ECONOMICS

The global economy continues to progress steadily, showing resilience in the face of various challenges. Despite concerns, there is no significant indication of widespread debt stress in global financial markets, thus mitigating the likelihood of a recession. Factors such as elevated global interest rates, ongoing geopolitical tensions, and other uncertainties have not derailed growth. Notably, the US economy has been a driving force, demonstrating robust demand and a rebound in production, contributing to overall global economic stability. However, risks remain, particularly in the latter half of 2024, as US growth is anticipated to decelerate, potentially impacting global growth negatively. Moreover, the recent increase in crude oil prices could fuel inflation and delay central banks’ plans for rate cuts. Factors like increased global military and political tension, disruptions caused by climate change in supply chains (particularly in mining and agriculture), and uncertainties related to upcoming elections in key regions may further influence the global economic outlook.

Whilst the trend of global disinflation continues, there is clear evidence of a split in inflationary trends. While inflation has declined in the eurozone and the UK, the US is experiencing renewed inflationary pressures. China, on the other hand, has stabilised from its deflationary trend earlier in the year. However, geopolitical tensions and disruptions in freight routes through the Red Sea present potential upside risks to near-term global inflation. These risks are further heightened by escalating military conflicts and pipeline disturbances in the Middle East and Russia, leading to increased oil prices. Nevertheless, we anticipate that developed economies will eventually reach their targeted or preferred inflation levels by the end of 2024. With regard to global monetary policy, the rationale for cutting rates in economies facing or nearing recession is clear. However, a less obvious justification exists for rate cuts when economies are relatively strong. Despite global policy rates reaching 15 to 20-year highs, real rates matter more than nominal rates in terms of monetary policy effects. As inflation, or inflation expectations, decreases, the level of policy restraint increases, which can further dampen economic activity and price pressures.

Global disinflation has resulted in tightening monetary conditions due to increases in real interest rates. While the US Federal Reserve (Fed), European Central Bank (ECB), and the Bank of England (BOE) have all raised policy rates, the divergence in inflation paths between the Atlantic regions has made policymakers cautious about implementing policy loosening measures. The emphasis on fully anchoring inflation expectations in policy discussions suggests that interest rate cuts may be postponed. The recent, largely unexpected rate cut by the Swiss National Bank (SNB) may pressure the ECB and BOE to consider rate cuts ahead of the Fed in response to easing inflation in their respective regions. Furthermore, the depressed prices of natural gas, a significant factor in European energy inflation, suggest that recent increases in oil prices are unlikely to unsettle inflation expectations across Europe. Nonetheless, we anticipate that the ECB and BOE will eventually align their rate moves with the Fed’s. Turning to the East, China’s economy has reflected tentative improvement, supported by sustained fiscal measures and a rebound in industrial activity downstream, fuelled by a surge in export growth driven by significant price reductions from exporters. These measures are, however, short-term in nature. The real estate sector, which remains a focal point of domestic confidence concerns, continues to hinder growth, as key indicators such as property sales remain subdued. Looking ahead, the rebound in export prices poses a risk to this external growth trajectory, thereby likely challenging the authorities’ growth target of “around 5%.”

Moving locally, the SA economy narrowly skirted a technical recession in 4Q23, with modest growth of 0.1% QoQ after a revised -0.1% QoQ print for 3Q23. A marginal recovery in household consumption and a slight increase in exports just managed to counterbalance the negative effects of increased imports, stagnant investment, and a decline in government consumption growth. The South African Reserve Bank (SARB) forecasts growth at 1.2% this year, improving to 1.6% by 2026. These projections are better than the 2023 outcome but below longer-run averages of around 2%. The central bank further estimates that while electricity shortages took 1.5 ppts off GDP last year, it will moderate to 0.6 ppts this year and 0.2 ppts in 2025. Over the medium term, we expect growth to maintain a moderate uptick in momentum as the burden of loadshedding eases – driven by the advent of private sector embedded generation and rooftop solar installations. Nonetheless, overall growth prospects will continue to be hampered by persistent challenges in the energy and logistics sectors, compounded by ongoing escalating geopolitical tensions and weak external demand.

On the monetary policy front, the SARB’s Monetary Policy Committee (MPC) remains wary of the impact of geopolitical uncertainties persisting into 2024, with the potential to keep global oil markets under pressure. Further risks include the susceptibility of imported commodities to currency devaluation and enduring elevated and unpredictable local food prices (which could potentially derail recent disinflation efforts). At the same time, electricity and logistics expenses present significant inflationary challenges. The fluctuation in fuel and food prices additionally introduces uncertainty into wage growth forecasts. Overall, at the current level of rates, the policy stance in SA is considered restrictive and consistent with the inflation outlook, and there is a need to address elevated inflation expectations. Subsequently, we maintain that the SARB’s MPC will not rush to cut the repo rate. Any possible interest rate cuts will likely only materialise towards the end of 2024 and depend on the inflation outlook (locally and abroad) and global interest rate developments as we progress further into this year. Current market sentiment suggests only one interest rate cut of 25 bps this year in SA, possibly two, with the second cut almost fully priced out per our expectations. Over the longer term, we expect the SARB to gradually cut rates from 8.25% to 7.5% through three 0.25% cuts, reflecting the theme of higher interest rates globally.

SA EQUITIES

SA assets continued to underperform their global equivalents on most metrics in 1Q24. For 1Q24, SA equities (as measured by the MSCI SA Index) delivered a negative return of 7.6% vs the MSCI All World Index, which returned a positive 9%. The MSCI SA has underperformed global equities by 40.2% since the end of 2022. For the reasons we outline below, we move to tactically overweight JSE-listed equities with an expected total return of 18% over the next 12 months, relative to global equities at 7% and bonds at 5%.

SA equities’ level of underperformance is becoming too difficult to ignore. While several deeper structural issues are unchanged, we see some shorter-term, more technical factors having exacerbated the extent to which local equities have underperformed. The underperformance in 2023 can largely be explained by corporates and investors being caught off guard by the extent of loadshedding and a downturn in certain key export commodities (platinum group metals [PGMs], coal, etc.) coupled with a change in pension fund regulations that allowed a higher proportion of offshore equities to be held by most local equity funds (resulting in the net selling of billions of dollars of SA equities). However, we believe the JSE’s underperformance at the start of 2024 can largely be explained by investor inertia as we approach the upcoming SA general election (29 May 2024), local and international adjustments to interest rate expectations, and the continued negative investor sentiment towards China.

