Finance Minister Enoch Godongwana presented South Africa’s (SA) 2025/2026 Budget on 12 March. The budget tabling, initially scheduled for February, was postponed due to a lack of consensus within the Government of National Unity (GNU) partners, who had concerns about a proposed 2% VAT increase. Regardless, the second iteration of the 2025 Budget has elicited mixed reactions from the market, reflecting a complex balancing act by the government. While there were no significant spending cuts, the approach taken – a modest VAT increase coupled with a reduced fiscal buffer – has raised critical questions about SA’s long-term fiscal sustainability. The government has opted for minor spending adjustments, far less drastic than anticipated in the scrapped February Budget Review. However, with the National Treasury (NT) facing limited options for increasing tax revenue, debt and deficit projections have deteriorated relative to the 2024 Medium-Term Budget Policy Statement (MTBPS) and the withdrawn February Budget Review.

The government has proposed key revenue-raising measures to address the R228bn spending overrun between FY26 and FY28. Individual taxpayers will face a three-year freeze on inflation-related tax bracket adjustments (bracket creep), effectively increasing personal tax burdens without explicit rate hikes. In addition, VAT will be raised by 0.5% annually for the next two years. These measures will generate an estimated R29bn in additional tax revenue for FY25/FY26 — far below the R60bn initially proposed in February. However, the lack of inflationary adjustments in personal income tax will erode disposable income, disproportionately impacting lower-income earners who will now be drawn into the tax net.

