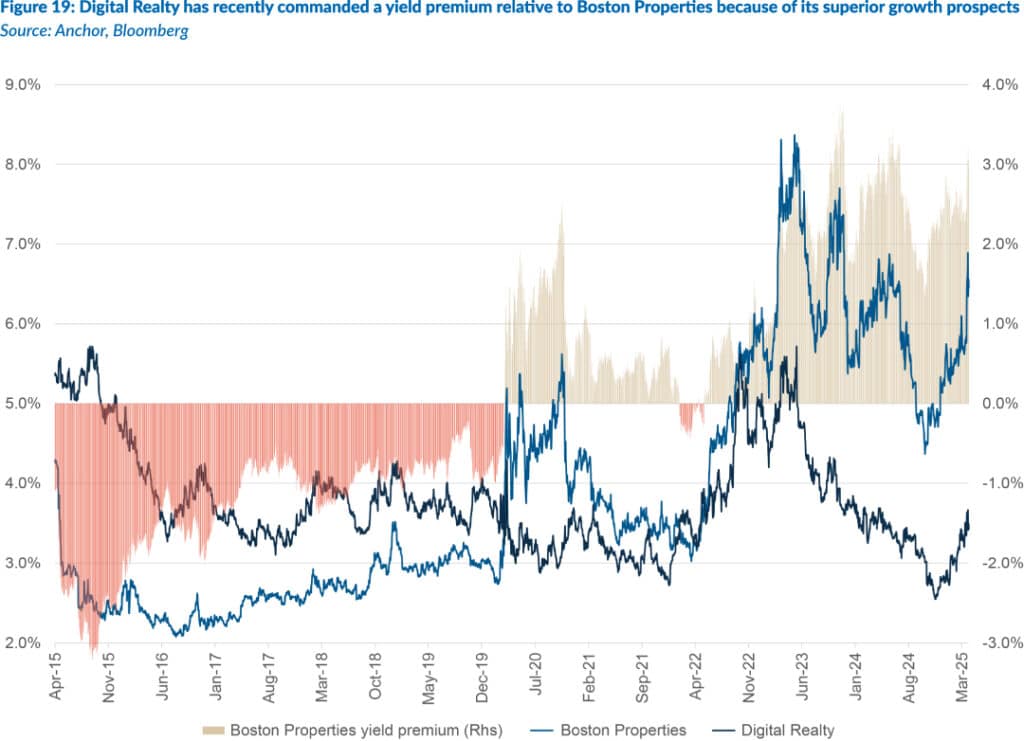

Much like with equities, this has created some potentially interesting opportunities at a company level. The state of commercial office property in the US has seldom looked worse. Boston Properties, the world’s largest listed office REIT, has vacancies at the highest level in two decades (a period which included the global financial crisis [GFC]) and a forward valuation almost as cheap as it was during the GFC trough.