While these factors remain a relevant overhang on the JSE, we believe we are at the point where all of this and more are priced in. The market now possesses enough optionality to tactically upweight the JSE, albeit for a post-election rebound. Our model suggests that should the ANC get between 45% and 50% of the national vote and form a coalition with smaller, more pro-growth parties (our base case), there is the potential for an 18% upside in local equities, primarily led by a rebound in domestic counters (banks, retailers, and local industrials). We see further potential upside should Chinese policymakers increase fiscal stimulus. This would spur a rebound in local equities highly correlated to the Chinese consumer (Naspers, Prosus, Richemont) and the construction sector (basic materials).

Another major influencing factor on the JSE this year has been the rebasing of interest rate expectations locally and abroad. Coming into the year, our base case was for three 25-bp interest rate cuts in 2H24, with further rate cuts in 2025. This expectation anchored our optimism for a rebound in consumer spending and credit performance from the local banking sector, both hamstrung by restrictive monetary policy for the last few years. The increased interest rates have had a far more negative impact on the SA consumer than in the developed world, where consumer spending, particularly in the US, has remained remarkably resilient.

Three months into the new year, the outlook for interest rates has shifted from three cuts to only one 25-bp cut, a significant departure from our view coming into the year. The ramifications of this rebasing of interest rate expectations are profound. One example would be in our local banks, where there is the greatest degree of sensitivity to interest rates. Where we had previously forecast a high likelihood of double-digit earnings growth from SA banks (driven by lower credit impairments), we would now be happy with mid- to upper-single-digit earnings growth. This, coupled with the stubbornly high cost of capital (higher than we had anticipated), meant there had to be a downward revision of earnings and total return for the sector relative to our forecasts in January.

Nevertheless, these changes have been more than priced into SA equities. Our forecasts of total returns from these levels over the next 12 months are conservatively in the mid-teens, driving a significant portion of the index’s forecast total return.

We have often lamented the stubbornly high cost of capital and low growth environment being a key reason why investing in a “risk-free” government bond (offering a real return of 6%) makes more sense than taking on the added risk of equities for not much more in terms of a return. What has perhaps changed over the last few months is that SA equities have continued to de-rate relative to other asset classes, and we believe earnings growth expectations have now reached a plateau, with scope for upward revisions from here.

The question then becomes, if valuations are screening extremely cheap on most metrics (in relative and absolute terms, etc.), with a seeming lack of investor interest in SA, what would the catalyst be to drive a rebound on the JSE? We believe a potential catalyst will be a benign outcome in the upcoming general election. Our base case is not b for some sweeping libertarian-type outcome, similar to what we have seen recently in Argentina (things have not reached the same extreme levels of suffering by the majority of the population) and are potentially about to see in Turkey (the current leadership’s power seems to be slipping as evidenced by recent sweeping losses in municipal elections).

Our base case is for a continued gradual erosion of power from the ANC, with its share of the vote slipping below 50% and alliances built with smaller, pro-growth parties with the potential to unlock pent-up demand within the economy. This outcome would likely invite parts of the global investor community, currently waiting on the sidelines (taking a cautious approach with the unlikely, yet nuclear, alliance of the ANC with the far-left Economic Freedom Fighters [EFF] party, a significant left-tail threat), to consider SA as an investment option once again.

To reiterate, our call to overweight SA equities will remain tactical (shorter term). Far more concrete pro-growth reforms are needed to get us to take a longer-term, more bullish view on domestic equities. The country and its economy’s potential is not questioned; it just requires the right leadership to steer the ship.

SA LISTED PROPERTY

SA property fundamentals declined significantly over the last few years as COVID-19 put pressure on retail rentals and offices emptied. Interest rates subsequently rose sharply, and bottom lines shrank. Share prices tanked, and many SA bellwether property shares are still at prices 50% below their highs. These appear to have bottomed in the last few months, and 1Q24 saw a total return of 3.5% from the FTSE/JSE SA Listed Property Index. This follows a 9.9% increase in December, which accounted for almost all of the 10.1% total return for 2023.

We are projecting a 15% total return for SA-listed property for the next 12 months as conditions improve (off a low property base and a high interest rate base).

SA property still trades at an average 30% discount to net asset value and forward distribution yields of around 11% for local and c. 8% for global portfolios (primarily Central and Eastern Europe [CEE]).

Property/REIT share prices are driven by the property fundamentals and the cost of money. Interest rates appear to have peaked globally and in SA, and money will become cheaper in the next 12-18 months. SA property fundamentals are still challenging, but lease reversions in the most challenged sector (office) have declined sharply as a full rent cycle has almost worked its way through post-COVID-19. So, net portfolio growth is returning, and the interest cost will begin to decline towards 2H24. Offshore portfolios are performing better, and growth prospects look reasonable. A reasonable portfolio with a dividend yield of 10% and growth of 5% can be constructed.

Our pick of the property sector is MAS. The share price took a dive when the company announced it would hold back on dividends for two years to fund developments. At a 15% forward distributable income yield, we think the share is worth over 50% more.

DOMESTIC BONDS

South African Government Bonds (SAGBs) recorded a negative 1.8% return at the index level in 1Q24. This follows a strong close to 2023 (when calendar year returns were more than 10% at the index level). Yields closed 1Q24 having increased across the curve, with the R2035 yield (the closest 10-year bond) moving from 11.375% to 12.280% – an increase of 0.905%.

The movement in the curve has been slightly steeper across the quarter, supporting shorter-duration bonds where less of the duration effect is felt and resulting in superior returns for the lower-yielding, shorter SA All Bond Index (ALBI) term splits. The ALBI is holding relatively stable at a duration of approximately 5.5 years – primarily as a result of the large proportion of the index being positioned around the R186 (15% of the index), even as the National Treasury switches this bond out for bonds deeper in the curve (including the R2053, ultra-long-end bond, issued at the end of 1Q24 and now a material part of the index at 1.5%).

