ECONOMICS

Russia’s invasion of Ukraine represents the greatest shift in European security since WWII, and it has rattled global financial markets to levels of volatility and uncertainty few could have predicted at the start of 2022. Nonetheless, analysis of the situation on the ground suggests that Russia’s advance has not gone according to plan amidst stiff resistance, logistical issues, and heavy losses. At this stage, the jury is out on how long the conflict will go on, with geopolitical analysts cautioning against optimism over what seems to be a de-escalation of the conflict. The situation remains fluid, making it increasingly difficult to predict the extent of the global economic fallout. Nonetheless, what is clear is that the impact on economic activity is set to spread beyond Ukraine and Russia’s borders.

A key factor here is commodities, with Russia and Ukraine representing sizeable proportions of global trade in energy, wheat, and fertilisers, amongst others. Energy has been in sharp focus given Europe’s dependence on Russian gas, with little in the way of sufficient and easily available substitutes. To date, pipeline gas flows to Europe have largely been unchanged, but a risk would be if Russia were to cut off supplies leading to shortages and rationing, although this seems unlikely at present. However, developments related to foodstuffs are also a key concern. Thus, further pressure is clearly being levelled on the cost of living given the surge in commodity prices. Whilst energy prices have been the central focus, food security is an important issue too and could have unforeseen consequences.

As a result of Russia’s invasion of Ukraine, broadly the supply shock in commodities is set to prolong some of the supply chain issues that emerged from the pandemic and which we had consequently hoped would begin to ease. As such headwinds to global growth are rising, with global growth forecasts slowly being adjusted lower across the board. Whilst COVID-19 is no longer a predominant issue, it is worth noting that Covid cases have once again been rising across the globe, and China has implemented several citywide lockdowns recently, further compounding the increasingly complex global macroeconomic environment.

The US Federal Reserve (Fed) kicked off its rate tightening cycle this month with a 25-bpt hike to the Fed funds target range to 0.25%-0.50%. Reflecting on the high inflation backdrop, Federal Open Market Committee (FOMC) members scaled up their rate expectations for the year ahead. This aggressive tightening path reflects the FOMC’s unease about the high rates of inflation. The eurozone’s geographic proximity to the conflict in Ukraine, and its greater trade ties with Russia and Ukraine, naturally leave it more exposed economically to the war than other parts of the world. A key worry is the region’s energy dependency on Russia; reducing it will not be simple, nor cheap. Nevertheless, we expect the European Central Bank (ECB) to remain fairly cautious in moving towards rate hikes, certainly relative to market pricing.

Whilst the growth outlook is highly uncertain, we expect the direct impact of the Russia-Ukraine conflict on SA to be limited, given the minimal direct trade links. We believe the indirect impact is likely to be larger should the Russia-Ukraine conflict dampen the euro area and UK growth outlook as exports to the region account for 27.7% of SA’s total exports. While a positive terms-of-trade shock could theoretically result in higher export volumes, in practice this is unlikely given ailing Transnet rail infrastructure, port bottlenecks, and electricity shortages, which combined is likely to put a cap on mining output and thereby exports. A potential key positive outcome for SA is that mining companies could use the windfall from higher export commodity prices to expediate their plans to invest in green energy and remove themselves from Eskom’s electricity grid. This increase in investment would be positive for GDP growth. While SA is likely to miss out on the current commodities boom on the growth (real GDP growth) front, higher export commodity prices will be positive for the current account and fiscus.

The 2022 Budget, presented in February, reaffirmed government’s commitment to fiscal consolidation, while continuing to support vulnerable households — a balance made possible by the commodities-induced tax revenue windfall. Despite the upward adjustment to expenditure, the spending outlook is clouded with risks, stemming from further state-owned enterprises (SOE) bailouts, continued extension of the Social Relief of Distress (SRD) grant or implementation of a basic income grant, and higher-than-budgeted public sector wages. Given the downside risks to the global growth outlook stemming from the Russia-Ukraine war, the SA Reserve Bank’s (SARB’s) Monetary Policy Committee (MPC) will be weary to hike rates aggressively as that would be negative for growth. Thus, the SARB will be cautious when considering the current path of interest rates, not wanting to raise rates too fast and thereby suppressing the current local economic recovery, but equally not wanting to raise rates too slowly and thus allowing inflation to rise rapidly, resulting in sharply higher inflation across all categories. Consequently, we believe the SARB will continue to follow a gradual rate-hiking path.

