ECONOMICS

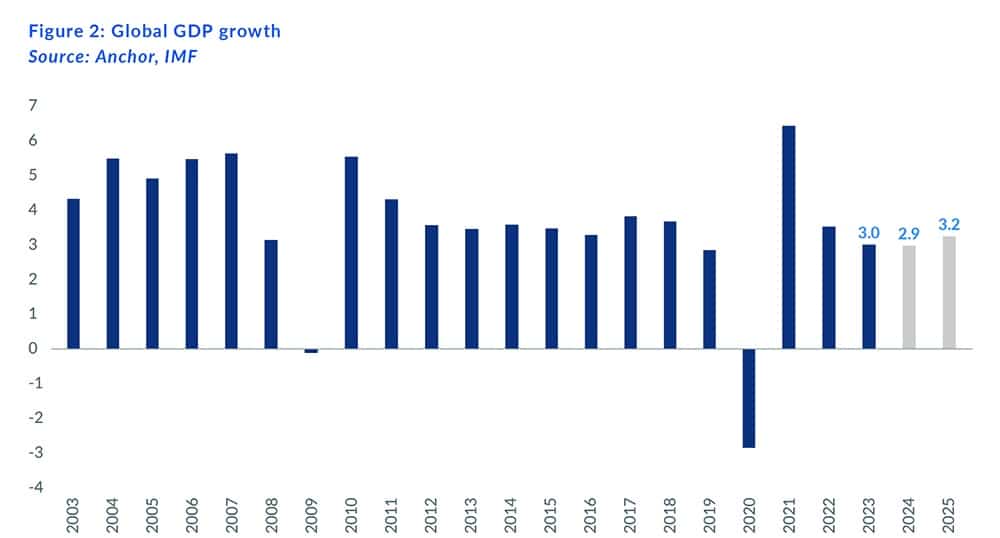

As we welcome the new year, we expect economic activity to remain subdued in 2024 amid a gradual global slowdown. This anticipated slowdown in global economic activity will be driven by a decline in consumer and investment action due to elevated interest rates and diminished savings. Moreover, extended geopolitical and economic fragmentation periods will likely impact global manufacturing supply chains, reducing trade flows. Significant risks to the outlook for 2024 include the potential for further geopolitical tensions, particularly with current apprehensions about the potential regionalisation of conflicts in the Middle East. This situation raises concerns about the possible repercussions on oil prices and its impact on global economic activity. As a small, open commodity-exporting economy, SA’s prospects are intrinsically tied to the global economy. As such, we expect slower global economic growth to dominate the agenda over the next year. Moreover, 2024 is set to be an incredibly important year on the global political front, with around 40 democracies that are set to hold elections. This will represent roughly 41% of the global population and 42% of global GDP. Notable countries holding elections include the US, the UK, SA and Taiwan – markets will closely watch these election results.

The US, in particular, has demonstrated significant economic resilience during 2023. However, this is expected to fade in 2024 amid a gradual slowdown. The early signs of a softening labour market are beginning to show, and weaker household consumption is also expected, given the high interest rates, lower savings rates and contracting disposable income. Moreover, there will likely be some volatility within US markets (and, by proxy, global markets) due to continued uncertainty over whether the US government can pass a budget amid increased politicking between Republicans and Democrats as the US Presidential Election looms. Global Inflation is expected to continue to trend lower, albeit at levels surpassing pre-pandemic figures. Regionalisation effects on production costs across supply chains influence this shift. While global prices are decreasing, they remain sticky due to oil price volatility. There is a near-term risk of an oil price surge tied to geopolitical tensions in the Middle East.