The US Fed and the SARB MPC opened the year with unexpectedly bearish statements on interest rates. These statements followed stronger-than-expected economic data prints (for consumption and employment, more specifically) and higher-than-expected inflation prints. The SARB MPC has also been pushing for a downward revision of the CPI target (currently a range of 3%-6%, with the midpoint being 4.5%). With CPI prints persistently approximately 1% above this target, the SARB has not indicated any appetite for rate cuts. The forward rate agreement (FRA) market reacted over the quarter, with expectations at the start of 2024 for 75 bps of rate cuts becoming an expectation of only one rate cut (of 25 bps) for the year.

At YE23, we stated Anchor’s expectation that rates would be stable for 1H24 with a gradual rate-cutting cycle after that. This view is unchanged – we expect two rate cuts in 2H24, with the risk to our view being on the downside (i.e., the higher likelihood of one rate cut rather than three).

With the date of SA’s general election confirmed for 29 May 2024 and the US presidential election cycle now a confirmed repeat (as far as presidential candidates – former US President Trump is yet to confirm his running mate), the markets domestically and globally are likely to remain slightly biased towards fear rather than optimism. The US election is currently priced with a small (sub-5%) betting lead for the Republican Party. SA election polling has shown expectations of a decline in ANC support, with the most benign being a 3%-5% drop (in line with the decrease in support the ANC recorded in the 2019 election). The more aggressive polls show that the ANC could lose its Parliamentary majority (an implied 8% drop in support from 2019 levels). The latter outcome would mean a coalition at the national government level. Given the ANC’s dominance of party politics at the government level since 1994’s dawn of democracy, this would be a watershed moment for the country. Some polls even show that ANC support is dropping nationally to the low 40% level. This would likely require a near-complete collapse in party support in KZN (where the ANC received 54% of the vote in 2019) and Gauteng (just over 50% of the vote in 2019) provinces.

The risk of this outcome would be that the ANC would need to find multiple larger parties and offer concessions, potentially setting up an unstable national governing coalition. In other scenarios, the ANC can retain control with smaller partners and thus smaller concessions without any coalition.

With the domestic bond sell-off during March resulting in bonds being oversold, we have positioned ourselves for a longer duration going into 2Q24. We view current bond levels as unsustainably cheap and attractive at any entry point to the curve. Still, we retain our bias towards the belly of the curve but have lengthened the duration of the funds across the board, with the Anchor Bond Fund duration now sitting at just under six years vs an index duration of just over 5.5 years. We remain neutrally disposed towards the prospects of domestic bonds as the attractive yield draws attention from investors domestically and abroad. One might, however, argue that the yields are attractive with good reason, as the risks in SA remain high, notwithstanding our expectations of more benign outcomes.

THE RAND

The rand weakened during 1Q24 as investors pared back their expectations for an interest rate cut. We had expected the rand to trade around R19.00/US$1 for much of the quarter, which appears to have been correct. Looking forward, we think the rand’s prospects have improved slightly, and we see it trading in the range of R18.00-R19.00/US$1 for 2Q24.

Projecting the rand’s value in a year’s time is a fool’s errand. This is because the rand vs US dollar exchange rate is one of the world’s most volatile currency pairs and trades well away from any modelled fair value for long periods. We note, however, that the rand trades within a R2.50 range to the US dollar in most 12-month periods.

The indicators for the rand’s fair value have reversed course, and slight green shoots of improvement are evident. The general sentiment is that loadshedding will dissipate, allowing the economy to grow at 1.2% this year – still a paltry growth rate but an improvement on the recent past. We are hopeful that the focus on electricity generation and improved logistics will bear some fruit for our economy. Global EMs have been trading poorly for the last few years, and we see some scope for the broader outlook to improve, giving a little more support to the rand. Coupled with what is most likely a benign election outcome in SA, we think a relief rally for the rand might be on the cards. In the context of the very gradual interest rate cutting cycle, domestically and abroad, we do not anticipate a strong movement in the local unit but rather a currency that trades with a positive backdrop for a period.

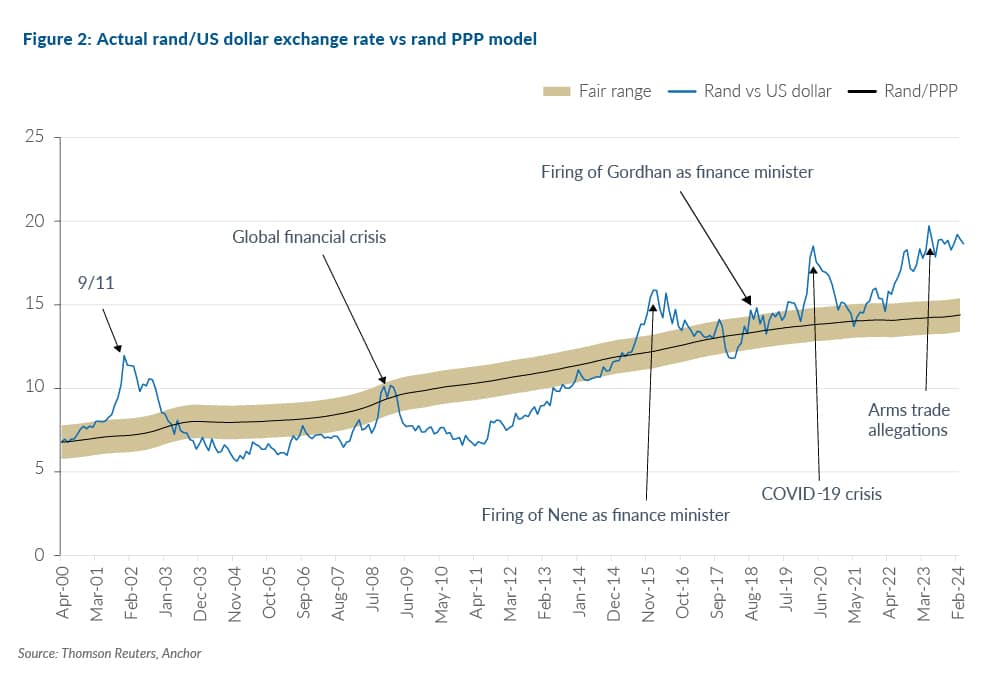

We retain our purchasing power parity (PPP) based model to estimate the rand’s fair value. We have extended this by three months since The Navigator – Anchor’s Strategy and Asset Allocation, 1Q24 report was published on 22 January 2024. Over our forecast period, we expect inflation abroad to come under control and return towards more normalised levels. This means that our PPP model shows an increasing propensity for long-term rand weakness from next year again. As a result, our PPP-modelled value for the rand vs US dollar at the end of the next 12 months is R14.74/US$1 (see Figure 2). We apply a R2.00 range around this to get to a modelled fair-value range between R13.74/US$1 and R15.74/US$1.