SA EQUITIES

The first quarter of 2022 saw the local equity market experiencing one of the strongest relative performances in recent memory, delivering a total return of 6.7% (FTSE/JSE Capped Swix) in rand and 16.2% in US dollar terms against the MSCI World, which delivered a negative total return of 5%. Its strong performance over the past three months (1Q22) puts the JSE ahead of global equity markets by 10.8% over the past 12 months – a showing that has surprised many analysts and strategists and, if anything, once again highlights how difficult the job of forecasting equity market returns really is. The recent strong performance of the JSE, largely fuelled by cheap relative valuations and a healthy weighting towards the basic materials sector as opposed to great secular growth prospects, has resulted in a reduction in our 12-month total return expectation for SA equities from 12%, at the beginning of the year, down to 9%. This is slightly below our total return scenario for domestic bonds and does not compensate for the additional risk inherent in the rand vs US dollar exchange relative to global equities and, as a result, we move from overweight local equities to neutral.

The JSE has, without a doubt, been a big beneficiary of the ‘growth to value’ regime shift in global markets that kicked off in late 2020 and really accelerated from mid-November last year. We have often written about the composition of the local market which, after years of stagnant economic growth and a commodities bull market, resulted in large index weightings in value-heavy sectors of the market such as basic materials and financials.

Much has been written about supply chain disruptions brought about by government efforts to contain the spread of the COVID-19 pandemic, and additional demand created by government stimulus in response to receding economic growth with the overstimulating of demand resulting in elevated inflation levels. Up until a few months ago, the inflationary pressures were largely expected to moderate towards 2H22, as government stimulus moderated, and supply chains eased. However, Russia’s invasion of Ukraine has resulted in new pressures on the inflationary backdrop as the supply of certain key basic materials have once again been disrupted. The net result has been an appreciation in SA’s key exports – greatly benefitting the local economy and the domestic current account surplus.

Turning to the JSE, SA finds itself in the unique position that its own top-down investment case screens more attractively now than it did towards the back-end of last year, when the outbreak of Omicron (the so-called ‘South Africa’) variant was still dominating headlines and there was significant uncertainty around how much more the local economy could absorb in terms of lockdowns.

Thankfully, the Omicron wave turned out to be far milder than experts initially expected, and attention was once again drawn to company fundamentals, with a fairly strong reporting season from domestic stocks in particular. Towards the middle of last year, we started turning bullish on the SA banks, with the investment cases largely being underpinned by undemanding multiples, and a far bigger earnings recovery out of COVID-19 than was initially anticipated. The call to be overweight banks turned out to be the right one, with the most recent earnings season well received by investors. With banks being one of the best-performing sub-sectors on the JSE YTD, and with a healthy 15% index weighting going into the year (now up to 17%), the contribution to the total 1Q22 return (+4%) was over half of the 6.7% delivered by the FTSE/JSE Capped Swix. The basic materials sector made up the balance (+2.7%) – with the rest of the JSE largely flat. Naspers and Prosus combined was the biggest detractor from the performance of the Capped Swix at close to a 3% negative drag and, for the quarter, was the only meaningfully negative contributor to returns.

Turning to our return expectations for the upcoming 12-month period, the recent strong performance of the banks, on the back of positive earnings revisions but also reratings, has resulted in our total return expectation for the sector moderating somewhat and resulting, in aggregate, in a lower total return for the Capped Swix to 9% (from 12%, previously). While the banks do not screen as expensive, the upside from here is not as obvious as it has been going into previous quarters. We see positioning around the Naspers/Prosus investment case, which has progressed from a consensus long for the past 10 years to being relegated into a camp that polarises the local investment community, as a key portfolio construction consideration for the next 12 months. On our numbers, we see Naspers/Prosus as the large-caps that offer the most upside in the local investment universe – record high discounts to NAV for Naspers, Prosus and on the underlying asset, Tencent, have presented investors with a great multi-year entry point, on our base-case scenario.