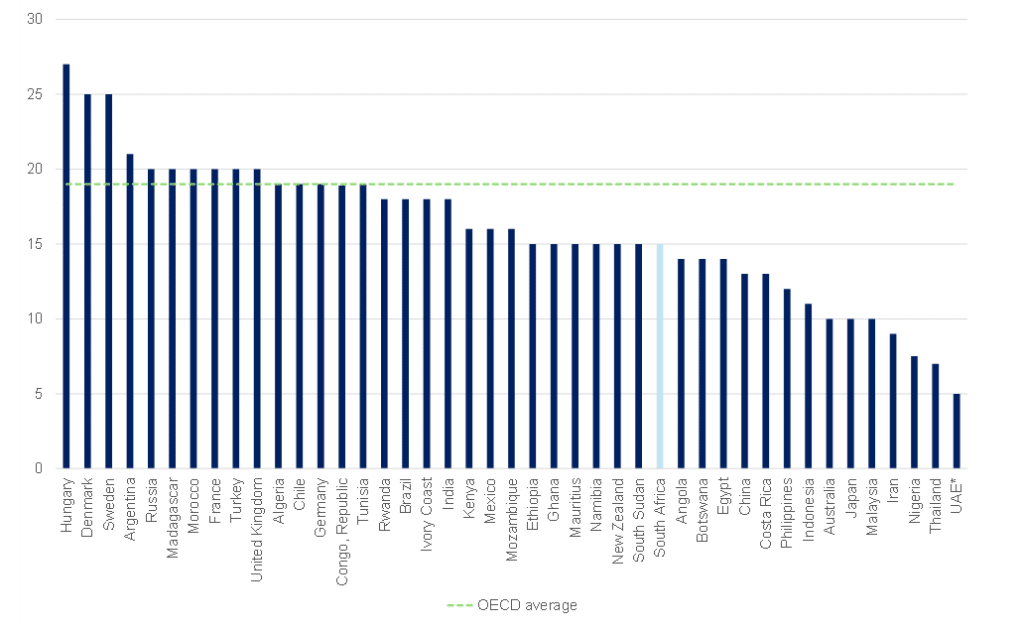

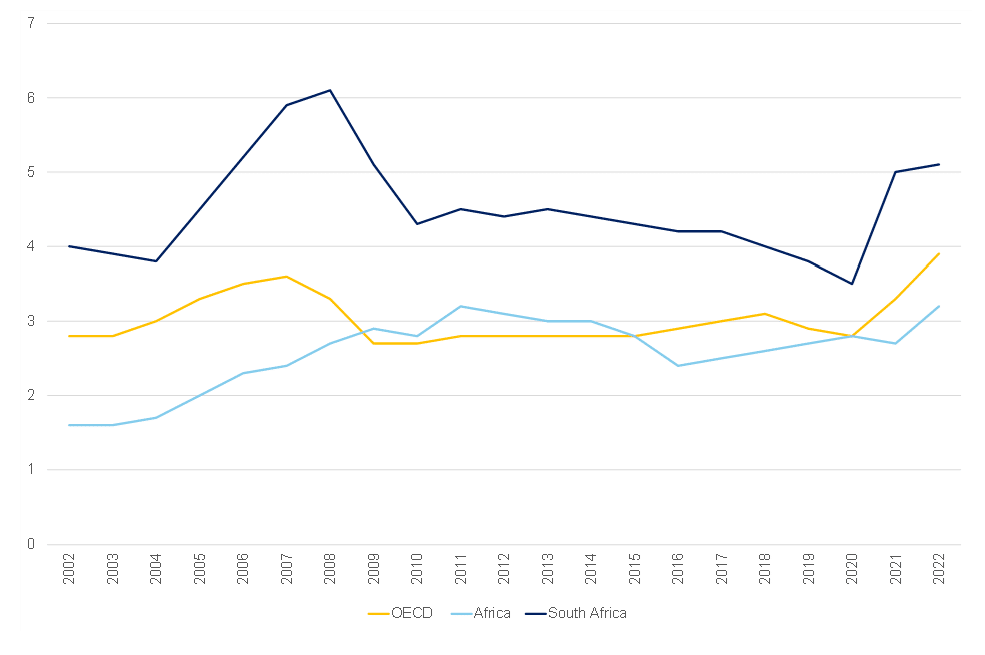

Whilst the NT has frequently pointed out that SA’s VAT rate remains relatively low in global comparisons (see Figure 1), the cumulative impact of the proposed tax measures is significant. Over the next year, these adjustments will extract R28bn from consumers, rising to nearly R120bn over the next three years. This approach effectively shifts the financial burden of unchecked government spending onto taxpayers, which could dampen consumer demand and overall GDP growth. Furthermore, SA already relies heavily on corporate income tax (CIT) as a share of total tax revenue compared to peer economies (see Figure 2). Increasing the tax burden on individuals without addressing structural inefficiencies in government spending could erode business confidence and discourage investment, ultimately slowing economic growth further. The budget also falls short of fostering economic expansion, as its spending priorities do not sufficiently support investment-led growth.

