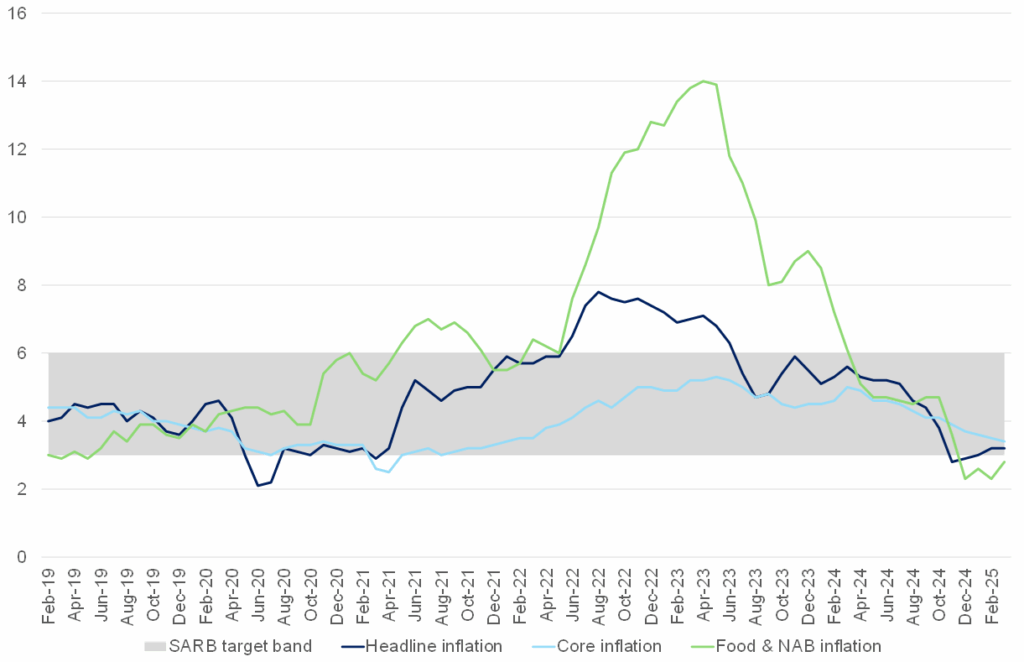

South Africa’s (SA) March headline Consumer Price Index (CPI) inflation data, released on 23 April, surprised on the downside, coming in at 2.7% YoY, below market expectations. The softer print was primarily driven by a continued decline in fuel prices and a lower-than-usual increase in education costs. On a monthly basis, inflation eased to 0.4%, from 0.9% in February, pointing to a broad-based deceleration in price pressures. A key factor in the March data is the annual review of education fees, which are surveyed only once a year during this period. The education price index rose by 4.5%, markedly lower than the 6.4% rise recorded in March 2024. Within this category, school fees grew by 5.0% (down from 6.6% a year earlier), while tertiary education fees advanced by just 3.7%, compared to 5.9% in 2024. While education costs remain elevated in absolute terms, the pace of increase has slowed, offering some relief to household budgets and contributing to the broader disinflation trend.

Core inflation, which strips out volatile components such as food and energy to offer a clearer picture of underlying price dynamics, also moderated. It slowed to 3.1% YoY (0.5% MoM) in March, down from 3.4% YoY (1.1% MoM) in February. This suggests a continued easing in underlying inflationary pressures across the domestic economy. Housing-related services, which had shown signs of reacceleration, remained relatively subdued. Rental inflation rose modestly to 2.6% YoY, from 2.5% in February, indicating ongoing sluggishness in the property market. Meanwhile, inflation in the vehicle segment continued to ease, and clothing and footwear prices remained under downward pressure, aided partly by imported disinflation, particularly from China. The restaurants and accommodation category also showed further deceleration, reflecting seasonal normalisation following the festive period.

Food and non-alcoholic beverages (FNAB) inflation edged slightly lower to 2.7% YoY in March, from 2.8% the previous month. Elevated maize prices from late 2024 continued to feed through to cereal-based products, though the pace of increase appears to be stabilising. Second-round effects in meat prices were evident, but MoM gains have started to taper, suggesting a potential peak in pass-through effects. Price gains in fish, vegetables, and fruit provided upward pressure, though overall food inflation remains relatively contained. That said, modest food price pressures are expected to persist through 2Q25, as higher farmgate prices for key staples continue to trickle down to the retail level.

Fuel prices continued to act as a major anchor on headline inflation. Fuel price deflation extended further, with pump prices down 8.8% YoY and 0.4% MoM in March. Looking ahead, this disinflationary trend is expected to deepen in April. Fuel prices were cut by a further 2.8% MoM at the start of April, and the daily data from the Central Energy Fund (CEF) suggest another decline of around 1.0% for early May. The continued softness in global oil markets (offsetting rand volatility) has been a critical driver of this trend, providing a significant drag on headline inflation and offering some respite to transport and logistics costs across the economy.

Figure 1: SA inflation, YoY % change

Source: Stats SA, Anchor

With the inflation baseline continuing to shift downward, the South African Reserve Bank’s (SARB) Monetary Policy Committee (MPC) now faces a nuanced dilemma—one rooted less in macroeconomic constraint and more in policy discretion. Real policy rates in SA remain in restrictive territory, meaning that current monetary policy is exerting a significant dampening effect on economic activity. This creates a window for the MPC to adopt a less restrictive stance, should it choose to do so.

From a macroeconomic fundamentals perspective, particularly in light of moderating core inflation, subdued wage growth, and softening consumer demand, the case for monetary easing has strengthened. The SARB has consistently underscored its commitment to anchoring inflation expectations and preserving financial stability, especially in a context of currency volatility. The rand remains vulnerable, and any further depreciation could reverse some of the recent inflation gains, particularly via fuel and food prices. Additionally, the uncertain global environment, marked by tightening geopolitical tensions and diverging monetary paths across major central banks, continues to inject caution into the MPC’s decision-making process.

While the March inflation data validate the SARB’s prior caution and suggest that monetary tightening has been effective, the threshold for cutting the repo rate below its estimated neutral level, where policy neither stimulates nor restrains inflation and growth, remains high. We maintain our outlook that the SARB will eventually lower the repo rate to this neutral level, but the exact timing remains uncertain given prevailing uncertainty. Crucially, the prospect of more aggressive easing cycles by major central banks—including the US Federal Reserve (Fed) and the European Central Bank (ECB)—raises the risk that SA may be forced to follow suit more decisively, especially if global growth falters and capital flows become more volatile. Should this materialise, it would increase the odds of a deeper and earlier rate-cutting cycle by the SARB.

However, such a scenario still hinges on domestic resilience and external stability. At the time of writing, markets have priced in a further two 25-bp cuts over the next 12 months, with even the probability of a third cut beginning to materialise. Nonetheless, while the door to rate cuts is increasingly ajar, the SARB’s cautious posture suggests it is not yet ready to walk through it. The March inflation print has made the case for easing more compelling, but the final decision remains contingent on a volatile mix of domestic and global variables.