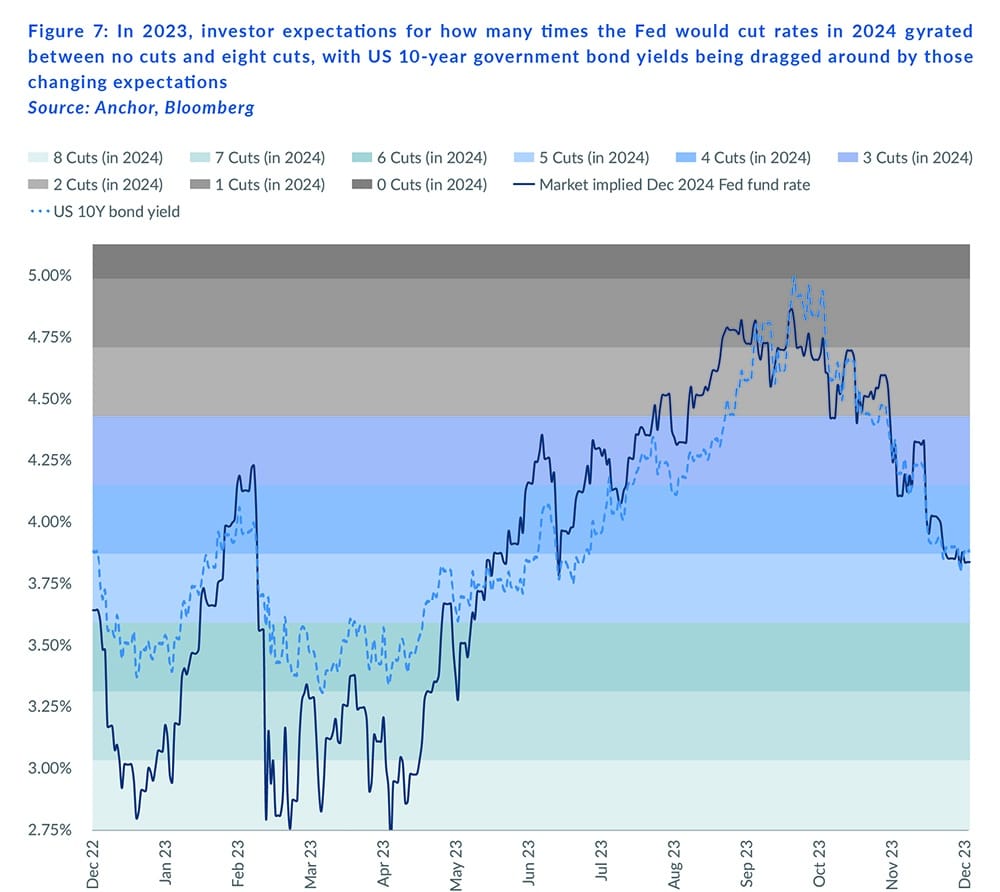

Notably, advanced economies have experienced a significant decline in their inflation rates throughout 2023, with the UK facing persistent inflation challenges. However, we continue to hold the view that the US Fed has reached the peak of its current rate-hiking cycle, with the federal funds rate at a midpoint of 5.375% for the past two meetings. In a broader context, we anticipate that the general global trend of hiking interest rates has, too, reached its peak. The major market driver in December 2023 was the US Fed pivot shown in its projection of a 75-bp cut (three 25-bp cuts) in the Fed funds rate from a midpoint of 5.375% to 4.625% by the end of 2024. Markets were pricing in nearly six cuts to 3.875% at the time of the December Federal Open Market Committee (FOMC) meeting, which has now declined to five cuts to 4.125% (at the time of writing), implying a 50-bp gap between the Fed and market expectations. Thus, financial markets across the board will remain on edge surrounding the timing and extent of the anticipated Fed cuts. As it stands, the Fed is broadly expected to start cutting rates during 1H24. A similar pattern is expected from the European Central Bank (ECB) and the Bank of England (BOE). This will, in turn, likely create space for emerging markets (EMs) to follow suit – some of which have already begun.

Locally, the proverbial chickens came to roost with the release of SA’s latest 3Q23 GDP print – despite a relatively robust and resilient 1Q23 and 2Q23, the SA economy contracted by 0.2% QoQ seasonally adjusted (sa) in 3Q23. Unsurprisingly, key issues such as the enduring financial strain on households and the continued supply-related obstacles caused by disruptions in rail and inefficiencies at our ports are beginning to meaningfully weigh on the local economy. Household consumption remains weak across all major categories, and investment is starting to slump – reversing the previous quarters’ surge, which was driven by solar energy projects. The decline is widespread among all types of enterprises and most types of capital outlay, reflecting low confidence and structural challenges. Furthermore, exports and imports were weak, indicating the domestic and external headwinds facing the economy.

On the inflationary front, SA faces a range of possible inflationary shocks over the coming months. The El Niño Southern Oscillation, typically associated with lower rainfall in the country, may contribute to an escalation in food prices. Additionally, intermittent geopolitical tensions could sustain elevated oil prices. Risks emanating from the ripple effects of heightened electricity costs and escalating logistical expenses loom, potentially leading to price hikes. Furthermore, there is apprehension regarding household inflation expectations, given the volatility observed in food and fuel prices in recent months, which might increase wage demands.

On the monetary policy front, the SA Reserve Bank (SARB) Monetary Policy Committee (MPC) kept the repo rate at 8.25% at its November meeting (the last for 2023). We maintain that this marks the peak in the current hiking cycle, and we foresee the first interest rate cut occurring in 2H24. Nevertheless, the MPC has underscored that risks to the inflation outlook lean towards the upside. Overall, looking ahead into 2024, we expect growth to remain subdued on the local front. Consumer spending growth will likely remain under pressure amid muted wage growth and the persistence of elevated interest rates. The existing bottlenecks at the country’s ports are expected to exert further pressure on both short-term growth and overall sentiment. Moreover, there are indications that the escalating issues at the ports are beginning to impact real economic activity, posing concerns for both near-term growth and general sentiment across the board. Nonetheless, whilst global and local economic growth prospects may appear muted for the foreseeable future, opportunities remain throughout most asset classes.