The domestic and global backdrop means we start with the rand meaningfully weaker than our modelled fair-value range. In previous cycles, US dollar strength has tended to dissipate (and reverse) toward the end of the US rate-hiking cycle. Current indications are that the US Fed will start cutting in June 2024 (or later), meaning that we expect to see currency normalisation, with the US dollar giving up some of its gains in the latter part of the year. However, we do not expect the currency to recover fully, and we are projecting a rand in the R18.00-R19.00/US$1 range in one year as domestic issues continue to weigh the rand down. For this report, we have modelled on R18.50/US$1.

We expect the rand to remain particularly volatile, and surprises are certain in the year ahead.

GLOBAL EQUITIES

We are bullish on equity markets on a two-year view, but the recent strong global equity markets performance has increased the risk of a correction in the shorter term. For long-term investors, we hold our quality positions.

Global equity markets delivered a robust performance in 1Q24, with DMs up 9% on average (following a 24% return in 2023). This is well ahead of almost all big investment bank forecasts, and high valuations need to be sustained to maintain a bullish stance for the next 12 months.

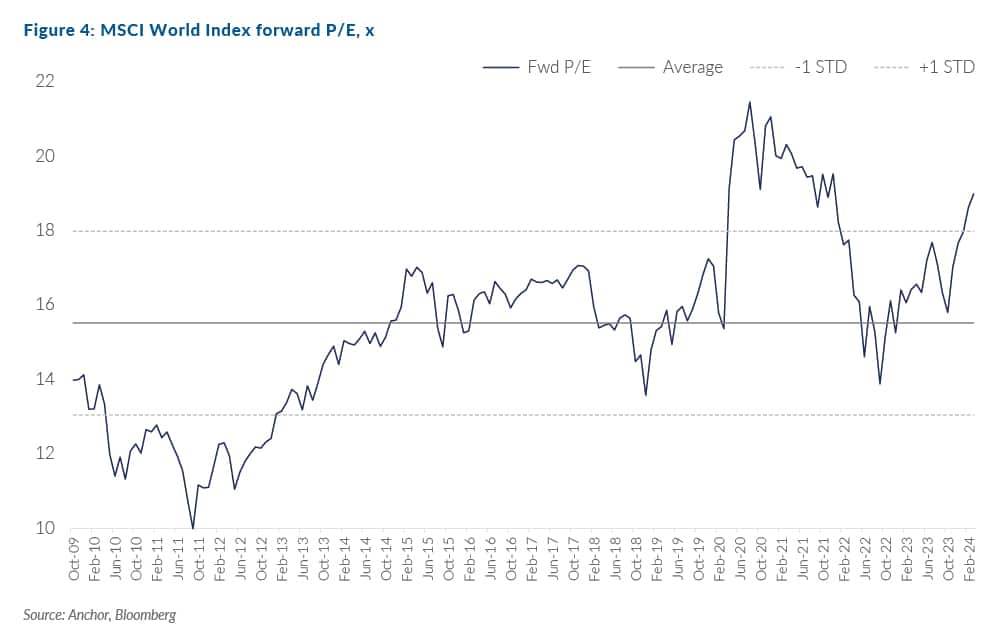

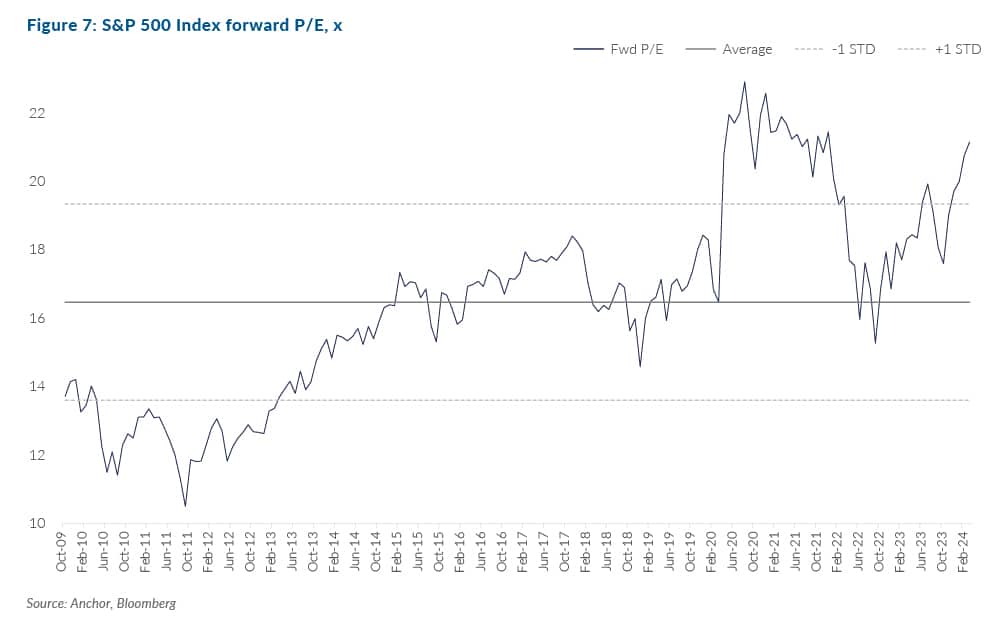

The S&P 500 Index’s forward P/E of 21x is meaningfully ahead of the 15-year average of 16.5x. However, the Magnificent Six tech companies (Apple, Microsoft, Nvidia, Amazon, Alphabet, Meta Platforms) inflate this number, and there is still reasonable value in the 494 companies below the “big tech guys.”

We had a good deal of healthy debate in concluding what global returns to project over the next 12 months. This is often the case in bull markets – when the fundamentals look very supportive of equity markets, but a lot seem to be “priced in”. Shares are seldom cheap when the future looks promising. We are very cognisant of valuations in our investment process, and this limits our return projection to 7%, a little lower than the long-term average.