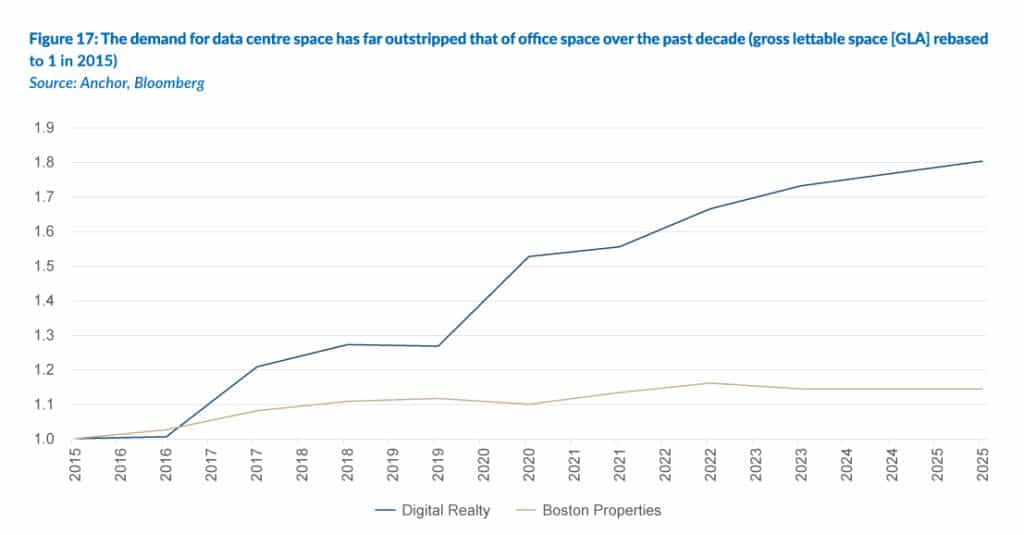

This valuation suggests that the reset in the office REIT space has room to run. At the other end of the spectrum, data centre REITs have experienced an incredible period of growth. The divergence in fortunes of the new and old-economy REITs can be best observed by comparing the increase in lettable space for Boston Properties relative to one of the largest data centre REITs (Digital Realty).

Digital Realty has almost doubled its supply of data centres over the past decade, while Boston Properties has barely added to its supply of office space over that period.

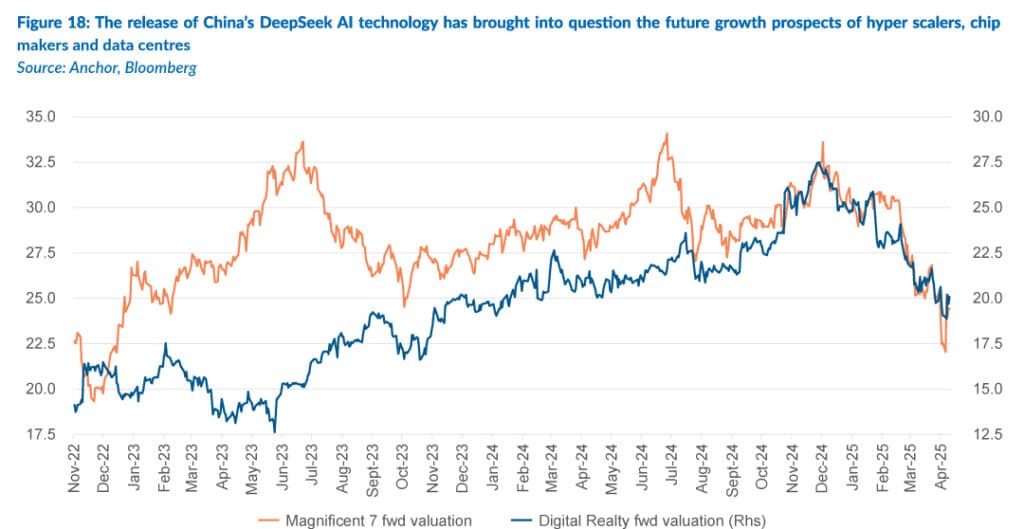

The revelation of China’s DeepSeek AI technology in January has introduced some uncertainty around future data processing and storage requirements for the AI revolution. This has made investors question their future earnings growth assumptions for hyper scalers, chip manufacturers and data centre REITs. To the extent that this rebasing of expectations is overdone, it could present an interesting entry point for investors, but there remains significant uncertainty.

The recent yield premium for Boston Properties has been warranted given Digital Realty’s superior growth prospects, but the quantum of that premium is less clear going forward.

There is still plenty of uncertainty surrounding the end state of the office property market and, ultimately, how much data storage will be needed to support the AI revolution. What is clear, though, is that while at the headline level, listed property as an asset class appears relatively unappealing, uncertainty and disruption are creating interesting opportunities for patient investors with a long-term mindset. At the asset class level, we anticipate that most returns will be delivered in dividends over the next twelve months, leaving investors in global REITs with a 5% total return in US dollar terms over the next twelve months.