SA EQUITIES

In the context of a robust global equity market backdrop (MSCI World +24.4% in 2023), JSE equities experienced a disappointing 2023 (MSCI South Africa -1%). In rand terms, the dominant local equity benchmark (FTSE/JSE Capped Swix) was up 7.9% in 2023, with more than 100% of that performance recorded in the last two months of the year. The only other major equity index we tracked that recorded a worse performance last year was that of China (MSCI China -11%). The mediocre performance from the JSE should be viewed in the context of the local bourse having experienced a strong relative year in 2022, with the MSCI South Africa Index having outperformed global equities by 14.3%. Having updated our models, which seek to capture c. 85% of the index from the bottom up, our total return expectation for 2024 is 10% in rand terms and 7% in US dollars. We continue to expect both global macro factors (particularly the direction of DM interest rates) and the economic performance of China to have an outsized influence on the local market, with the added tail risk of SA’s general election expected midway through 2024.

There have not been many changes to our assumptions since the end of the previous quarter (4Q23), with our earnings growth expectations remaining essentially flat (no further deterioration from the cuts we took to our numbers halfway through last year) and the restrictively high cost of capital remaining the key reason for us having had to drop the exit multiples we use to forecast total returns. In other words, the current high interest rate and low-growth environment have resulted in us having to reduce our total return expectations over the last year. In most cases, we would view these headwinds as cyclical that would typically reverse in the near term. However, with the continued deterioration in the SA economy, determining how long the current low-growth environment will last has become more challenging. Without structural reform, we would expect the current tough operating conditions to persist.

As disappointing as the underperformance of the local economy might be, our base case is that conditions will not get dramatically worse for the local companies we look at, as was the case in 2023. We expect loadshedding to have at least reached a peak, with private generation expected to pick up strongly in 2024, coupled with the fact that South Africans have become far better at coping with the disruptions that come with loadshedding. The last quarter of 2022 and the first half of 2023 were a shock to the system because of just how bad loadshedding got. Retailers went into the 2023 festive season with too much inventory they could not sell and spent much of the first half discounting stock and having to invest in different ways of keeping the lights on. Some retailers were more effective in adapting to the changing conditions, a good example being Shoprite, which had the luxury to spend disproportionately on diesel and effectively capture market share at the expense of Pick n Pay and Spar, which, due to cashflow constraints, did not have the same luxury.

With less direct impacts on operations because of loadshedding, the local banks index experienced another strong year (FSE/JSE Banks Index +18%). The high interest rate environment has been a kicker to banks’ earnings for the last few years, while lending books have proven resilient in the face of weakening local operating conditions. With interest rates expected to have peaked for this cycle, the tailwinds to the banks’ earnings should start to recede towards the back end of 2024. As many domestically focussed companies’ earnings have deteriorated over the last few years, the resilience of the banks’ earnings resulted in us taking a constructive stance on the sector. In aggregate, we expect the banking sector to continue to grind out high single-digit earnings growth with close to double-digit dividend yields for mid- to upper-teen total returns.

Outside of the purely domestically focused counters, the local market continues to rely heavily on China’s economic outcome. Optically, Naspers, Prosus (and Tencent) offer excellent value. However, the latest developments with the gaming regulator in China are expected to add further regulatory overhang in the sector. We await the outcome of the draft regulations that seek to cap in-game spending within the Tencent gaming ecosystem, which will clarify the direction of travel for the earnings profile over the medium term. Regardless of the outcome, the latest developments have not been helpful from a sentiment perspective and have resulted in us having to temper our expectations from an exit multiple standpoint.

Another company heavily reliant on the performance of the Chinese consumer in 2024 is CFR Richemont. Going into 2023, we were optimistic about the prospects for a bout of post-COVID-19 revenge spending by the Chinese consumer, with the outcome somewhat disappointing.

Turning to the highly cyclical basic materials sector, the difficult operating conditions locally (Transnet underperformance, loadshedding etc.) combined with a tough demand backdrop, primarily because of the continued underperformance of the Chinese property market, resulted in a disappointing performance in 2023 (JSE Basic Materials Index -12%). As an investment house, we gravitate towards higher-quality businesses, and we often use mining companies as an example of the type of business we tend to avoid in any meaningful size. The outcomes in 2023 demonstrated the reasons why. Simply stated, costs have been rising (many of which are dollar-denominated), and the commoditised top lines have come under pricing pressure. Locally, issues with Transnet rail and ports created further headaches for iron ore and coal mines, which could not export their full quota of mined production. We acknowledge the optionality in the basic materials sector, yet we have maintained cautious/underweight positioning, waiting for a turnaround in operating momentum before adding additional exposure.

With risks abounding globally and locally, we expect another eventful year ahead for the JSE. The total return forecast of 10% is our base case, and it would not take much to see a far greater return. Interest rate cuts globally, a positive outcome in SA’s national elections and the simmering down of geopolitical risks could drive positive upside surprises. On our numbers, should the JSE revert to the average P/E multiple of the past five years, we could expect total returns of over 25% – a vastly different picture from DM equities.

SA LISTED PROPERTY

This article is not so much about the historic performance of the local property sector but rather the impressive performance of SA-listed property in December 2023 – a reminder of why investors should keep a diversified portfolio. The SA-listed property sector delivered a spectacular return of 9.9% in December 2023, accounting for almost all of the 10.1% total return for the year. During the month, the FTSE/JSE SA Listed Property Index outperformed bonds (+1.43% MoM), cash (+0.65% MoM) and equities (+2.0% MoM). In December, Lighthouse Capital, Hyprop Investments, and Equites Property Fund (EQU) were the top performers among the property counters, delivering total MoM returns of 23.3%, 21.4%, and 18.7%, respectively.