Figure 1: Comparative standard VAT rates by country, 2024/2025, %

Source: National Treasury, Anchor

Figure 2: Corporate income tax as a % of GDP

Source: National Treasury, Anchor

A Broader Perspective: Mounting Fiscal Sustainability Risks

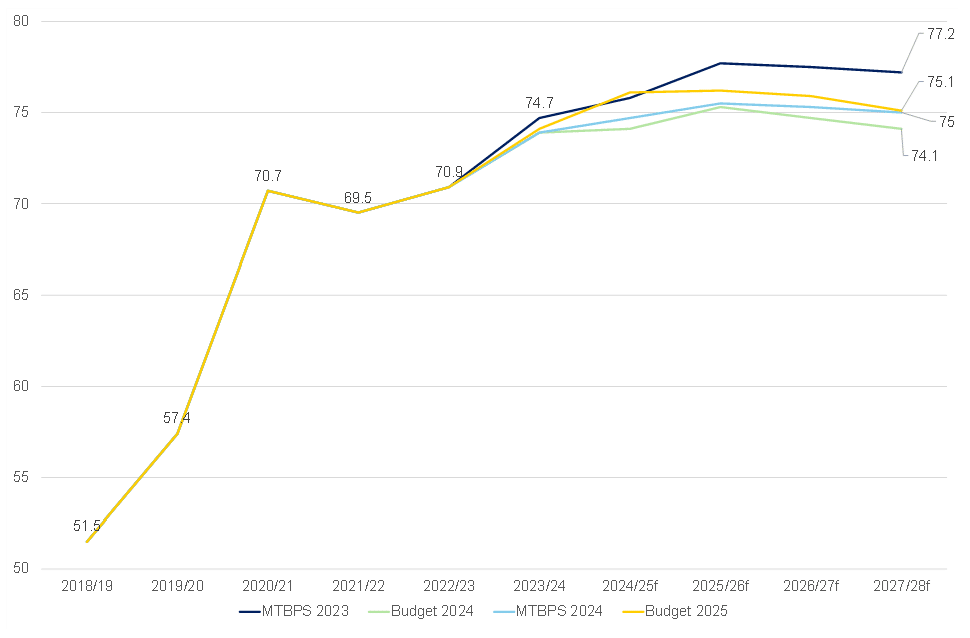

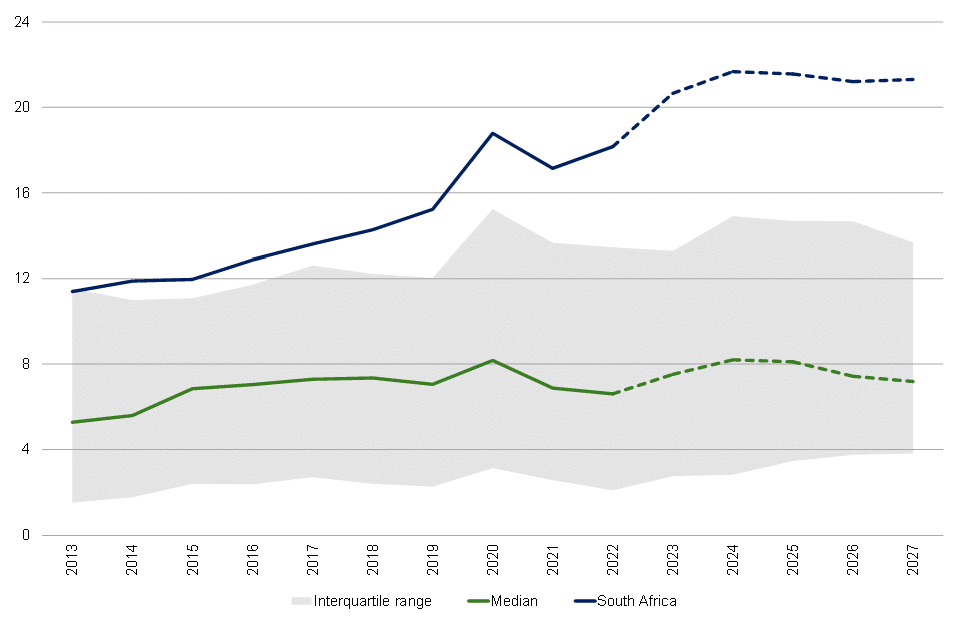

As the NT grapples with recurring spending pressures, the risks to fiscal sustainability continue to escalate. Gross loan debt is now projected to peak at 76.2% of GDP in 2025/2026, exceeding the 75.5% estimate from the 2024 MTBPS. This rise in debt has implications for long-term bond yields, raising borrowing costs for the government and the private sector. Additionally, debt-service costs are set to reach R389.6bn in the current financial year, meaning that for every rand raised in revenue, ZAc22 will be allocated to servicing debt – a significant constraint on fiscal flexibility.

A crucial shift in the NT’s strategy for managing expenditure overruns has emerged. Unlike the February Budget Review, which relied primarily on VAT increases, the current budget leans more heavily on “stealth taxes,” mainly through bracket creep. Historically, the NT mitigated spending increases by cutting expenditure elsewhere or handling state-owned enterprise (SOE) bailouts through “below-the-line” adjustments. However, this discipline appears to have weakened, signalling a more direct pass-through of spending excesses onto taxpayers. This shift raises concerns about the country’s fiscal trajectory, suggesting a diminishing capacity to curb expenditure growth.

Figure 3: SA government debt forecasts as a % of GDP

Source: National Treasury, Anchor

Figure 4: Debt-service cost trends in SA and peers* as a % of revenue

Source: National Treasury, Anchor

*Consists of 84 emerging market economies.

Where Does the Budget Go from Here?

With the budget now tabled in the National Assembly, the next stage involves scrutiny by parliamentary committees. Each committee will assess aspects relevant to its portfolio before the budget returns to the National Assembly for a vote. Traditionally, this process has been relatively smooth, as the African National Congress (ANC) has historically commanded a parliamentary majority, ensuring the passage of budgetary legislation with minimal resistance. However, the 2024 National and Provincial Elections (NPEs) altered this dynamic. Having lost 71 seats, the ANC no longer holds an outright majority and now requires the support of at least 42 additional Members of Parliament (MPs) to pass any legislation.

Without the backing of the Democratic Alliance (DA), the ANC must seek support from either the Economic Freedom Fighters (EFF) or the MK Party to secure the budget’s approval. This situation introduces a degree of political uncertainty, as securing cooperation from these parties may involve policy concessions or contentious negotiations. Fortunately, Parliament has the authority to amend the budget under the Money Bills Amendment Procedure and Related Matters Act, allowing several weeks for revisions. Given the current political landscape, amendments are likely. Political brinkmanship is also expected to come into play, particularly in discussions surrounding the VAT hike. Should the budget fail to secure adequate support from the GNU partners, any revisions will likely focus on three key areas: (1) fiscal consolidation, with a peak in debt forecast for FY25/FY26, (2) maintaining the current weekly bond issuance levels, and (3) increasing infrastructure spending to stimulate economic growth. One notable omission from the budget is any provision for the recent court ruling on social relief of distress (SRD) grant inclusion. Although the ruling has been suspended, it remains a potential fiscal risk. Additionally, the NT has not allocated funds to compensate for the withdrawal of US aid, which could impact social and development programmes.