We remain neutral on the basic material sector, outside of gold, where we continue to have no exposure. Our positioning within the sector remains biased towards wanting to own miners with exposure to the most attractive underlying commodities, which we see as coal, copper, aluminium, and other metals, which fare favourably in the longer-term energy transition theme. One sub-sector of basic materials we continue to view with caution would be the platinum group metals (PGM) complex, where the companies’ latest set of operating results highlighted key vulnerabilities in their investment cases. These include rapidly rising costs and diminishing returns on marginal capital expenditure. In our view, the bull case for the PGMs now largely rests on whether the world’s largest producer of palladium, Norilsk Nickel, is sanctioned and is unable to sell palladium into the market. We see this as a relatively low-probability event; however, we concede that, in recent times, we have seen many low-probability events happen and, as a result, we have kept some marginal exposure.

We continue to see reasonably good value across the local market, with no sectors screening as overheated from a valuation perspective. When making forecasts, we follow a bottom-up approach that represents about 90% of the index. However, the elevated levels of geopolitical risks and uncertainty around inflation in the US and Europe mean that the macro calls will likely continue to lead the direction of the market over the short- and medium-term.

SA LISTED PROPERTY

We remain moderately positive on good returns from JSE-listed property shares for 2022, as earnings levels and dividends become more predictable after the uncertainty brought about by the pandemic since the beginning of 2020.

In 1Q22, the total return for the FTSE/JSE SA Listed Property Index was a negative 1.3%. The SA component of the index produced a solid return, but those companies with exposure to Eastern Europe came under some pressure because of the war in Ukraine. The proximity of Romania and Poland to Ukraine caused jitters for the likes of Nepi Rockcastle, MAS, and Redefine.

We do not believe these companies will earn less because of the conflict and their economies might get a spending boost from the millions that have fled Ukraine. A country like Poland was battling with qualified labour and its pool of potential employees has also increased. There is a risk, nevertheless, that funding appetite (and rates) could be impacted in these regions as they might be perceived to now be riskier. On balance, however, we do not believe the medium-term fundamentals for these companies have changed materially and there is the potential for a bounce-back over the next few months – although we also highlight that these shares have not fallen materially.

The property sector should pay out dividends of 7.2%, in aggregate, and sustain a two-year growth rate of 5%-10% as conditions normalise further. We project an 10.4% total return from JSE-listed property in 2022.

The SA-driven segment of the market has some recovery growth in 2022 (less rental concessions, etc.), but thereafter growth will be challenged as local interest rates rise and negative reversions continue. By contrast, we expect sustained c. 5% earnings growth in the offshore counters, largely driven by development profits and better underlying GDP growth, particularly in Central and Eastern Europe. The offshore exposure we have in our property fund is in aggregate trading at a 6.5%-7.5% euro yield with sustainable dividend growth, and all of this in hard currency. This should create a profile of sustained 10%-15% rand returns over the medium term, which we consider attractive in the context of global opportunities.

DOMESTIC BONDS

1Q22 has been a difficult quarter for fixed income in general and SA government bonds (SAGBs) have not been exempt from this sell-off. The benchmark R2030 yield moved from 9.35% to 9.60% and the All Bond Index (ALBI) returned 1.89% for the quarter (extrapolated over the year this would imply a net 2022 return of below 7.50%).

SAGBs have been sensitive to Russia’s invasion of Ukraine, anticipation of central bank actions and global growth and inflation expectations. The February invasion of Ukraine resulted in an indiscriminate emerging market (EM) sell-off that drove SAGB yields up by over 100 bpts over the course of 3 weeks (on 18 February the R2030 yield was 9.075% and by 8 March it had reached 10.26%).

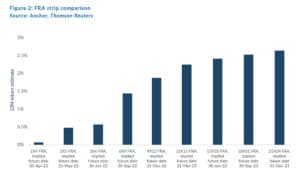

Central bank actions remain front and centre – the Fed began its rate-hiking cycle this past quarter and has signalled its willingness to hike by 50 bpts if it sees the need (US inflation has been elevated at over 7% YoY). Domestically, the SARB MPC has hiked local rates by 25 bpts at both its meetings this year (with the latter hike seeing 2 members voting for a 50-bpt hike). We maintain our view that derivative markets are pricing in too aggressive a rate-hiking cycle (current implied expectations are for 180 bpts worth of hikes by end-2022, with another 70 bpts of hikes by end-2023).