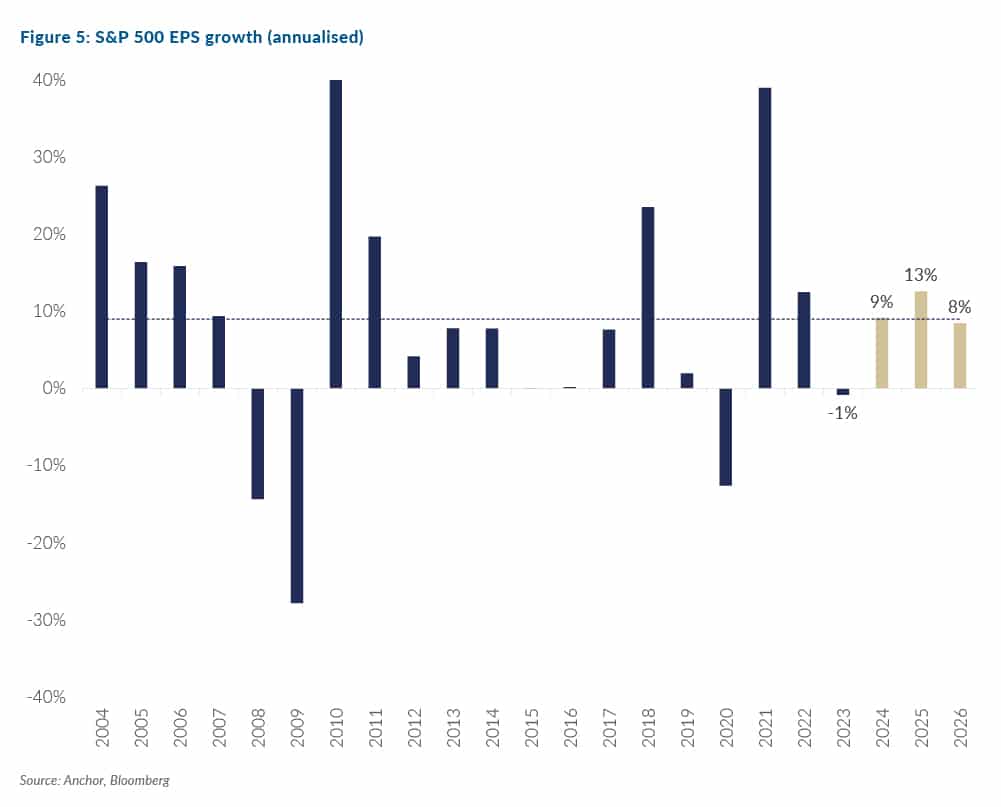

Conditions for strong equity performance are favourable for the medium term as inflation declines, central banks begin cutting rates (from very high levels), and medium-term US earnings growth is sustained in double digits. Equity markets tend to do well when earnings growth is strong and accelerating.

The message sent by the US Fed is key to market performance. US interest rates are now at historically high levels (5.25% from zero only 24 months ago), and expectations of interest rate cuts this year have declined from six cuts to three (which equates to 1.5% of cuts vs 0.75%). This is because the decline in inflation has stalled somewhat, and the economy has remained much stronger than anticipated. In other words, the Fed does not feel compelled to cut rates to avoid a recession. This is good news; at this stage, it appears that the management of the interest rate cycle has been exceptional. Economy doomsayers have been confounded, and strong government expenditure has aided this process. If the economy does slow down, the Fed has plenty of ammunition to provide interest rate support.

Expectations are for a strong earnings outcome, which is reflected in market performance and levels. Since October 2023, markets have been on an unrelenting march upwards. This means that the risks of a correction are higher, and any disappointments could be very negative for specific shares. We have seen some evidence of this of late in consumer-oriented US companies. The market could be especially sensitive to inflation reports and earnings performance in the coming months. Therefore, stock selection becomes especially important.

Equity alternatives are considerably more attractive than they have been for the past decade, with money market funds offering a 5%-plus return in US dollar terms and US 10-year treasuries trading at yields over 4.3%. If you are prepared to give up some liquidity or take a little more credit risk, 6%-9% yields are available. In our alternative investment offering, we are targeting double-digit, US dollar-denominated returns. Higher rates also mean that the high dividend yield shares in the US have become relatively less attractive, as a 5% dividend yield is not what it used to be if I can get 5% “in the bank”.

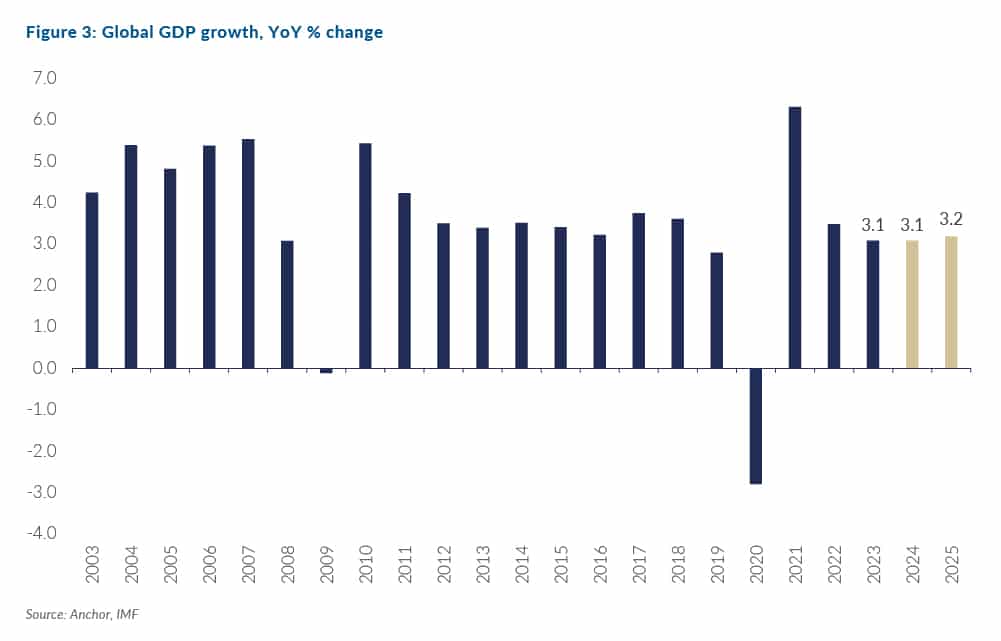

The economic reality shown in the chart below indicates reasonable and accelerating global GDP growth. US GDP growth has surprised in 2023 and looks set to register around 2.4% for 2024; many were forecasting a recession this year, but strong US national and local government spending has provided a big boost.