For the first time in recent years, we are projecting a higher total return for SA-listed property (12%) than domestic equity and SA bonds. After a few years of poor performance, SA property eked out a double-digit return but still trades at an average 30% discount to NAV and a forward distribution yield of around 13% for local portfolios and c. 8% for global portfolios (primarily Central and Eastern Europe [CEE]).

Property fundamentals and the cost of money drive property/real estate investment trust (REIT) share prices. Interest rates appear to have peaked globally and in SA, and the cost of money will become meaningfully cheaper over the next 12 months. Property fundamentals in SA are still challenging, but lease reversions in the most challenged sector (office) have declined sharply as a full rent cycle has almost worked its way through post-COVID-19. So, net portfolio growth is returning, and the interest cost will start to decline towards 2H24. Offshore portfolios are performing better, and growth prospects look reasonable. A reasonable portfolio with a dividend yield of 10% and growth of 5% can be constructed, and this becomes attractive if interest rates decline towards 10% over the next 12 months.

We highlight that the SA REITS trade at an attractive forward dividend yield compared with five years ago even though dividend payout ratios are now lower (except for Resilient and EQU) and distributable income definitions are also more conservative than five years ago (except for EQU on our assessment). Our pick of the property sector is MAS PLC, where the share price took a dive when it announced that it would hold back on dividends for two years to fund developments. At a 15% forward distributable income yield, we think the share is worth over 50% more.

DOMESTIC BONDS

For 2023, SA Government Bonds (SAGBs) returned 10.14% at an SA All Bond Index (ALBI) level. Given their weak performance in 2Q23 and 3Q23, SAGBs gained significant ground in 4Q23. Yields bounced back from the weak absolute and relative levels reached in 3Q23, with the R2035 (now the bond nearest to the 10-year term) closing the year at 11.375%, having reached a maximum yield of 12.58% in 3Q23.

The movement in the curve has been linear across the year, with the index term split returns being directly proportional to their duration. Indeed, comparing a short-duration bond (R186, yield moving from 8.75% to 8.67% over the year) vs a long-duration bond (R2044, yield moving from 11.565% to 12.215 over the year), the longer-duration bonds have been the most attractive to hold. Additionally, the ALBI itself has become short-biased due to the decreasing duration of the heaviest-weighted bond in the index – the R186 (accounting for c. 15% of the index).

On the central bank front, the year ended with strong statements from US Fed members that no further rate hikes are expected and that the next rate movement is likely to be downward. This sparked a year-end rally across financial markets, with SAGBs moving in tandem.

The SARB is likely (albeit not certain) to follow suit. We expect the SARB to keep rates at their current levels (the repo rate is at 8.25%) for 1H24, with a gradual rate-cutting cycle expected in 2H24. Current market expectations are more bullish, with 75 bps of cuts priced into the domestic forward rate agreements (FRAs) strip to year-end 2024.

The major 2024 domestic risk event will likely occur in 2Q24 – SA’s national election, expected to be held in April or May. Forecasts vary, but the governing ANC is widely expected to drop below 50% nationally. If this comes to fruition, post-election negotiations regarding a coalition government will occur. If the ANC is only slightly below 50%, these negotiations will likely be straightforward in finding one or two smaller coalition partners. However, if the ANC is materially below the 50% level (in the low-40% range), it will require a bigger coalition partner and more concessions from the ANC to this partner.

Given the combination of the above factors (the national elections and the potential for rate cuts), we have retained a neutral duration position in the fund. However, considering its low-yield characteristics, we are cognizant of the shortening R186, a bond we do not believe is appealing. Our preference remains the belly of the curve, where the duration can be managed while offering more desirable yields. We are projecting a twelve-month return on bonds of 10% for this report.

THE RAND

During 2023, the rand weakened due to a stronger US dollar, risk aversion, and domestic economic and political malaise. We had expected the rand to trade in the range of R19.00-R20.00/US$1 for much of 4Q23. In retrospect, it spent much of 4Q23, stronger than our expected range, ending at R18.43/US$1. This strength was primarily a reaction to the financial markets becoming more enthusiastic about US rate cuts than we had anticipated. Looking forward, we think the rand’s prospects have deteriorated, and we see it trading in the R18.75-R20.00/US$1 range for 1Q24.

Projecting the rand’s value in a year’s time is a fool’s errand. This is because the rand vs US dollar exchange rate is one of the world’s most volatile currency pairs and trades well away from any modelled fair value for long periods. We note, however, that the rand trades within a R2.50 range to the US dollar in most 12-month periods.

The indicators for the rand’s fair value continue to deteriorate. We note that the current account will likely weaken further, as the SARB keeps explaining. Financial markets are focusing on SA’s worsening fiscal situation, questioning the government’s ability to achieve a sustainable primary surplus by 2025. However, loadshedding, poor government infrastructure and logistics, and negative sentiment continue to weigh on the domestic economy. We expect the global environment to become more supportive gradually, but one might argue that it is already priced in. Therefore, we expect the local unit to continue to trade with a negative overhang.