SA has a far less pressing need to rein in inflation than developed markets (DMs), with the most recent print (5.7% YoY in February) being below the top-end of the SARB’s target band (3%-6%). The combination of local muted inflation (relative to global DMs) and the strength of the rand (currently at R14.58/US$1) should enable the SARB MPC to moderate its rate-hiking cycle. The risks to this view remain the elevated oil price (still at around US$100/bbl at the time of writing), an escalation of the war in Ukraine and potential further waves/variants of COVID-19.

Given the abovementioned rate-hiking cycle, our expectation is for further rate hikes of 75 bpts to the end of 2022, with a further 100-bpt rise in 2023. This implies a repo rate of 5% and 6% at the end of 2022 and 2023, respectively.

Considering the above, we maintain our view that SAGBs can tighten materially from their present yields, and our expectation is for a 12-month return of 10% for this asset class comprising interest yield of 9.3% and capital gains of 0.7%.

THE RAND

The SA rand is supposed to be a high-beta currency that moves significantly as investor appetite for EMs ebbs and flows. Astonishingly, it has done quite the opposite over the past quarter – strengthening by nearly 10% as investors have been adjusting to the war in Ukraine. In part, we think that the rand started 2022 a little too weak and in part the higher export prices for coal, PGMs and iron ore have supported the local unit. All things considered, it is a remarkable outcome for the currency.

Looking forward, projecting the rand’s value in a year’s time is a fool’s errand. The rand vs US dollar exchange rate is one of the world’s most volatile currency pairs and trades well away from any modelled fair value for long periods. We note, however, that the rand trades within a R2.50 range to the dollar in most 12-month periods.

Some of the rand’s strength has been from hedge funds taking significant positions. We expect that these hedge funds will at some stage take profit on these positions. It is entirely plausible that the rand may, in the next month or so, spike weaker as hedge funds sell their rand positions down. Thereafter, we expect that the fundamentals of a strong trade balance and improved fiscal outlook will support the currency to continue its grind stronger.

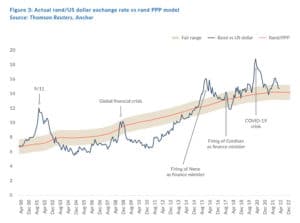

We retain our purchasing power parity (PPP) based model for estimating the fair value of the rand and we have extended this out by three months since the publication of The Navigator – Anchor’s Strategy and Asset Allocation, 1Q22 report on 16 January 2022. Our PPP-modelled value for the rand vs US dollar at the end of the next 12 months is R14.03/US$1 (See Figure 3). We apply a R2.00 range around this to get to a fair-value range of between R13.03 and R15.03/US$1.

We expect the rand to remain particularly volatile and we retain our view of a reasonable trading range being R14.50-R15.00 against the US dollar. For the purposes of modelling, we are working on a fair value of R14.60/US$1. This would imply that we see the rand unchanged over the next year, although the path will be volatile.

GLOBAL EQUITIES

Strong earnings growth and flattish markets have been nudging world stock markets back into reasonable valuation territory. Our caution on markets over the past 9 to 12 months has been warranted and we are now entering a new phase as the era of excessively loose monetary policy seems to be over.

At index levels, few commentators are expecting big returns over the next 12 months, but certain segments of the market and specific geographies are now offering value not seen for some time. We believe that the focus should be on specific shares and sectors rather than the market as a whole.

Figure 4 below shows the MSCI World Index forward P/E multiple, which is now at a more digestible 17x. With earnings growth of above 10% in the past six months and indices declining, the market is over 15% cheaper than six months ago and certain sectors are 20%-50% cheaper. The winners of 2020 became the villains of 2021.

It is somewhat surprising that world indices are ‘only’ down in the region of 7% in 1Q22, considering the Russian invasion of Ukraine, the highest inflation in decades, and a sharp increase in US bond yields. We could well be experiencing a rally in a gradual bear market or at least a period of lower returns. The most common explanation for relative market strength (given current conditions) is that with inflation so high, real bond yields are very negative and equities are the only hope of inflation-beating returns.