Investor Implications: The Crucial Disconnect

The fundamental disconnect between the economy’s ability to sustain government spending and the NT’s ambitions is at the heart of SA’s fiscal conundrum. The country’s economic growth remains too sluggish to support escalating expenditure, necessitating difficult decisions on trimming government spending. A comprehensive public expenditure review is essential to identify and eliminate inefficiencies and wasteful spending. Simultaneously, spending should be refocused on initiatives that directly enhance economic growth and employment creation.

Uncertainty over parliamentary budget approval means investors and credit rating agencies will likely adopt a cautious “wait-and-see” stance. To be fair, rating agencies were always likely to wait for credible evidence of stronger growth and fiscal improvement before taking positive action. Nonetheless, investors, particularly those in the bond and equity markets, will closely monitor whether the government can deliver credible fiscal consolidation. Additionally, the lack of clear structural reforms in the budget could dampen investor sentiment, as sustainable economic growth remains elusive. Business confidence is likely to be affected by concerns over tax hikes, particularly VAT and bracket creep, which could reduce consumer spending and corporate profitability. Foreign investors may also adopt a more risk-averse approach due to policy uncertainty.

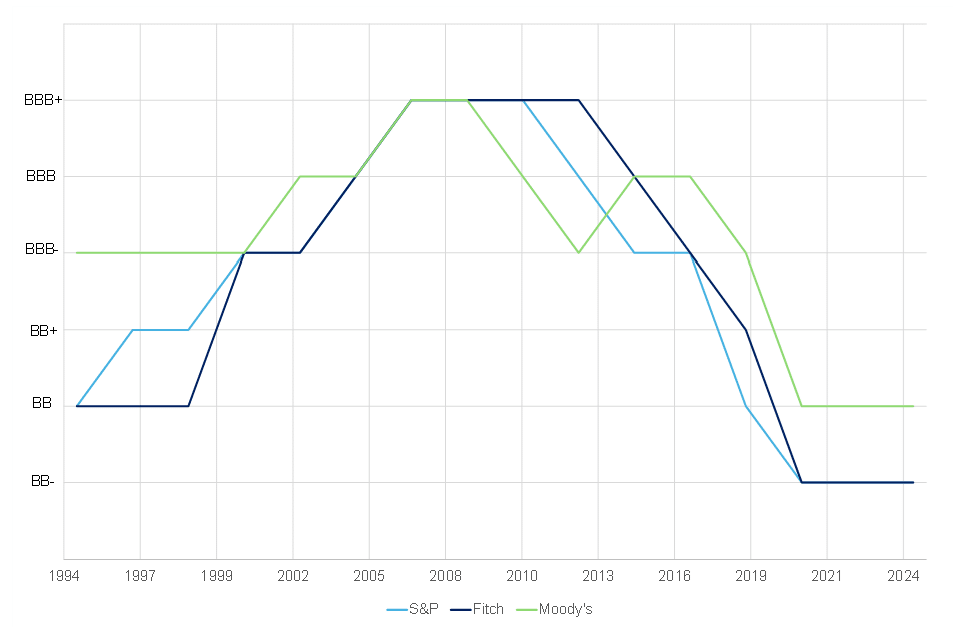

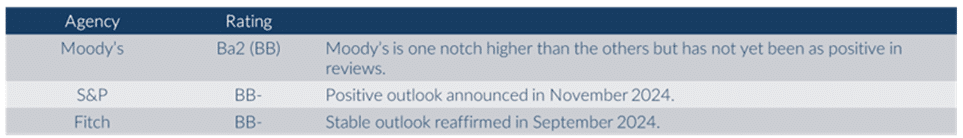

Figure 5: SA sovereign credit ratings

Source: Reuters, Anchor

On a more optimistic note, SA appears to be on the verge of exiting the Financial Action Task Force (FATF) greylist. Recent plenary discussions confirm that the country has now met 37 of the 40 technical compliance benchmarks. With only two outstanding deficiencies, SA could officially exit the greylist by October 2025, pending the FATF’s final assessment. This would be a significant milestone, potentially improving investor confidence and reducing compliance burdens for local financial institutions. A successful greylist exit could encourage greater capital inflows, particularly in the financial and banking sectors, as regulatory risks ease.

Overall, the latest budget highlights the government’s attempt to navigate a difficult fiscal environment with constrained options. While revenue-raising measures have been introduced, the government’s reliance on increasing the tax burden on individuals rather than implementing substantive spending cuts raises concerns about long-term sustainability. The parliamentary review process introduces additional uncertainty, particularly given the ANC’s diminished majority. Meanwhile, the impact of rising debt-service costs and slow economic growth underscores the need for structural reforms to enhance fiscal resilience. Looking ahead, key factors to watch include the final parliamentary approval process, potential budget amendments, and developments in SA’s credit ratings and greylisting status.