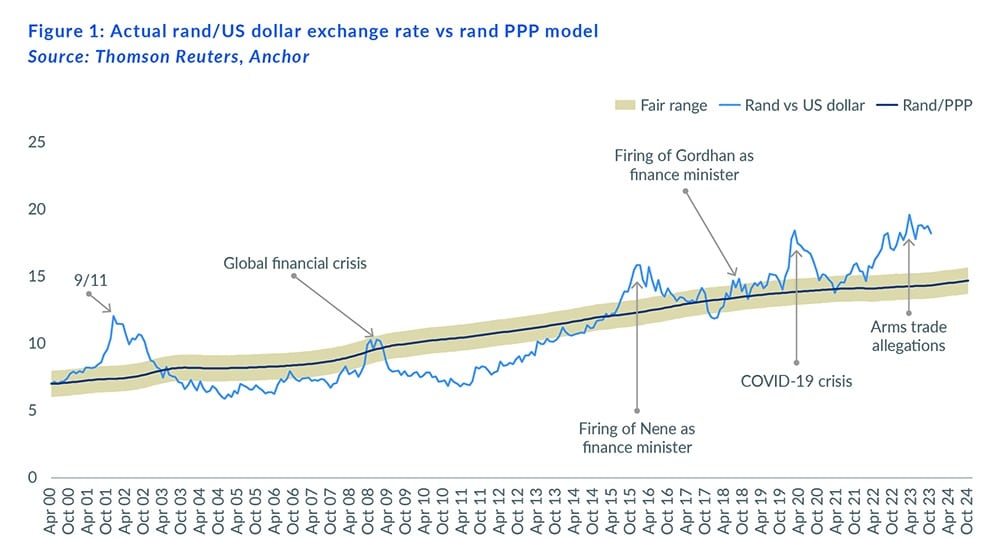

We retain our purchasing power parity (PPP) based model for estimating the rand’s fair value. We have extended this out by three months since the publication of The Navigator – Anchor’s Strategy and Asset Allocation, 4Q23 report on 13 October 2023. Over our forecast period, we expect inflation abroad to come under control and return towards more normalised levels. This means our PPP model shows an increasing propensity for long-term rand weakness from 2024. As a result, our PPP-modelled value for the rand vs US dollar at the end of the next 12 months is R15.10/US$1 (see Figure 1). We apply a R2.00 range around this to get to a modelled fair-value range of R14.10-R16.10/US$1.

The current domestic and global backdrop means we are starting with the rand meaningfully weaker than our modelled fair-value range. In previous cycles, US dollar strength has tended to dissipate (and reverse) toward the end of the US rate-hiking cycle. Current indications are that the US Fed will start cutting in March 2024, meaning that we expect to see currency normalisation, with the dollar giving up some of its gains in the latter part of this year. However, we do not expect the currency to recover fully, and we are projecting a rand in the R18.75-R20.00/US$1 range in one year as domestic issues continue to weigh the rand down. For this report, we have modelled on R19.00/US$1.

We expect the rand to remain particularly volatile, and surprises are inevitable in the year ahead.

GLOBAL EQUITIES

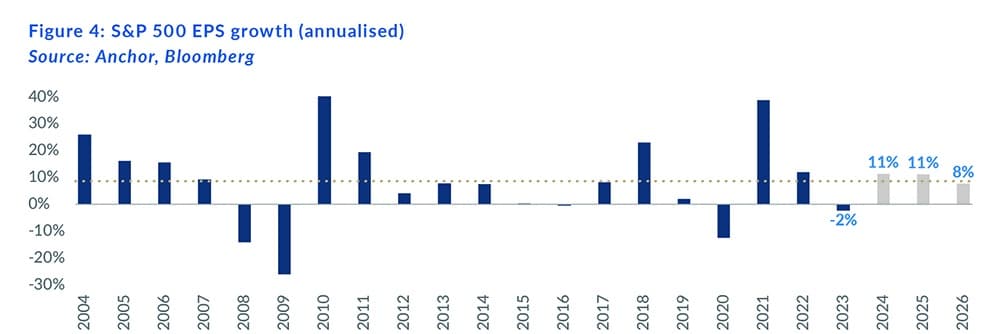

Conditions for a robust global equity performance are favourable over the medium term as inflation declines, global central banks begin cutting rates (from very high levels), and medium-term US earnings growth is sustained in the double digits. Equity markets tend to do well when earnings growth is strong and accelerating.

However, this has to be viewed in the context of relatively high valuations, so the starting point for 2024 is already factoring in some fairly good news going forward. Consequently, our 7% projected 12-month return for global equities seems less impressive than the narrative. Still, we would be comfortable taking longer-term equity positions, knowing that conditions need to catch up with the market after a very strong 4Q23.

Very few big global banks and investment houses expected a great year in 2023 as interest rates started the year in a strong rate-hiking cycle. The opposite happened, and the MSCI World was up 24.4% for the year, and the US S&P 500 rose by 26.3% (up 11.7% in 4Q23 alone). Likewise, market expectations are fairly muted this year because of the high starting valuations and recent strong performance. But, given improving conditions, we are biased towards a positive performance with the risk of the market taking a breather for a few months.