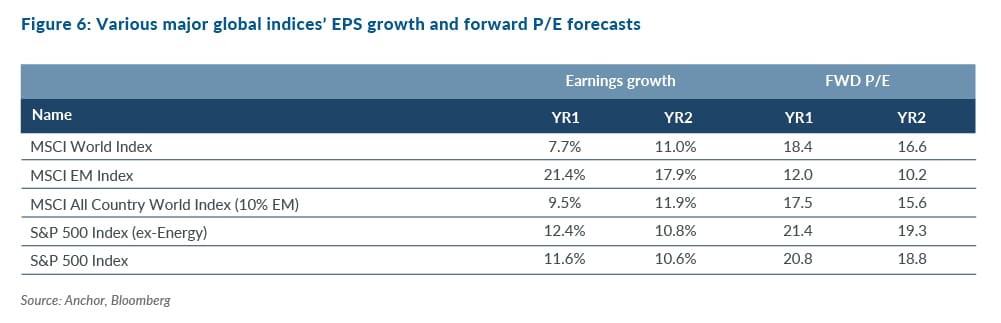

Valuations at the index level in global DMs look full (MSCI World forward P/E of 18.4x).

The most important determinant of markets is earnings, which have proved resilient in the face of higher interest rates. While many companies have been negatively impacted, those that have been able to pass on the inflation pressures have flourished. In 2023, US earnings growth recorded a 1% decline. However, double-digit US dollar earnings growth should resume in 2024 and beyond, which is positive for equities. Declining interest rates and increasing earnings are a positive concoction when one looks further out to 2H24 and beyond.

The S&P 500 Index forward P/E is 20.8x (see table below). Multiples often increase when earnings dip as long as the future outlook is more positive. EMs are much cheaper and have strong recovery potential.

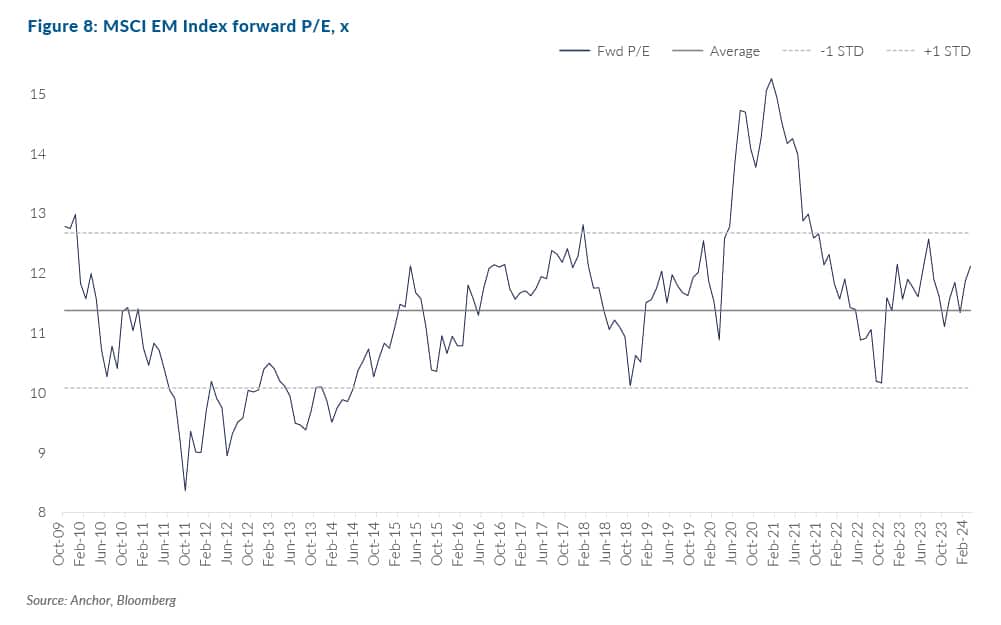

Figure 6 is shown graphically in the charts below.

EMs have started to look interesting recently as global investors look for value. The Chinese market has begun to show some green shoots after being considered uninvestable a year ago. As a result, some of the best companies in the world are trading in single-digit P/E multiples – a stark contrast to the US. EM valuations are cheap, and a shift in sentiment could potentially lead to a sharp short-term rise. An exciting opportunity is the Chinese AI shares, which have not shared the same positive reaction to the rapidly evolving future. This is despite many of these shares having invested heavily in this space in the past decade.