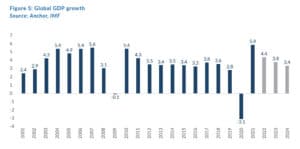

US households and corporates started 2022 with very strong balance sheets and historically low debt levels. World GDP growth is projected to be strong this year and beyond (see Figure 5 below) and this gives global central banks the comfort to increase rates without throttling the future. DM interest rates are also coming from close to zero and we do not expect them to be increased to unpalatable levels.

But the risk is real that the consumer-driven companies (that have benefited so materially from the cash waterfall that the average US consumer has experienced in the Covid-stimulus) could see a reversal of fortunes. Higher interest rates and more expensive goods (especially oil) will put pressure on consumer discretionary spend.

This is where secular growth companies become more attractive – companies that are growing on the back of a long-term trend and are not overly sensitive to economic cycles (for example, we expect e-commerce retail sales to increase from 16% to 30% of total retail sales in the US over the next five years). We have plenty of these in our portfolios and many of these companies have fallen with the crowd as growth companies have fallen out of favour. This sets them up to outperform the market as company fundamentals triumph. The combined earnings growth rate of our offshore model share portfolio is in the region of 10%-15% and this growth comes cheaper than it has for the past two years. The outperformers of the past 12 months (defensive, value, and energy shares) are likely to fade.

We also favour small exposure to EMs and particularly China, whose listed shares have crashed in recent months. In contrast to the US, China is stimulating to drive growth and the government has, for the first time in 12 months, made market-friendly statements. This has seen a sharp bounce in Chinese shares off extreme lows, but they still trade at record low valuations relative to their US counterparts. Geopolitical uncertainties are the highest they have been in decades, but the upside optionality and risk/reward equation favours some portfolio exposure.

The table in Figure 6 shows the relative value of EMs, where we expect growth to be the strongest in year-two.

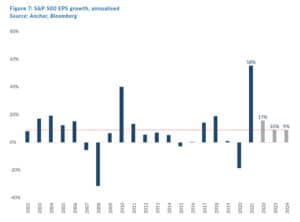

The simplest and most compelling argument for equity ownership is Figure 7 below, which illustrates the 8% US dollar-denominated annual earnings growth rate for the past 20 years. Market returns follow earnings growth (plus dividends) over time and any investor should be delighted with an annualised return of this magnitude. We expect this growth to be exceeded in 2023 and 2024 and the equity market remains the essential core of any long-term portfolio.

GLOBAL BONDS

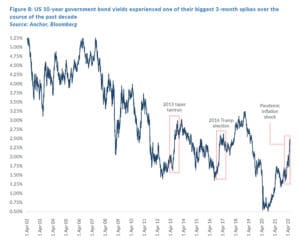

The first quarter of 2022 saw some outsized moves in yields, as expectations for the path of monetary policy in major DMs shifted dramatically. We started the year with consensus for three US rate hikes of 0.25% each in 2022 and no movement on European rates (which are still in negative territory). As US inflation reached 40-year highs at the start of the year, investors and central banks became incrementally more concerned about inflation and during 1Q22, the market moved to price in an extra six US rate hikes for 2022, driving US rates to c. 2.5% by year-end. Even Europe, which has had negative rates since 2014 and has not had a rate hike in over 10 years, is expected to see some rate hikes in 2H22. The ECB has guided that it will not hike rates until after it is done winding down its bond purchasing programme (QE). In December, it communicated that QE tapering would last into 2023 but investors now expect that timeframe to be brought forward significantly. The US Fed has even indicated that it may start shrinking its balance sheet as early as its next meeting in May – something which, at the start of the past quarter, seemed much more likely to happen in 2023. These rapidly shifting expectations caused US 10-year government bond yields to spike c. 1% in 1Q22. Three-month spikes of more than 0.75% have only happened about 4% of the time over the past 30 years.