About half of the 2023 US equity market performance came from the Magnificent Seven stocks. These artificial intelligence-driven (AI-driven) tech shares (Apple, Amazon, Nvidia, Microsoft, Meta, Tesla, and Alphabet) are trading at high valuations. While retained exposure to these counters is essential, they might not be where the outperformance comes from, and hence, stock-picking becomes increasingly important.

Equity alternatives are considerably more attractive than they have been for the past decade, with money market funds offering 5%-plus returns in US dollar terms and US 10-year treasuries trading at yields above 4%. If you are prepared to give up some liquidity or take a little more credit risk, yields of 6%-9% are available. In our alternative investment offering, we are targeting double-digit US dollar returns. Higher rates also mean that the high dividend yield shares in the US have become relatively less attractive, as a 5% dividend yield is not what it used to be if I can get 5% “in the bank”.

The economic reality in the chart below shows reasonable and accelerating GDP growth. US GDP growth has surprised in 2023 and looks set to register around 2.4% YoY growth for 2023. Many were forecasting a US recession in 2023, but strong US national and local government spending has provided a big boost. The result, however, is that 2024 forecasts are now looking relatively muted (+1.3%) as the impact of higher interest rates starts to bite. The market, however, is looking forward beyond the bottoming.

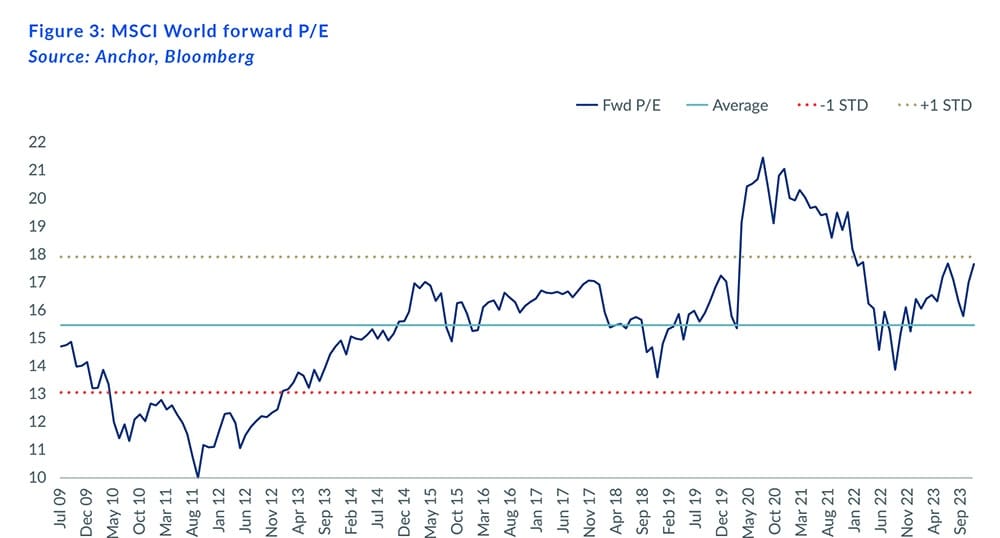

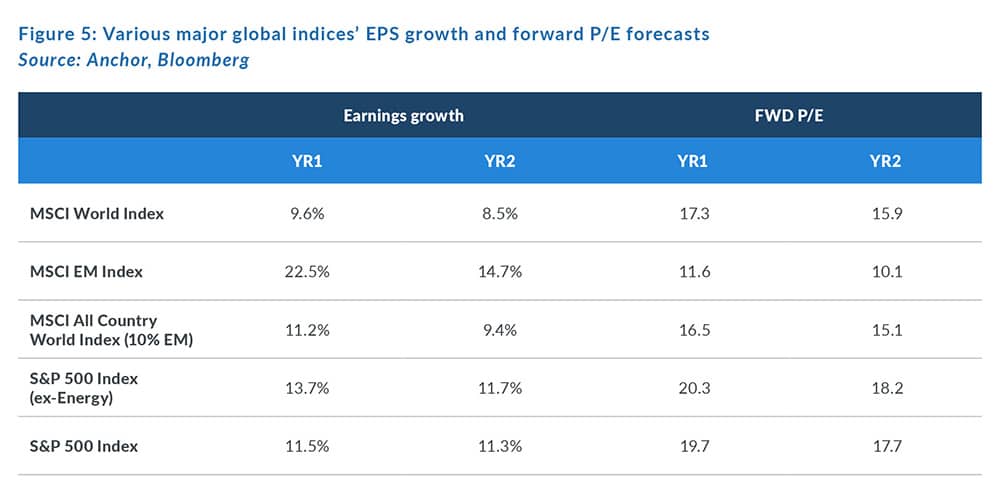

Valuations at the index level in global DMs look full (MSCI World forward P/E of 17.3x).