GLOBAL BONDS

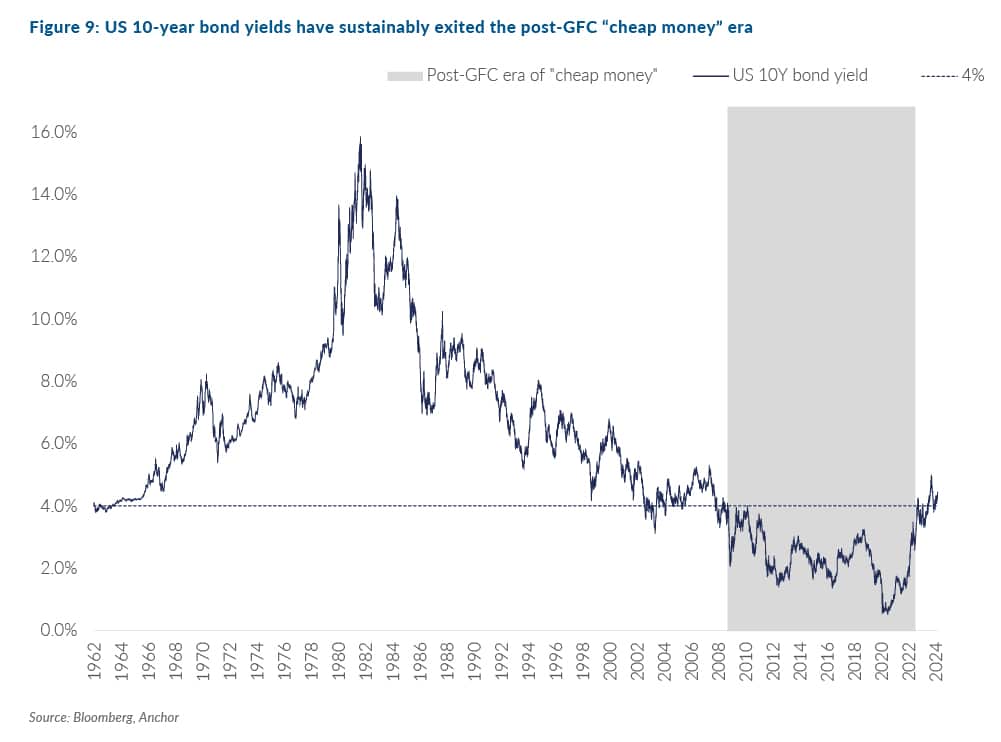

In the 50 years leading up to the 2008 global financial crisis (GFC), rates on US 10-year government bonds were above 4% for all but a few months. The GFC forced the US Fed into some extreme monetary easing that included slashing rates to zero and purchasing trillions of dollars of US government bonds, resulting in 14 years with extraordinarily low borrowing rates (the US 10-year bond yield averaged 2.3% during this period). Then, the COVID-19 pandemic and Russian invasion of Ukraine caused an inflationary shock that pushed US inflation to 40-year highs and forced a re-think of whether the post-GFC era of cheap money was sustainable. Since mid-2023, US 10-year bond yields have spent c. 80% of the time above 4%, and we think this is probably a level that investors will need to start getting used to again as we exit the post-GFC period of unusually cheap borrowing rates.

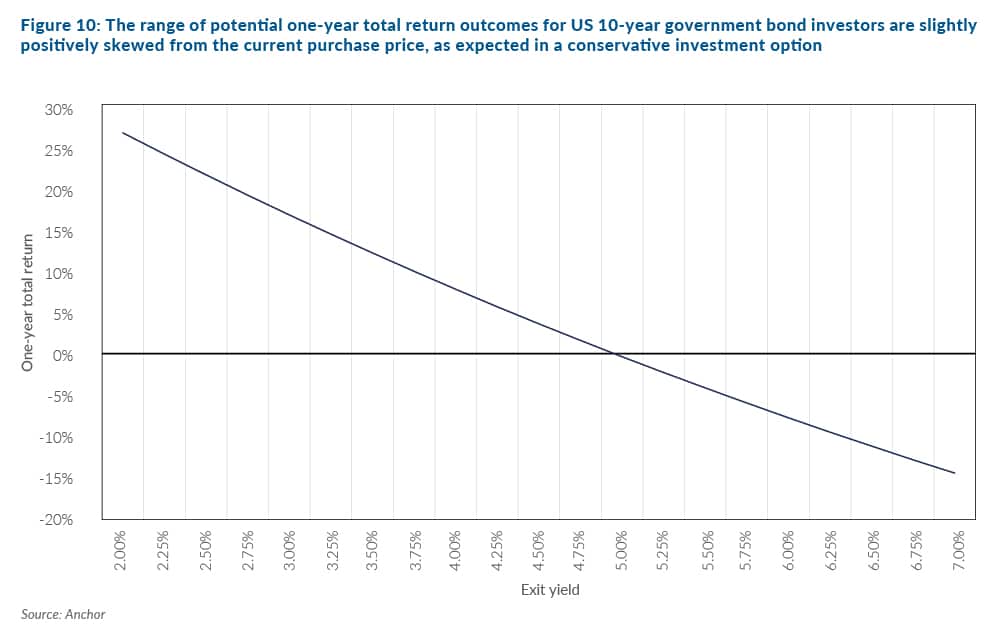

The prospect of earning c. 4% on US 10-year government bonds is unlikely to result in a flood of investors rushing into the asset class. However, it gives risk-averse investors a positive real return (at least on a pre-tax basis). The math that underpins the total return which fixed-rate bond investors achieve on their investments now suggests that with a one-year investment horizon, the realistic outcomes are slightly positively skewed, as one would expect in a conservative investment option. Our assumption that US 10-year government bond yields will hover around the 4% to 4.5% level for the foreseeable future suggests that investors will likely achieve a c. 5% total return in US dollar terms over the next twelve months when investing in 10-year US government bonds.

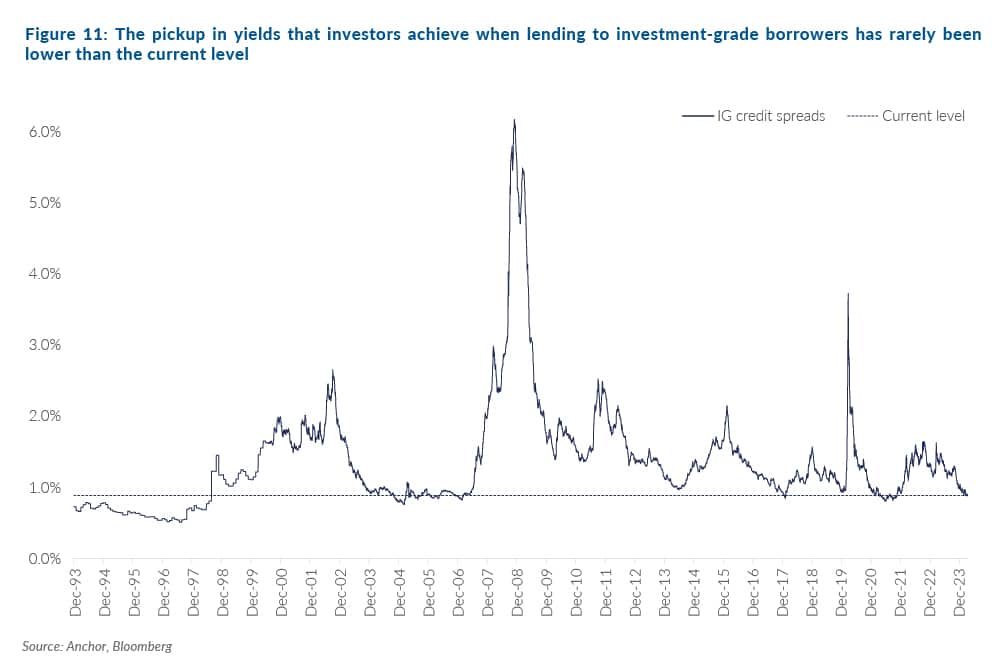

While US 10-year bond yields seem fairly valued, the premium investors demand for lending to investment-grade corporate borrowers relative to the US government’s borrowing rate has rarely been lower.