US 10-year bond yields tend to be sensitive to medium-term growth expectations, and we think it will be tough for yields to climb significantly from these levels especially with central banks in aggressive tightening mode, as this notably increases the risk of policy errors driving the economy into a recession. We have written extensively about our views on global inflation elsewhere in this document, so we will not rehash those thoughts here but suffice to say that we think inflation will peak soon, start easing towards the end of 2Q22 and then drop fairly quickly into year-end, easing the pressure on central banks to act. This means that, as we reach the end of our forecast horizon towards the end of 1Q23, we are likely to be in an environment of neutral central bank policy and decent economic growth, driven by consumers with good employment prospects, bloated savings, and manageable debt burdens. This environment should support US 10-year rates at around 2.4%, leaving investors with a 2.2% total return in US dollar terms over the course of the next year.

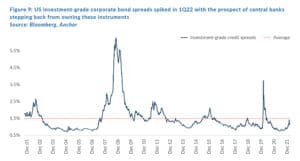

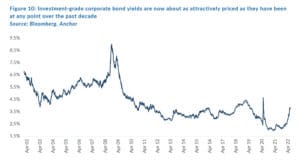

The corporate bond market also had a tough start to 2022 as investment-grade corporate credit spreads spiked off historically low levels, briefly touching the 1.5% level which they have only breached twice in the past decade. This, combined with the spike in interest rates, gave US corporate bonds their fourth-worst quarter in 50 years (-7.7% in 1Q22).

The sell-off in rates and credit spreads leaves investors with yields that are about as enticing as they have been at any point in the past decade, with the prospect of total returns exceeding long-term inflation.

Investment-grade corporate credit spreads rallied slightly into the end of 1Q22 to 1.15% – a level which we think is sustainable in an environment that is likely to see reasonable economic growth over the next twelve months. Investors in investment-grade corporate credit should experience a 3.5% total return in US dollar terms over the next 12 months.

GLOBAL PROPERTY

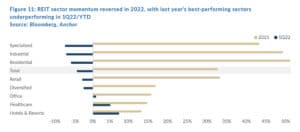

Rising global rates were a headwind for DM real estate investment trusts (REITs) in 1Q22, leaving them as one of the worst-performing equity sectors (FTSE EPRA/NAREIT Global REIT Index -4.2% QoQ) after a stellar year for the asset class in 2021.

In a theme that has played out across asset classes, the winners of 2021 were the 1Q22/YTD losers. The pandemic beneficiaries, linked to the online economy, including logistics and data centre REITs struggled in 1Q22 as assumptions around growth trajectories were revisited and anaemic yields were shunned in the face of rising rates.

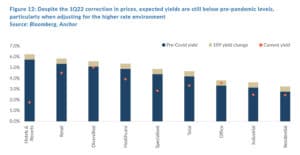

The 1Q22 performance has gone some way toward correcting the valuation dispersion amongst the REIT sectors but, in general, valuations are still looking stretched, with forward dividend yields below their pre-pandemic levels, especially when factoring in a higher interest rate environment (US 10-year government bond yields are c. 0.5% higher than pre-COVID).

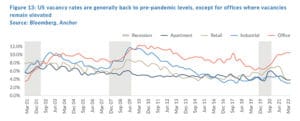

The office sector remains one of the most disrupted because of the pandemic, and vacancy rates in US metropolitan offices are only marginally below their all-time highs (experienced in the wake of the -global financial crisis [GFC]), but with some signs that they are stabilising.

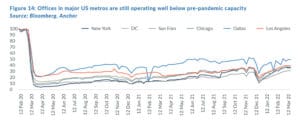

The debate still rages on how much work-from-home (WFM) we will see as pandemic movement restrictions fade. Commercial real estate systems specialist, Kastle Systems, has aggregated data from office access systems of c. 2,600 buildings it services across the US and the data suggest that most major metros are still seeing offices operating well below their pre-pandemic levels. Should we see this trajectory continue to normalise, the office sector (where yields are still around pre-pandemic levels) could be one of the more interesting.

We expect global bond yields to settle around these levels (though likely with some volatility) even as central bank action lifts short-term rates. Stabilising bond yields should remove a major headwind for global REITs although, with valuations already elevated, we are not expecting much of a re-rating going forward. As such, we think investors should expect a low single-digit income growth to combine with the 3.4% dividend yield for a 6% total return in US dollar terms over the next twelve months, though likely with some significant volatility in the first half of that investment horizon.