The most important determinant of markets is earnings, which have proved resilient in the face of higher interest rates. While many companies have been negatively impacted, those that have been able to pass on the inflation pressures to their customers have flourished. For 2023, US earnings growth is projected to record a 2% YoY decline. However, double-digit US dollar earnings growth should resume in 2024 and beyond, which is positive for equities. Declining interest rates and increasing earnings are positive concoctions when looking further into 2H24 and beyond.

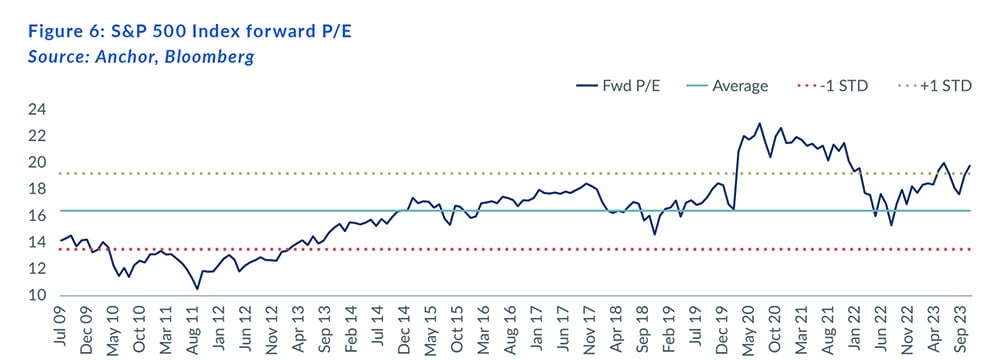

The S&P 500 Index forward P/E is 19.7x (see table below). Multiples often increase when earnings dip as long as the future outlook is more positive. EMs are much cheaper and have strong recovery potential.

This is shown graphically in the chart below.

EMs have been a letdown in 2023 as the much-vaunted Chinese recovery has disappointed. Chinese government stimulus has been less aggressive than in previous cycles, but the government could act more decisively in the next six months. EM valuations are cheap, and a shift in sentiment could see a sharp rise, but current sentiment is extremely negative. An exciting opportunity is the Chinese AI stocks, which have not shared the same positive reaction to the rapidly evolving future. This is despite many of them having invested heavily in this space over the past decade.

GLOBAL BONDS

In 2022, global bonds experienced their worst year on record (Bloomberg Global Bond Index -16% YoY) when the US 10-year government bond yield started at 1.5% and ended 2022 at 3.9%. On the surface, 2023 seemed positively dull by comparison, with US 10-year bond yields beginning and ending the year at 3.9%. However, beneath the surface, 2023 was a real rollercoaster ride, with the US 10-year bond yield reaching a low of 3.3% in May and a high of 5% in October. The 5% level that US 10-year bonds reached in 2023 was the first time that level had been attained since 2007. While investors largely agreed that the US Fed would hike rates to around 5% during 2023 and keep them there through year-end, what happened beyond that in 2023 left investors guessing. The consensus expectation for what the Fed would do in 2024 (implied by market pricing) shifted between eight rate cuts (2.0% of cuts) and no rate cuts, with the year ending at the midpoint of that range.

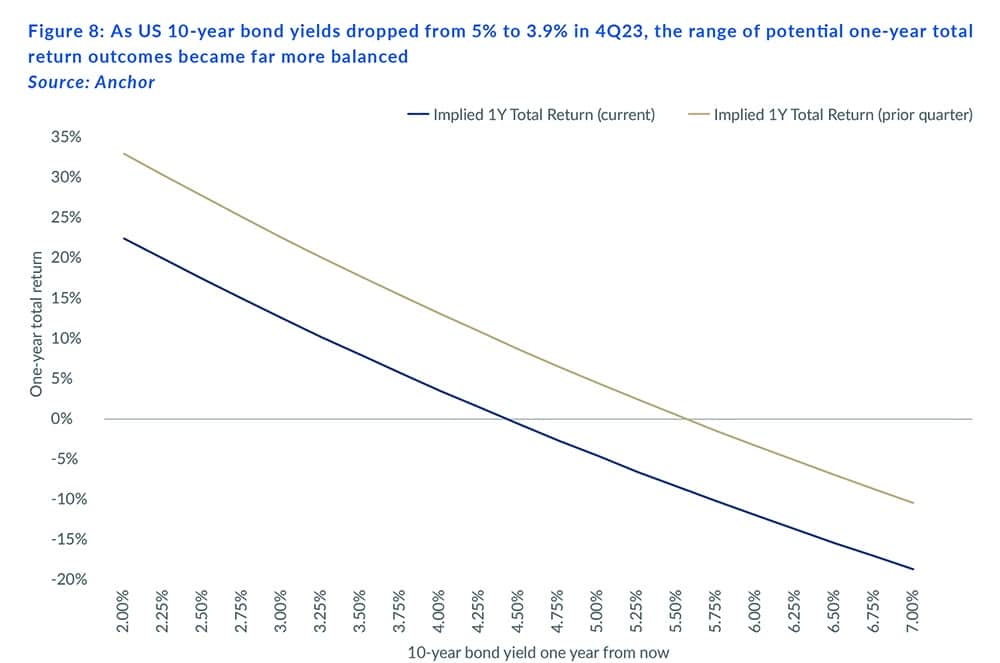

That is all behind us now, and what is more important for investors is what happens in 2024. In 4Q23, we saw significant upside potential removed from the bond market as rates dropped from their 15-year high (c. 5%) to 3.9% at year-end. This has resulted in an 8% QoQ total return for the Bloomberg Global Bond Index, leaving the range of potential return outcomes for bond investors in 2024 far more balanced.