This leaves investors in US investment-grade credit with limited potential for capital gains from tightening credit spreads. However, the fundamentals of these borrows are generally reasonably solid, and the economic conditions are likely to remain relatively benign, leaving limited prospects of material capital losses. The most likely one-year total return outcome for US investment-grade corporate bond investors will likely come predominantly from income of c. 5.5% p.a.

GLOBAL PROPERTY

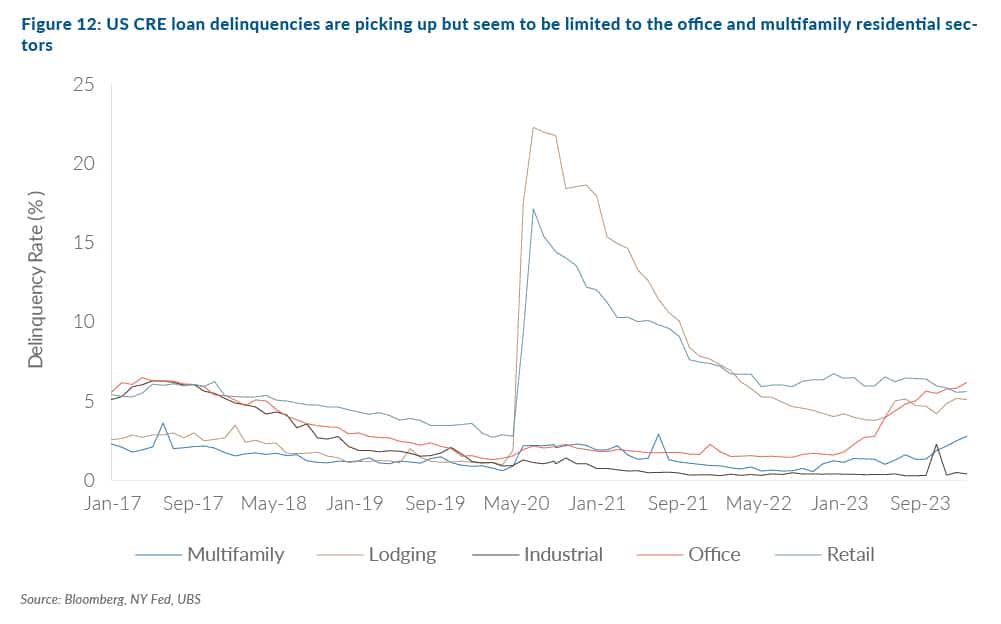

Global listed property struggled in 1Q24 (-1.8% QoQ) as investors digested the prospect of interest rates staying “higher-for-longer”. Added to the rate headwinds faced by listed property was a resurfacing of concerns about delinquencies on commercial real estate (CRE) debt at US regional banks. However, we note that these rising delinquencies seem to be limited to office and multifamily residential properties and, as such, present a reduced likelihood of becoming a systemic challenge for the asset class.

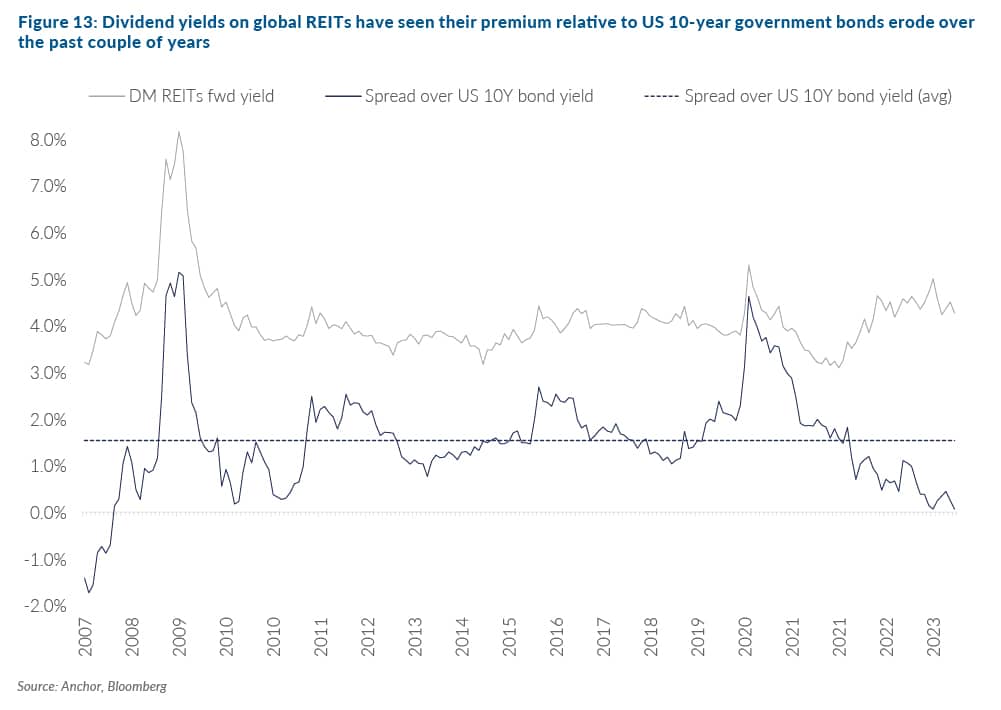

The narrative of rates staying higher-for-longer and the prospect of increasing CRE loan delinquencies stifling lending conditions make it seem unrealistic to anticipate a meaningful re-rating in the asset class, despite valuations appearing somewhat depressed for the sector. Global real estate investment trust (REIT) dividend yields have also yet to meaningfully adjust to a world of higher rates, suggesting that the current valuations are perhaps more realistic in a world of generally higher interest rates.

Analysts have pencilled in slightly below-average earnings growth for the sector of c. 3.1% for 2024. This, combined with a c. 4% dividend yield and our expectation for a small de-rating, will result in a total return of c. 6% in US dollar terms over the next twelve months.