We expect the US economy to maintain its strong momentum (that surprised investors in 2023) into 1H24, dragging inflation normalisation out for longer than anticipated and perpetuating the gyrating Fed expectations and rate volatility through 1H24. However, on a one-year view, we anticipate that the US economy will start to cool in 2H24, allowing inflation to normalise and the Fed to embark on a more consistent rate-cutting path, bringing more certainty to investors and pushing US 10-year bond yields slightly lower. We expect this outcome to deliver small capital gains alongside the 3.9% of income for a 5.2% total return in US dollar terms over the next twelve months for US 10-year government bond investors.

For those investors in US corporate bonds, the equation is a little more challenging, with credit spreads below 1%, a level rarely achieved and maintained over the long run. As such, we expect that spread to drift back towards the long-run average, particularly into the back of this year, as elevated funding rates start to weigh on credit affordability. The headwind from normalising credit spreads will be slightly offset by our expectation of slightly lower interest rates, but this should still result in a slight capital loss over the next twelve months, which will dilute the decent income on offer (c. 5.1% p.a.) for a total return of 4.3%.

GLOBAL PROPERTY

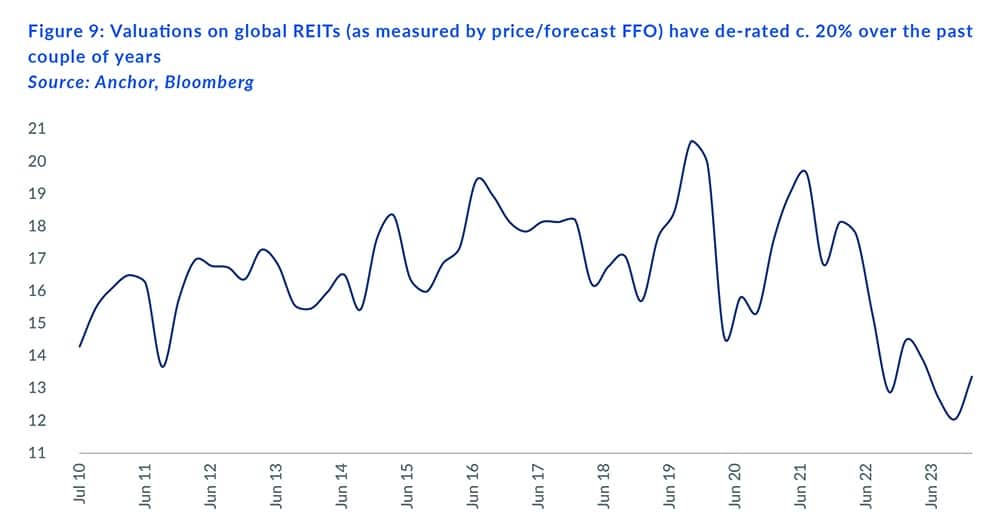

Global listed property (4Q23 +15.2% QoQ) experienced a quarter of outperformance relative to global equity markets (4Q23 +11.5% QoQ) for the first time in about two years, as investors became increasingly optimistic about the prospect of lower rates and the probability of the US avoiding a recession. Before COVID-19, US REITs generally traded at c. 17 times forecast funds from operations ([FFO] the REIT equivalent of earnings) but have de-rated over the past few years to c. 13.3 times anticipated FFO.

Part of the de-rating is justified and reflects a higher interest-rate environment relative to the pre-COVID-19, post-global financial crisis (GFC) period characterised by global central banks deploying significant quantitative easing (QE) and keeping rates anchored around 0%. This probably justifies a shift in fair values from 17 times to 14 times forward earnings, and on this basis, global REITs appear marginally cheap in aggregate. With structurally lower ratings, commensurately higher dividend yields (c. 4.4%) and a lot of the COVID-19-related commercial real estate challenges largely behind us and in the earnings base, we are starting to get incrementally more interested in global listed property, which we think can start to see moderate earnings growth combined with attractive dividend yields for a decent total return outcome of c. 6.2% over the next twelve months.

As always, with listed property, the various sectors will likely experience mixed fortunes. Office REITs now have vacancy rates similar to those experienced during the lows of the GFC in their base. Still, they probably need to spend significantly on refurbs in the short term to meaningfully entice the work-from-home (WFH) cohort back. Residential REITs have been a beneficiary of limited housing supply recently, but that should reverse in 2024 as the US residential REIT market sees the biggest wave of new apartment supply in decades come online with the anticipated delivery of 440,000 new units and c. 900,000 units currently under construction. There will be plenty of winners and losers in all these shifts, but for the next twelve months, at the asset class level, we anticipate conditions being more conducive than they have been in years.